The bygone week was yet another in recent times where risk-off sentiment dominated trading themes across geographies. Escalating tensions between North Korea and the rest of the world kept traders and investors in a safe-haven hunting mode, with war of words between the US and North Korean administration getting more intense by the day. UN votes to impose new sanctions, dollar suffers broader losses and Treasury yields bounce off from multi-month lows as retail inflation comes in tad higher.

To start with, US markets had barely recovered from the twin devastation of cyclones Harvey and Irma when yet another war rhetoric from North Korea, demonstrating its unrelenting stand by firing missiles and testing suspected nuke capabilities rocked markets across the time zones. With fresh sanctions from most of its trading and non-trading partners in force, which could curb crude supplies, textile exports, end overseas labor contracts to the country, North Korea may continue to hog limelight in a negative sense.

US treasury yields jumped to 2.20% from a low of 2.01, crude prices rose marginally while VIX, the widely followed volatility index, trended lower as quarter-end approaches. US Consumer Inflation rose to 1.9% for August, compared with 1.7% for July. Surging gasoline and house rentals were seen as key contributors to the spurt in CPI.

With the US Federal Reserve Open Market Committee meeting in the coming week, the odds of a rate rise still remain low. There is wide expectations that the FOMC will announce its balance sheet unwind schedule so that a rate hike action is reserved for the next meeting. Bank of England kept rates steady with inflationary pressures building up. Markets hope a hike sometime soon.

With the US Federal Reserve Open Market Committee meeting in the coming week, the odds of a rate rise still remain low. There is wide expectations that the FOMC will announce its balance sheet unwind schedule so that a rate hike action is reserved for the next meeting. Bank of England kept rates steady with inflationary pressures building up. Markets hope a hike sometime soon.

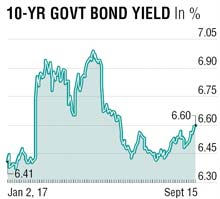

Indian markets had mixed fortunes. While equities performed steadily, bond yields remained elevated after the double-whammy of higher than expected Retail and Wholesale Inflation. Wholesale Inflation (WPI) for August came in at 3.24%, up from 1.88% for July and 1.09% in August 2016. Surge in food prices continued to be a major influence, alongside a sequential increase in prices of fuel and manufactured products as well as an unfavorable base effect. Similarly, August Consumer Price Index came in at 3.36% compared to 2.36% in July. Price rise in vegetables and rise in HRA were key factors. Barring marginally higher than expected numbers, the trajectory of inflation is well per expectations. IIP showed an expansion for July and the modest growth was led from both mining and electricity sectors.

Bond yields continue to stabilise at the upper end of the 6.30-6.60% range and traders look askance for fresh factors. The auction calendar for the second half of fiscal and plummeting hopes for an October rate-cut on the back of firming inflation expectations have soured trader sentiment. Although the week did not have a scheduled auction of dated securities, an OMO Sale substituted to drain liquidity out. Volumes on NDS-OM have seen drops week-over-week basis and the sentiment is expected to remain weak. Corporate bond market saw fewer primary issuances. RBI announced another OMO sale on September 28 to wind up the first half of the fiscal.

Coming week could be critical for rate markets with US, EU and Japan central banks meeting to decide on rates. No change expected though, one would look forward to the future guidance. Benchmark 10-year bond should present a good buying opportunity around current levels as a break above 6.65% may not sustain.

The writer is executive director, Lakshmi Vilas Bank