The bygone week had no shortage of market moves in the holiday-shortened session. Stocks were up modestly, bond yields were seen steadily moving up and the US dollar appears to have found some short-term support It was also a “Week of Minutes”, with the release of policy meetings minutes from the US FOMC, Europe ECB and India’s MPC.

The minutes suggest the end of easy money regime and preparedness to hike rates. Volatility is likely to persist as markets adjust to a different set of economic conditions from those witnessed post the Lehman crisis. Rising interest rates and other economic policy uncertainties are likely to result in more episodes of market volatility, including big stock market moves both up and down.

The US stocks finished modestly higher on the week as volatility persisted: in three of the four trading days benchmark US Treasury note retraced somewhat from a mid-week surge to 2.94% and is still below the highs of 2013.

Minutes of January Federal Open Market Committee meeting indicated that Fed officials have greater confidence in the near-term economic and policy outlook, and believe and it is highly likely we may see a couple of more rate hikes in calendar 2018. In a week which did not have a note auction yields remained higher and marginally retreated towards weekend on account “flight to safety” in anticipation of the upcoming Italian elections. In another market, the European Central Bank (ECB) published minutes from its January meeting that showed that some members had pushed for removing a commitment to increase quantitative easing if necessary and a preference for dropping the easing bias. However, the broader view of the policymakers was that an adjustment was premature and not yet justified by the stronger confidence

The US dollar remained range bound and recovered some lost ground. It, however, remained stronger against some Emerging Market Currencies, Indian rupee weakened past 65.00 for the first time in many months as bunched up import cover and repatriation fears kept sentiment weak for the local currency, Reserve Bank of India (RBI) was believed to be intervening to contain volatility. With rupee liquidity in a neutral state in the domestic money markets, aggressive intervention in the spot market may not be possible.

RBI’s minutes of the February MPC also got released during the week. The minutes appeared rather more hawkish than the script or the following press conferences shown on the policy day. Retail inflation risks overshooting the medium-term target of 4% and even poses a chance of embracing the 6% handle in the coming months. Most members averred the deleterious effects of the Government’s fiscal profligacy and the likely out-of-control scenario on account of MSP implementation. The banking space in the country is at some sort of crossroads with alleged scams, huge investment losses on account of rising yields, poor credit growth and the paucity of capital. If crude oil prices were to spike unexpectedly, and if RBI were to resort to a pre-emptive rate hike, the interest rate and currency markets could be in turmoil

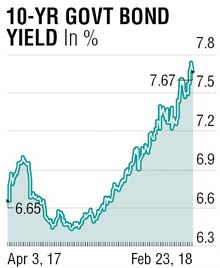

Looking at market prices, bond yields have already risen over 100 basis points, pricing in the reality of quickening inflation. And on the face of such sharp rise in yields, it would appear that RBI is behind the rate curve and hence, further pessimism among bond buyers. Post-release of minutes, the ten-year yield touched circa 7.75%, indicating a 175 basis spread over overnight rates. The steepness appears to suggest bond markets are missing something scary ahead.

Benchmark 10y yields should remain contained below 7.75 with a likely test of 7.60%.

The writer is a market expert