I recently had a conversation with a leading Indian economist, one whose views are well respected among politicians and policymakers. The issue was tax compliance and why Indian corporates work hard at evading taxes.

My argument to him was simple. Lower the corporate tax rates to 10 per cent, eliminate most deductions to reduce the paperwork required to manage record keeping, simplify the process of filing returns, and compliance would improve.

My contention was based on proven research on human behaviour that decision-making, especially decisions involving money, is based on a mental evaluation of expected costs (minuses) and benefits (pluses). Tax paying is no different. Business owners evaluate the cost of getting caught versus the benefits from evading.

Under the current Indian tax system, the benefits from tax evasion far outweigh the costs. High tax rates make evasion more beneficial, and poor detection systems and minimal penalties make the cost of tax evasion low.

I argued that in order to improve compliance, the tax system must be changed to reduce the benefits from evasion and increase the costs associated with getting caught. Lowering the tax rate will improve compliance significantly because it reduces the benefit from evasion.

A business making Rs 1 crore in profit taxed at 33 per cent gets an implicit benefit of Rs 33 lakh from tax evasion. If the tax rate was 10 per cent, the assigned benefit from tax evasion will be substantially reduced. If at the same time, tax evasion is made a criminal offence with the possibility of significant jail time, it would commensurately raise the cost of evasion.

The combination of reducing the tax rate, which reduces the benefits from tax evasion, and a criminal penalty, which raises the cost of evasion, would go a long way towards improving tax compliance in this country.

I had barely finished my argument when the economist jumped up, pulled out his smartphone and showed me the US corporate tax rate. I think he was trying to make the argument that American companies are compliant despite high tax rates in that country, so why should high rates be a deterrent for Indian companies. Most liberal economists get extremely nervous at any talk of tax reduction. Their mantra is that the government machinery (of which they are an integral part) must be kept well fed if humanity is to survive.

But economics is never that simple. There is never a clean one-to-one relationship between the variables. And, before I could tell him that the US had better compliance because the costs of tax evasion were significantly higher than in India (tax evaders face jail time in the US), and detection and prosecution was significantly better (it’s harder to bribe one’s way out in the US), he was gone, gleeful that he had scored a point.

Empirical studies document a strong relationship between high tax rates and high tax evasion. Countries with high tax rates face higher rates of tax evasion.

So, how does India compare with other countries with respect to taxation of its businesses.

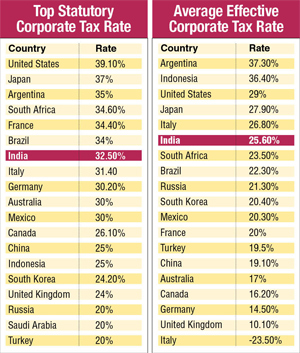

I examined 2012 data from the US Congressional Budget Office comparing corporate tax systems in the G20 nations using two measures: the statutory tax rate, which is the stated rate, and the average effective tax rate that corporations eventually pay after credits and deductions.

India’s corporate tax rate ranks relatively high on both measures. It has the seventh highest statutory rate (32.5 per cent), and the sixth highest average effective tax rate (25.6 per cent — see table). India places a relatively high tax burden on corporations, which discourages investment and encourages tax evasion.

The standard argument one gets whenever tax reduction is proposed is where would the government get money for public infrastructure projects if it reduced rates. People conflate tax rates with tax revenues.

Increasing tax rates does not mean higher tax revenue. In fact, just the opposite is true. Lower tax rates leads to higher tax revenues because of higher economic growth and greater compliance.

In the mid 1980s, Ronald Reagan reduced the top tax rate in the US by almost 25 per cent, as a result of which tax revenues to the US treasury increased by almost 45 per cent. So if the government wants to increase the total tax revenue collected, it needs to lower tax rates, not raise them.

Two other issues affect compliance rates in India. One is a complicated tax code and the cost it imposes in terms of time, money and mental anguish. As a result, many choose not to file. Secondly, Indian politicians have shown themselves to be very poor custodians of taxpayer money, as a result of which people are loathe to pay taxes. Look at the election manifestos of all the political parties in Karnataka.

They are jumping up to outdo each other in promising freebies to the electorate — all of course from public funds. Taxpayers watch this irresponsible misuse of their hard-earned money and it factors into the cost-benefit analysis of tax compliance.

Government debt could become a major problem for India in the coming years. Additional tax revenue will be required to meet infrastructure expenses. That can only come from broadening the tax base and greater compliance. This will require a combination of tax simplification, significantly lower tax rates and criminal penalties for evasion.

The author is the founder, contractwithindia.com. Views expressed are personal.