A short week, by courtesy two public holidays, was characterised by some unfortunate terror atrocities in both Spain and Finland in the international arena while local market participants got to analyse two key pieces of news: the much-awaited Consumer Price Inflation (CPI) index for July 2017 and minutes of the August RBI Monetary Policy Committee (MPC).

Global markets surrendered midweek gains and headed into the weekend largely unchanged. A renewed surge in volatility was sparked by concerns due to a terrorist attack in Barcelona and followed by Finland and on news of joint US-South Korea military exercises from Monday.

Of larger significance will be the weekend Jackson Hole symposium where US Federal Reserve Chairperson is expected to speak on Financial Stability and the pressure points that Fed is currently tracking in terms of asset prices. US 10-year Treasury note yields edged lower on the week, to 2.19% and the broader index of volatility hardened to multi-week highs.

Even for a truncated week like the last one, there was no dearth of action in the domestic market – with some dramatic developments in a bellwether IT company and the accompanying volatility in Dalal Street. Bond markets reacted negatively to a more-than-expected spike in July CPI numbers, and the release of August RBI MPC’s minutes suggested the caution with which the August rate cut was doled out was justified.

Consumer Price Inflation for July picked up to 2.36% as slowing disinflation in food prices, especially vegetable prices, weighed in. June numbers were downwardly revised and holds hope if monsoon turns out to be better. While one suspects we have seen the low-point in inflation for some time to come, the focus may shift to manufacturing data and other key data points that will show the health of the broader economy.

The minutes of August RBI monetary policy meeting highlighted the risks of aggressive rate cuts in an environment characterised by “high valuations in equity and fixed-income markets, an appreciating currency and persistence of liquidity overhang in the money market, which have proven to be recipes for financial imbalance”, in the words of an MPC member.

India’s trade deficit continued to widen as higher gold imports offset a sustained export growth for the eleventh straight month. Higher imports of gold silver and crude contributed to widening of the deficit, with import of gold especially, which has been on the rise from February.

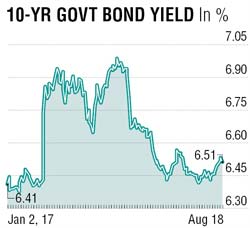

Rupee continued to trade with a weaker bias relative to the unidirectional strength of last many weeks. However, the upside to dollar strength was capped around 64.30s with exporter interest dominating flows. Benchmark 10 year yields have settled above 6.50% and market participants may await fresh factors and clues for new positions. One way to look at the lower dividend payout to the government by RBI may eventually pave way for another possible rate cut as a counter to the need for higher- substituted borrowing.

Within a 6.40-6.60 range, the bias is to add to duration above 6.55. We see curve flattening at the long end therefore investors may return to the bond street once geo-political tensions abate.

The writer is executive director, Lakshmi Vilas Bank