YOUR MONEY: Close joint bank accounts with your spouse and change nominees on your insurance

Managing your finances is never simple, but a divorce can make it far more difficult. In addition to the emotional turmoil of a divorce, it can also cause a lot of financial upheaval. By establishing a plan and relying on professional help where necessary, you can ensure your best possible financial outcome and avoid damage to your credit score during this tumultuous time.

The financial impact of divorce can last for decades and carry on into older age. People who went through a divorce in their 30s or 40s are still feeling the financial pain well into their 60s and 70s. Thus, there are some things we need to keep in mind to maintain some sanity when it comes to navigating the financial aspects of divorce.

Though it seems impossible in the midst of the emotional turmoil of a divorce, making the best financial decisions for both parties will benefit both in the long run.

Whether it is your best friend or a co-worker, there will be no shortage of unsolicited advice from people you know during a divorce. They will be all too happy to share a story of a nightmare divorce, or an amicable one and tell you what you should — or shouldn't — do in your own situation. It is best to heed only the advice of those you trust, and preferably, someone who is working in the domain.

When emotions are high we often wear them on our sleeves. In these times, we may find ourselves talking about our divorce to everyone. But because there is so much personal information — financial and otherwise — tied up in the divorce process, it's best to keep the details of your situation private and confidential.

Focus on finances

This is one of the most important steps towards regaining the charge of your life. A lawyer can help you through the legalities of things like separation agreements and child visitation, but when it comes to finances and managing joint debts, it is best to work with someone who specialises in finances. If you don't know where to start, ask your divorce lawyer or mediator to recommend a financial planner they trust or have worked with in the past.

While working towards the same, keep points in mind such as-

Close joint credit accounts: Once you have filed for divorce, it is important to cease accruing debt in both of your names and thus closing any joint account that you both share

Keep track of income and expenses: This is always a smart idea, but particularly during the stress and chaos of a divorce, it can be helpful to track and document financial details including child support and alimony payments, and shared medical and other expenses

Secure your own health insurance coverage: For many couples one spouse is the main policyholder on the health insurance coverage for the entire family. When you get divorced, there will be a grace period for one or both of you to find new coverage on separate policies

Insurance beneficiary changes to make during a divorce: Most married people have their spouse as the primary beneficiary. The purpose of insurance is to protect those closest to you from financial devastation in case of an emergency and for a married person, no one is closer than a spouse. But, in the case of a divorce, particularly an acrimonious one, there is a good chance you will no longer want your ex-spouse profiting from your loss. If no children are involved, few reasons exist to continue having an ex-spouse as your insurance beneficiary. The easiest way to change your beneficiary after the divorce is to contact your life insurance agent; he can verify if the policy is revocable and re-designate your beneficiary.

Property/ motor insurance and divorce: Real and personal property must be insured by the actual owner of the property (for example, a car registered in your name must be owned by you). So, property/ motor insurance policies must be modified or rewritten to reflect the proper owner as the insured. If the ownership is changed, a new deed should be drawn up to reflect the new arrangement, and the policy should be updated.

Also, if you move into an apartment (even temporarily), you should buy renters insurance to cover your possessions.

Ensure your children are covered: One of the biggest challenges of divorce is that it frequently turns people into single parents. Sadly, many parents find they cannot rely on their ex-spouses after they end the marriage, financially or otherwise. If you have minor children who should benefit from your retirement accounts or life insurance policies, make sure any changes you put in place account for that. Make sure you appoint a person who will fulfill your wishes pertaining to the amounts you designate to your child and when in case of your untimely death. It's a good idea to get these details in writing and notarized as well.

Take it one day at a time

Divorce is never something we plan for, and it can feel completely overwhelming looking at all of the decisions and details that need to be worked out. But by slowing down and taking things one step and one day at a time, you will find that both you and your finances will adjust to this life change. And you may just make the transition a lot more seamlessly than you think you are capable of.

The writer is head, product development, SBI General Insurance

![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

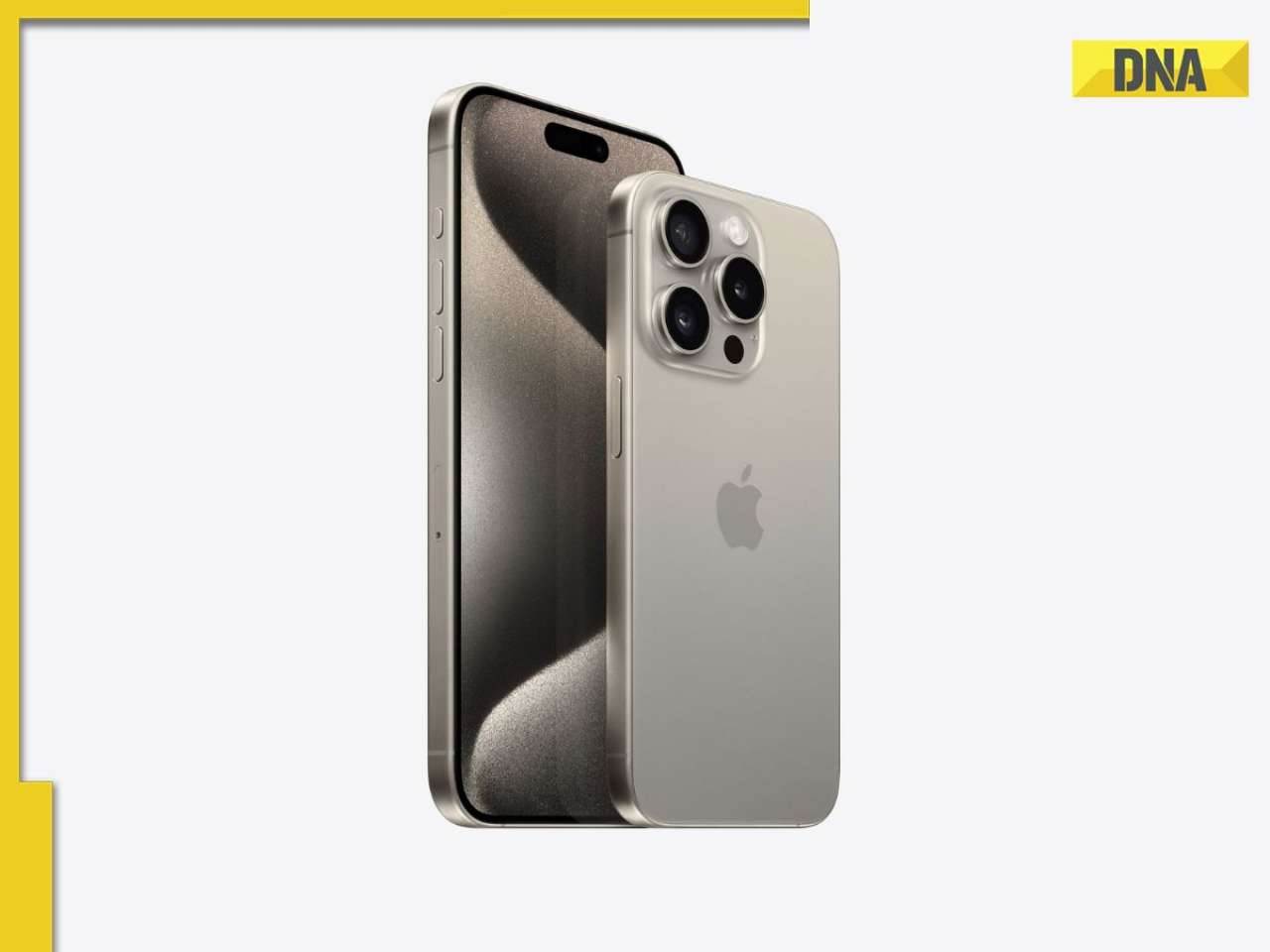

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() Apple iPhone camera module may now be assembled in India, plans to cut…

Apple iPhone camera module may now be assembled in India, plans to cut…![submenu-img]() HOYA Vision Care launches new hi-vision Meiryo coating

HOYA Vision Care launches new hi-vision Meiryo coating![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding

In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding![submenu-img]() In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month

In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch

Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?

What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans

Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans![submenu-img]() Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive

Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive![submenu-img]() Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now...

Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now... ![submenu-img]() IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR

IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR![submenu-img]() GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals

GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals![submenu-img]() 'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash

'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash![submenu-img]() IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB

IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here

Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here![submenu-img]() Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home

Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home![submenu-img]() This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...

This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...![submenu-img]() Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

)

)

)

)

)

)

)