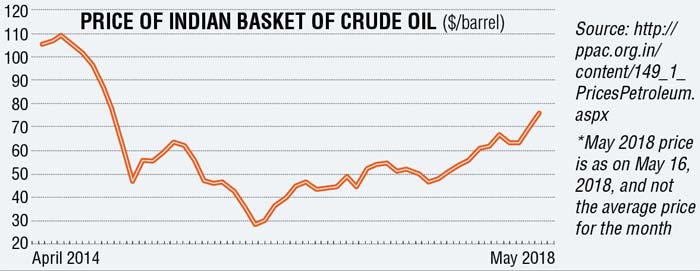

Prime Minister Narendra Modi’s luck on the oil front seems to be running out. In May 2014, when he took over as the prime minister of the country, the price of the Indian basket of crude oil averaged at $106.85 per barrel. In the coming months and years, the price of oil came down dramatically, touching a low of $28.08 per barrel, during January 2016. Take a look at Figure 1, which plots this fall.

On May 16, 2018, the price of the Indian basket of crude oil was at $76.31 per barrel, having crossed $75 per barrel. The fall in oil prices helped the government in two ways:

1) The central government and the state government captured a significant chunk of the fall by increasing taxes on petrol and diesel. As on May 1, 2018, in Delhi, the tax (excise duty + VAT) on petrol was 100% of dealer price. In case of diesel, the tax amounted to 66% of the dealer price. In May 2014, the tax on petrol was 47% of dealer price. In the case of diesel, the tax amounted to around 25% of dealer price. Of course, this increase in taxes helped the central government as well as the state governments shore up their tax revenues.

2) Further, a fall in oil imports, helped in pushing up the gross domestic product number (a measure of the size of the economy), in a way that most people don’t realise. Imports are a negative entry into the gross domestic product (GDP) number. Hence, a fall in oil imports adds to the GDP number to that extent. In 2013-14, the total oil import bill of the country had amounted to $155.8 billion. The average price of oil during the year had stood at $105.52 per barrel. In 2014-15, the total oil import bill fell to $124.6 billion, when the average price of oil during the year was at $84.16 per barrel.

In 2017-18, the total oil import bill was at $101.2 billion, against $80.8 billion in 2016-17. The average price of oil was at $56.43 per barrel and $47.56 per barrel, respectively.

The overall fall in oil imports helps in upping the GDP number to that extent. With the price of Indian basket of crude oil crossing $75 per barrel, this advantage of low oil imports that helped boost the overall GDP number, is going to suffer to some extent.

Predicting oil prices is tricky business. Nevertheless, in the months to come, the chances that oil prices will continue to remain high, are pretty good. There are two main reasons for the same. Saudi Aramco, the largest oil company in the world, has an initial public offering (IPO) scheduled. The company will get a better valuation if the oil price is high. This means that Saudi is likely to work in a manner so as to keep oil prices high.

Second, the United States (US) has just re-initiated sanctions on Iran. Iran produces around 4% of the global economic output of oil. With the United States acting like a bully, oil importing countries are likely to move away from buying oil from Iran. This is likely to drive up global oil prices further.

Over and above this, the rupee has been rapidly losing value against the dollar. This will add to the country’s oil import bill and pull down the GDP to that extent. Given that the government did not pass on the entire drop in the price of oil to the end consumer, equity demands that it protect the consumer from the increase in the price of oil as well, by cutting taxes on petrol and diesel. The question is how likely is that? While, it is difficult to analyse the finances of different state governments, one can look at the finances of the central government a little more clearly. In 2018-19, the central government expects to earn Rs 6,03,900 crore by way of central goods and services tax, or around Rs 50,325 crore per month. The central GST collections have been much lower than that number.

In this scenario, it will be difficult for the government to cut taxes on petrol and diesel, without either cutting down on expenditure or borrowing more. Borrowing more would mean increasing the fiscal deficit. Fiscal deficit is the difference between what a government earns and what it spends.

Also, several assembly elections are scheduled during 2018-19. As was the case in Karnataka, where assembly elections happened recently, petrol and diesel prices weren’t raised in the run up to the election. If oil prices go up rapidly, and let’s say touches around $100 per barrel, in that scenario, the Modi government is likely to do what the Manmohan Singh government did before this. The oil companies (both the oil marketing companies as well as the oil producing companies) will be asked to take the hit, and the end consumer will be protected, atleast to some extent.

But at the end of the day, elections need to be won.

The writer is the author of the Easy Money trilogy. Views expressed are personal.