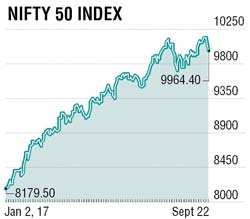

Nifty made a new all-time high of 10 179 last week and cheered the street. However, it turned very short-lived, when the index saw carnage on Friday witnessing its biggest single-day fall in last 10 months. Nifty ended in red with a loss of 121 points, or 1.2%, week on week at 9964. Mid and small cap index also lost an estimated 3%. In this carnage the pharma sector emerged in good health gaining 1.36% in which Dr Reddy's gained 12% and Cipla 4%, IT sector gained 0.36% in which Wipro and Tech Mahindra rose 3% each.

Rest all sector indices ended in red in which metals melted the most 4.68% with Hindalco losing 6%, Tata Steel 3.62% and Vedanta 2.82%. PSU banks lost 3.83% in which SBI was down by 3.46%, Bank Baroda 2.13%. In the cement sector, ACC was down 7.6%, Ambuja Cement 5.6% and Ultratech 5%. The broader market also witnessed sell-off as advance to decline ratio was down to 1:4.42. Foreign institutional investors continued selling aggressively, sold worth Rs 5,450 crore while domestic institutional investors bought worth Rs 3,582 crore.

Last week, US Federal Reserve kept the rates unchanged in hawkish policy citing inflation at 2% and will start trimming exposure to $4.2 trillion balance sheet by $10 billion every month starting October. And North Korea threatened to test hydrogen bomb in the Pacific Ocean triggered sell-off in the markets.

Speculation about the Indian government going in for a fiscal deficit relaxation led to a fall in rupee and an increase in bond yields with a talk of Rs 40,000-50,000 crore stimulus to revive the economy. The rupee weakened 1.28%, or 82 paise, to close at 64.88. SBI Life IPO subscribed 3.6X. Dixon Technology has done fantastic debut on the bourses with huge gains while Matrimony got tepid response on listing.

In key events this week, US Q2 final GDP on Thursday and India’s current account deficit numbers will be announced on Friday.

Markets will take cues from the global developments between North Korea and the US and further clarification of the stimulus package plan by the finance ministry. Expiry of September F&O series on Thursday will keep markets volatile. This time bears may gain further control over the markets after a long time and Nifty may remain the trading range of 9800-10150 in this week.

On weekly charts, Nifty made a “Bearish Engulfing” pattern indicating a massive latent selling pressure at 10150. For the second time, bulls were not able to push beyond the all-time highs in the market. Nifty has major support at 9920 and decisive breach below this support could see further decline towards 9880-9800 range while on the upside Nifty may see reversal on the upside if crosses 10050 level for a possible upside towards 10150.

The writer is head-retail research, Motilal Oswal Securities