India’s banking landscape is set for a dramatic change. The Narendra Modi government is laying the foundation for the creation of a few mega public sector banks by merging the fragile ones with the biggies. The State Bank of India (SBI) has already absorbed five associate banks with itself.

Next in the outing is the proposed merger of Bank of Baroda, Vijaya Bank and Dena Bank to create India’s third-largest bank with a business size of Rs 14.82 lakh crore. Punjab National Bank (PNB) is expected to be in wedlock next with any of the other weaker banks. We could have a fourth flag leader coming from the South, like Canara Bank. Private sector banks will have to compete with these ‘muscled’ public sector giants. In a way, the plot for the public sector banks (PSBs) couldn’t have been any different if the political power at the Centre was not with the BJP but with the Congress or any other party.

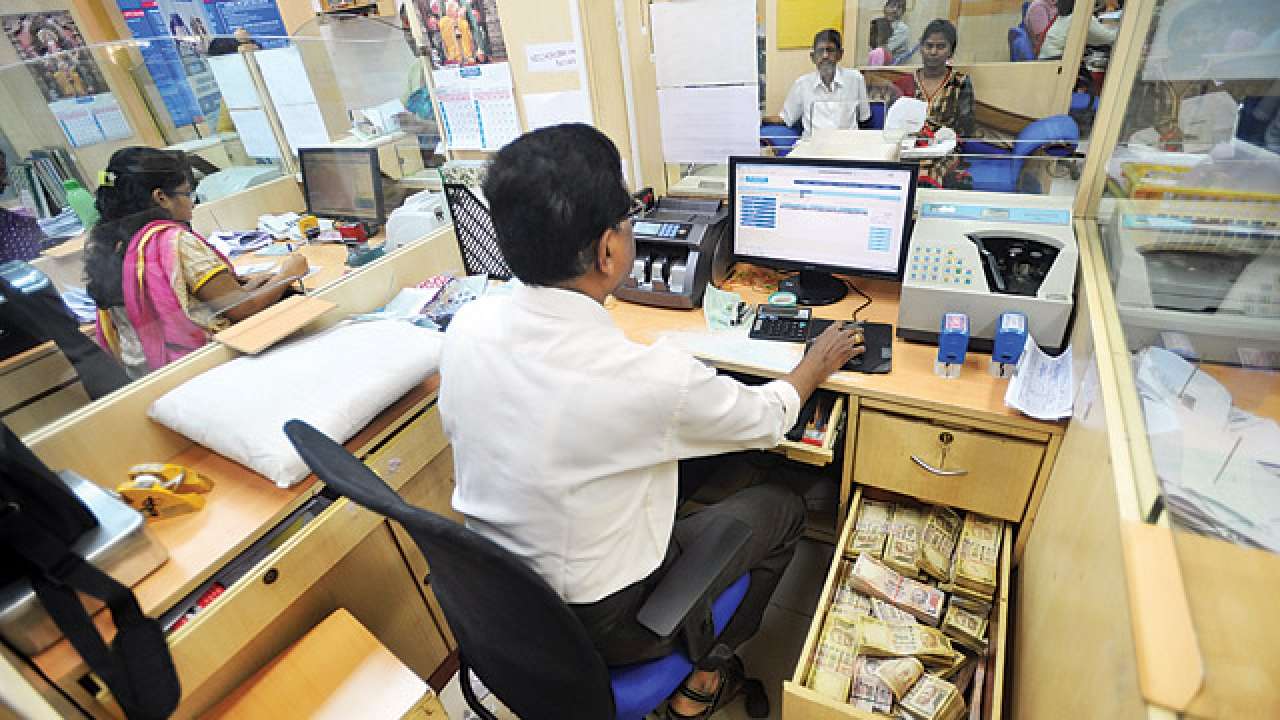

Sitting on bad loans pegged at Rs 10 lakh crore, consolidation was the only rational way out. The other route would have been a recapitalisation of the banks using taxpayers’ money. Many consider this a futile and costly exercise, with no end in sight.

According to the Comptroller and Auditor General’s report (2017), the government infused Rs 1,18,724 crore in PSBs between 2008-09 to 2016-17. The second wave of recapitalisation of Rs 2.11 lakh crore was announced by the government on October 24, 2017. The timing of the announcement of the merger of Bank of Baroda, Vijaya Bank and Dena Bank has surprised many, as it has come ahead of the general elections to be held next year.

The bank unions could get energised with FM Arun Jaitley saying there won’t be any job cuts. But labour unions are going through a rough patch and the Modi government believes it can tackle such situations without any political cost.

The wealth of several PSBs has been eroded by successive spells of poor lending practices and lacklustre recovery methods. Earlier, governments have been using taxpayers’ money to bail out beleaguered PSBs which sit on a huge pile of non-performing assets (NPAs). In the new making of a powerhouse, Bank of Baroda will gain from the strong footprint of Bengaluru-based Vijaya Bank in the South and the low-cost deposits of Dena Bank.

Though Dena Bank is saddled with the highest NPAs (22 per cent of its advances), its CASA is 39.80 per cent of its total deposit base. Consolidation does not automatically guarantee the success of the PSBs. This should be backed by strong bank boards and high governance standards. We should do away with loose lending practices, often influenced by politicians and corrupt bankers. But there is a strong view that the need is not for big banks but good banks.

With the banking sector facing unprecedented crisis immediate solutions should rather have been to improve lending practices, stringent recovery for corporate defaulters. There should have been an adequate public debate before such a move was initiated so that the stakeholders like account holders and depositors are taken into confidence.

The move to merge was so swift that even the respective bank managements were taken unawares. The government may be the largest shareholder but the PSBs which are the pillars of the economy can be strengthened only if the bank boards are independent and strong.