In a world beset with uncertainties, where a lot of moving parts determine the daily course, any prediction is at the best guesswork based on present variables. But what makes it interesting is that some of the components would always work, making the outcome more satisfactory.

Federal Open Market Committee (FOMC) of the US Federal Reserve is responsible for controlling two most important variables in US economy. One, the committee looks at the gradient of inflation and sets course for either increase or decrease in repo rates. This is popularly referred to as “dot plots” for future inflation projections. Two, the committee also looks at another important variable – US employment data – as it adjusts it’s policy bias to push the economy towards full employment potential. A third important dimension was added when US Federal Reserve effectively bought over various assets from cash-hungry banks (called QE) around 2009. The stash is now more than $3 trillion.

FOMC has been sending signals to the market on the inevitability of selling down these assets over the last few meetings. It’s an important step to remember as this act of FOMC would not only bring down global dollar liquidity but also can affect investment patterns. In the just-concluded FOMC meeting, US Fed stated, “In view of realised and expected labor market conditions and inflation, the committee decided to maintain the target range for the federal funds rate at 1 to 1-1/4%. The stance of monetary policy remains accommodative, thereby supporting some further strengthening in the labour market conditions and a sustained return to 2% inflation.” They also maintained that “In October, the committee will initiate the balance-sheet normalisation program described in the June 2017 addendum to the committee’s policy normalisation principles and plans.”

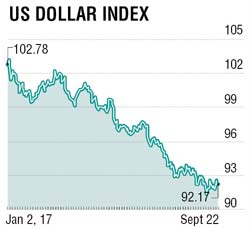

This has now resulted in dollar Index inching higher from recent lows and technically looks good for a bounce back unless political news deflates any chances of further recovery. Elsewhere, GBP moved up substantially rallying to a high of 1.3618 against US dollar on the basis of positive input for early rate hike news. Since then, GBP-USD pair has been moving in a narrow range and looks ripe for a correction in the interim. The movement in EUR-USD has been just the opposite of what happened in Dollar Index. The surge of euro has now stalled predictably, and if we look at the technical charts it shows some chance of the correction in the short term.

In India, both CPI and WPI readings were higher than expectations putting paid to any hopes of further rate cut in the forthcoming RBI Policy meeting. With inflation expectation being where it is now, benchmark bond yields have reacted towards upper side. The 10-year Indian benchmark yield has recently gone past 6.60%. The benchmark yield can easily move towards 6.75% in future if the trend in CPI moves into the higher trajectory. Recently, RBI announced the balance of payments data for Q1 (April-June). As per the data, India’s current account deficit (CAD) for the period widened to $14.3 billion (2.4% of GDP) in Q1 of FY 2017-18 as against $0.4 billion (0.1% of GDP) in Q1 2016-17. The capital account flows, especially investments into Bonds (both government and corporate) has been substantial. However, the limit is almost exhausted and unless it is increased, the deficit would have to come from somewhere. As we all know, INR has appreciated considerably against USD this year and a correction is overdue, given the structural nature of the issue (trade deficit etc). Given this background, I would be more comfortable if the USD-INR pair moves towards 64.8000 from current levels.

In a nutshell, I see a rebound in dollar. Consequently, euro and GBP may consolidate lower. I am expecting some weakness in USD-INR as the pair moves slowly towards 64.8000-65.0000 range.

The writer is senior regional head - treasury advisory group, HDFC Bank