With respect to cooperative banks, the Union Budget recommended amendments to the Banking Regulation Act to improve oversight through RBI.

As the Finance Minister Nirmala Sitharaman presented the Union Budget on Friday, she revealed several reforms across the banking sector and financial markets.

While presenting the budget, she said, "A clean, reliable and robust financial sector is critical to the economy. In our efforts to achieve the USD 5 trillion economy, the financial architecture should keep evolving and move from strength to strength.”

She proposed the "sale of balance holding of Government of India in IDBI Bank to private, retail and institutional investors through the stock exchange.", riding on the bank consolidation and capital infusion of Rs. 3,50,000 crore into Public Sector Banks (PSBs).

Moreover, she announced that the Deposit Insurance and Credit Guarantee Corporation (DICGC) has been permitted to increase Deposit Insurance coverage to Rs. 5 lakh per depositor from Rs. 1 lakh.

With respect to cooperative banks, the Union Budget recommended amendments to the Banking Regulation Act to improve oversight through RBI.

Further, Non-Banking Financial Company's (NBFC) limit to be eligible for Debt Recovery Mechanism via SARFAESI Act, 2002, is proposed to be reduced from Rs. 500 crore to Rs. 100 crores or loan size from existing Rs. 1 crore to Rs. 50 lakh.

Sitharaman also stated that the budget proposed amendments to the Pension Fund Regulatory and Development Authority (PFRDAI Act) to initiate separation of National Pension System (NPS) trust of government employees from the statutory body. This would enable the employees to set up a pension fund other than the government.

Moreover, to infuse the flow of capital into the financial system, many measures were proposed in the Budget.

As per the press release by the Finance Ministry, the measures are as follows:

1. FPI limits in corporate bonds are proposed to be increased to 15 per cent of outstanding stocks from the current 9 per cent.

2. Specified categories of Government securities would be opened fully for non-resident investors, along with domestic investors as well.

3. New Debt-based Exchange Traded Fund (ETF) consisting primarily of Government Securities to be floated. This is on the back of the massive success of the previous version. Further, it is expected to give retail investors access to Government securities, attractive investment option to Pension Funds and long-term investors.

4. New legislation is proposed for laying down mechanisms for netting of financial contracts; this is to improve investor confidence and further expand the scope of Credit Default Swaps.

5. A new mechanism would be devised to further support the Partial Credit Guarantee Scheme floated by the Government, post the Union Budget 2019-20, to address the liquidity crisis of NBFCs. The Government will offer support by guaranteeing securities so floated.

Sitharaman presented the Union Budget 2020 in a record speech of 160 minutes. She had cut short her Budget speech before she could finish her 13,331-word speech.

This was the longest Budget speech by any finance minister.

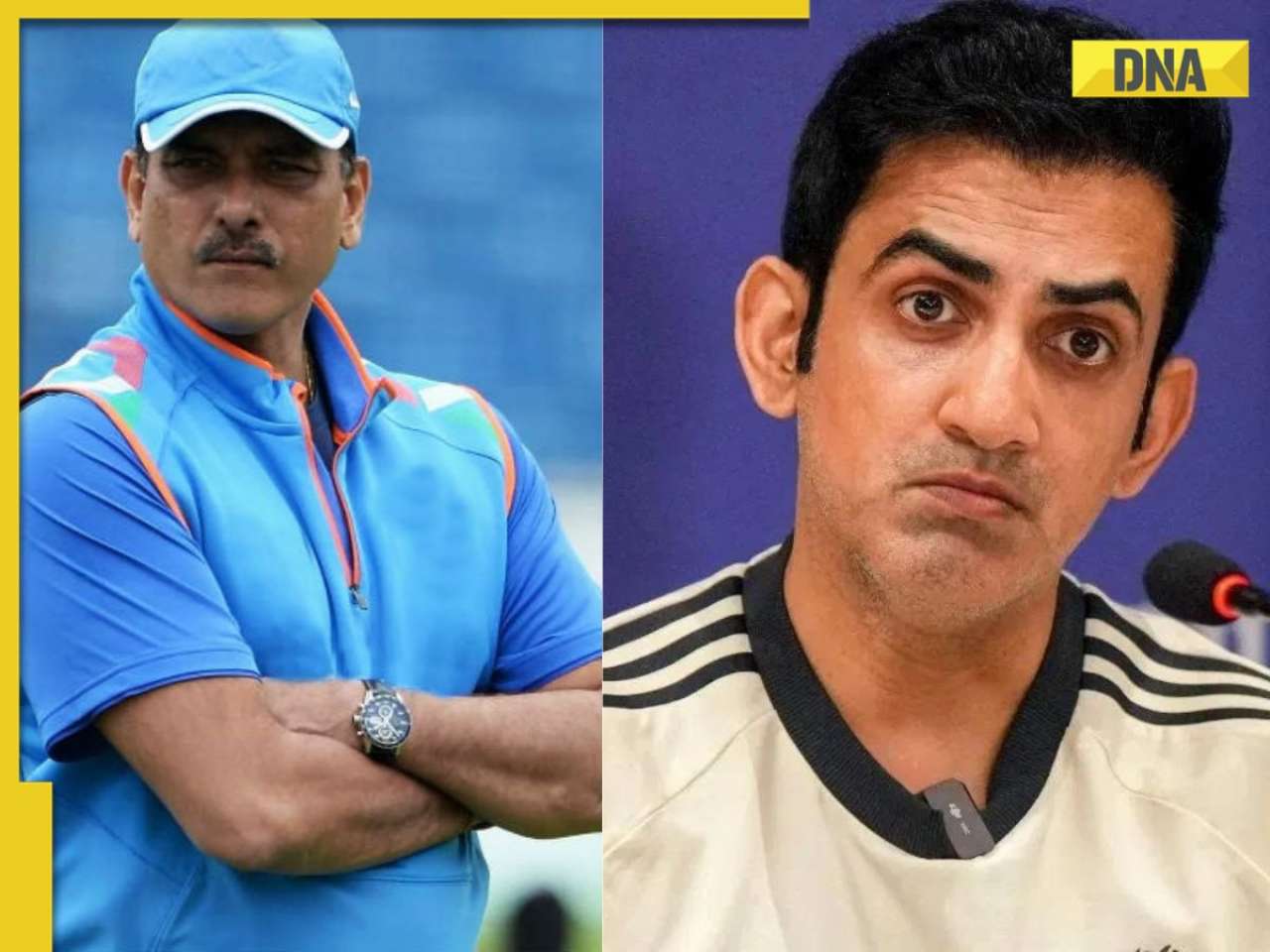

![submenu-img]() 'He's contemporary...': Ravi Shastri's 'no-nonsense' take on Gautam Gambhir as Team India head coach

'He's contemporary...': Ravi Shastri's 'no-nonsense' take on Gautam Gambhir as Team India head coach![submenu-img]() Karnataka cabinet renames Ramanagara district as Bengaluru South

Karnataka cabinet renames Ramanagara district as Bengaluru South![submenu-img]() Farah Khan, Sajid Khan's mother Menka Irani passes away at 79

Farah Khan, Sajid Khan's mother Menka Irani passes away at 79![submenu-img]() Meet man who quit high-paying job, mortgaged everything to build Rs 4186 crore firm, produced India’s first…

Meet man who quit high-paying job, mortgaged everything to build Rs 4186 crore firm, produced India’s first… ![submenu-img]() Video of Mukesh Ambani playing Haldi with Ranveer Singh during Anant-Radhika’s wedding goes viral, WATCH

Video of Mukesh Ambani playing Haldi with Ranveer Singh during Anant-Radhika’s wedding goes viral, WATCH![submenu-img]() Meet woman, a doctor who cleared UPSC exam to become IAS officer, resigned after 7 years due to...

Meet woman, a doctor who cleared UPSC exam to become IAS officer, resigned after 7 years due to...![submenu-img]() Meet IAS officer, one of India's most educated men, who earned 20 degrees, gold medals in...

Meet IAS officer, one of India's most educated men, who earned 20 degrees, gold medals in...![submenu-img]() Meet Maths genius, who worked with IIT, NASA, went missing suddenly, was found after years..

Meet Maths genius, who worked with IIT, NASA, went missing suddenly, was found after years..![submenu-img]() Meet Indian genius who fled to Delhi from Pakistan, worked at two IITs, awarded India’s top science award for…

Meet Indian genius who fled to Delhi from Pakistan, worked at two IITs, awarded India’s top science award for…![submenu-img]() Meet woman who cracked UPSC exam after accident, underwent 14 surgeries, still became IAS officer, she is...

Meet woman who cracked UPSC exam after accident, underwent 14 surgeries, still became IAS officer, she is...![submenu-img]() 5 Men Rape Australian Woman In Paris Just Days Ahead Of Olympic | Paris Olympics 2024

5 Men Rape Australian Woman In Paris Just Days Ahead Of Olympic | Paris Olympics 2024![submenu-img]() US Elections: 'I Know Trump's Type', Says Kamala Harris As She Launches Election Campaign

US Elections: 'I Know Trump's Type', Says Kamala Harris As She Launches Election Campaign![submenu-img]() Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu

Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu![submenu-img]() J&K Encounter: Search Operation By Indian Army, Police Continue, 1 Terrorist Neutralised In Kupwara

J&K Encounter: Search Operation By Indian Army, Police Continue, 1 Terrorist Neutralised In Kupwara![submenu-img]() Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu

Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu![submenu-img]() NASA images: 7 mesmerising images of space will make you fall in love with astronomy

NASA images: 7 mesmerising images of space will make you fall in love with astronomy![submenu-img]() 8 athletes with most Olympic medals

8 athletes with most Olympic medals![submenu-img]() In pics: Step inside Jalsa, Amitabh Bachchan, Jaya Bachchan's Rs 120 crore mansion with gym, jacuzzi, aesthetic decor

In pics: Step inside Jalsa, Amitabh Bachchan, Jaya Bachchan's Rs 120 crore mansion with gym, jacuzzi, aesthetic decor![submenu-img]() Remember Paul Blackthorne, Lagaan's Captain Russell? Quit films, did side roles in Hollywood, looks unrecognisable now

Remember Paul Blackthorne, Lagaan's Captain Russell? Quit films, did side roles in Hollywood, looks unrecognisable now![submenu-img]() This actor was called next superstar, bigger than Amitabh, Vinod Khanna, then lost stardom, was arrested for wife's...

This actor was called next superstar, bigger than Amitabh, Vinod Khanna, then lost stardom, was arrested for wife's...![submenu-img]() Karnataka cabinet renames Ramanagara district as Bengaluru South

Karnataka cabinet renames Ramanagara district as Bengaluru South![submenu-img]() Meet man, tribal who tipped off Army about Pakistani intruders in Kargil, awaits relief from govt even after...

Meet man, tribal who tipped off Army about Pakistani intruders in Kargil, awaits relief from govt even after...![submenu-img]() Puja Khedkar case latest update: Shocking details about her parents Manorama Khedkar, Dilip Khedkar revealed

Puja Khedkar case latest update: Shocking details about her parents Manorama Khedkar, Dilip Khedkar revealed![submenu-img]() Kargil Vijay Diwas Live Updates: PM Modi visits Dras to mark 25th anniversary of Kargil Vijay Diwas

Kargil Vijay Diwas Live Updates: PM Modi visits Dras to mark 25th anniversary of Kargil Vijay Diwas![submenu-img]() Big rejig in BJP: New state chief for Bihar and Rajasthan named

Big rejig in BJP: New state chief for Bihar and Rajasthan named![submenu-img]() DRDO fortifies India's skies: Phase II ballistic missile defence trial successful

DRDO fortifies India's skies: Phase II ballistic missile defence trial successful![submenu-img]() Gaza Conflict Spurs Unlikely Partners: Hamas, Fatah factions sign truce in Beijing

Gaza Conflict Spurs Unlikely Partners: Hamas, Fatah factions sign truce in Beijing![submenu-img]() Crackdowns and Crisis of Legitimacy: What lies beyond Bangladesh's apex court scaling down job quotas

Crackdowns and Crisis of Legitimacy: What lies beyond Bangladesh's apex court scaling down job quotas![submenu-img]() Area 51: Alien testing ground or enigmatic US military base?

Area 51: Alien testing ground or enigmatic US military base?![submenu-img]() Transforming India's Aerospace Industry: Budget 2024 and Beyond

Transforming India's Aerospace Industry: Budget 2024 and Beyond![submenu-img]() Farah Khan, Sajid Khan's mother Menka Irani passes away at 79

Farah Khan, Sajid Khan's mother Menka Irani passes away at 79![submenu-img]() Aishwarya blushes singing 'Meri Saason Mein Basa Hai' in presence of Salman, old video goes viral amid divorce rumours

Aishwarya blushes singing 'Meri Saason Mein Basa Hai' in presence of Salman, old video goes viral amid divorce rumours![submenu-img]() Chalti Rahe Zindagi review: Siddhant Kapoor's relatable but boring lockdown drama can be skipped

Chalti Rahe Zindagi review: Siddhant Kapoor's relatable but boring lockdown drama can be skipped ![submenu-img]() 'This is nothing but...': Pahlaj Nihalani on CBFC's delay in censor certification of John Abraham's Vedaa

'This is nothing but...': Pahlaj Nihalani on CBFC's delay in censor certification of John Abraham's Vedaa ![submenu-img]() Does Janhvi Kapoor pay for social media praise, positive comments? Actress reacts, 'itna budget...'

Does Janhvi Kapoor pay for social media praise, positive comments? Actress reacts, 'itna budget...'![submenu-img]() Video of Mukesh Ambani playing Haldi with Ranveer Singh during Anant-Radhika’s wedding goes viral, WATCH

Video of Mukesh Ambani playing Haldi with Ranveer Singh during Anant-Radhika’s wedding goes viral, WATCH![submenu-img]() 'BMW, Mercedes, all gone’: Man's luxury cars worth over Rs 10000000 ruined, watch viral video

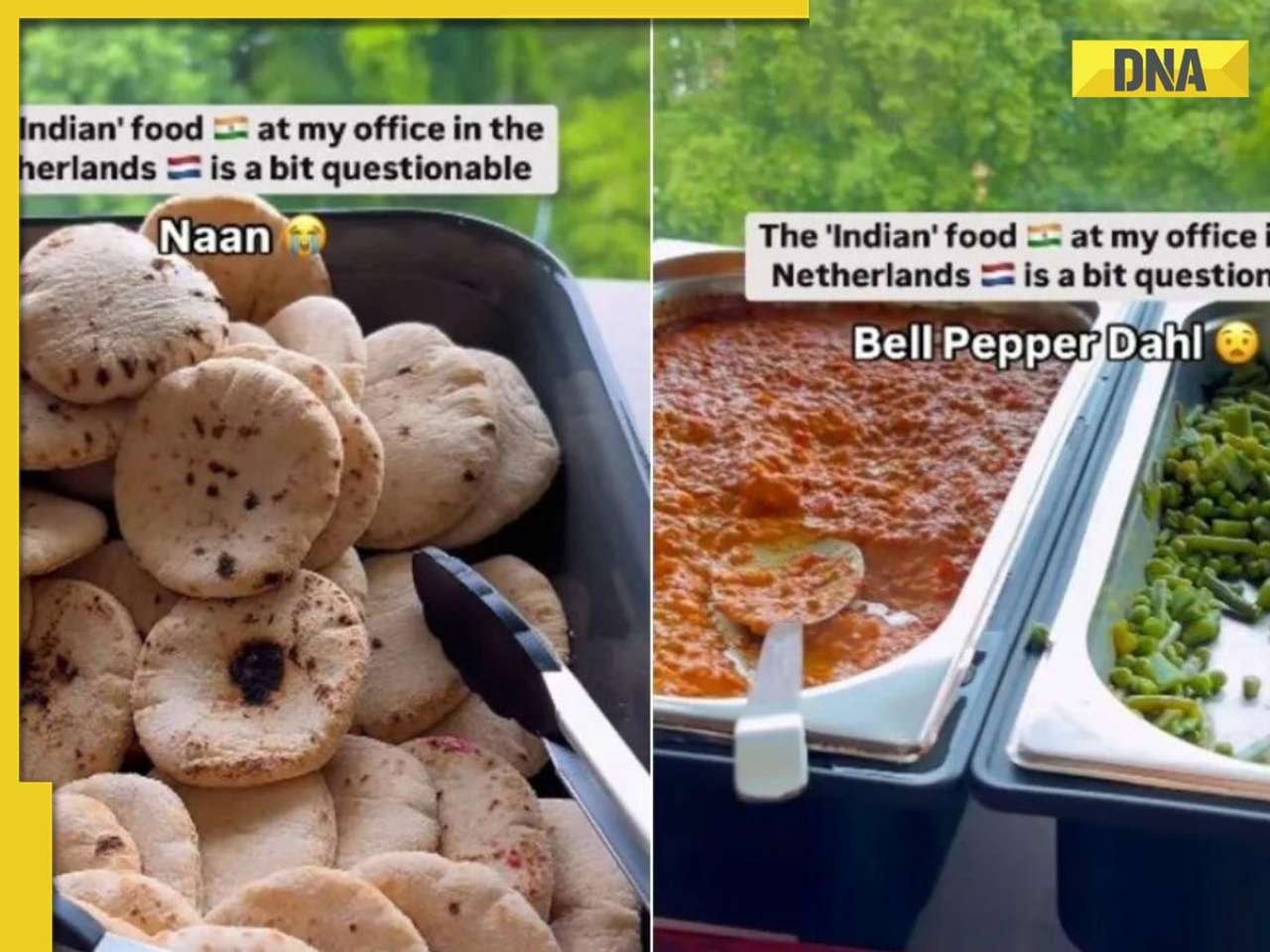

'BMW, Mercedes, all gone’: Man's luxury cars worth over Rs 10000000 ruined, watch viral video![submenu-img]() Watch video: 'Questionable' Indian food served to employees in Dutch office; Internet reacts

Watch video: 'Questionable' Indian food served to employees in Dutch office; Internet reacts![submenu-img]() This small nation is most important country in world, plays huge role in shaping geopolitics, it is...

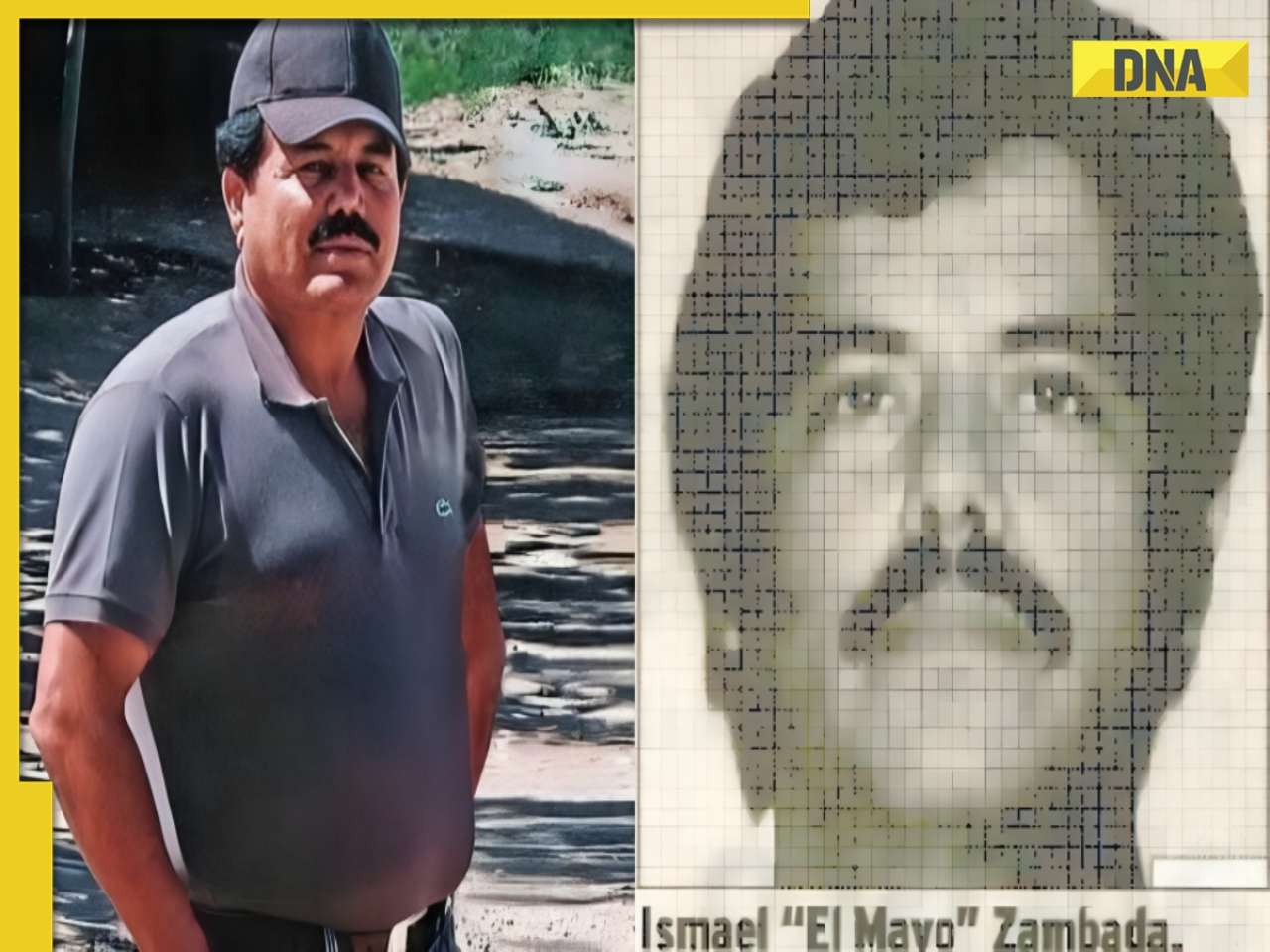

This small nation is most important country in world, plays huge role in shaping geopolitics, it is...![submenu-img]() El Mayo in US custody: Who is Mexican drug lord Ismael Zambada, Sinaloa cartel leader arrested with El Chapo's son?

El Mayo in US custody: Who is Mexican drug lord Ismael Zambada, Sinaloa cartel leader arrested with El Chapo's son?

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)