Policy Watch: New government needs to ease FDI rules to spur investment, create more jobs

As the country prepares to go in for elections, some things are becoming crystal clear. Whoever comes to power will have to deal with two major problems.

One will be financial. The outgoing government has left behind several unpaid bills. These include, on an annual recurring basis, higher gas prices (upwards of Rs 0.75 lakh crore), food security (Rs 1 lakh crore), increased salaries for government staff and other "social security" doles. Then there are unpaid bills -- bad loans(Rs 1.9 lakh crore, just for the 2008-13 period), Food Corporation of India arrears (Rs 50,000 crore), oil subsidies, fertiliser subsidy Rs 6 lakh crore budget deficit and a host of other demands.

The new government will have to find the means to finance these, even while tax receipts have dwindled. Expect some critical recalibration of policies on account of this, irrespective of who comes to power.

The second problem will be job creation. With over 100-150 million people unemployed(http://www.dnaindia.com/money/column-policy-watch-govt-needs-to-focus-on-creating-jobs-not-doles-1917157), any government that comes to power will have to create new jobs. Failure to do so will inevitably lead to social unrest.

Unfortunately creating jobs means increasing capital formation, or investing in projects (highways, railways etc) that requires money. Can the government rustle up this additional money?

One simple solution would be to ease FDI rules. But FDI needs investment protection. It needs an assurance that there won't be retrospective tax and ownership laws. It will demand better enforcement of laws, equally, not selectively, and faster adjudication of disputes. Will the new government be able to deliver on this front?

There will also be a need to sift out countries which claim to be investors and those which have actually invested in India.

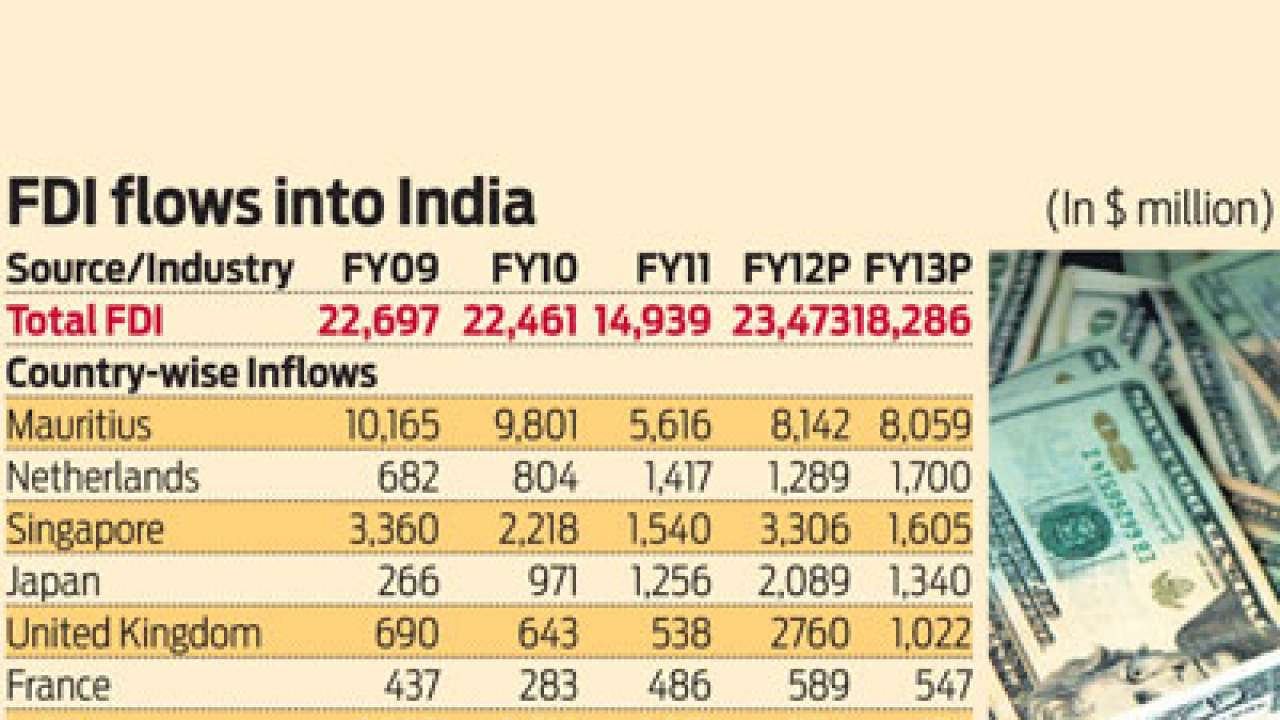

A look at RBI's data on FDI (http://www.rbi.org.in/scripts/AnnualReportPublications.aspx?Id=1110) shows how the US, despite its hype on investor protection and trade,is #7 in ranking. Japan, which was supposed to have become India's largest FDI partner, is actually at #4, not #1. The Netherlands and Singapore, meanwhile, have quietly climbed to #2 and #3 respectively. The largest FDI comes from Mauritius, which is actually more of a tax haven conduit for investment (largely short-term) into India.

There is another aspect that needs to be carefully monitored. FDI into manufacturing is growing. It jumped from just 21% of total FDI in 2008-09 to 36% in 2012-13. That is good news for a country where manufacturing has not grown much, and where jobs need to be created urgently. But with India's rigid labour laws and its new land acquisition laws, will FDI in manufacturing continue to hold out the same allure?

Likewise, it is heartening that FDI into financial services saw a decline from 20% to 15% of total FDI. But with the government's penchant for making India a tax haven for hot money (through instruments like participatory notes - http://www.dnaindia.com/money/1906450/column-policy-watch-p-notes-the-big-money-laundering-machine), will manufacturing continue to remain attractive?

Critically, the government will have to nudge investments into infrastructure to spur economic growth and also create jobs. It may, therefore, have to hive off some highways, airports and rail routes for development by private entrepreneurs – maybe on a BOT (build operate andt ransfer) basis. Look at the miracle that has taken place in ports and aviation, ever since they were thrown open to FDI and the private sector.

The numbers, as they stand, hold out a lot of hope. But beware the hype. What matters is long-term FDI, not merely loans, nor sale of equipment to India. The new government will have to find ways to seduce countries to vote with their money, and participate in the country's growth.