In mid-1970s, I applied to Delhi School of Economics for a Master’s programme. An interview was part of the admission process and I was asked a question with a concocted scenario. As Prime Minister, Indira Gandhi goes to USA and forgets to take any money with her. However, she is so well known that she manages to pay for her board and lodging through IOUs issued to the bearer. Once back in India, she was supposed to honour these IOUs. But, busy with hurly burly of governing India, she forgot. Who paid for her stay in USA?

Economists love the expression ‘ceteris paribus’, ‘other things remaining unchanged’. Ceteris paribus, this is classic quantity theory of money.

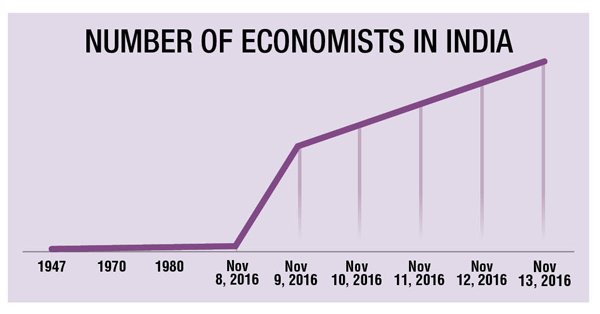

Money supply in USA increased and every US citizen paid for Indira Gandhi’s stay through higher prices. Someone sent me a concocted graph, showing a dramatic increase in economists in India after November 8. The Indira Gandhi episode in reverse – November 8 means reduction in Gross Domestic Produce (GDP), prices and interest rates.

Let me muddy waters, ignoring temporary dislocation and focusing on what happens thereafter: Real estate and land prices will crash. Bad for GDP. GDP is value of goods and services produced in a year. I purchase a plot of land from you. Does that enter GDP calculations? Of course not, no value addition has occurred. For GDP calculation purposes, that’s a transfer payment.

A mock-graph of Economists in India that’s doing Social Media rounds. Creator unknown.

On a broader point, demonetization is about stocks, its impact on flows (GDP is a flow) needs careful reasoning.

Fine, but brokerage is a service and that enters GDP calculations. True, but what are brokerage fees based on? Are they in “black” or “white”?

Which land/real estate price declines, the “white” (registered valued) or the “black” (premium)? If the answer to either question is “black”, what does this have to do with official and legal measurement of GDP?

On prices, do we have in mind a decline in prices or a decline in inflation (where rate of increase in prices slows)?

But there’s the rental market too and those prices can affect the denominator when nominal GDP is deflated to get real GDP.

Perhaps, but depends on ceteris paribus assumptions.

There was some cash in the system. That was for transactions, speculation (people were holding on to it for no particular obvious reason) or black. After the transition period is over, that transaction bit comes back into the system. Ceteris paribus, there is no change. The speculative cash holding was “idle”, it wasn’t performing multiplier effects money supply is supposed to have. That comes into the system, with positive externalities and efficiencies.

Ceteris paribus, that has an expansionary effect. As for the black bit, bulk of the tax evading part probably comes back into the system, while the illegal black part is destroyed. Apart from affecting RBI’s liabilities, what does destruction of a stock of black wealth do?

The elements of cash that come into the system are with RBI or scheduled commercial banks, though either can be “channeled” into what is “government” proper. That’s going to be spent. Therefore, one can’t do a ceteris paribus on the contractionary, ignoring the expansionary. That’s the danger with making strong statements on interest rates. Interest rates may well decline, but not per se because of this. They are largely a function of what RBI does.

The waters are exceedingly muddy on aggregate demand and supply, which is why I am skeptical about this exponential increase in economic expertise. Non-aggregate redistribution arguments are more robust, since there is a transfer from relatively rich to relatively poor. So are sector specific arguments (real estate, construction, trade, elections).

The author is an economist and member, NITI Aayog.