The bygone week witnessed another flat week in Global markets as equities were little changed on a net basis amid slowing activity ahead of the holiday period. However, bond yields rose sharply with the key US 10-year Treasury notes rising this week to 2.49% from 2.36% a week ago as the passage of the US tax reform Bill is expected to provide fiscal stimulus beginning 2018. Crude prices rose marginally too while the VIX, widely followed volatility index, slipped to below 9.50. Indian bonds continued to sell off with the minutes of the latest Reserve Bank of India monetary policy committee (MPC) suggesting RBI’s heightened concerns over inflation.

The GOP-sponsored tax bill, formerly known as the Tax Cuts and Jobs Act of 2017, was passed by both houses of Congress this week and will soon be signed into a law. The law’s key provisions include a lower corporate tax rate — 21%, down from 35% — and lower rates on individuals as well as a near doubling of the standard deduction. The Congress also passed a stopgap spending Bill that will fund the government through 19 January and avoid a payment crisis. Major US industrial houses celebrated the passage of the Bill with bonuses and wage hikes.

For records, the Dow Jones Industrials, the benchmark US Equity index, has had a record high-close on 70 occasions, surpassing a 22-year old record. A combination of surfeit of liquidity, lower rates and return of economic growth in major economies is said to be fuelling a never-before-seen optimism, this century. In other news, Catalonian secessionist improved their strength with a slender margin in the region’s parliament. And Portugal received its first rating upgrade from Fitch, a two-notch nudge into the BBB league that makes it barely investment grade.

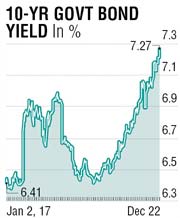

Indian bond markets suffered the most damage in recent years with key benchmark yield testing close to 7.30% in yet another carnage. The minutes of the December MPC meeting released last week suggested that the rate-cut cycle has decisively come to an end and most members of the RBI committee are worried about the risks of fresh inflation. Rising crude prices and a higher probability of fiscal slippage, accompanied by higher inflation expectations of household-survey are presumably key reasons behind RBI’s preference to taper rate-cut expectations and prepare markets for a cyclical upturn. That five out of six members vote for a no-change and continuance of neutral policy on liquidity was sufficient enough to drive bond yields past the 7.20%.

There is very little to suggest that the poor sentiment in the rates’ markets will reverse any sooner as the risks of fiscal slippages, the prospect of additional supply of bonds (farm loan waiver will have its impact on state finances), firmer global crude prices may keep bond yields elevated. Between August and now, yields on benchmark bonds have risen by nearly 90 basis points. The spread over 3m TBills, almost a percentage point now, comes across as one of the steepest in the last 6 years and may have its deleterious impact on credit growth which has taken a severe beating in the last 15 months.

With another cut in HTM ratio becoming operational in the coming week and a development in one of the auction papers last week, bond markets will have to brace for more negative sentiment. The 3-5y segment will be the toast as we get into the last quarter of a tumultuous financial year.

The writer is a markets expert