Silver prices are down to around $35 per ounce (1 troy ounce equals 31.1 grams) in international markets after touching a high of $49.845 per ounce on April 25, 2011.

Silver prices are down to around $35 per ounce (1 troy ounce equals 31.1 grams) in international markets after touching a high of $49.845 per ounce on April 25, 2011.

This price was the highest since January 1980, when the white metal touched $50.35 per ounce.

So what are the immediate reasons for this fall in price of around $15 per ounce?

Rumours on Wall Street have it that George Soros, the famed hedge fund manager, is selling his positions in gold and silver.

The Wall Street Journal reported: “George Soros’s big hedge fund, a firm operated by high-profile investor John Burbank and some other leading firms have been selling gold and silver, according to people close to the matter, after furiously accumulating precious metals for much of the past two years.”

Soros Fund Management had been buying silver to protect against the possibility of deflation (or the prospect of falling prices). “But now the $28 billion Soros firm...believes chances of deflation are reduced,” says the Journal. And so they are selling out.

Other than Soros, Mexican billionaire Carlos Slim is also rumoured to be selling silver futures as a hedge. These rumours have had a negative impact on the price of silver.

The minimum amount of cash or margin that needs to be deposited with brokers in order to trade silver futures at the Chicago Mercantile Exchange (CME) has been increased significantly. From today, investors will have to pay $21,600 per contract to trade silver futures on the margin.

That’s up from $8,700 required before April 25, 2011, when silver touched a high of $49.845. The current margin is $16,200 per contract.

How does an increase in margins impact the price of silver? Investors who are trading on the margin must get out of their positions if they can’t pay up the higher margin required. This in turn leads to a fall in price.

Let us understand this through an example. One silver contract on CME is standardised at 5000 ounces of silver. Prior to April 25, 2011, when silver touched a high of $49.845, the margin required to trade silver on the CME was $8,700 per contract.

Let us say an investor trading on the margin picked up one contract of silver at $46 per ounce. The position would be worth $230,000 ($46 x 5000 ounces). Of this, the investor’s equity would be $8,700, or the amount he has paid as the margin.

Now, let us say the price of silver goes up to $50 (it did not go beyond $49.845, but I am assuming $50 for ease of calculation). At this point, the investor’s position is worth $250,000 ($50 x 5000ounces). His equity increases to $28,700 ($250,000 - $230,000 + $8,700), so all is well.

At nearly $50 per ounce on April 25, 2011, silver reached a resistance level. As Michael D Sheimo explains in his book Stock Market Rules, “Resistance...is a level where stock market advances stopped in the past, where stock buyers stopped buying.” Silver had touched an all time high of $50.35 in January 1980.

Knowing this, the investors started to sell silver and the price of silver started to fall, and let us say, the price of silver was at $45 per ounce. At this point of time, the investor’s position would be worth $225,000. But his equity would be down to $3,700 {$8,700 - ($230,000, the initial position minus $225,000, the value of the current position)}.

Given that the exchange required a level of margin of $8,700, a margin call would be generated asking the investor to pay $5,000 more.

As the price of silver keeps falling, the investor will have to keep paying a greater margin, to keep maintaining a total margin of $8,700. At a price of $43 per ounce, the investor will have to pay $10,000 more to maintain a margin of $8,700.

As the price keeps increasing margin calls will keep getting generated, and at a certain point, the investor might simply run out of money and thus decide to sell out.

Also at a certain level, the exchange will also increase the margin required to trade silver in order to ensure that it does not have to keep issuing frequent margin calls to investors.

This is basically what has happened at CME. More margin calls have been issued to investors, and the margin amounts have also been increased at the same time. This has led to a situation where investors have sold out, leading to a fall in price of the white metal.

Of course on the brighter side the increase in margins will squeeze out the short-term speculators.

Investors selling out of silver ETFs

The falling price has also led to investors selling out of some of the biggest silver ETFs. This in turn has further accentuated the fall in price.

The falling price has led to a number of analysts coming out with sell reports on silver. But the point is what were these analysts doing when the price of silver was going through the roof? A major section of analysts now believe that the metal could fall to as low as $30 early next week. This would mean a fall of 40% from the top achieved on April 25, in a period of a little over two weeks.

Having said that, the fundamental reasons for investing silver, which I have discussed in my previous articles, still remain strong. “I’m holding for now, as the fundamental case is still intact. Short-term trading in this market is for professionals only. I am considering adding to long-term positions,” wrote Adam Sharp, editor of Wealth Wire in a recent column.

John Williams who runs Shadow Stats estimates that adjusted for inflation (using the consumer index), you’d be looking at a silver price of $490 per ounce.

A lot will depend on whether Ben Bernanke decides to launch Quantitative Easing 3 (QE 3). QE2 ends on June 30, 2011. Currently, the US is printing money to meet nearly 75% of its fiscal deficit. So, the chances are that they really wouldn’t have any other option but to launch QE3.

And as and when that happens, the price of gold and silver might start going through the roof again. As Sharp puts it, “By the time QE3 is announced (guessing early 2012 or before), I suspect we will be back at or above all-time highs.”

The writer works in the financial services industry and can be reached at chandniburman@yahoo.com. Views are personal.

![submenu-img]() 'He's contemporary...': Ravi Shastri's 'no-nonsense' take on Gautam Gambhir as Team India head coach

'He's contemporary...': Ravi Shastri's 'no-nonsense' take on Gautam Gambhir as Team India head coach![submenu-img]() Karnataka cabinet renames Ramanagara district as Bengaluru South

Karnataka cabinet renames Ramanagara district as Bengaluru South![submenu-img]() Farah Khan, Sajid Khan's mother Menka Irani passes away at 79

Farah Khan, Sajid Khan's mother Menka Irani passes away at 79![submenu-img]() Meet man who quit high-paying job, mortgaged everything to build Rs 4186 crore firm, produced India’s first…

Meet man who quit high-paying job, mortgaged everything to build Rs 4186 crore firm, produced India’s first… ![submenu-img]() Video of Mukesh Ambani playing Haldi with Ranveer Singh during Anant-Radhika’s wedding goes viral, WATCH

Video of Mukesh Ambani playing Haldi with Ranveer Singh during Anant-Radhika’s wedding goes viral, WATCH![submenu-img]() Meet woman, a doctor who cleared UPSC exam to become IAS officer, resigned after 7 years due to...

Meet woman, a doctor who cleared UPSC exam to become IAS officer, resigned after 7 years due to...![submenu-img]() Meet IAS officer, one of India's most educated men, who earned 20 degrees, gold medals in...

Meet IAS officer, one of India's most educated men, who earned 20 degrees, gold medals in...![submenu-img]() Meet Maths genius, who worked with IIT, NASA, went missing suddenly, was found after years..

Meet Maths genius, who worked with IIT, NASA, went missing suddenly, was found after years..![submenu-img]() Meet Indian genius who fled to Delhi from Pakistan, worked at two IITs, awarded India’s top science award for…

Meet Indian genius who fled to Delhi from Pakistan, worked at two IITs, awarded India’s top science award for…![submenu-img]() Meet woman who cracked UPSC exam after accident, underwent 14 surgeries, still became IAS officer, she is...

Meet woman who cracked UPSC exam after accident, underwent 14 surgeries, still became IAS officer, she is...![submenu-img]() 5 Men Rape Australian Woman In Paris Just Days Ahead Of Olympic | Paris Olympics 2024

5 Men Rape Australian Woman In Paris Just Days Ahead Of Olympic | Paris Olympics 2024![submenu-img]() US Elections: 'I Know Trump's Type', Says Kamala Harris As She Launches Election Campaign

US Elections: 'I Know Trump's Type', Says Kamala Harris As She Launches Election Campaign![submenu-img]() Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu

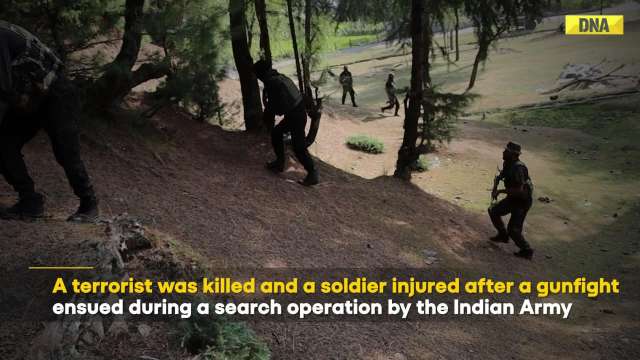

Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu![submenu-img]() J&K Encounter: Search Operation By Indian Army, Police Continue, 1 Terrorist Neutralised In Kupwara

J&K Encounter: Search Operation By Indian Army, Police Continue, 1 Terrorist Neutralised In Kupwara![submenu-img]() Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu

Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu![submenu-img]() NASA images: 7 mesmerising images of space will make you fall in love with astronomy

NASA images: 7 mesmerising images of space will make you fall in love with astronomy![submenu-img]() 8 athletes with most Olympic medals

8 athletes with most Olympic medals![submenu-img]() In pics: Step inside Jalsa, Amitabh Bachchan, Jaya Bachchan's Rs 120 crore mansion with gym, jacuzzi, aesthetic decor

In pics: Step inside Jalsa, Amitabh Bachchan, Jaya Bachchan's Rs 120 crore mansion with gym, jacuzzi, aesthetic decor![submenu-img]() Remember Paul Blackthorne, Lagaan's Captain Russell? Quit films, did side roles in Hollywood, looks unrecognisable now

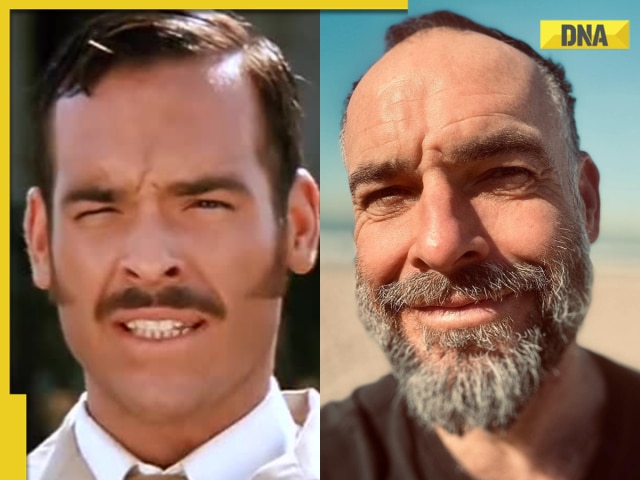

Remember Paul Blackthorne, Lagaan's Captain Russell? Quit films, did side roles in Hollywood, looks unrecognisable now![submenu-img]() This actor was called next superstar, bigger than Amitabh, Vinod Khanna, then lost stardom, was arrested for wife's...

This actor was called next superstar, bigger than Amitabh, Vinod Khanna, then lost stardom, was arrested for wife's...![submenu-img]() Karnataka cabinet renames Ramanagara district as Bengaluru South

Karnataka cabinet renames Ramanagara district as Bengaluru South![submenu-img]() Meet man, tribal who tipped off Army about Pakistani intruders in Kargil, awaits relief from govt even after...

Meet man, tribal who tipped off Army about Pakistani intruders in Kargil, awaits relief from govt even after...![submenu-img]() Puja Khedkar case latest update: Shocking details about her parents Manorama Khedkar, Dilip Khedkar revealed

Puja Khedkar case latest update: Shocking details about her parents Manorama Khedkar, Dilip Khedkar revealed![submenu-img]() Kargil Vijay Diwas Live Updates: PM Modi visits Dras to mark 25th anniversary of Kargil Vijay Diwas

Kargil Vijay Diwas Live Updates: PM Modi visits Dras to mark 25th anniversary of Kargil Vijay Diwas![submenu-img]() Big rejig in BJP: New state chief for Bihar and Rajasthan named

Big rejig in BJP: New state chief for Bihar and Rajasthan named![submenu-img]() DRDO fortifies India's skies: Phase II ballistic missile defence trial successful

DRDO fortifies India's skies: Phase II ballistic missile defence trial successful![submenu-img]() Gaza Conflict Spurs Unlikely Partners: Hamas, Fatah factions sign truce in Beijing

Gaza Conflict Spurs Unlikely Partners: Hamas, Fatah factions sign truce in Beijing![submenu-img]() Crackdowns and Crisis of Legitimacy: What lies beyond Bangladesh's apex court scaling down job quotas

Crackdowns and Crisis of Legitimacy: What lies beyond Bangladesh's apex court scaling down job quotas![submenu-img]() Area 51: Alien testing ground or enigmatic US military base?

Area 51: Alien testing ground or enigmatic US military base?![submenu-img]() Transforming India's Aerospace Industry: Budget 2024 and Beyond

Transforming India's Aerospace Industry: Budget 2024 and Beyond![submenu-img]() Farah Khan, Sajid Khan's mother Menka Irani passes away at 79

Farah Khan, Sajid Khan's mother Menka Irani passes away at 79![submenu-img]() Aishwarya blushes singing 'Meri Saason Mein Basa Hai' in presence of Salman, old video goes viral amid divorce rumours

Aishwarya blushes singing 'Meri Saason Mein Basa Hai' in presence of Salman, old video goes viral amid divorce rumours![submenu-img]() Chalti Rahe Zindagi review: Siddhant Kapoor's relatable but boring lockdown drama can be skipped

Chalti Rahe Zindagi review: Siddhant Kapoor's relatable but boring lockdown drama can be skipped ![submenu-img]() 'This is nothing but...': Pahlaj Nihalani on CBFC's delay in censor certification of John Abraham's Vedaa

'This is nothing but...': Pahlaj Nihalani on CBFC's delay in censor certification of John Abraham's Vedaa ![submenu-img]() Does Janhvi Kapoor pay for social media praise, positive comments? Actress reacts, 'itna budget...'

Does Janhvi Kapoor pay for social media praise, positive comments? Actress reacts, 'itna budget...'![submenu-img]() Video of Mukesh Ambani playing Haldi with Ranveer Singh during Anant-Radhika’s wedding goes viral, WATCH

Video of Mukesh Ambani playing Haldi with Ranveer Singh during Anant-Radhika’s wedding goes viral, WATCH![submenu-img]() 'BMW, Mercedes, all gone’: Man's luxury cars worth over Rs 10000000 ruined, watch viral video

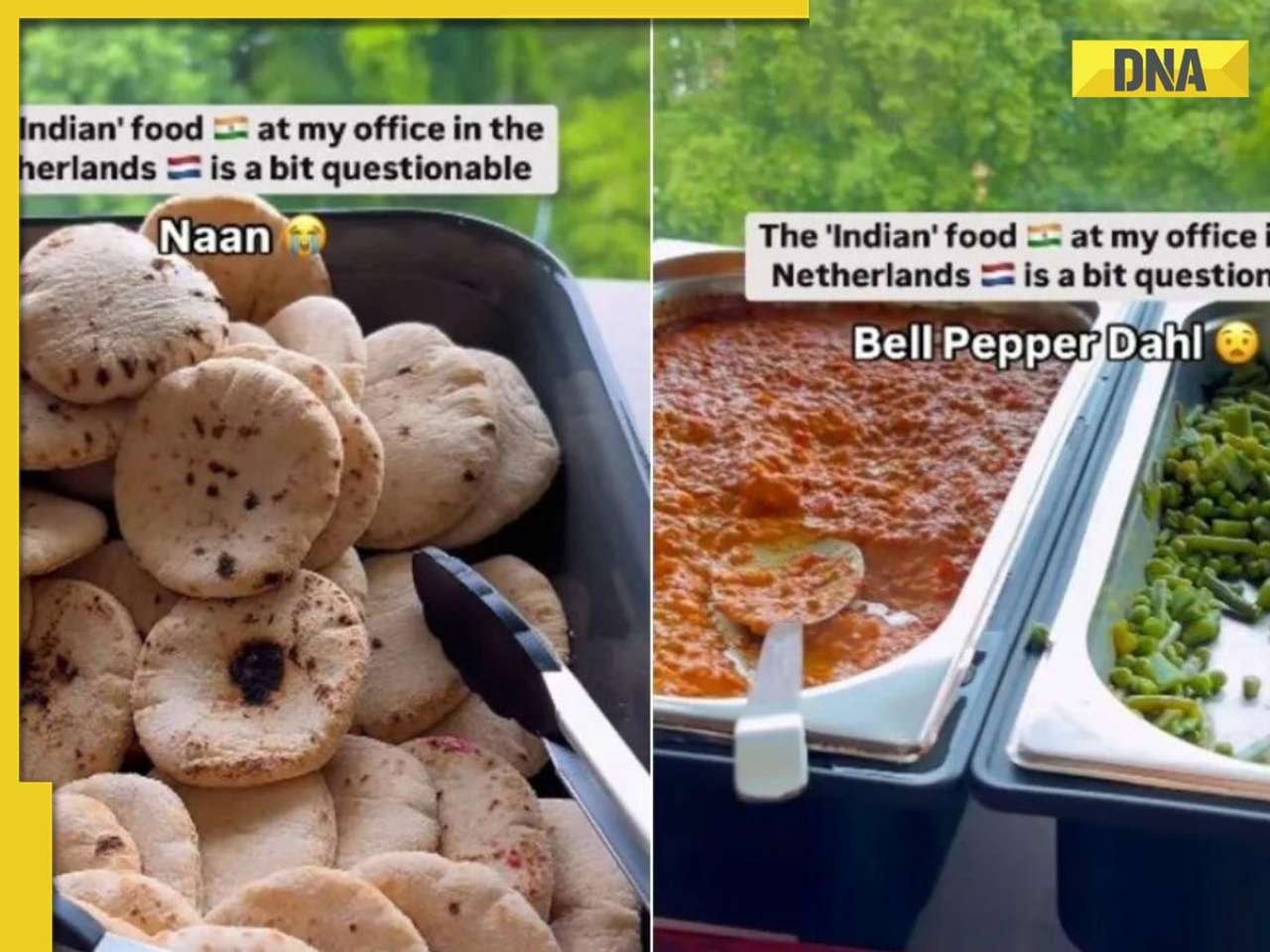

'BMW, Mercedes, all gone’: Man's luxury cars worth over Rs 10000000 ruined, watch viral video![submenu-img]() Watch video: 'Questionable' Indian food served to employees in Dutch office; Internet reacts

Watch video: 'Questionable' Indian food served to employees in Dutch office; Internet reacts![submenu-img]() This small nation is most important country in world, plays huge role in shaping geopolitics, it is...

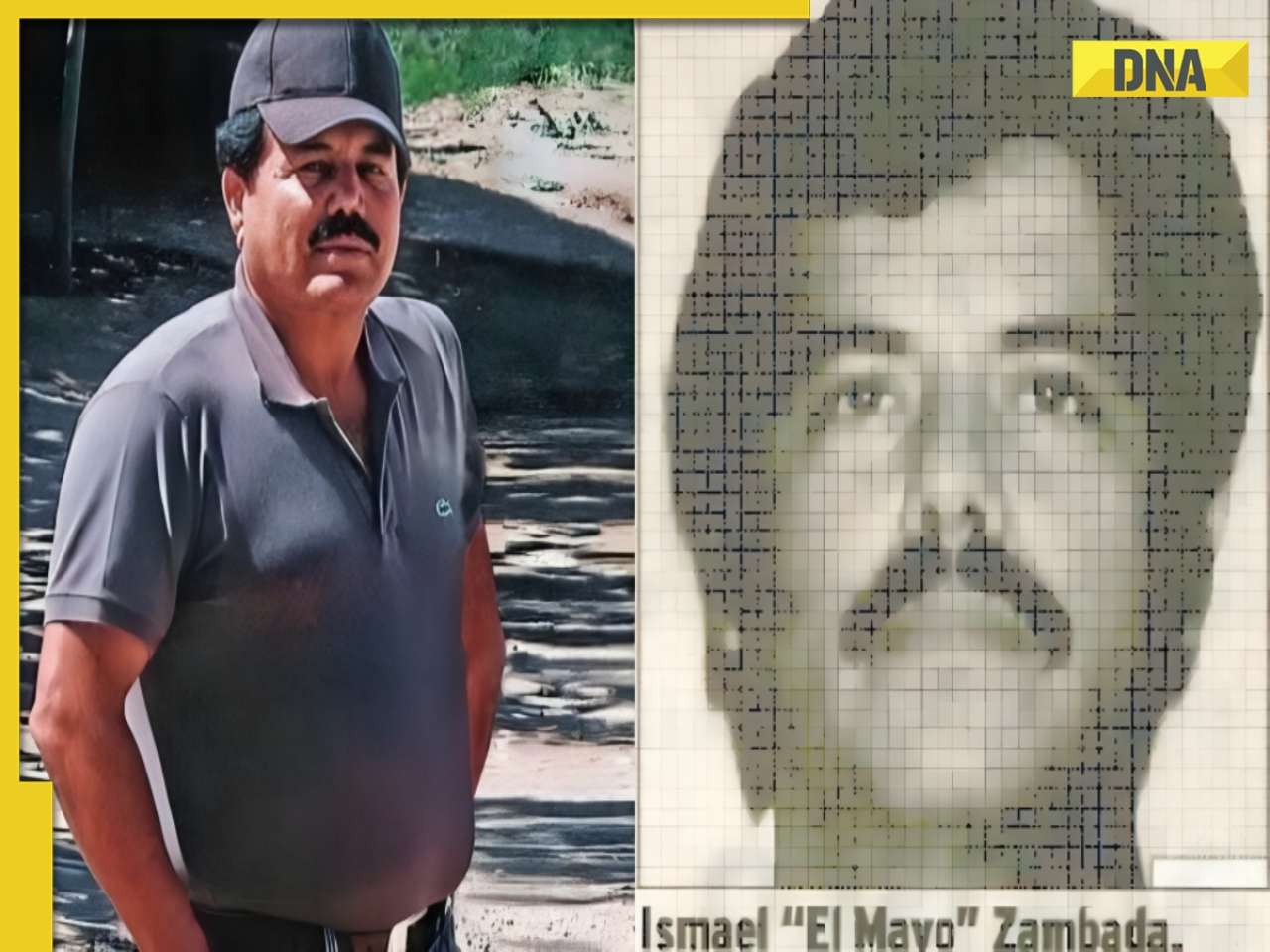

This small nation is most important country in world, plays huge role in shaping geopolitics, it is...![submenu-img]() El Mayo in US custody: Who is Mexican drug lord Ismael Zambada, Sinaloa cartel leader arrested with El Chapo's son?

El Mayo in US custody: Who is Mexican drug lord Ismael Zambada, Sinaloa cartel leader arrested with El Chapo's son?

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)