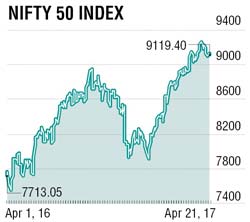

For the third week in a row, rallies got sold into taking markets lower. Nifty registered a negative week. Earnings having been pouring in thick and fast, and so far are in line with expectation. News flow on geopolitical concerns, monsoons and outlook on economy guided trading pattern. The Indian Meteorological Department's (IMD) forecast for India's crucial June-September or south-west monsoon season stands at 96% of long-period average, with an error of +/- 5%. The IMD considers rain in India as normal if it is between 96% and 104% of 50-year average of 89cm for the four months beginning June.

Banking, financial services and insurance, so far reported healthy set of Q4FY17 earnings update, while IT has been a disappointment. DCB Bank reported healthy profit before tax growth of 17% YoY. Net interest income grew 31% YOY to Rs 220 crore, helped by 10 basis point (bp) YoY improvement in margins to 4.04%. Performance on asset quality was impressive as concerns were high due to impact of demonetization on SME loans. Gruh Finance reported PAT of Rs 11,040 crore driven by strong loan growth, controlled operating expenses and lower provisioning charge. Loan growth for the quarter was a robust 19% YoY driven by growth of 19% in housing loans and 37% in developer loans. Gross non-performing loans (GNPLs) ratio was largely stable YoY at 0.31%. The company continued to maintain nil net NPLs (0.09% in 4QFY16). HDFC Bank delivered stellar performance on all fronts. It's PAT grew 18% YoY to Rs 3,990 crore, led by 27% YoY PPoP growth. The bank delivered robust loan growth, strong cost control, margins improvement and impeccable asset quality, with NSL less than 50 bp. Excellent performance by subs: a) HDB Financials' loans grew 32% YoY to Rs 33,500 crore and PAT rose 28% YoY for FY17; b) HDFC Securities' PAT grew 62% YoY to Rs 220 crore; PAT margin expanded to 39% from 33% a year ago. IndusInd Bank's (IIB) 4QFY17 PAT grew 21% YoY (in-line) to Rs 750 crore, while YES Bank registered PAT growth of 30% YoY. Both of them reported one off large account provision which impacted operating performance.

Cement companies proxy to infra and housing growth opened the Q4FY17 earnings update with ACC. Volume trend reversal came after three quarters. 1QCY17 volumes increased 3.8% YoY to 6.60 million tonne (mt), led by ramp-up of new capacity in the east. Cement realization of Rs 4,265/t (+4% YoY, -2% QoQ) was marginally below our estimate of Rs 4,297/t. However, the full impact of price hikes initiated in February/March 2017 would be reflected in realization improvement in 2QCY17. RMC volumes rose 8% YoY, led by higher sales of value-added products. Revenue increased 8% YoY to Rs 3,099 crore (est. of Rs 3,090 crore), led by volume growth in both cement and RMC.

Cement companies proxy to infra and housing growth opened the Q4FY17 earnings update with ACC. Volume trend reversal came after three quarters. 1QCY17 volumes increased 3.8% YoY to 6.60 million tonne (mt), led by ramp-up of new capacity in the east. Cement realization of Rs 4,265/t (+4% YoY, -2% QoQ) was marginally below our estimate of Rs 4,297/t. However, the full impact of price hikes initiated in February/March 2017 would be reflected in realization improvement in 2QCY17. RMC volumes rose 8% YoY, led by higher sales of value-added products. Revenue increased 8% YoY to Rs 3,099 crore (est. of Rs 3,090 crore), led by volume growth in both cement and RMC.

The Reserve Bank of India was worried about inflation, however going by minutes of the monetary policy committee meet, all six members voted in favour for a pause and continued to maintain neutral stance. Murmurs of rate hike are doing the rounds. Members point towards upside risk to inflation from Vegetable prices, rising rural wages, Possibility of El-Nino, Higher Rent allowance in 7th Pay Commission, higher global commodity prices and uncertainty regarding crude prices. Most members agree that impact of demonetization has been transitory in nature and of much lower magnitude than earlier anticipated. Committee sees "further scope for a more complete transmission of policy impulse, including for small savings and administered rates"; this could mean a reduction in savings bank rate soon. Over all reading of the minutes hints toward the beginning of the rate hike cycle in the second half of the fiscal year.

To sum up earnings so far is in line with expectation. Trading flavour has been profit taking which we expect to continue in ensuing week. For Nifty; 8950 to 9000 remains a strong support zone while it looks difficult for it to surpass 9250- 9300 in near future.

The writer is head-retail research, Motilal Oswal Securities