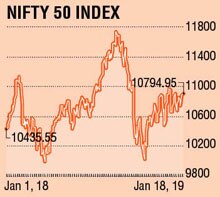

The Indian equity indices managed to close higher by 1.04% at 10907 last week, swinging in a very narrow range with high volatility. But the broader market underperformed and both the mid and small cap indices closed marginally negative by 0.78% and 0.40% respectively.

Among the sectors, only Energy, Information Technology (IT) and Realty sector closed in green rest all ended in the red. The IT (4.81%) and Energy (4.10%) lead the gains while Media lost 4.28% followed by Pharma which ailed by 2.4%. Bank Nifty remained unchanged or flattish with mixed performance by the PSU Banks which lost 2.41% while private banks gained 0.14%.

In the previous week, both the foreign institutional investors (FII) and domestic institutional investors (DII) were buyers in equities. FIIs bought worth Rs 331 crore and DIIs bought shares of Rs 521 crore.In the last week highlights, Brexit deal was rejected in the UK parliament and government managed to claim the confidence vote. India's December month trade deficit stood at $13.30 billion due to soft crude prices while CPI inflation stood at 2.2% in December, lowest level in 18 months. Hindustan Unilever clocked 10% volume growth in Q3'19, Reliance became the first Indian company to post Rs 10,000 crore quarterly profits and was the biggest contributor for the gains in Nifty 50 along with Infosys, YES Bank and Wipro.

The 50-share Nifty started on a somber note and made low of 10692 on Monday and recovered post lowest inflation data which prompted expectation of rate cut in the upcoming Reserve Bank of India (RBI) policy meeting and hopes that the US and China would resolve their trade dispute. For the rest of the sessions, Nifty sailed in rough waters but managed to close higher in last two sessions. Sun Pharma closed at the lowest level in six years tanking 12% post a second whistle-blower letter containing allegations of corporate governance lapses in the company which was denied by the management in the last closing hours.

The 50-share Nifty started on a somber note and made low of 10692 on Monday and recovered post lowest inflation data which prompted expectation of rate cut in the upcoming Reserve Bank of India (RBI) policy meeting and hopes that the US and China would resolve their trade dispute. For the rest of the sessions, Nifty sailed in rough waters but managed to close higher in last two sessions. Sun Pharma closed at the lowest level in six years tanking 12% post a second whistle-blower letter containing allegations of corporate governance lapses in the company which was denied by the management in the last closing hours.

In the key global events this week, Bank of Japan Policy will be meeting on Tuesday, European Central Bank on Thursday. The US markets are closed today in observance of Martin Luther King Day. In the ongoing corporate earnings season, Kotak Mahindra Bank, L&T Finance, TVS Motors, Asian Paints, Havells, Pidilite, ITC, Mcdowell, Ultratech Cement, Colgate, YES Bank, Biocon, L&T, DHFL, M&M Finance etc. will announce their Q3'19 results.

Technically, Nifty remained in the same range of 10600 to 11000 for the fifth week which shows consolidation pattern and is likely to witness range breakout anytime. With multiple tops at 10950 and higher base formation on a weekly scale is structurally positive. For the week, markets will take cues from the global markets and stock specific action on result announcements. Nifty support levels at 10870-10820-10770-10700 while resistance levels at 10950-10980-11170. Probable broader Nifty trading range could be between 10700 and 11170.

The writer is VP-retail research, Motilal Oswal Financial Services