With GST Network facing bottlenecks now, bizmen fear situation could worsen when filing will be in full swing

The GST Network, which is the interface between businessmen and the government, could face major bottlenecks when filing returns for GST will begin, and so there should be a provision for filing it half yearly instead of the monthly option, said businessmen and experts.

They also said that tax on necessary items like sanitaryware should be either abolished or kept to a minimum as they are the key in Swachchhata Abhiyaan of the Centre.

'We will have to file three full fledged returns in a matter of 20 days every month. Till the network becomes robust, the return filing should be made half yearly," said Vaaris Isani, president of Gujarat Sales Tax Bar Association.

Businessmen say that they do not have opposition to the GST but they are facing issues in terms of procedures and high incidence of taxes, which could upset the roll out of what is termed as 'The Biggest Indirect Tax Reform' in independent India.

"Ceramic, furniture, electrical and a few other products are taxed at 28%. Such high rates will make local products noncompetitive in the Indian market and will lead to dumping of Chinese products. The government should immediately reduce taxes on such products," said Shailesh Patwari, president of Gujarat Chamber of Commerce nd Industry (GCCI).

Patwari also demanded the provision of Reverse Charge Mechanism (RCM) should be abolished as it does not increases the revenue of the government and is a matter of harassment for genuine tax payers.

BUSINESS SPEAK

TRANSPORT

Bumps Ahead

Transporters complain of ambiguity in the implementation. While it is said that players need to register themselves as they are subjected to Reverse Charge Mechanism (RCM), there are other aspects of business where registration is a must. A provision, which mandates that if supplies are made outside a radius of 10 km, falls under e-Way bill is also complicating matters as over 70 per cent of the operates are not properly literate.

Transporters are not required to register as RCM applies to them, but there are various aspects which make registration compulsory. We have met the government asking to remove ambiguities. Business has dipped by about 15-20%.”

—Nimesh Patel, chairman of GST Committee, All India Motor Transport Congress

HOTELS AND RESTAURANTS

Footfalls drop by 50%

Hoteliers say that while the concept of One Nation One Tax seems good, it is impracticable in a vast and diverse country like India. Players in smaller cities and towns stand to lose in the game. Players told DNA that footfalls in local restaurants have dropped by about 50 per cent. They forsee a return of a higher tax regime in the country.

From June to August, the business has dropped by 50%. Our staff strength has decreased by 20-25%. High taxes in Metro cities is okay but in smaller cities, the restrictions make business unviable.

—Sanat Relia, president, The Southern Gujarat Hotel and Restaurant Association

FOOD ITEMS

Left in bitter taste

Wholesale business in grains, pulses and spices has been traditionally in cash and on credit. Demonetisation has hit it hard. Now GST is yet another blow, say businessmen. While it was claimed that GST would bring down prices, actually prices of sweets have increased. Bakers have raised prices.

In the processed food sector, over 80% of business is unorganised. Subjecting them to compliance of filing monthly returns is unjustified. The complaince requirements are confusing. If job losses happen in this sector, it will not be compensated.

—Hiren Gandhi, chairman, Food Committee, Gujarat Chamber of Commerce and Industry

CERAMICS

Lower taxes

Morbi, in Saurashtra region with about 650 companies, is the ceramic hub of India. Its production stands at Rs28,500 crore, of which exports constitute about Rs6,200 crore. The tax rate has remained by and large the same after the roll out of GST. Players say these are not luxury products and the tax should be decreased from 28% to 12%. They want fuels to be a part of GST.

We assure the government of zero revenue loss. These are basic items for sanitary use and should be taxed at 12%. Fuel is a major input for our sector. We want it under the GST umbrella so that players can get input tax credit, which will help continue price advantage in export markets.

—Nilesh Jetparia, president, Morbi Ceramics Association

![submenu-img]() IND vs SL, 1st T20I: Predicted playing XIs, live streaming details, weather and pitch report

IND vs SL, 1st T20I: Predicted playing XIs, live streaming details, weather and pitch report![submenu-img]() Women's Asia Cup 2024: India beat Bangladesh by 10 wickets to reach ninth successive final

Women's Asia Cup 2024: India beat Bangladesh by 10 wickets to reach ninth successive final![submenu-img]() Apple reduces prices of iPhones across models, iPhones 13, 14 and 15 will be cheaper by Rs...

Apple reduces prices of iPhones across models, iPhones 13, 14 and 15 will be cheaper by Rs...![submenu-img]() 'Elon Musk treated me badly for...,' says Tesla chief's daughter Vivian Jenna Wilson

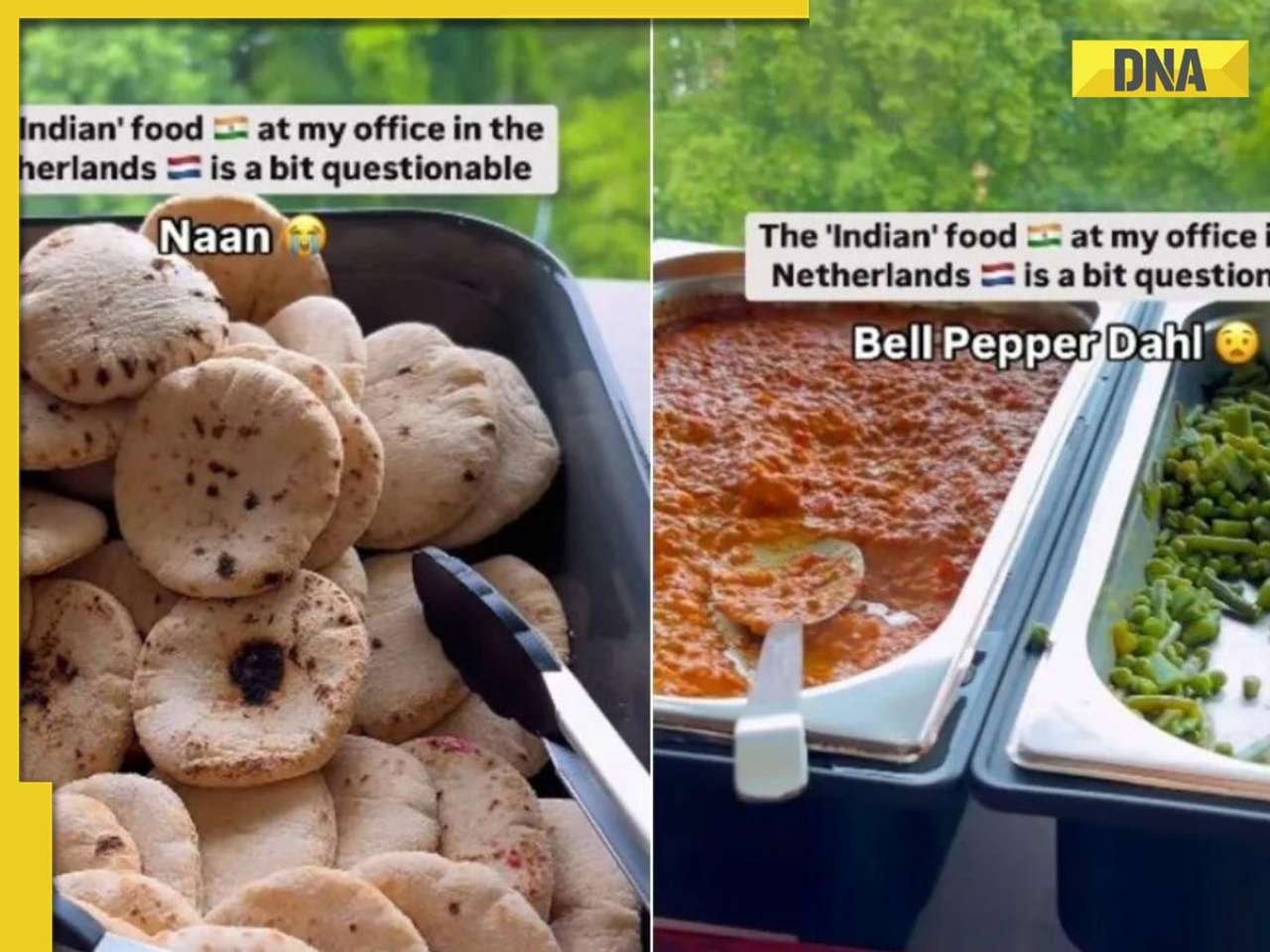

'Elon Musk treated me badly for...,' says Tesla chief's daughter Vivian Jenna Wilson![submenu-img]() Watch video: 'Questionable' Indian food served to employees in Dutch office; Internet reacts

Watch video: 'Questionable' Indian food served to employees in Dutch office; Internet reacts![submenu-img]() Meet woman, a doctor who cleared UPSC exam to become IAS officer, resigned after 7 years due to...

Meet woman, a doctor who cleared UPSC exam to become IAS officer, resigned after 7 years due to...![submenu-img]() Meet IAS officer, one of India's most educated men, who earned 20 degrees, gold medals in...

Meet IAS officer, one of India's most educated men, who earned 20 degrees, gold medals in...![submenu-img]() Meet Maths genius, who worked with IIT, NASA, went missing suddenly, was found after years..

Meet Maths genius, who worked with IIT, NASA, went missing suddenly, was found after years..![submenu-img]() Meet Indian genius who fled to Delhi from Pakistan, worked at two IITs, awarded India’s top science award for…

Meet Indian genius who fled to Delhi from Pakistan, worked at two IITs, awarded India’s top science award for…![submenu-img]() Meet woman who cracked UPSC exam after accident, underwent 14 surgeries, still became IAS officer, she is...

Meet woman who cracked UPSC exam after accident, underwent 14 surgeries, still became IAS officer, she is...![submenu-img]() 5 Men Rape Australian Woman In Paris Just Days Ahead Of Olympic | Paris Olympics 2024

5 Men Rape Australian Woman In Paris Just Days Ahead Of Olympic | Paris Olympics 2024![submenu-img]() US Elections: 'I Know Trump's Type', Says Kamala Harris As She Launches Election Campaign

US Elections: 'I Know Trump's Type', Says Kamala Harris As She Launches Election Campaign![submenu-img]() Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu

Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu![submenu-img]() J&K Encounter: Search Operation By Indian Army, Police Continue, 1 Terrorist Neutralised In Kupwara

J&K Encounter: Search Operation By Indian Army, Police Continue, 1 Terrorist Neutralised In Kupwara![submenu-img]() Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu

Breaking! Nepal Plane Crash: Saurya Airlines Flight With 19 On Board Crashes In Kathmandu![submenu-img]() NASA images: 7 mesmerising images of space will make you fall in love with astronomy

NASA images: 7 mesmerising images of space will make you fall in love with astronomy![submenu-img]() 8 athletes with most Olympic medals

8 athletes with most Olympic medals![submenu-img]() In pics: Step inside Jalsa, Amitabh Bachchan, Jaya Bachchan's Rs 120 crore mansion with gym, jacuzzi, aesthetic decor

In pics: Step inside Jalsa, Amitabh Bachchan, Jaya Bachchan's Rs 120 crore mansion with gym, jacuzzi, aesthetic decor![submenu-img]() Remember Paul Blackthorne, Lagaan's Captain Russell? Quit films, did side roles in Hollywood, looks unrecognisable now

Remember Paul Blackthorne, Lagaan's Captain Russell? Quit films, did side roles in Hollywood, looks unrecognisable now![submenu-img]() This actor was called next superstar, bigger than Amitabh, Vinod Khanna, then lost stardom, was arrested for wife's...

This actor was called next superstar, bigger than Amitabh, Vinod Khanna, then lost stardom, was arrested for wife's...![submenu-img]() Meet man, tribal who tipped off Army about Pakistani intruders in Kargil, awaits relief from govt even after...

Meet man, tribal who tipped off Army about Pakistani intruders in Kargil, awaits relief from govt even after...![submenu-img]() Puja Khedkar case latest update: Shocking details about her parents Manorama Khedkar, Dilip Khedkar revealed

Puja Khedkar case latest update: Shocking details about her parents Manorama Khedkar, Dilip Khedkar revealed![submenu-img]() Kargil Vijay Diwas Live Updates: PM Modi visits Dras to mark 25th anniversary of Kargil Vijay Diwas

Kargil Vijay Diwas Live Updates: PM Modi visits Dras to mark 25th anniversary of Kargil Vijay Diwas![submenu-img]() Big rejig in BJP: New state chief for Bihar and Rajasthan named

Big rejig in BJP: New state chief for Bihar and Rajasthan named![submenu-img]() Mumbai rains: Schools, colleges to operate normally today, BMC urges citizens to...

Mumbai rains: Schools, colleges to operate normally today, BMC urges citizens to...![submenu-img]() DRDO fortifies India's skies: Phase II ballistic missile defence trial successful

DRDO fortifies India's skies: Phase II ballistic missile defence trial successful![submenu-img]() Gaza Conflict Spurs Unlikely Partners: Hamas, Fatah factions sign truce in Beijing

Gaza Conflict Spurs Unlikely Partners: Hamas, Fatah factions sign truce in Beijing![submenu-img]() Crackdowns and Crisis of Legitimacy: What lies beyond Bangladesh's apex court scaling down job quotas

Crackdowns and Crisis of Legitimacy: What lies beyond Bangladesh's apex court scaling down job quotas![submenu-img]() Area 51: Alien testing ground or enigmatic US military base?

Area 51: Alien testing ground or enigmatic US military base?![submenu-img]() Transforming India's Aerospace Industry: Budget 2024 and Beyond

Transforming India's Aerospace Industry: Budget 2024 and Beyond![submenu-img]() Chalti Rahe Zindagi review: Siddhant Kapoor's relatable but boring lockdown drama can be skipped

Chalti Rahe Zindagi review: Siddhant Kapoor's relatable but boring lockdown drama can be skipped ![submenu-img]() 'This is nothing but...': Pahlaj Nihalani on CBFC's delay in censor certification of John Abraham's Vedaa

'This is nothing but...': Pahlaj Nihalani on CBFC's delay in censor certification of John Abraham's Vedaa ![submenu-img]() Does Janhvi Kapoor pay for social media praise, positive comments? Actress reacts, 'itna budget...'

Does Janhvi Kapoor pay for social media praise, positive comments? Actress reacts, 'itna budget...'![submenu-img]() Parineeti Chopra's cryptic post about 'throwing toxic people out of life' scares fans: 'Stop living for...'

Parineeti Chopra's cryptic post about 'throwing toxic people out of life' scares fans: 'Stop living for...'![submenu-img]() Highest grossing animated film ever has earned Rs 12200 crore; beat The Lion King, Toy Story, Frozen, Minions, Shrek

Highest grossing animated film ever has earned Rs 12200 crore; beat The Lion King, Toy Story, Frozen, Minions, Shrek![submenu-img]() Watch video: 'Questionable' Indian food served to employees in Dutch office; Internet reacts

Watch video: 'Questionable' Indian food served to employees in Dutch office; Internet reacts![submenu-img]() This small nation is most important country in world, plays huge role in shaping geopolitics, it is...

This small nation is most important country in world, plays huge role in shaping geopolitics, it is...![submenu-img]() El Mayo in US custody: Who is Mexican drug lord Ismael Zambada, Sinaloa cartel leader arrested with El Chapo's son?

El Mayo in US custody: Who is Mexican drug lord Ismael Zambada, Sinaloa cartel leader arrested with El Chapo's son?![submenu-img]() Viral video: 15-foot python attacks and nearly swallows Jabalpur man, here's how locals save him, watch

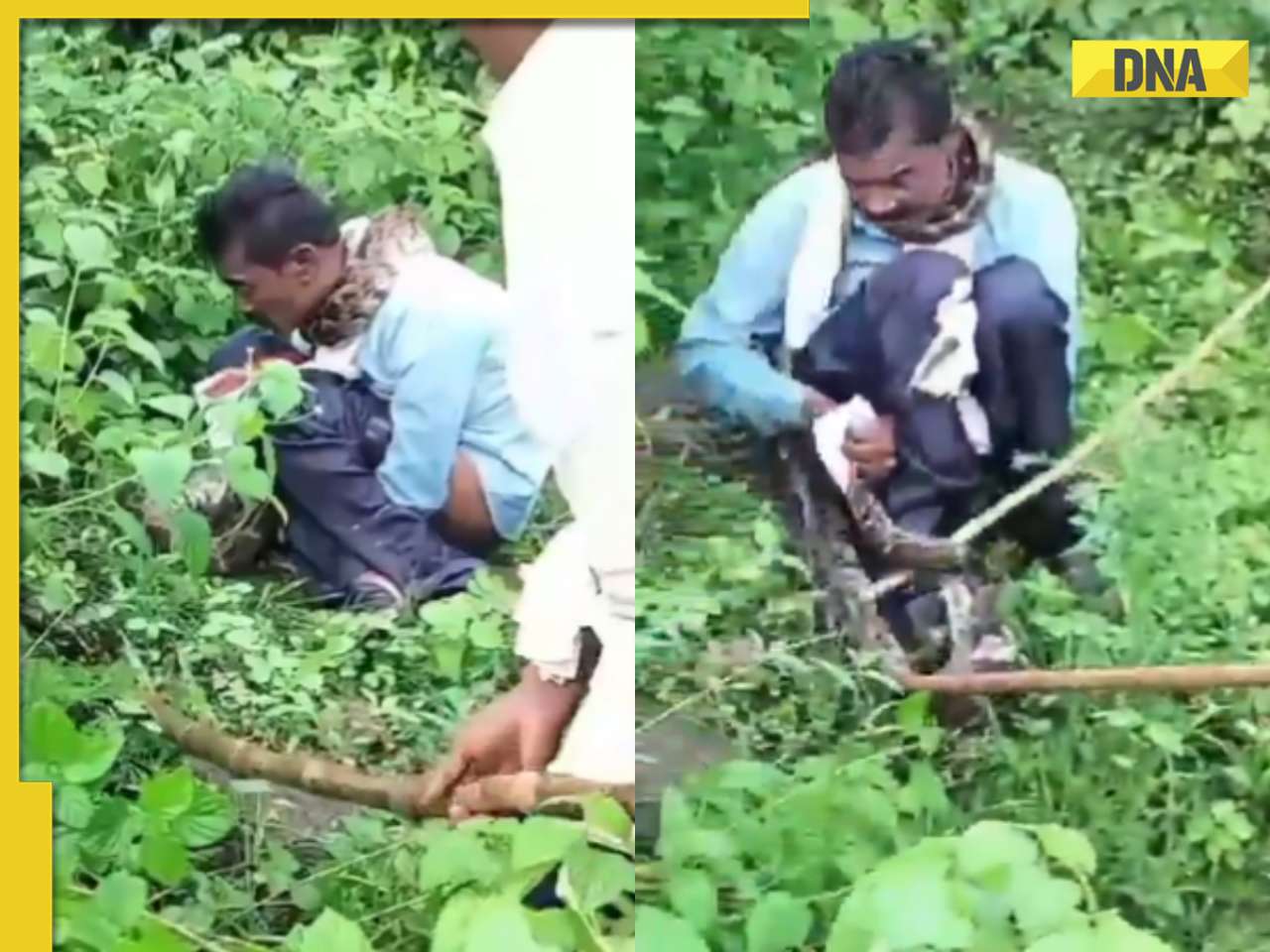

Viral video: 15-foot python attacks and nearly swallows Jabalpur man, here's how locals save him, watch![submenu-img]() 'Anant knows everything': Akash Ambani, Isha Ambani tell Amitabh Bachchan as…

'Anant knows everything': Akash Ambani, Isha Ambani tell Amitabh Bachchan as…

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)