Catering to a very niche clientele and ‘not’ the general mass, luxury housing has evolved at a rapid pace in India. The new rich prefer the discreet and yearn for experiential luxury, not just outside their homes but also within it. And the rising number of high net-worth individuals, comprising start-up founders and high-salaried professionals, has prompted developers to think ‘out of the box’ to satisfy their nouveau riche clients.

Meanwhile, affordable housing undoubtedly has taken centre stage in India over the past 3-4 years due to concerted efforts by the government, giving rise to speculations that luxury housing is losing its sheen. To add to its horror, DeMo in late 2016 had a cascading effect on luxury housing supply and sales merely because this segment attracts the bulk of unaccounted money in both primary and secondary realty markets. This is further validated by ANAROCK data which indicates that while there was a total decline of 41% in the new supply in 2017 from the preceding year, luxury (> Rs 1.5 crore) comprised the maximum fall by a staggering 49%.

Hence, while numbers paint a gloomy picture for luxury category, we cannot completely rule out the business prospects of this small yet fairly important segment of the Indian real estate. Here’s why!

Luxury housing has its own clientele that serves a specific class of people who aspire to live in high-class homes in key locations that come decked up with state-of-the-art amenities. The booming economy coupled with mushrooming start-ups has also given rise to a new breed of entrepreneurs who may have not acquired ‘old wealth’ but have earned it. These so-called millennials have risen above the middle-class median and, thereby, prefer to live big.

That said, the number of millionaires in India, according to Johannesburg-based New World Wealth report, was a whopping 3,30,000 people in 2017 — a tiny fraction of India’s total population. But this number is expected to reach over 9,50,000 by 2027, rising by 190%. Also, within the Asia-Pacific region, India has the fourth-largest population of millionaires while in the Forbes list of the ‘World’s Billionaires’ for 2017, India accounts for an impressive 101. These numbers thus suggest that luxury projects have significant takers in the country.

Bruised but not broken: Undoubtedly, ‘affordable housing’ is the flavour of the season, but it is also wrong to say that luxury homes have lost their lustre. Some interesting numbers by ANAROCK data reveal that luxury real estate may have been bruised — post DeMo particularly — but definitely not broken.

Bruised but not broken: Undoubtedly, ‘affordable housing’ is the flavour of the season, but it is also wrong to say that luxury homes have lost their lustre. Some interesting numbers by ANAROCK data reveal that luxury real estate may have been bruised — post DeMo particularly — but definitely not broken.

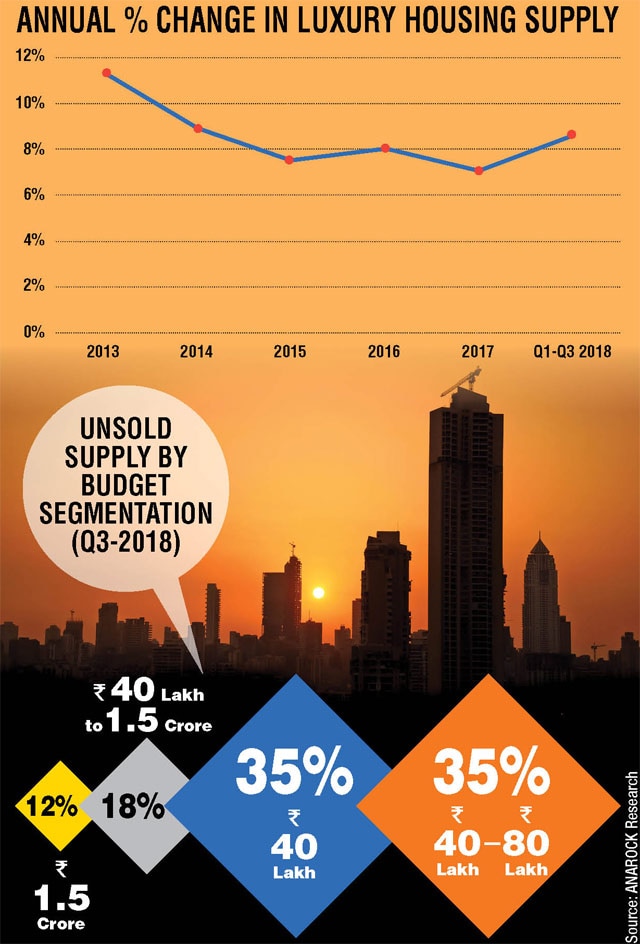

Supply picking up, albeit slowly: Data suggested a decline in luxury supply (> Rs 1.5 Crore) in 2017 as against the preceding year but in the first three quarters of 2018 it increased by almost 29% across the top 7 cities in comparison to the corresponding period in 2017.

Mumbai Metropolitan Region (MMR) tops luxury supply: Of the total new supply in the luxury segment in 2018 (approx. 12,090 units), MMR saw maximum supply with the launch of nearly 6,310 new units, followed by NCR with nearly 2,650 units, and Hyderabad with 1,585 units. Surprisingly, Pune saw least supply of luxury units with <100 units, followed by Kolkata with just 160 units.

Unsold Inventory: Further, out of the total unsold stock as on Q3 2018 (approx. 6.87 lakh units) across the top 7 cities, luxury housing comprised just 12% of the total stock with 82,280 units. Of this, MMR has the maximum unsold luxury stock comprising 59%.

Thus, while luxury real estate has remained subdued since 2013 it is now picking up so as to cater to its niche clients belonging to the ultra-rich category. Besides, the fact that the rich went slow in buying coincides with their typical trait of being vigilant managers of their own money and highly risk-averse temperament.

The ‘Luxury’ haven: Today’s ultra-rich typically prefer to live life king-size! From theme-based homes to smart homes to having state-of-the-art amenities, the expectations of luxury buyers are growing with changing dynamics and rising aspirations. Most of them yearn for experiential luxury which in a way, is also prompting developers to collaborate with branded designer labels like Armani or even the hotel chains. Four Seasons Private Residences in Mumbai is a perfect example of such developments. The priority for most of these developments is to have discreet luxury wherein there are limited number of units in one project. While such residences come with a heavy price tag, they are fully managed and serviced. Other perks include a proper house-keeping team to manage these homes, room service facility, engineering, and concierges, among the many other facilities. This effectively gives an experience to the discerning customer.

Slow but Steady: Thus, to completely write off the luxury segment and its future business prospects is definitely too harsh for a segment that caters only to the select-few. While most builders have followed the tide and shifted their focus entirely on affordable housing, the select-few in each of the top cities continue to bet on luxury homes. These established and well-capitalized builders across MMR, NCR and Bengaluru have understood that if the location, quality, craftsmanship and service standards of these luxury abodes is done right, they are sure to succeed. That said, there will continue to be high demand from the ultra-rich and also the non-resident Indians who have come back to live in the country of their origin.

Author is Head—Research, ANAROCK Property Consultants