Avoid much exposure to interest rate risk, given the high near-term uncertainties

With the Reserve Bank of India lowering interest rates for the first time since August 2017, it is advisable for debt mutual fund investors to stick to short and medium duration mutual funds.

These are suitable for investors who look for stable returns with a short- term investment horizon. Given the high near term uncertainties, fund managers are asking investors to avoid much exposure to interest-rate risk. Instead, investors should stick to debt funds with a low maturity profile and good credit quality. Do remember that through the most part of 2018, fixed income markets were exposed to increased volatility. Now, a well-anchored repo rate, RBI's commitment to address liquidity requirements and prospects of further rate cut will help reduce the volatility in bond yields, especially in the shorter end of the yield curve, experts tell DNA Money. Read on.

Capital appreciation in debt funds

Beyond the overnight and liquid funds (that are meant for parking idle cash for a very small time), there five clear categories where investors can keep money from six months to four years. These are ultra-short duration funds, low duration funds, money market funds, short duration funds, and medium duration funds. If interest rates decline, such as what is happening now, bond prices will rise (and yields drop). That's because more people will want to buy bonds that are already available in the market because the coupon rate will be higher than on similar bonds about to be issued, which would be influenced by current interest rates. This will give capital appreciation as debt funds' Net Asset Value will go up for investors holding older bonds.

Debt fund managers look at the yield curve to gauge how interest rates will move in the future. Accordingly, they take positions in different securities. A yield curve describes the relation between the yield on short-term bond (referred to as the short end of the yield) and long-term bond (referred to the as long end of the yield). Typically a yield curve is upward sloping (normal) or a steep yield curve as investors need to be compensated for risks associated with holding a bond with a longer maturity. This happens when investors expect interest rates to rise on the back of high inflation or excess liquidity in the market as RBI might increase interest rates to lower inflation or absorb liquidity.

But when investors expect interest rates to fall on the back of lower inflation or tight liquidity conditions, investors do not demand compensation in the form high yield on long-term bond as they expect rates to fall further. This causes the yield curve to invert as the yield on short-term bond is higher than the yield on long-term bond.

Another round of rate cut

HDFC MF said in an investor note that decision to reduce policy rate by 25 bps came as a positive surprise for the market. Given that RBI forecasts inflation over the next one year below its medium-term target of 4%, there is a chance of further rate cut in the next six months unless inflation surprises negatively. It feels a large increase in gross market borrowings in FY20 over FY19 along with low demand for government bonds due to excess Statutory Liquidity Ratio (SLR) in the banking system could put upward pressure on yields.

"Though the near term inflation outlook remains benign due to low food prices and range bound oil prices, we prefer to maintain a cautious stance considering a modest uptick in growth in FY20, credit growth outpacing deposit growth and likely fiscal pressure. In view of the above, the short to medium end of the yield curve continues to offer better risk-adjusted returns than the long end. Hence, we continue to recommend investment in short to medium duration debt funds," the country's largest fund-house said.

Longer bonds may see volatility

Wealth managers want to avoid longer bonds due to anticipated volatility. Sunil Sharma, chief investment officer, Sanctum Wealth Management says: "We continue to prefer short to medium duration AAA oriented strategies. We'd look to deploy capital tactically on spikes in interest rates. Longer end duration bonds could now likely be more volatile given higher supply ahead, especially once the pace of OMOs (Open Market Operations by the RBI) subsides. For risk-averse investors, ultra-short term and liquid funds would be a safe choice to park funds until clarity emerges."

Suyash Choudhary, head – fixed income, IDFC AMC is of the view that the obvious implication for the yield curve is to steepen as the market is called upon to take higher supply at the duration part of the curve. "In duration, our preference would be for quasi like State Development Loans and corporate bonds rather than government bonds. While supply there is a near term problem, it typically dissipates into the new financial year. Also, starting spreads in duration segment are already reflecting higher supply. The most sustainable trade, however, is in the two to five year AAA corporate bonds."

DSP Mutual Fund is telling investors that shorter tenure bonds are better. "Short tenor corporate bonds (two to four years) trading at around 100 bps spreads over government securities would remain a preferred segment for a stable accrual profile without diluting the credit as well as duration profile of investments. These spreads have been on a higher side owing to prevailing tight liquidity conditions. At the turn of this quarter, we expect liquidity conditions to improve which will aid to compress these credit spreads," says DSP MF. The fund-house recommends apportioned investments in roll down strategies and conventional short-term funds as opportune investment avenues through this phase of interest rate cycle.

Some fund managers are also explicitly telling investors to avoid any sort of interest-risk in debt funds Pankaj Pathak, fund manager – fixed income, Quantum Mutual Fund said that although the RBI's stance and the global outlook looks favourable for long bonds, he is concerned about the excessive supply of bonds in the coming quarters. Demand-supply dynamics is likely to turn against the long bonds as supply from centre and state government will increase and on the same time pace of OMOs are likely to slow down.

"Additionally we are entering into an uncertain election cycle; we believe foreign investor demand will also remain muted until there is clarity on the next government and its likely macro-economic policies...We keep a neutral stance on the bond market over the medium term. However, given the high near term uncertainties, we advise investors to avoid much exposure to interest rate risk and should stick to debt funds with low maturity profile and good credit quality," says Pathak. He feels the credit crisis that began in the Indian bond markets after the IL&FS default in September is not over yet. He points to the widening of spreads between corporate and sovereign yields as reflective of lack of investor confidence in the credit market.

![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

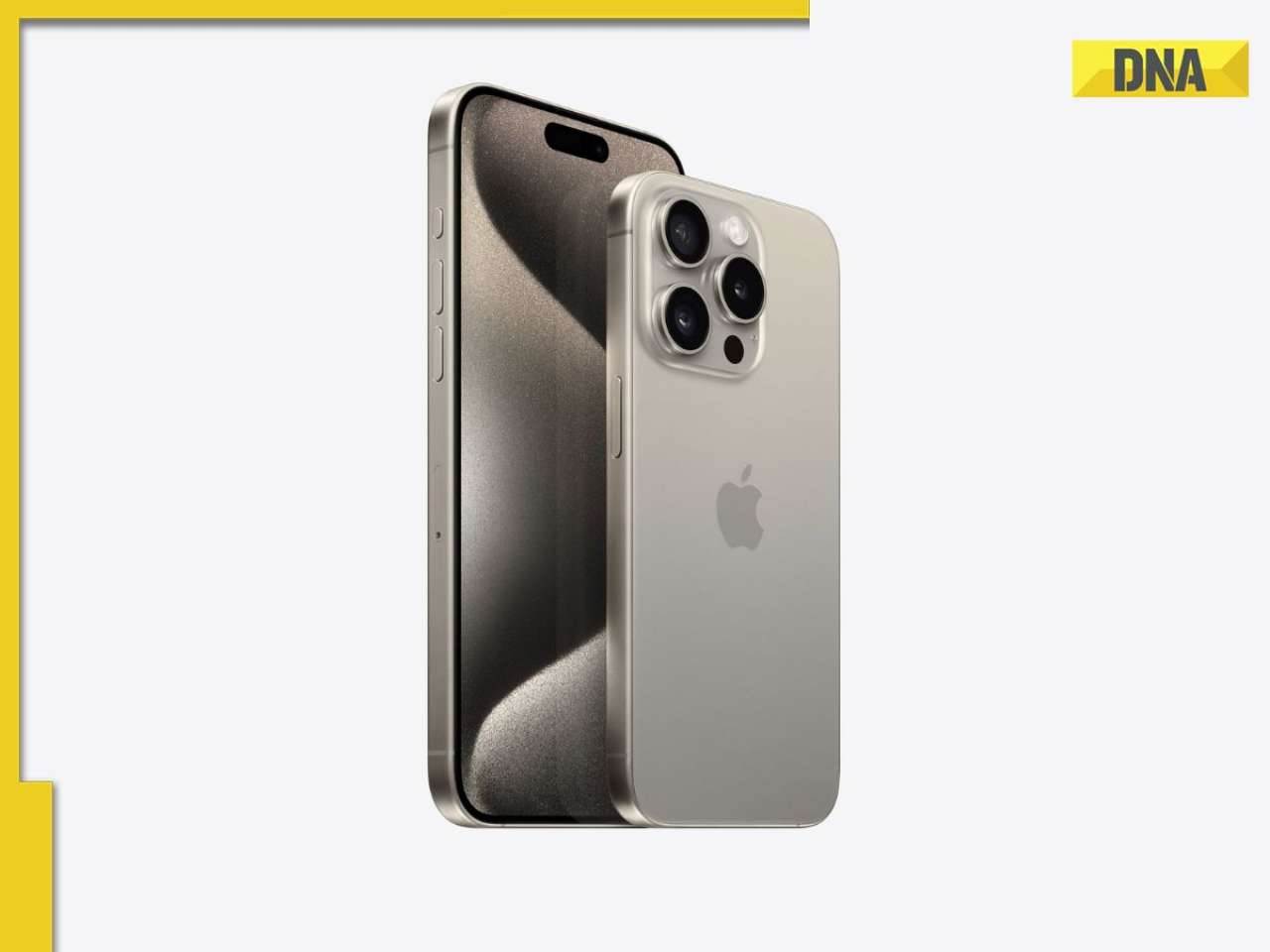

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() Apple iPhone camera module may now be assembled in India, plans to cut…

Apple iPhone camera module may now be assembled in India, plans to cut…![submenu-img]() HOYA Vision Care launches new hi-vision Meiryo coating

HOYA Vision Care launches new hi-vision Meiryo coating![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding

In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding![submenu-img]() In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month

In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch

Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?

What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans

Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans![submenu-img]() Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive

Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive![submenu-img]() Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now...

Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now... ![submenu-img]() IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR

IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR![submenu-img]() GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals

GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals![submenu-img]() 'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash

'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash![submenu-img]() IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB

IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here

Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here![submenu-img]() Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home

Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home![submenu-img]() This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...

This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...![submenu-img]() Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

)

)

)

)

)

)

)

)