Another week of volatile trading went by as weekend developments over the Syria row should keep markets in jitters in the next few days. The US President Donald Trump took a U-turn in his tone after expressing a desire to withdraw US troops from Syria's intractable war. Friday night's missile attack was most unexpected and possibly a culmination of the traumatic experiences in Damascus.

While UK and French join the US to strike targets in Syria over the alleged use of chemical weapons, Russia's stance could because of further tensions. These Mid-east tensions boosted oil prices to their highest levels since 2014, with WTI Crude costing $67.50 a barrel, up $5 a barrel from a week ago.The US 10y note edged higher 4 basis to close at 2.82%. Equities remained flat.

In parallel developments, trade frictions and ongoing trade negotiations were relentless this week. The initial euphoria on apparently conciliatory comments from Chinese President Xi that the measures his country will take to open markets to foreign competition died without a whimper as the officials from China later clarified that his statement was not a concession to the US and that China is prepared to retaliate.

In other market events, minutes of the latest meeting of the FOMC show that the Federal Reserve is increasingly confident it will reach its targeted 2% inflation goal. In another market zone, the minutes of the European Central Bank's most recent meeting showed the ECB noted risks to the economic outlook from increasing trade tensions and a stronger euro. The dollar has been broadly stable against majors with Japanese Yen unmoved after S&P's revision of Japan's rating to positive from stable

In other market events, minutes of the latest meeting of the FOMC show that the Federal Reserve is increasingly confident it will reach its targeted 2% inflation goal. In another market zone, the minutes of the European Central Bank's most recent meeting showed the ECB noted risks to the economic outlook from increasing trade tensions and a stronger euro. The dollar has been broadly stable against majors with Japanese Yen unmoved after S&P's revision of Japan's rating to positive from stable

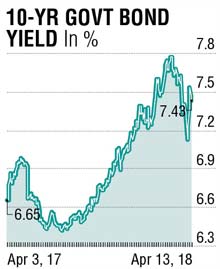

Indian markets appear less cheerful and rather disappointed with the smaller than expected size if foreign institutional investor (FII) limits that got increased by a half-a-percentage point of outstanding debt. The benchmark 10y bond-yields moved beyond 7.50% and was at a point in time about 55 basis above the low registered in early April. Appetite is low inspite of a good bid-to-cover ratio in the weekly bond auctions. Buying needs to broad-based for yields to stabilise at lower levels.The geopolitical risks and rising crude prices could be a reason, probably. The market also lacks the conviction required to stay invested as recent dovish stance within a broader hawkish undertone by MPC could be seen as a temporary change in outlook. The response is also endorsed by some large banks that have started increasing their MCLRs.

On the data front, retail inflation and IIP came in slightly worse than expected levels. The seasonal factor of higher tuition fees influenced the March numbers although food inflation has been lower. The core inflation continues to remain higher and could well be a thorn in overall inflation dynamics. On trade data front, March data showed a widening of the deficit even as imports of gold has shown a drop for the third consecutive month. On a year-over-year basis, the trade deficit has nearly doubled from $47 billion in FY17 to $87 billion in FY18. Indian rupee continues to remain stable with any short-term or intraday weakness attracting exporter selling.

For the week ahead, any move above 7.50% should see some buying interest in benchmark bonds as the message in the April MPC is clearly in favour of an extended pause.

The writer is a market expert