When Xiaomi entered India in 2014 Micromax was the second largest phone brand in the country. Five years down the line, Chinese phone brands dominate the handset landscape and Micromax, along with other Indian players, is a pale shadow of itself. But how long will they continue their dream run?

VS Nair, an octogenarian residing in Kerala, had recently bought his life's first smartphone for talking to his grandson over video call in the capital city and checking out his latest pictures on WhatsApp. This was the first time he used his phone, earlier a feature one, for a purpose other than making a voice call.A mobile phone has traversed a long distance since its arrival in the market -- from a communication device to the one, which has replaced many basic things including a camera, calendar, alarm clock and to some extent even the juke box – TV.

Consumer preferences have changed over the years, which have been tapped well by the Chinese mobile players operating in the Indian market. With latest specs – high-resolution camera, selfie options, huge storage capacity, flash charge technology, Chinese brands, including Xiaomi, Oppo, Vivo and Huawei, have flooded the market with their hard to resist offerings at affordable prices, pushing back the likes of Samsung and Apple.

Chinese brand incursion

In 2018, the Chinese brands accounted for 60% market share of the Indian smartphone market, as per data from Cyber Media Research (CMR). On the other hand, Indian brands such as Mircomax, Intex, Lava, which had a significant presence till the last two years, are almost out of the picture with the aggression of Chinese players. Xiaomi through its aggressive online push has been able to garner a bigger pie of the Indian market giving a tough competition to Samsung.Let's look at the numbers. In terms of market share, Xiaomi's share went up to 28% in 2018 from 6 % in 2016, while for Vivo the share went up to 9 % from 5 %, and for Oppo, the share increased to 8 % from 5 % during the period, according to data from Counterpoint Research.

Samsung, which was a dominant player before Chinese brands' invasion, has been maintaining its market share – in 2016, it was enjoying a share of 25 % and is hovering around the same number currently.Prabhu Ram, head- Industry Intelligence Group (IIG), CMR, says the Chinese smartphone brands were able to attract and capture Indian millennials, providing them with affordable smartphones with latest specs backed by attractive designs.

"With their keen investment in understanding consumer personas and mapping their products, Chinese brands could capture the India market. The hunger for growth was such that Chinese brands set an aggressive pace for innovation, introducing new models at regular intervals. In comparison, the competition failed to grasp changing market realities, and failed in introducing timely innovations, or, in marketing themselves well," Ram said.The data from CMR shows in 2016, Xiaomi shipped 5.9 million units which went up to 24.6 million units in 2017 and 38.7 million units till November 2018. Similarly, for Vivo, it jumped from 5.7 million units to 12.4 million units, and for Oppo, from 5.5 million units to 10.9 million units, respectively.

The hunger for latest smartphones has been fuelled by cheap 4G mobile services, especially, after the entry of new telecom player Reliance Jio. Indian players lost out because of late adoption of 4G while Chinese players could easily capture the market with their 4G ready phones.

Online vs offline

The early success for Chinese smartphone brands came exclusively through online platforms. Though, the focus has now shifted to offline as well after attaining maturity and scale."Xiaomi enjoyed the early mover advantage in the online space and primarily continues to leverage from online only. Even though it expanded offline, its 80% or so sales are still online," says Faisal Kawoosa, founder, TechArc, a consulting firm.

Last year, on October 29, Xiaomi opened 500 retail points – MI stores in a single day in rural areas – which will cover areas as far as Moreh, 650 km from Guwahati located on India-Burma border and just 100 meters away from Burma and in Aalo (Along) in Arunachal Pradesh, the last town of India bordering China.The new MI stores will serve as Xiaomi's prime retail stores situated in several towns ranging from Tier 3, 4, 5 and below. These stores will sell all products from the Xiaomi stable, be it smartphones, TVs and other consumer products. In line with its expansion plans, Xiaomi India plans to open 5,000+ MI Stores all over India by end of 2019.

Last year, on October 29, Xiaomi opened 500 retail points – MI stores in a single day in rural areas – which will cover areas as far as Moreh, 650 km from Guwahati located on India-Burma border and just 100 meters away from Burma and in Aalo (Along) in Arunachal Pradesh, the last town of India bordering China.The new MI stores will serve as Xiaomi's prime retail stores situated in several towns ranging from Tier 3, 4, 5 and below. These stores will sell all products from the Xiaomi stable, be it smartphones, TVs and other consumer products. In line with its expansion plans, Xiaomi India plans to open 5,000+ MI Stores all over India by end of 2019.

Besides, Chinese brands continue to outspend others in marketing, whether it be through promotional tie-ups, or through exclusive celebrity endorsements, or sponsorship of large-format sporting events, adds Ram.Roughly, 40% of mobiles – feature phones and smartphones will continue to be sold online while rest will be through the offline medium. "There is no choice for a brand to decide whether be online or offline. They have to be omnipresent, especially for smartphones," Kawoosa said.

Apart from online, the other major factor that contributed to the success of Chinese brands was the dealer margins. Most of them gave better margins at 10-12 % compared to 6% by Samsung.However, not everybody could take advantage of the online medium. For instance, Samsung had a misjudgement about the online channel, adds Kawoosa.

The primary reason for the growth of the online segment has been mainly due to the push of third-party platforms like Amazon and Flipkart. "They continue to invest a lot in promoting online, especially for smartphones. Samsung did not join the rally at the right time, which was advantaged by Xiaomi".Even Apple's iPhone got impacted, but that was more because of OnePlus than other Chinese players. "For Apple, there are two reasons. One, OnePlus was able to successfully create a new definition of the premium market, which was at half the price of Apple. Second, the acceptability of Android in luxe segment (techARC categorises Rs 50,000 and above as luxe segment), which can be seen by the fact that more OEMs are launching smartphones in this segment. We have Google, Huawei, Asus, Oppo other than the traditional Samsung in this space now," Kawoosa said.

Samsung's focus was on the mid and premium segment, and somewhere they lost out to brands offering cutting edge specs at entry level. "Samsung's new Galaxy 'M' series of smartphones with industry-first features indicates the importance it accords to India as a growth market. It would look at bolstering and taking the fight to Xiaomi in this price segment, and further cement its leadership in the Indian market. With a differentiated product strategy, Samsung would be able to build on its traditional strengths," he said.

Consolidation

Almost all Chinese players have domestic manufacturing facilities in India to cater to the rising demand for their phones. Xiaomi, Oppo, Vivo all have their manufacturing units in India employing a substantial number in India. 'Make in India' phone is a new marketing strategy for such players.This also reduces their time to market significantly. As per data from CMR's India Mobile Handset Review Report, Chinese brands account for around 60% when it comes to domestic manufacturing in India.

But, consolidation is imminent in the mobile handset industry on the lines of telecom players industry. Indian mobile players are fast depleting, while smaller Chinese players such as LeEco and Gionee have recently exited the market.Besides, going forward, as India move towards 5G technology, players not investing in research will be forced out of the market.

Karn Chouhan, an analyst at Counterpoint Research, says there will be a consolidation for Indian brands and entry-level brands which operate in the range of Rs 5,000-7,000 and this will help bigger players only. Currently, the top 10 brands constitute 90 % of the mobile market and it will continue to be the same or more.Even, small Chinese players won't be able to sustain in the long term. They will come and sell a few thousands of phones as anything can be sold in the Indian market that offers huge potential.

India is the second largest mobile market in the world and with only 500 million smartphone users at a base of 1 billion mobile users, the opportunity for the players be it mobile handset or telecom service provider is ample.

Way forward

However, given the changing policy and market dynamics in India, it remains to be seen how the Chinese smartphone brands cope up in the year ahead. In 2018, the hypercompetitive market in India, and the pursuit for profitability took a toll on some Chinese brands.While some faced the brunt, others changed their strategy and some exited the market. In 2019, it will be tough for new smartphone players from China to replicate the success of the early market entrants in India.

"For Chinese players in India, the year ahead will be one of focusing on reviewing, readjusting and renewing their India strategy to continue their dominance. The demanding nature of the India market, while having significant growth potential, is also fraught with risks," Prabhu Ram of CMR said.For succeeding in India, it is not just about focusing on getting some elements right – whether it be a product, price or marketing. It is all about offering a composite package of all the elements, wherein made for India smartphones offer value for money, come with industry-leading innovations, and are available to the customer at every touchpoint of convenience for them.

"No doubt, Chinese mobile players will continue to dominate the market this year but there will be big competition amongst the Chinese brands to outdo each other. Indian players are just sustaining in the market with an aim to survive, they are not aiming any market share," adds Chouhan.Xiaomi has realised that online market has saturated, which is why a huge focus was laid on offline expansion last year.

Both mobile handset and telecom and industry are banking on rising data consumption to drive their growth. A recent report by Ericssonsaid smartphone subscriptions in India are likely to grow from 560 million in 2018 to 1 billion in 2024, and data traffic per smartphone per month is expected to grow at a compounded annual growth rate of 14%, from 6.8 GB in 2018 to 15 GB in 2024.

A recent research from Nielsen survey on handset consumers had said the appetite for data consumption has risen over the last few years. Earlier, mobile users were consuming 4 GB data a month, while today the consumption is as high as 1 GB per day.Increasingly, it will become difficult for smartphone makers only to create a distinguishing factor in the handsets, and competition will become more aggressive in the coming times. There will be more upgradation programmes, cashback offers, exchange offers and tie ups with telecom service providers to offer content with Netflix and Amazon Prime to create differentiation.

The road for Chinese players in India may not be as smooth as it was earlier as the competition is expected to increase manifold and online market staring at saturation. For Xiaomi, this is only the 5th year in India. Let's wait and watch, Kawoosa ends.

![submenu-img]() Meet Gautam Adani’s ‘right hand’, used to work as teacher, he’s now Rs 1600000 crore…

Meet Gautam Adani’s ‘right hand’, used to work as teacher, he’s now Rs 1600000 crore…![submenu-img]() Meet actor who worked with Amitabh Bachchan, Aishwarya Rai, entered films because of a bus conductor, is now India's..

Meet actor who worked with Amitabh Bachchan, Aishwarya Rai, entered films because of a bus conductor, is now India's..![submenu-img]() Meet Bollywood star, who was a tourist guide, married 4 times, went bankrupt, his son died by suicide, then...

Meet Bollywood star, who was a tourist guide, married 4 times, went bankrupt, his son died by suicide, then...![submenu-img]() This actor made Sharmila Tagore forget her lines, once did film for Rs 100, could never be a superstar because..

This actor made Sharmila Tagore forget her lines, once did film for Rs 100, could never be a superstar because..![submenu-img]() Volkswagen Taigun GT Line, Taigun GT Plus launched in India, price starts at Rs 14.08 lakh

Volkswagen Taigun GT Line, Taigun GT Plus launched in India, price starts at Rs 14.08 lakh![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Abhishek Sharma? Hrithik Roshan's brother from Kaho Naa Pyaar Hai has become TV star, is married to..

Remember Abhishek Sharma? Hrithik Roshan's brother from Kaho Naa Pyaar Hai has become TV star, is married to..![submenu-img]() Remember Ali Haji? Aamir Khan, Kajol's son in Fanaa, who is now director, writer; here's how charming he looks now

Remember Ali Haji? Aamir Khan, Kajol's son in Fanaa, who is now director, writer; here's how charming he looks now![submenu-img]() Remember Sana Saeed? SRK's daughter in Kuch Kuch Hota Hai, here's how she looks after 26 years, she's dating..

Remember Sana Saeed? SRK's daughter in Kuch Kuch Hota Hai, here's how she looks after 26 years, she's dating..![submenu-img]() In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding

In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding![submenu-img]() In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month

In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() Meet actor who worked with Amitabh Bachchan, Aishwarya Rai, entered films because of a bus conductor, is now India's..

Meet actor who worked with Amitabh Bachchan, Aishwarya Rai, entered films because of a bus conductor, is now India's..![submenu-img]() Meet Bollywood star, who was a tourist guide, married 4 times, went bankrupt, his son died by suicide, then...

Meet Bollywood star, who was a tourist guide, married 4 times, went bankrupt, his son died by suicide, then...![submenu-img]() This actor made Sharmila Tagore forget her lines, once did film for Rs 100, could never be a superstar because..

This actor made Sharmila Tagore forget her lines, once did film for Rs 100, could never be a superstar because..![submenu-img]() Mumtaz urges to lift ban on Pakistani artistes in Bollywood: ‘Woh log hum logon se...'

Mumtaz urges to lift ban on Pakistani artistes in Bollywood: ‘Woh log hum logon se...'![submenu-img]() Not Kiara Advani, but this actress was first choice opposite Shahid Kapoor in Kabir Singh, she rejected because...

Not Kiara Advani, but this actress was first choice opposite Shahid Kapoor in Kabir Singh, she rejected because...![submenu-img]() IPL 2024: Yashasvi Jaiswal, Sandeep Sharma guide Rajasthan Royals to 9-wicket win over Mumbai Indians

IPL 2024: Yashasvi Jaiswal, Sandeep Sharma guide Rajasthan Royals to 9-wicket win over Mumbai Indians![submenu-img]() IPL 2024: How can RCB still qualify for playoffs after 1-run loss against KKR?

IPL 2024: How can RCB still qualify for playoffs after 1-run loss against KKR?![submenu-img]() CSK vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

CSK vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() RR vs MI: Yuzvendra Chahal scripts history, becomes first bowler to achieve this massive milestone in IPL

RR vs MI: Yuzvendra Chahal scripts history, becomes first bowler to achieve this massive milestone in IPL![submenu-img]() 'Yeh toh second tier ki bhi team nhi': Ramiz Raja slams Babar Azam and co. after 3rd T20I loss vs New Zealand

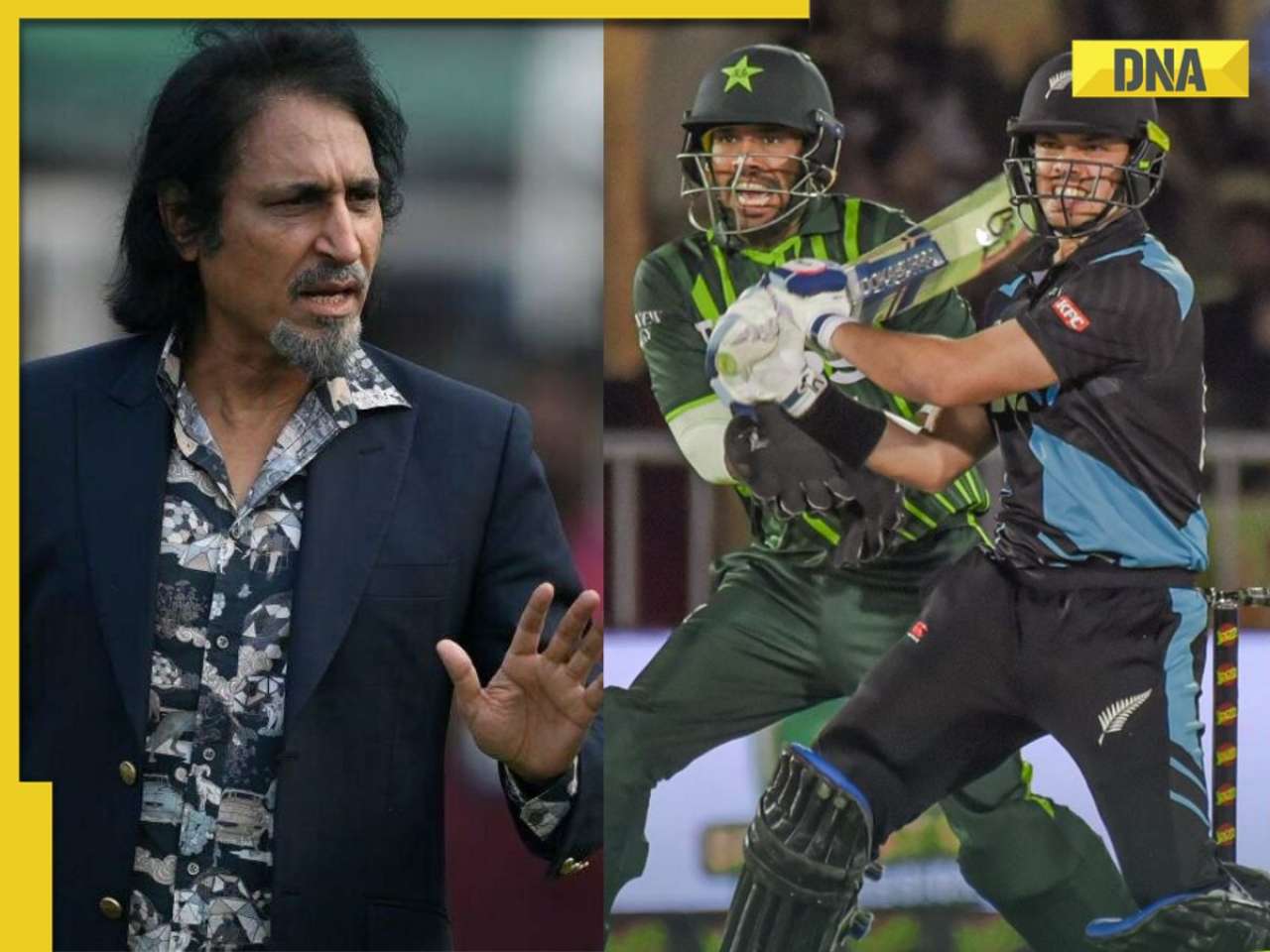

'Yeh toh second tier ki bhi team nhi': Ramiz Raja slams Babar Azam and co. after 3rd T20I loss vs New Zealand![submenu-img]() Mukesh Ambani's son Anant Ambani likely to get married to Radhika Merchant in July at…

Mukesh Ambani's son Anant Ambani likely to get married to Radhika Merchant in July at…![submenu-img]() India's most expensive wedding costs more than weddings of Isha Ambani, Akash Ambani, total money spent was...

India's most expensive wedding costs more than weddings of Isha Ambani, Akash Ambani, total money spent was...![submenu-img]() Meet Indian genius who lost his father at 12, studied at Cambridge, took Rs 1 salary, he is called 'architect of...'

Meet Indian genius who lost his father at 12, studied at Cambridge, took Rs 1 salary, he is called 'architect of...'![submenu-img]() Earth Day 2024: Google Doodle features aerial photos of planet's natural beauty, biodiversity

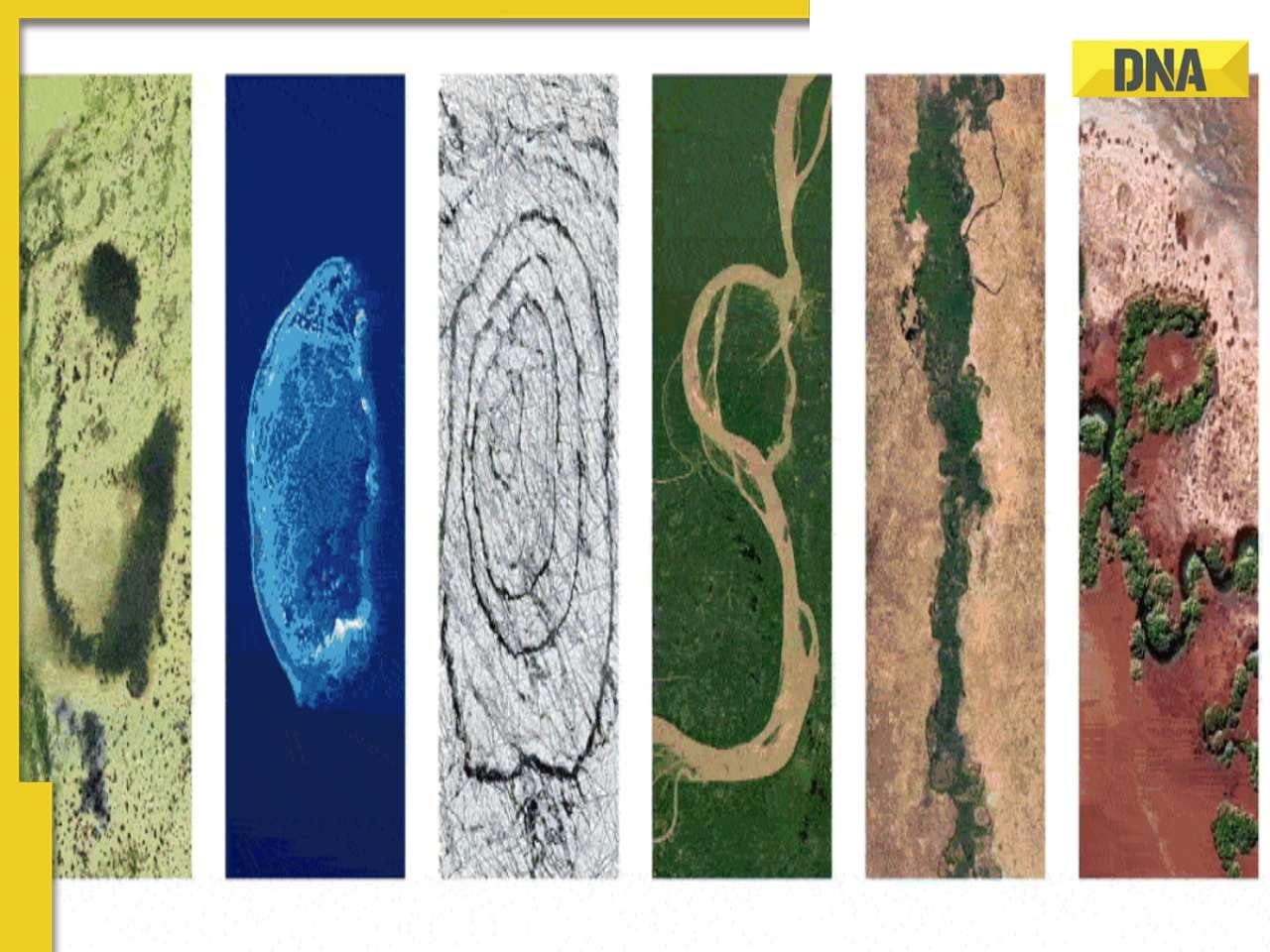

Earth Day 2024: Google Doodle features aerial photos of planet's natural beauty, biodiversity![submenu-img]() Meet India's first billionaire, much richer than Mukesh Ambani, Adani, Ratan Tata, but was called miser due to...

Meet India's first billionaire, much richer than Mukesh Ambani, Adani, Ratan Tata, but was called miser due to...

)

) Last year, on October 29, Xiaomi opened 500 retail points – MI stores in a single day in rural areas – which will cover areas as far as Moreh, 650 km from Guwahati located on India-Burma border and just 100 meters away from Burma and in Aalo (Along) in Arunachal Pradesh, the last town of India bordering China.The new MI stores will serve as Xiaomi's prime retail stores situated in several towns ranging from Tier 3, 4, 5 and below. These stores will sell all products from the Xiaomi stable, be it smartphones, TVs and other consumer products. In line with its expansion plans, Xiaomi India plans to open 5,000+ MI Stores all over India by end of 2019.

Last year, on October 29, Xiaomi opened 500 retail points – MI stores in a single day in rural areas – which will cover areas as far as Moreh, 650 km from Guwahati located on India-Burma border and just 100 meters away from Burma and in Aalo (Along) in Arunachal Pradesh, the last town of India bordering China.The new MI stores will serve as Xiaomi's prime retail stores situated in several towns ranging from Tier 3, 4, 5 and below. These stores will sell all products from the Xiaomi stable, be it smartphones, TVs and other consumer products. In line with its expansion plans, Xiaomi India plans to open 5,000+ MI Stores all over India by end of 2019.

)

)

)

)

)

)