RBI cuts rate for first time in 18 months, moves on rupee market, addresses NBFC crisis and extends relief to farmers

Reserve Bank of India (RBI) will set up a task force on the offshore rupee markets (offshore non-deliverables forward market – NDF), the size of which is estimated to be over $20 billion according to forex experts. The volatility in the domestic forex market is often attributed to the rates of the rupee in the offshore market, which is used by foreign banks and also Indian companies with an overseas presence.

NDF operates 24x7 in major financial markets like London, Dubai, Singapore and other places where the market participants can place bets on the level of the rupee and also hedge their rupee exposures.

"Simple extension of the forex market to 11 pm and allowing delivery on exchange will do wonders for our forex market. It will also have a positive impact on the bond market as these are interconnected," said Anindya Banerjee, currency analyst at Kotak Securities.

The rupee on Thursday rose by 11 paise to close at Rs 71.45 against the US dollar after RBI cut the repo rate and changed its policy stance to neutral. By lowering the inflation forecast for the next fiscal, it also hinted at more rate cuts.

Ritesh Bhansali, vice-president, Mecklai Financial, said, "There is a lot of liquidity that is flowing into the overseas market which is a concern for the central bank. The task force will study the market and see what relaxations can be offered to the foreign investors to draw them to the domestic market."

RBI's policy efforts have been to align incentives for non-residents to gradually move to the domestic market for their hedging requirements. "At the same time, there is a need to improve residents' access to derivatives markets to hedge their currency risks. In order to take forward the process of gradual opening up of the foreign exchange market and also to benefit from a wider range of participants and views, it is proposed to set up a task force on offshore rupee markets. The task force will examine the issues relating to the offshore rupee markets in depth and recommend appropriate policy measures that also factor in the requirement of ensuring the stability of the external value of the rupee," RBI said in a release.

Research by the National Institute of Public Finance and Policy shows India's turnover in the NDF market was at $16.5 billion in 2016, which was 16.7% higher than the 2013 level. BRICS (Brazil, Russia, India, China and South Africa) currencies formed around 35% of NDF in 2016.

"For the first time, RBI is acknowledging the existence of the non-deliverable forwards market. They will study the market and understand the reason why the domestic forex market moves with the NDF, how to control the NDF market," said a forex dealer.

MONETARY POLICY

- RBI cuts key lending rate (repo) by 0.25% to 6.25%

- Reverse repo rate cut to 6%, bank rate to 6.5%, CRR unchanged at 4%

- Headline inflation estimates revised down to 2.8% in March quarter, 3.2-3.4% in the first half of next fiscal and 3.9% in Q3 of FY20

- Projects GDP growth to accelerate to 7.4% next fiscal, from 7.2% in 2018-19

- Pegs April-September growth in range of 7.2-7.4%, and 7.5% in Q3 of 2019-20

- Oil price outlook hazy, trade tensions to weigh on global growth prospects

- To revise definition of bulk deposits as single rupee deposits of Rs 2 crore and above from Rs 1 crore currently

- To issue guidelines to harmonise major categories of NBFCs

- Proposes to set up a task force on offshore rupee markets

- Removes restrictions on foreign portfolio investors investing in the corporate debt market

- To come out with a discussion paper on payment gateway service providers and payment aggregators

- Hikes limit of collateral-free agricultural loans to Rs 1.6 lakh from Rs 1 lakh, to help small and marginal farmers

- Monetary policy committee votes 4:2 in favour of the rate cut, unanimous on the change in stance

- Two monetary policy committee members Chetan Ghate and Viral Acharya were for status quo in rates

- Next meeting of the MPC from April 2-4

The shift in stance provides flexibility to address, and the room to address, sustained growth of India’s economy over the coming months as long as inflation remains benign

Shaktikanta Das, governor, RBI

There are several innovative announcements in policy apart from a rate cut that could potentially trigger a new paradigm for financial markets... Opening up the ECB route for applicants under the IBC could facilitate a faster turnaround

Rajnish Kumar, chairman, SBI

We should see a moderation in borrowing rates. Providing banks with increased flexibility on bulk deposits is a welcome move and will assist them in better managing their asset liability mismatches

Zarin Daruwala, CEO, India, Standard Chartered Bank

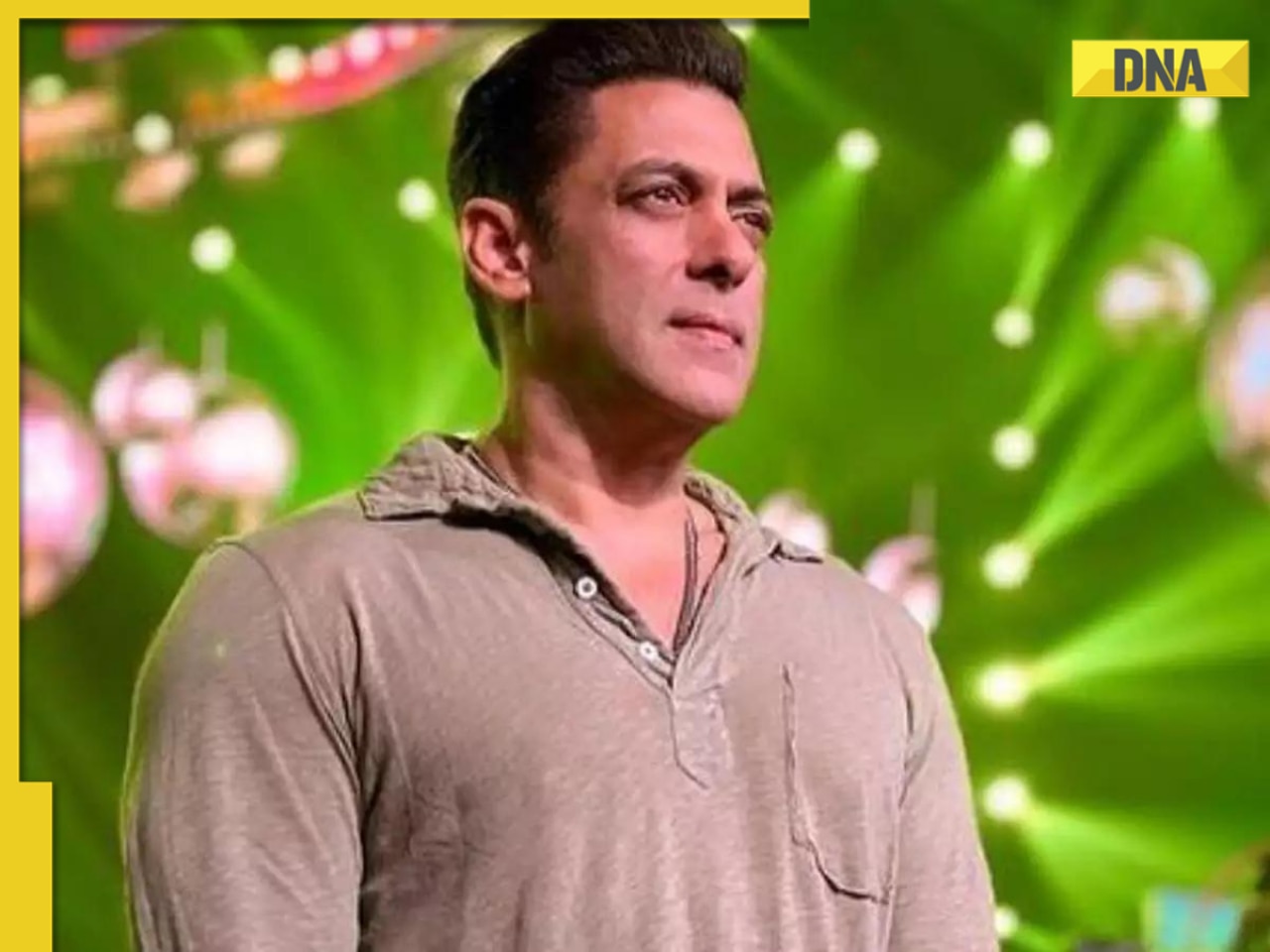

![submenu-img]() Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins

Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins![submenu-img]() Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'

Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'![submenu-img]() India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat

India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat![submenu-img]() Vellore Lok Sabha constituency: Check polling date, candidates list, past election results

Vellore Lok Sabha constituency: Check polling date, candidates list, past election results![submenu-img]() Meet NEET-UG topper who didn't take admission in AIIMS Delhi despite scoring AIR 1 due to...

Meet NEET-UG topper who didn't take admission in AIIMS Delhi despite scoring AIR 1 due to...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch

Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch![submenu-img]() Remember Tanvi Hegde? Son Pari's Fruity who has worked with Shahid Kapoor, here's how gorgeous she looks now

Remember Tanvi Hegde? Son Pari's Fruity who has worked with Shahid Kapoor, here's how gorgeous she looks now![submenu-img]() Remember Kinshuk Vaidya? Shaka Laka Boom Boom star, who worked with Ajay Devgn; here’s how dashing he looks now

Remember Kinshuk Vaidya? Shaka Laka Boom Boom star, who worked with Ajay Devgn; here’s how dashing he looks now![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?

What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?![submenu-img]() DNA Explainer: Reason behind caused sudden storm in West Bengal, Assam, Manipur

DNA Explainer: Reason behind caused sudden storm in West Bengal, Assam, Manipur![submenu-img]() Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins

Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins![submenu-img]() Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'

Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'![submenu-img]() India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat

India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat![submenu-img]() This film has earned Rs 1000 crore before release, beaten Animal, Pathaan, Gadar 2 already; not Kalki 2898 AD, Singham 3

This film has earned Rs 1000 crore before release, beaten Animal, Pathaan, Gadar 2 already; not Kalki 2898 AD, Singham 3![submenu-img]() This Bollywood star was intimated by co-stars, abused by director, worked as AC mechanic, later gave Rs 2000-crore hit

This Bollywood star was intimated by co-stars, abused by director, worked as AC mechanic, later gave Rs 2000-crore hit![submenu-img]() IPL 2024: Rohit Sharma's century goes in vain as CSK beat MI by 20 runs

IPL 2024: Rohit Sharma's century goes in vain as CSK beat MI by 20 runs![submenu-img]() RCB vs SRH IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Sunrisers Hyderabad

RCB vs SRH IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Sunrisers Hyderabad ![submenu-img]() IPL 2024: Phil Salt, Mitchell Starc power Kolkata Knight Riders to 8-wicket win over Lucknow Super Giants

IPL 2024: Phil Salt, Mitchell Starc power Kolkata Knight Riders to 8-wicket win over Lucknow Super Giants![submenu-img]() IPL 2024: Why are Lucknow Super Giants wearing green and maroon jersey against Kolkata Knight Riders at Eden Gardens?

IPL 2024: Why are Lucknow Super Giants wearing green and maroon jersey against Kolkata Knight Riders at Eden Gardens?![submenu-img]() IPL 2024: Shimron Hetmyer, Yashasvi Jaiswal power RR to 3 wicket win over PBKS

IPL 2024: Shimron Hetmyer, Yashasvi Jaiswal power RR to 3 wicket win over PBKS![submenu-img]() Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home

Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home![submenu-img]() This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...

This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...![submenu-img]() Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video![submenu-img]() iPhone maker Apple warns users in India, other countries of this threat, know alert here

iPhone maker Apple warns users in India, other countries of this threat, know alert here![submenu-img]() Old Digi Yatra app will not work at airports, know how to download new app

Old Digi Yatra app will not work at airports, know how to download new app

)

)

)

)

)

)

)

)