In recent past, the focus has shifted to the choice of the next chair of the US Federal Reserve. Apart from this, the expectation of big bang reforms in tax from the Trump administration is also on the screen. In an otherwise sedate Europe, Catalonia issue in Spain has hogged the limelight.

That may not lead to any rethinking at European Central Bank. In the recently concluded Congress in China, party leader and Chinese president Xi Jinping anointed himself as the undisputed leader.

In India, a massive bank recapitalisation plan has propelled a big rally in state-owned bank stocks. Who says life is static. On the contrary, in the market space, life is always moving at a hectic pace and is interesting. Let’s gauge the influence of these on the current state of affairs in the market space, especially its influence on currency and interest rate movements.

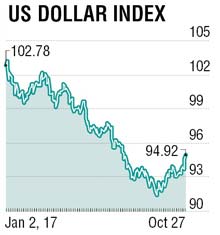

In the second half of October, US President Donald Trump hinted at unveiling his tax plan. News reports then had assumed that most of the influential Republicans would support Trump’s plan. This bolstered both stocks and bonds in the US as dollar index rallied to move above 94 on October 25, 2017. Successive data points also have been dollar supportive in the past few weeks. For example, US manufacturing PMI was at nine-month high and the reading was much above consensus market estimates. Also, one must note that the US durable goods orders jumped by 2.2% for September. This was much higher than market estimates which had put the number at 1.0%. However, there are also uncertainties which had proved to be party poppers as far as the dollar index goes. The uncertainty surrounding tax proposals, US budgets and more importantly the choice of the next US Federal Reserve chair would keep the market guessing about the next big move. In technical parlance, the dollar index has found good support around 91.00 on weekly charts and is facing first resistance around 93.99 levels. However, a bullish bias is still visible. Hence, we can see the dollar marching ahead higher in the days/weeks to come.

In Europe, euro has gained a bit towards the later part of October as it is awaiting ECB decision on winding down of QE. However, ECB’s decision to continue with QE for a little longer and the dovish tone of Draghi did not support euro. Technically speaking, euro has support around 1.1677 (100 DMA) and below that level may not be sustainable. Euro faces resistance around 1.1802. Hence, it may consolidate between 1.1600 to a.1800 in the coming days/weeks. GBP has also rallied after favourable UK GDP data lifted the possibility of a rate hike by Bank of England. Technically speaking, the area around 1.3124 (GBP-USD) has remained solid support. However, the rally in GBP is also moving into resistance area around 1.3240. This means we could anticipate a prolonged era of consolidation, as far as GBP-USD pair is concerned.

Union finance minister Arun Jaitley announced big bang bank recapitalisation plan. Before that the central government also announced ambitious expenditure on building road assets across the country. As we all know, Indian banking sector (especially public sector banks) have been suffering from high non-performing assets and low credit growth. The plan proposed by the FM is expected to boost the capital of state-run banks, which could then invest in newer projects. In the meanwhile, the minutes of the latest Monetary Policy Committee of the Reserve Bank of India is seen as hawkish as far as the interest rate is concerned as most believe that the likelihood of higher inflation trajectory could persist in future. As a result, the likelihood of a rate cut has reduced substantially. The latest data on imports and exports suggest that India’s merchandise exports grew faster in September. At the same time, we have also witnessed a renewed interest in Indian equities/debt by foreign investors. The flip-flop in the dollar also has boosted chances of emerging market currencies including the rupee. Given this background, I would assume that USD-INR pair continues to consolidate between a broad range of 64.7500-65.5000. Similarly, the 10-year benchmark yield may remain trapped at the higher range between 6.75-6.85%.

In a nutshell, dollar rebound would test resistance around 94 but may remain bullish, euro could remain range-bound and consolidate within 1.1600-1.1800 range, while USD-INR consolidates within a range of 64.7500-65.5000.

The writer is senior regional head, treasury advisory group, HDFC Bank.