This summer, the increase in temperature and electricity use in Mumbai is coinciding with the expiry of the city’s power purchase agreements (PPAs). Mumbai’s electricity distribution companies (Discoms) — Tata Power, BEST and Reliance Infrastructure — have approached the Maharashtra Electricity Regulatory Commission (MERC) for the renewal of their PPAs for which hearings are underway. Power purchase accounts for around 70 per cent of the cost of supply for Discoms and forms the bulk of consumer tariff. Therefore, economical power purchase is crucial for ensuring affordable tariffs. These agreements, if renewed, will have long-term implications for electricity supply in Mumbai. In this regard, we make the case for competitive bidding to ensure the most economical power procurement.

The three PPAs, between BEST-Tata Trombay, Tata Distribution- Tata Trombay and Reliance Distribution – Reliance Dahanu, are expiring. All these PPAs are long-term “cost-plus” contracts, and, for Tata and Reliance these are also sister concerns. Tariff determination under “cost-plus” happens on an annual basis and allows recovery of most of the claimed costs, along with a guaranteed return on investment. As against this, tariff discovered through bidding provides a cost trajectory for the entire term of the PPA and is generally more efficient. Notably, none of the Discoms have competitively bid PPAs.

The Discoms are seeking renewal on three main grounds: islanding, transmission constraints, and the ‘competitiveness’ of their tariff. We examine these below. Mumbai has an islanding scheme that allows isolating it from the rest of the grid in case of disturbances. Consequently, Mumbai has a separate grid, which is connected to the larger state grid through tie-lines. This limits the amount of electricity that can be imported into the city, and has been used to justify signing pre-identified PPAs. Tata’s Trombay and Reliance’s Dahanu stations (embedded generation) are part of the Mumbai grid and hence, unaffected by the constraint. Augmentation in transmission capacity has happened in a piecemeal manner, making power-purchase from embedded generation imperative. Instead of using the transmission constraint as an excuse to continue old cost-plus contracts, the PPA renewal is an opportunity to completely review transmission planning and enable more economical power procurement options.

Also, currently, nearly half of Mumbai’s power is imported from outside. With increasing open access, many big consumers such as the railways, airports, industries, and commercial complexes are likely to migrate away from the Discoms. Hence, if islanding is to continue, it should be done through public consultation with regard to its coverage (who will get supply if islanded), need, and costs.

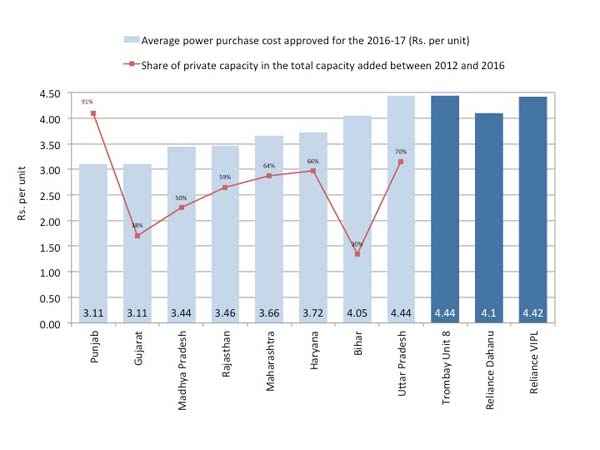

Mumbai Discoms claim that their identified PPAs are the most economical. However, data shows otherwise: the graph shows the average cost for coal-based thermal capacity contracted by various states in the past five years (2012 to 2017). With the exception of Uttar Pradesh and Bihar, the average cost of procurement is below Rs 4 per unit. As against this, the cost of generation for Tata’s newest coal-based unit, Trombay Unit 8, is Rs 4.44 per unit, while that of Dahanu is Rs 4.10 per unit and for VIPL is Rs 4.42 per unit.

In addition, since all these contracts are cost-plus, any increase in cost mostly gets passed on to consumers. This was most recently seen in the case of VIPL: at the time of approval of the PPA, Reliance claimed that the tariff was competitive. However, the claimed tariff for FY 2014-15 has increased from Rs 3.92 to Rs 6.28 per unit ( > 60 per cent).

The National Tariff Policy mandates that all future power procurement be undertaken through competitive bidding. Currently, surplus power is available with many states and there is a high chance of discovering better options. Hence, if Mumbai Discoms undertake bidding, they are likely to discover better options. Nothing precludes the embedded generating stations from participating and, indeed, winning the contracts.

As the electricity sector gears up for an increase in open access, net-metering, and reducing costs of renewable energy, the demand of Discoms is bound to shrink. Additionally, the uncertainty regarding changeover and network rollout put a question mark on the need and relevance for any long-term PPA. Given this, the regulator (MERC) should use the PPA renewal process to completely overhaul transmission planning, reviewing the islanding scheme, and mandating bidding for power procurement. Maintaining the status quo would only prolong Mumbai’s wait for competition.

The authors are with Prayas (Energy Group), Pune.