A stronger-than-expected payroll data, a continuance of its current policy stance by European Central Bank (ECB), liquidity infusion measures by Reserve Bank of India (RBI) and largely weaker sentiments in equity markets except for a late Friday rally in the US stocks after data release characterised the week than went by.

The much-awaited non-farm payroll data from the US underlined the optimism its Federal Reserve Board members have been nurturing over the last few policy meetings.

The US Treasury yields inched up marginally post-data release. Crude prices gained on hopes of fresh output cuts ahead of a meeting between oil ministers from Organization of the Petroleum Exporting Countries (Opec) and the US shale firms.

In other developments, the ECB kept interest rates and asset purchases unchanged in its monetary policy review. However, the central bank omitted the mention of its stance that it will boost the asset purchases if outlook turned less favourable, thereby indicating that it is inching closer to the exit of its massive stimulus programme.

In other developments, the ECB kept interest rates and asset purchases unchanged in its monetary policy review. However, the central bank omitted the mention of its stance that it will boost the asset purchases if outlook turned less favourable, thereby indicating that it is inching closer to the exit of its massive stimulus programme.

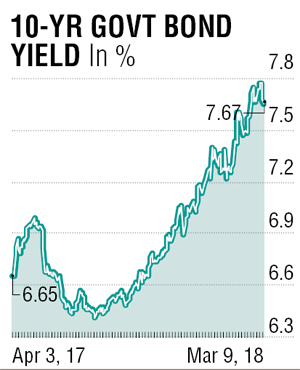

Indian markets continue to show weakness in both equities and fixed income segments.

While the former is more volatile, the latter is unidirectionally weak.

The markets did not cheer Reserve Bank of India’s (RBI) announcement that it will inject Rs 1 lakh crore short-term money into the banking system ahead of the end of the financial year that normally sees cash crunch.

Towards the end of the week, RBI also announced a switch where the Government of India switched a 2018 bond with 2029/2031 bonds worth Rs 15,968 crore. While these short-term measures and tweaks do provide some positives, the underlying sentiment is weak and one wonders how the large borrowing program that should start kicking in a few weeks from now will be sustained.

From a positioning perspective, the yield curve flattened as traders shorted the mid segments. Market participants expect an increase in FPI limits by at least 2.5%, which will pave way for about Rs 1 lakh crore of foreign investment.

Comparisons with other emerging market countries like Indonesia or Korea (where foreigners hold nearly 25% of local currency debt) suggests there is decent room for increase.

The week ahead sees the release of both the CPI and WPI. Expectations are strong that retail inflation will show lower readings for the first time in five months.

That could well be a shot in the arm for bond traders. Test of 7.60% in the 10y segment is expected in the coming days.

The writer is a market expert