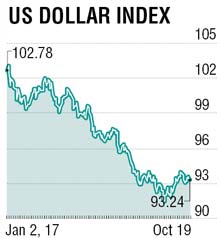

Geopolitical risk returned to markets this month helping the US dollar to hit a 10-week high before it gave up some gains.

The German and New Zealand general elections resulted in a hung Parliament, pro-Independence referendums in Catalonia (Spain) and Kurdistan (Iraq) strengthened separatist forces, snap polls were announced in Japan (October 22) while the anti-Theresa May lobby in the Conservative Party threatened a coup.

The economic balance now favours developed markets which are experiencing economic expansion (in the US, despite hurricane disruption) by running down slack while oil exporters are running down sovereign wealth funds to balance budgets. This spurred the US Federal Reserve to commence calibrated balance sheet normalisation while the European Central Bank is expected to announce its asset purchase taper at its October 26 meet. The only puzzling piece is the tepid inflation in the G-3 which is moderating hawkish tendencies. This is despite crude oil climbing to two-year highs above $60 per barrel after the Kurdish vote to secede.

Going forward, the US dollar would be influenced by the fate of President Trump’s tax/infrastructure plan (including profit repatriation), choice of the next Federal Reserve chair (influencing the pace of tightening), rhetoric on the US-Iran nuclear deal, the status of the Korean face-off and progress in Nafta negotiations. The euro would rhyme to the progress in the formation of the German coalition and the aftermath of the Catalan Independence vote.

The Sterling pound had rallied on PM May’s astute handling of the Tory leadership crisis, Bank of England (BoE) governor Carney’s comment that “the UK is running out of spare capacity and tolerance for over the target inflation” and media reports that the EU Summit (October 19-20) would consider a conditional two-year transition period for the UK beyond March 2019. However, it dipped on BoE Carney warning about the negative effects of a no Brexit deal.

In Japan, Prime Minister Shinzo Abe’s intent in announcing a snap election to take advantage of opposition disarray was scuttled by the formation of the new Party of Hope. The election has now morphed into a three-way fight with the ruling LDP/Komite coalition expected to win a simple majority instead of the present two-thirds. Curiously, the yen is a currency which strengthens on domestic political uncertainty, on safe-haven demand.

After mid-September, the Indian rupee weakened dramatically to 65.90 per dollar as FII flows about-turned and on nervousness of a substantial fiscal stimulus. However, RBI’s apparent hesitation to cut rates any further, the phased relaxation of the corporate bond limit for foreign portfolio investors, covert intervention and a surge in stock markets pulled it back to 64.69/$. In the near term, the rupee is expected to trade in the 64.50-65.50 range.

Softer-than-expected inflation prints (Sept CPI +3.3% year on year, WPI 2.6% year on year), buoyant industrial production (August +4.3% year on year) and rise in exports (September 25.7% year on year) have put paid to the anticipated growth disruption out of the demonetization and GST-related issues. This has provided the bullish ballast to domestic equity markets while pushing the government 10-year bond yields past 6.75%.

The writer is chief operating officer, Kotak Mahindra Bank