Calendar 2019 promises to be an interesting year. Brexit vote gets defeated, massively. The US shutdown continues. Oil prices are up and threatening to derail the low-inflation euphoria. The US-China trade talks continue to hang on a rope of rumours and thread of reality. India retail inflation at 18-months low making a mockery of the real interest spreads. Markets volatile although the CBOE volatility index is further subdued. Earnings season is mixed and would not confirm concerted global growth as Germany reports the slowest growth in five years.

Towards close of Friday, the Dow Jones index was strongly up amid optimism over the potential for a US-China deal. While the US yields have hardened and crude prices have further advanced, the underlying sentiment is still brittle and suspect. Data flow from the US is somewhat disrupted due to the partial government shutdown and this could blur the outlook on macroeconomic strength. The interruption also makes Federal Reserve's job tough as it fails to get a real gauge of what lies ahead in terms of macro stability.

In other developments, Brexit defeat will be a historic event. The massive margin by which May's proposal got defeated puts the PM's political career in a crisis. All eyes on what the Plan B would detail when it is presented to the British Parliament on Monday.

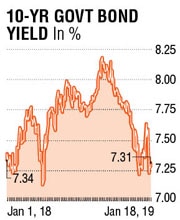

Global growth continues to be slack. In confirmation was the latest GDP data for Germany for the full year 2018 which came in at 1.7%, well below IMF estimates for developed economies. A Reuters poll now predicts the probability of a recession in the next two years at 35%.Indian Bond markets find their familiar nemesis in fiscal worries and sticky core inflation. Benchmark yields inched past the 7.60%, something less expected, as pessimism reigned supreme. Both wholesale and retail inflation came in lower than market forecast. Annual Wholesale Inflation edged lower to 3.80% from 4.64% in November while annual Retail inflation came in at an 18-month low of 2.19%. Food prices continue to pull down the inflation numbers and could well be a Trojan horse for the statistically oriented. The core inflation continues to be stickily higher and is more a function of estimates on housing etc.

Global growth continues to be slack. In confirmation was the latest GDP data for Germany for the full year 2018 which came in at 1.7%, well below IMF estimates for developed economies. A Reuters poll now predicts the probability of a recession in the next two years at 35%.Indian Bond markets find their familiar nemesis in fiscal worries and sticky core inflation. Benchmark yields inched past the 7.60%, something less expected, as pessimism reigned supreme. Both wholesale and retail inflation came in lower than market forecast. Annual Wholesale Inflation edged lower to 3.80% from 4.64% in November while annual Retail inflation came in at an 18-month low of 2.19%. Food prices continue to pull down the inflation numbers and could well be a Trojan horse for the statistically oriented. The core inflation continues to be stickily higher and is more a function of estimates on housing etc.

At a time when markets are bracing for the next Monetary Policy Committee (MPC) meeting results on February 7, the softer inflation numbers generally should fuel in optimism and dovish expectations. However, that is not the case. The Reserve Bank of India (RBI) governor has expressed concern over the wide differences between retail inflation ex-food and energy and cum-food and energy.

He has also highlighted the large volatilities within the inflation basked among sub-components. Aided by a firming crude price, the default reaction could well be a no-change policy. Liquidity is expected to be met on a need-based basis so the traders are setting up for a likely disappointment. The probability is of a likely wait-and-watch approach on rates. This could also mean an unwind of the bond rally and valuation gains of December.

That the trade deficit narrowed to a 10-month low of $13 billion did not cheer the currency market. The rupee remained weaker all through the week and RBI also relaxed offshore borrowing rules which now enables a wider class of corporates to borrow overseas. Ideally, this should support rupee as the domestic companies find borrowing conditions tough on-shore.

Bonds continue to stay a week and although at 7.60 there is value for a medium-term strategy, in the short run the sentiment is decidedly weak. 7.70% may get tested in the erstwhile benchmark bond where the market has witnessed heavy selling last week. The writer is a market expert