India mandates anti-money laundering measures for crypto exchanges under PMLA.

The Indian government has taken a significant step to tighten oversight of the digital asset sector by bringing crypto trading, safekeeping, and other financial services under the ambit of the Prevention of Money Laundering Act. The Union finance ministry issued a gazette notification on Tuesday, mandating that crypto exchanges and intermediaries dealing with virtual digital assets (VDA) must perform KYC of their clients and users of the platform. Additionally, they must report suspicious activity to the Financial Intelligence Unit India.

The notification classifies entities dealing in VDA as "reporting entities" under PMLA, which means that they will be required to maintain a record of all transactions, including cash transactions exceeding INR 10 lakh, for at least five years. Furthermore, they must maintain a record of all series of cash transactions integrally connected to each other, where such series of transactions have taken place within a month and the monthly aggregate exceeds INR 10 lakh.

This move by the Indian government aligns with the global trend of regulating digital-asset platforms to adhere to anti-money laundering standards similar to those followed by other regulated entities such as banks or stockbrokers. The gazette notification specifies that virtual digital assets exchanged with fiat currencies, exchange between one or more forms of virtual digital assets, transfer of virtual digital assets (VDA), safekeeping or administration of virtual digital assets or instruments enabling control over virtual digital assets, and participation in and provision of financial services related to an issuer's offer and sale of a virtual digital asset will now be covered under the Prevention of Money Laundering Act, 2002.

The Indian government aims to curb illegal activities such as money laundering and other financial crimes while ensuring transparency and accountability in the crypto sector. The inclusion of crypto exchanges and intermediaries as reporting entities under PMLA will require them to maintain records of all transactions and report any suspicious activities, thus enhancing the government's efforts to combat financial fraud and other illegal activities.

Read more: What is the latest US work authorisation program for visa-holding students? Know here

![submenu-img]() Meet Gautam Adani’s ‘right hand’, used to work as teacher, he’s now Rs 1600000 crore…

Meet Gautam Adani’s ‘right hand’, used to work as teacher, he’s now Rs 1600000 crore…![submenu-img]() Meet actor who worked with Amitabh Bachchan, Aishwarya Rai, entered films because of a bus conductor, is now India's..

Meet actor who worked with Amitabh Bachchan, Aishwarya Rai, entered films because of a bus conductor, is now India's..![submenu-img]() Meet Bollywood star, who was a tourist guide, married 4 times, went bankrupt, his son died by suicide, then...

Meet Bollywood star, who was a tourist guide, married 4 times, went bankrupt, his son died by suicide, then...![submenu-img]() This actor made Sharmila Tagore forget her lines, once did film for Rs 100, could never be a superstar because..

This actor made Sharmila Tagore forget her lines, once did film for Rs 100, could never be a superstar because..![submenu-img]() Volkswagen Taigun GT Line, Taigun GT Plus launched in India, price starts at Rs 14.08 lakh

Volkswagen Taigun GT Line, Taigun GT Plus launched in India, price starts at Rs 14.08 lakh![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Abhishek Sharma? Hrithik Roshan's brother from Kaho Naa Pyaar Hai has become TV star, is married to..

Remember Abhishek Sharma? Hrithik Roshan's brother from Kaho Naa Pyaar Hai has become TV star, is married to..![submenu-img]() Remember Ali Haji? Aamir Khan, Kajol's son in Fanaa, who is now director, writer; here's how charming he looks now

Remember Ali Haji? Aamir Khan, Kajol's son in Fanaa, who is now director, writer; here's how charming he looks now![submenu-img]() Remember Sana Saeed? SRK's daughter in Kuch Kuch Hota Hai, here's how she looks after 26 years, she's dating..

Remember Sana Saeed? SRK's daughter in Kuch Kuch Hota Hai, here's how she looks after 26 years, she's dating..![submenu-img]() In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding

In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding![submenu-img]() In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month

In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() Meet actor who worked with Amitabh Bachchan, Aishwarya Rai, entered films because of a bus conductor, is now India's..

Meet actor who worked with Amitabh Bachchan, Aishwarya Rai, entered films because of a bus conductor, is now India's..![submenu-img]() Meet Bollywood star, who was a tourist guide, married 4 times, went bankrupt, his son died by suicide, then...

Meet Bollywood star, who was a tourist guide, married 4 times, went bankrupt, his son died by suicide, then...![submenu-img]() This actor made Sharmila Tagore forget her lines, once did film for Rs 100, could never be a superstar because..

This actor made Sharmila Tagore forget her lines, once did film for Rs 100, could never be a superstar because..![submenu-img]() Mumtaz urges to lift ban on Pakistani artistes in Bollywood: ‘Woh log hum logon se...'

Mumtaz urges to lift ban on Pakistani artistes in Bollywood: ‘Woh log hum logon se...'![submenu-img]() Not Kiara Advani, but this actress was first choice opposite Shahid Kapoor in Kabir Singh, she rejected because...

Not Kiara Advani, but this actress was first choice opposite Shahid Kapoor in Kabir Singh, she rejected because...![submenu-img]() IPL 2024: Yashasvi Jaiswal, Sandeep Sharma guide Rajasthan Royals to 9-wicket win over Mumbai Indians

IPL 2024: Yashasvi Jaiswal, Sandeep Sharma guide Rajasthan Royals to 9-wicket win over Mumbai Indians![submenu-img]() IPL 2024: How can RCB still qualify for playoffs after 1-run loss against KKR?

IPL 2024: How can RCB still qualify for playoffs after 1-run loss against KKR?![submenu-img]() CSK vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

CSK vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() RR vs MI: Yuzvendra Chahal scripts history, becomes first bowler to achieve this massive milestone in IPL

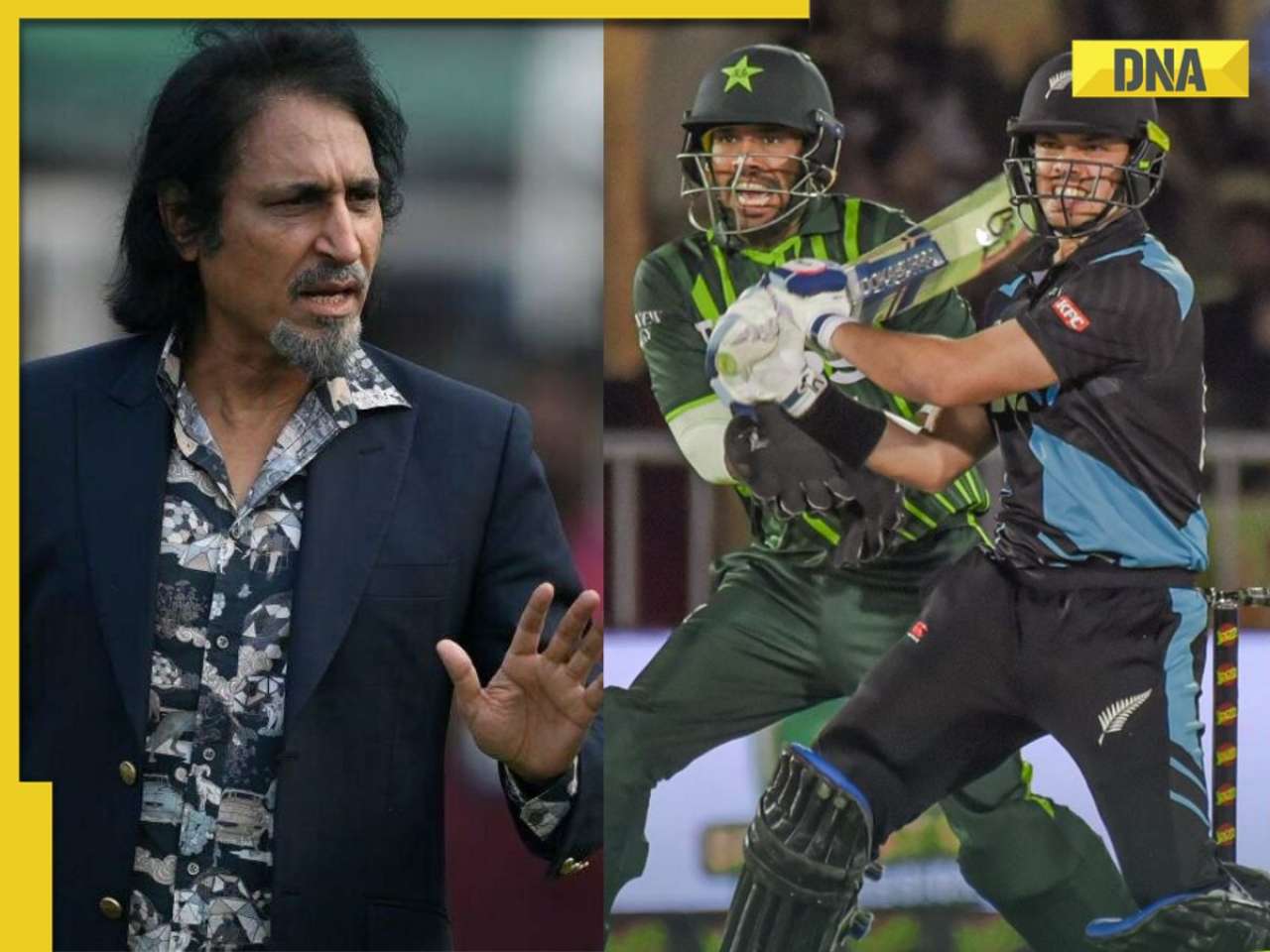

RR vs MI: Yuzvendra Chahal scripts history, becomes first bowler to achieve this massive milestone in IPL![submenu-img]() 'Yeh toh second tier ki bhi team nhi': Ramiz Raja slams Babar Azam and co. after 3rd T20I loss vs New Zealand

'Yeh toh second tier ki bhi team nhi': Ramiz Raja slams Babar Azam and co. after 3rd T20I loss vs New Zealand![submenu-img]() Mukesh Ambani's son Anant Ambani likely to get married to Radhika Merchant in July at…

Mukesh Ambani's son Anant Ambani likely to get married to Radhika Merchant in July at…![submenu-img]() India's most expensive wedding costs more than weddings of Isha Ambani, Akash Ambani, total money spent was...

India's most expensive wedding costs more than weddings of Isha Ambani, Akash Ambani, total money spent was...![submenu-img]() Meet Indian genius who lost his father at 12, studied at Cambridge, took Rs 1 salary, he is called 'architect of...'

Meet Indian genius who lost his father at 12, studied at Cambridge, took Rs 1 salary, he is called 'architect of...'![submenu-img]() Earth Day 2024: Google Doodle features aerial photos of planet's natural beauty, biodiversity

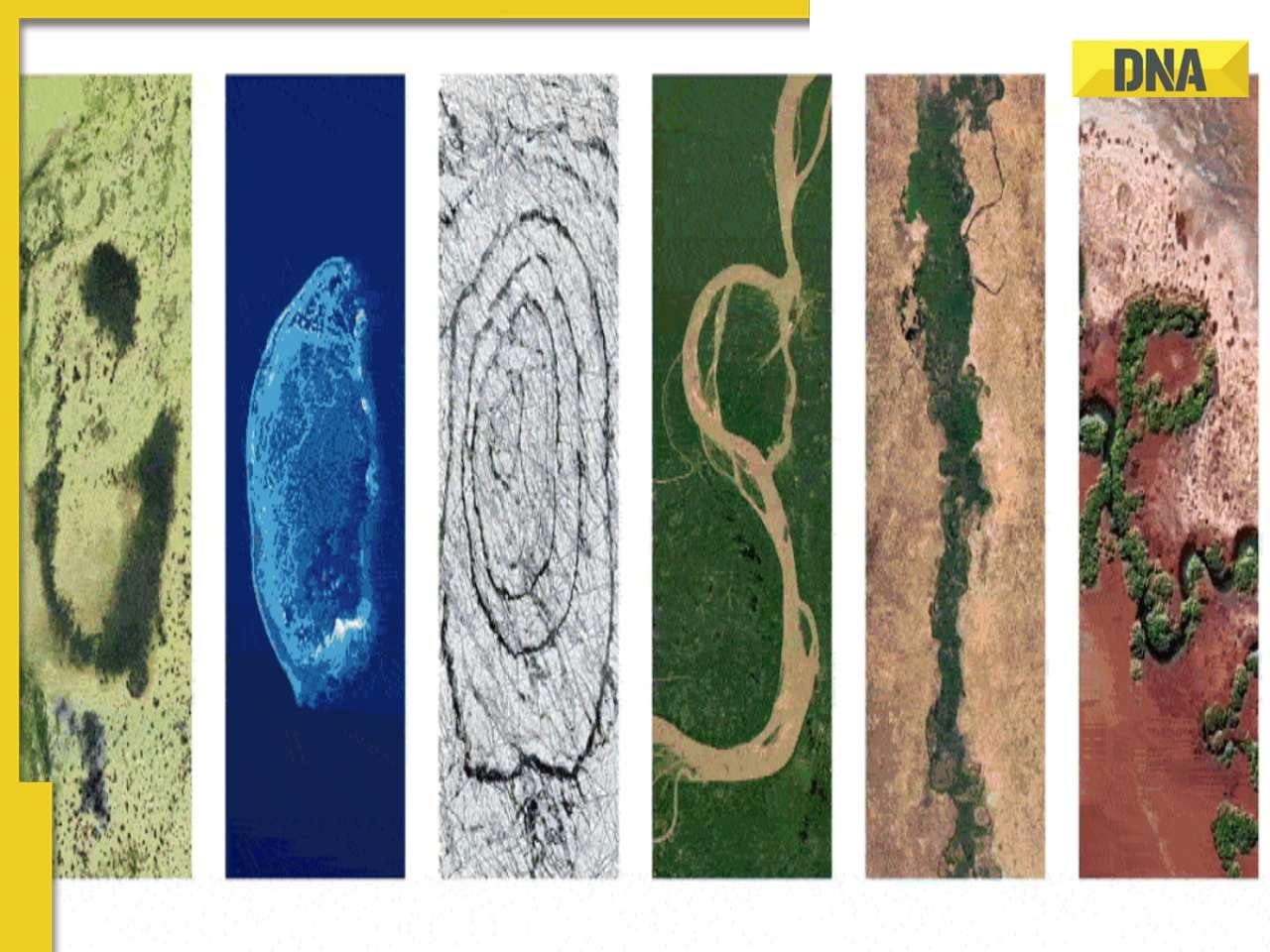

Earth Day 2024: Google Doodle features aerial photos of planet's natural beauty, biodiversity![submenu-img]() Meet India's first billionaire, much richer than Mukesh Ambani, Adani, Ratan Tata, but was called miser due to...

Meet India's first billionaire, much richer than Mukesh Ambani, Adani, Ratan Tata, but was called miser due to...

)

)

)

)

)

)

)