A fairly priced-in US Federal Reserve (Fed) event and subdued domestic inflation data coupled with an encouraging IIP data were key events in the bygone week.

The US Federal Open Market Committee (FOMC) increased key rates by 25 bps to the range of 1 -1.25%.

The policy document also acknowledged inflation will remain below the target of 2% and one gleaned the overall tone to be dovish this time.

The less-expected announcement though was a plan to trim its balance sheet in a graded manner.

Markets largely shrugged this event and key treasury yields moved lower towards 2.10% on the policy day.

Markets largely shrugged this event and key treasury yields moved lower towards 2.10% on the policy day.

Indian markets witnessed a raft of economic data during the week.

First, the key CPI data showed inflation eased to fresh record lows for the month of May, to print 2.18%.

Core inflation reading came in at 4.20%, well below expectations and reinforces the perception that inflation trajectory is undershooting the Reserve Bank of India (RBI) expectations and the recent policy-drift to a less hawkish undertone has been well founded.

The next piece of data, IIP was a mixed bag.

While, at 3.1%, it was better than 2.7% reported in the previous month, it was also far lower than 6.5% growth last year same time. Poor off-take of capital and consumer goods and deceleration in mining and manufacturing were key reasons. However, the fact that upward revision of March numbers should provide hope.

The markets largely ignored the US Federal Reserve (Fed) rate hike as domestic data drove market sentiment and momentum. Trading volumes showed increase and bond yields traded at the lower end of the weekly range.

Easing inflation, with estimates of a sub 2% reading for June, and expectations of a better than normal prospects for monsoon, the bond street is witnessing sustained optimism.

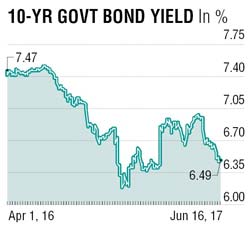

May be at current levels a rate cut in August is nearly priced in. The new 10-year bond touched its lowest point of 6.46% since its debut and interspersed with occasional profit taking, the trend has been lower last few weeks.

The events to look forward are the implementation and the immediate impact of the goods and services tax (GST) and the progress with regard to monsoon. The RBI clarified in the June policy statement that GST impact may have been overstated which douses the apprehension of inflationary trend post implementation.

With the dollar trying to correct its weakening trend and the US Treasuries likely to see some profit taking, domestic benchmark bond yields should trade in the range of 6.45 to 6.52%.

The writer is executive director, Lakshmi Vilas Bank