Khirod Chandra Panda is involved in numerous significant projects aimed at advancing the field of Fraud Detection across various sectors.

In the fast-paced world of technology and finance, innovation is the key to success. A visionary tech innovator who is revolutionizing the financial services and device protection industries across borders is needed. With a deep understanding of the evolving needs of consumers and businesses, tech experts developed groundbreaking solutions that are shaping the future of these sectors. With a passion for creating seamless and secure financial experiences, innovative products have gained global recognition. The cutting-edge technology has not only simplified financial processes but has also ensured the utmost security and protection for users. In a world where cyber threats are on the rise, some solutions offer peace of mind to individuals and businesses alike.

One such expert, Khirod Chandra Panda is involved in numerous significant projects aimed at advancing the field of Fraud Detection across various sectors. Particularly noteworthy is his contribution to analyzing customer transactional and conversational data within the Insurance and Finance domains. Through collaborative efforts, he conducted research that resulted in a 25% reduction in fraud, signifying a substantial milestone for both himself and his team. This achievement underscores his continuous commitment to combating fraud while prioritizing the needs of legitimate customers. Furthermore, alongside him and his peers authored over 15 papers delving into the implications of fraud and devising strategies to combat it, showcasing the broader impact of their research efforts. Additionally, he had the privilege of sharing insights and best practices on rule-based fraud detection at Pega World, where he addressed industry leaders. Each of these accomplishments serves as a testament to Khirod’s dedication to the analytics field and his ongoing mission to combat fraud effectively.

In his role as Principal Engineer, he played a crucial role in driving his organization’s product Engineering department towards enhancing customer satisfaction by reducing fraudulent claims, thereby enabling the organization to better serve legitimate customers in a timely and consistent manner. His contributions have primarily revolved around devising solutions utilizing various algorithms to categorize customers and introduce friction in the process to detect fraudulent activities. Khirod’s consistently pursued innovation and process improvement initiatives to optimize their operations in the organization.

Additionally, he facilitated workshops aimed at fostering a culture of continuous improvement and knowledge sharing within his team. Furthermore, his advocacy for skill development initiatives to empower fellow team members has been instrumental in enhancing their organization's diversity, sustainability, and operational efficiency. Moving forward, he committed to advancing his organization’s capabilities in analytics and algorithms, recognizing the significant potential for further improvements and impact in this area.

One of Khirod’s notable achievements in the field involves augmenting call center agents with generative AI, resulting in a significant reduction in average handle time by 30 seconds per call. With an average of 100 calls per day per agent, this translates to approximately 200 hours saved per agent per year, equating to a cost savings of $30,000 per agent annually. Additionally, through the implementation of AI/ML processes in fraud rules management within the claims process, his organization achieved substantial savings of around $2 million per year.

Amidst these accomplishments, he encountered and successfully navigated various challenges, particularly in ensuring compliance with Personally Identifiable Information (PII) regulations while utilizing data and training machine learning algorithms. This involved collecting data from diverse sources and structuring it into a cohesive dataset, as well as continuously adapting and fine-tuning algorithms to incorporate new patterns as they emerged. These efforts were essential in overcoming regulatory hurdles and achieving successful outcomes in their initiatives.

In the realm of compliance and fraud detection, integrating AI and Machine Learning (ML) technologies has emerged as a game-changer, automating the analysis of extensive datasets to uncover subtle patterns indicative of fraudulent activities. Blockchain technology is also gaining traction for its ability to enhance security and transparency in transactions, ensuring data integrity and thwarting unauthorized access. Moreover, Regulatory Technology (RegTech) solutions streamline compliance processes, automating tasks such as monitoring and reporting to keep pace with evolving regulations.

In customer messaging, AI-driven personalization enables businesses to deliver tailored messages, enhancing engagement. Omnichannel communication platforms ensure consistent messaging across various channels, while real-time interaction tools like chatbots improve customer service. Looking ahead, ethical AI use and transparency will be paramount, as will adaptive machine learning models to detect new fraud schemes. Integrated customer experience management platforms will become essential, combining CRM, fraud detection, compliance, and messaging systems for a holistic approach.

Businesses should embrace advanced technologies and experts like Khirod Chandra Panda, prioritize data privacy, and foster continuous learning and adaptation to navigate these challenges effectively and thrive in a dynamic digital landscape.

![submenu-img]() Balancing Risk and Reward: Tips and Tricks for Good Mobile Trading

Balancing Risk and Reward: Tips and Tricks for Good Mobile Trading![submenu-img]() Balmorex Pro [Is It Safe?] Real Customers Expose Hidden Dangers

Balmorex Pro [Is It Safe?] Real Customers Expose Hidden Dangers![submenu-img]() Sight Care Reviews (Real User EXPERIENCE) Ingredients, Benefits, And Side Effects Of Vision Support Formula Revealed!

Sight Care Reviews (Real User EXPERIENCE) Ingredients, Benefits, And Side Effects Of Vision Support Formula Revealed!![submenu-img]() Java Burn Reviews (Weight Loss Supplement) Real Ingredients, Benefits, Risks, And Honest Customer Reviews

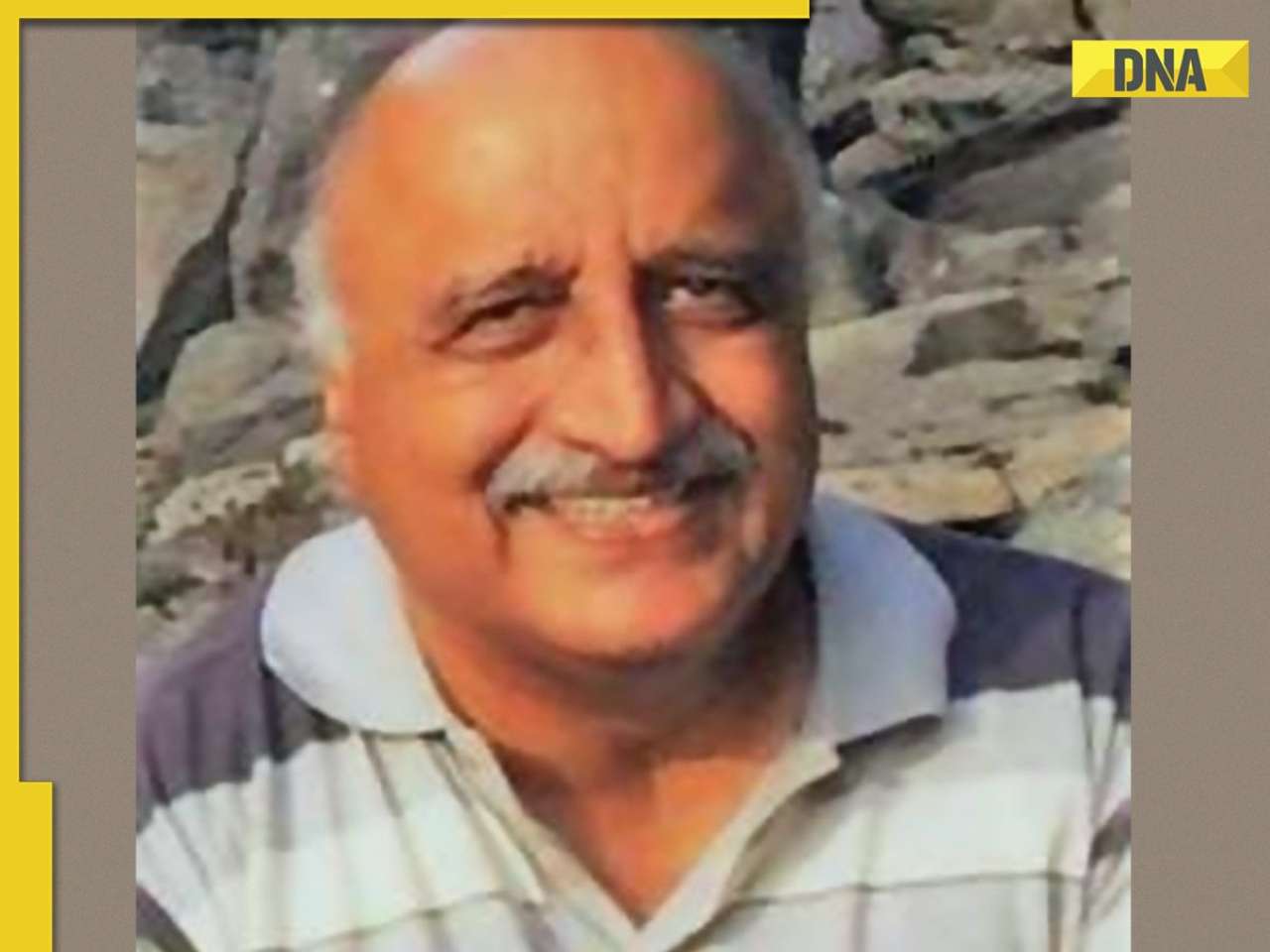

Java Burn Reviews (Weight Loss Supplement) Real Ingredients, Benefits, Risks, And Honest Customer Reviews![submenu-img]() Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'

Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'![submenu-img]() RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results DECLARED, get direct link here

RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results DECLARED, get direct link here![submenu-img]() IIT graduate Indian genius ‘solved’ 161-year old maths mystery, left teaching to become CEO of…

IIT graduate Indian genius ‘solved’ 161-year old maths mystery, left teaching to become CEO of…![submenu-img]() RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results to be announced soon, get direct link here

RBSE 12th Result 2024 Live Updates: Rajasthan Board Class 12 results to be announced soon, get direct link here![submenu-img]() Meet doctor who cracked UPSC exam to become IAS officer but resigned after few years due to...

Meet doctor who cracked UPSC exam to become IAS officer but resigned after few years due to...![submenu-img]() IIT graduate gets job with Rs 45 crore salary package, fired after few years, buys Narayana Murthy’s…

IIT graduate gets job with Rs 45 crore salary package, fired after few years, buys Narayana Murthy’s…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024

Urvashi Rautela mesmerises in blue celestial gown, her dancing fish necklace steals the limelight at Cannes 2024![submenu-img]() Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'

Kiara Advani attends Women In Cinema Gala in dramatic ensemble, netizens say 'who designs these hideous dresses'![submenu-img]() Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024

Influencer Diipa Büller-Khosla looks 'drop dead gorgeous' in metallic structured dress at Cannes 2024![submenu-img]() Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera

Kiara Advani stuns in Prabal Gurung thigh-high slit gown for her Cannes debut, poses by the French Riviera![submenu-img]() Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’

Heeramandi star Taha Shah Badussha makes dashing debut at Cannes Film Festival, fans call him ‘international crush’![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'

Gurucharan Singh is still unreachable after returning home, says Taarak Mehta producer Asit Modi: 'I have been trying..'![submenu-img]() ‘Jo mujhse bulwana chahte ho…’: Angry Dharmendra lashes out after casting his vote in Lok Sabha Elections 2024

‘Jo mujhse bulwana chahte ho…’: Angry Dharmendra lashes out after casting his vote in Lok Sabha Elections 2024![submenu-img]() Deepika Padukone spotted with her baby bump as she steps out with Ranveer Singh to cast her vote in Lok Sabha elections

Deepika Padukone spotted with her baby bump as she steps out with Ranveer Singh to cast her vote in Lok Sabha elections![submenu-img]() Jr NTR surprises fans on birthday, announces NTR 31 with Prashanth Neel, shares details

Jr NTR surprises fans on birthday, announces NTR 31 with Prashanth Neel, shares details ![submenu-img]() 86-year-old Shubha Khote wins hearts by coming out to cast her vote in Lok Sabha elections, says meant to inspire voters

86-year-old Shubha Khote wins hearts by coming out to cast her vote in Lok Sabha elections, says meant to inspire voters![submenu-img]() Watch viral video: Man gets attacked after trying to touch ‘pet’ cheetah; netizens react

Watch viral video: Man gets attacked after trying to touch ‘pet’ cheetah; netizens react![submenu-img]() Real story of Lahore's Heermandi that inspired Netflix series

Real story of Lahore's Heermandi that inspired Netflix series![submenu-img]() 12-year-old Bengaluru girl undergoes surgery after eating 'smoky paan', details inside

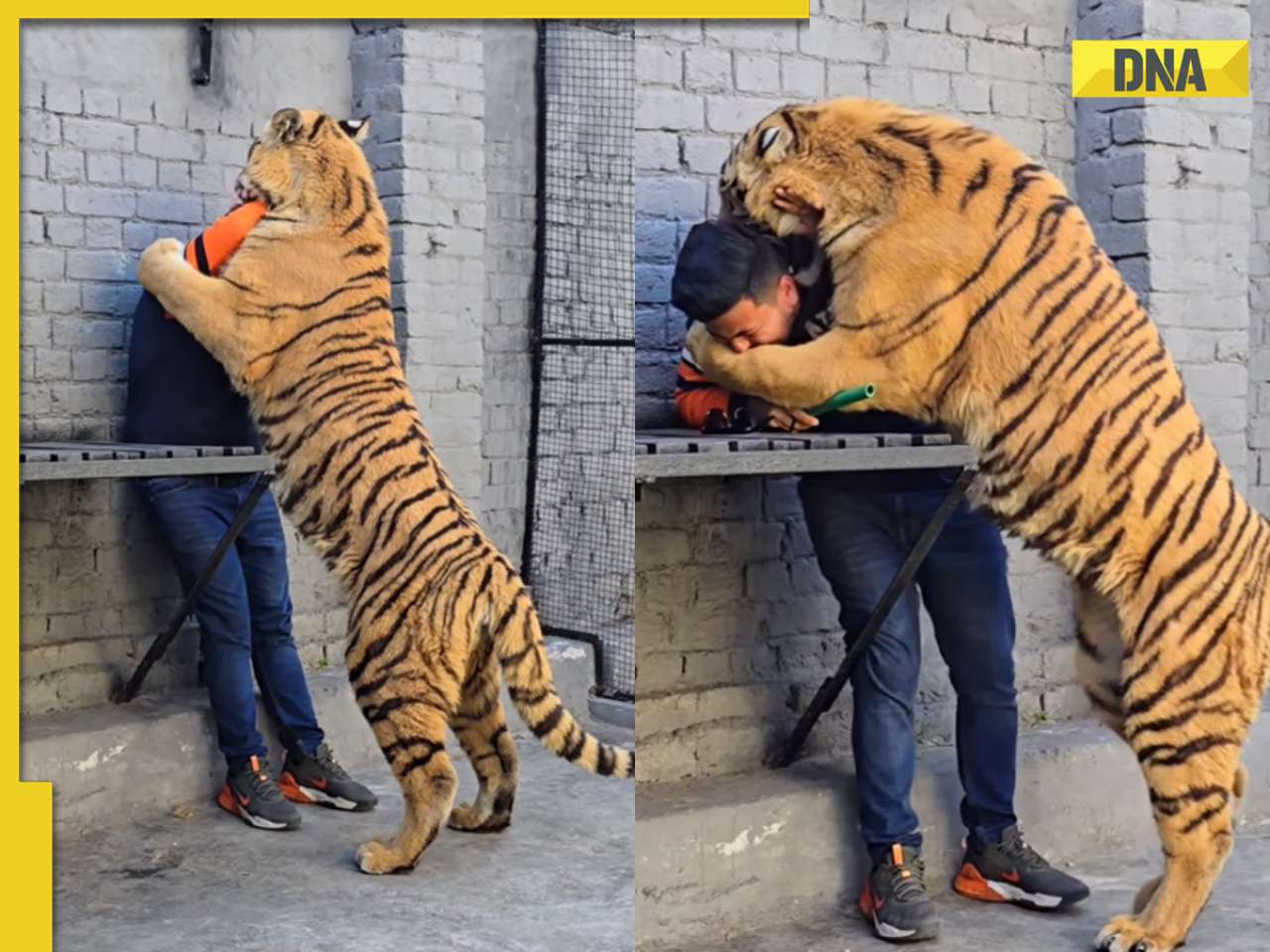

12-year-old Bengaluru girl undergoes surgery after eating 'smoky paan', details inside![submenu-img]() Viral video: Pakistani man tries to get close with tiger and this happens next

Viral video: Pakistani man tries to get close with tiger and this happens next![submenu-img]() Owl swallows snake in one go, viral video shocks internet

Owl swallows snake in one go, viral video shocks internet

)

)

)

)

)

)

)