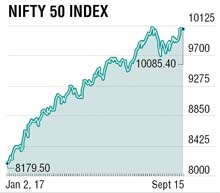

Nifty made an unsuccessful attempt at the peak of 10137 on August 2, and then moved sideways to end the week with a gain of 150 points i.e. 1.52% at 10085. The Midcap Index also saw a gain of 2%. The first- two days saw sharp gains followed by three days of consolidation. Pharma stocks were exactly what the doctor prescribed.

The sector woke up after a long time to end 5.63% higher, powered by Divis Lab up by 20%, Sun Pharma 11%, Lupin 4%, Aurobindo Pharma and Dr. Reddy’s 2% each. Bank Nifty followed with a 1.94% gain with Bank of Baroda contributing 6%, Axis Bank nearly 5% and HDFC Bank 3.5%. The modest upmove was broad based in that every sector index ended in the green. Nifty has resistance at the current high of 10137, and more importantly at 10141 from the Resistance 1 for the September Futures and Options (F&O) series. It would then be in all time high territory with the following resistance way up at 10350.

Last week, Bank of England kept its rates unchanged. Geo-political tension re-intensified post one more missile fired by North Korea which was condemned by all countries. India CPI and WPI inflation inched up higher due to higher vegetable and fuel prices, IIP grew 1.2% in July on weak output of consumer durables and capital goods.

The rupee depreciated to 64.07 levels and crude price were higher at $55. The flow of funds from portfolio investors and FDI in manufacturing and services surged India’s forex reserve to a record $400 billion.

The rupee depreciated to 64.07 levels and crude price were higher at $55. The flow of funds from portfolio investors and FDI in manufacturing and services surged India’s forex reserve to a record $400 billion.

FIIs sold stocks worth 3365 crores while DIIs bought worth 3835 crores. Capacite Infra Projects IPO saw record subscription of 186 times on very strong demand. ICICI Lombard IPO will close today and SBI Life IPO will kick off from September 22 raising Rs 8,000 crore.

Key global events to watch in this week are - FOMC Policy statement on Wednesday, US and Euro Manufacturing and Services PMI data to be released on Friday. In absence of any major event in this week, we may see consolidation with higher bottom, bulls are still in charge and will continue attempting to scale new highs this week.

On weekly charts, Nifty made a bullish candle indicating that buyers are in control of the medium-term trend. It is slightly below to its historical high of 10137 while Nifty 500 index has made an all-time high. Broader market is improving though Nifty 50 is a slight laggard comparatively. Index traded in a range between 10028 to10131 for the last four sessions. If Nifty decisively moves above 10137 then it can rally towards 10270 and 10350 while break below 10020 could mean a decline toward 9980 -9880 levels.

The writer is head-retail research, Motilal Oswal Securities