Investing can often feel like trying to learn a new language, especially with all the jargon and complex concepts thrown your way. But don't worry; we're here to make things simple.

You don't want just to let it sit in your bank account, but you also don't want to lock it up for years in a long-term investment. You want something safe with decent returns and the flexibility to get your money back in a few months.

This is where Ultra Short Duration Funds come in.

What are Debt Funds?

Before discussing Ultra Short Duration Funds, let's understand a debt fund. A debt fund is like a pool of money many people contribute.

This money is then lent to companies or governments who pay back with interest. The interest earned is then distributed back to the investors.

There are many debt funds, each suited for a different investment duration. Some are for a few days, some for a few months, and some for many years.

What are Ultra Short Duration Funds?

There are around 16 types of debt funds, each suitable for a different investment period - from a few days to over ten years. Ultra Short Duration Funds fall somewhere in the middle of this range.

They are typically recommended for an investment period of 3 to 12 months. Why 3 to 12 months, you ask? Well, there are two reasons:

If you want to invest for less than three months, other debt funds, like overnight and liquid funds, are better options. And if you want to invest more than 12 months, long-term debt funds could give you higher returns.

As per the rules set by SEBI (the body that regulates mutual funds in India), the Macaulay duration of an Ultra Short Duration Fund should be between 3 and 6 months. What's 'Macaulay duration'? Without getting too technical, the Macaulay duration is when a fund earns back its price through interest payments. For Ultra Short Duration Funds, this duration is between 3 and 6 months. So, to earn the expected return, staying invested for at least this duration is recommended.

In simple terms, if you invest in an Ultra Short Duration Fund for less than three months, it could be risky. If you invest more than 12 months, you might miss out on higher returns from other debt funds.

Key Factors to Consider Before Investing

Before you dive into Ultra Short Duration Funds, here are some essential things to keep in mind:

Risks and Returns

Ultra Short Duration Funds, like all debt funds, come with these risks:

Credit Risk: This is the risk that the company or government that borrowed money can't pay it back. For example, if a company goes bankrupt, it might not be able to repay its loans. Ultra Short Duration Funds try to minimize this risk by investing in high-quality bonds from reputable issuers.

Interest Rate Risk: This is the risk that changes in interest rates can affect your investment. If interest rates go up, the value of your investment might go down. This is because when interest rates rise, the price of existing bonds (which have lower interest rates) falls.

Expense Ratio

Every fund charges a fee for managing your money, known as the expense ratio. The average expense ratio for Ultra Short Duration Funds is around 0.5% to 1%.

For example, suppose you invest Rs. 1,00,000 in an Ultra Short Duration Fund with an expected return of 7% per annum and an expense ratio of 1%.

Over six months, your investment would grow to Rs. 1,03,500 without considering the expense ratio. But once you factor in the expense ratio, your returns would be reduced by Rs. 500 (1% of Rs. 1,00,000 divided by 2, as the expense ratio is annual and you're investing for half a year). So, your actual returns would be Rs. 3,000 (Rs. 3,500 - Rs. 500), and your investment would grow to Rs. 1,03,000.

Now, if the expense ratio were 2%, your returns would be reduced by Rs. 1,000, and your investment would grow to Rs. 1,02,500.

As you can see, a higher expense ratio can significantly eat into your returns, primarily when investing for a short period. So, comparing expense ratios before investing in Ultra Short Duration Funds is a good idea.

Investment Plan

Investing without a plan is like studying for an exam without knowing the syllabus. Here are some things to consider when making your investment plan:

Your Goals: Are you saving for a vacation or a new car in the next 3-6 months? Ultra Short Duration Funds could be a good fit. They can offer higher returns than a savings account and are less risky than investing in the stock market for a short period.

Your Risk Tolerance: These funds could be a good match if you prefer playing it safe with your money. They invest in high-quality bonds and aim to provide steady returns.

Your Investment Horizon: These funds can be a good choice if you have some extra cash you'd like to park your money for a short period (3-6 months). They offer quick access to your cash and decent returns.

Your Long-Term Goals: If you're looking for high returns over the long term, there might be better options than these funds. Consider equity or long-term debt funds for your long-term goals.

Remember, investing isn't a one-size-fits-all. It's all about finding what works best for you.

Taxation of Ultra Short Duration Funds

Regarding taxation, Ultra Short Duration Funds are treated like debt funds. Like all debt funds, Ultra Short Duration Funds are subject to taxation and any returns you make from these funds are added to your total income and taxed according to your income tax slab rate.

Benefits of Investing in Ultra Short-Duration Funds

Investing in Ultra Short Duration Funds comes with several advantages:

Low Risk

These funds are safer than long-term debt funds due to their short maturity period. They are less exposed to interest rate risks, which means the value of your investment is less likely to fluctuate with changes in interest rates.

Higher Returns than Savings Accounts and Fixed Deposits

While Ultra Short Duration Funds can provide higher returns than savings accounts and fixed deposits, it's important to remember that they also carry a higher risk. They can offer returns ranging from 7% to 9%, higher than a savings account or a fixed deposit can offer, however, unlike savings accounts, these returns are not guaranteed, and your investment value can fluctuate.

How to Invest in Ultra Short-Duration Funds?

Investing in Ultra Short Duration Funds is a simple 3-step process:

Choose a Platform: You can invest through a mutual fund platform or directly on the fund house's website.

Complete KYC: You must complete a Know Your Customer (KYC) process. This usually involves providing some identification and address proof.

Select the Fund and Pay: Once your KYC is done, you can choose the Ultra Short Duration Fund you want to invest in and make the payment.

And that's it! You've invested in an Ultra Short Duration Fund.

Conclusion

Ultra Short Duration Funds can be a great addition to your investment portfolio if you're looking for short-term investment options with decent returns and low risk.

Ultra Short Duration Funds: Frequently Asked Questions (FAQs)

What are Ultra Short Duration Funds?

Ultra Short Duration Funds are a category of debt mutual funds that primarily invest in fixed-income securities with very short maturities, typically ranging from 3 months to 1 year. They aim to provide slightly higher returns than traditional savings accounts or liquid funds while maintaining relatively low interest rate risk.

What are the benefits of investing in Ultra Short Duration Funds?

Ultra Short Duration Funds offer potential returns exceeding savings accounts and traditional fixed deposits, while minimizing interest rate risk compared to longer-term debt funds. These funds provide easy liquidity for quick access to your money, and benefit from professional management to optimize your investment portfolio.

What types of securities do Ultra Short Duration Funds invest in?

Ultra Short Duration Funds typically invest in a mix of money market instruments, short-term corporate bonds, treasury bills, certificates of deposit (CDs), commercial paper (CP), and other debt securities with short maturities. They focus on securities with high credit quality to minimize default risk.

Who should consider investing in Ultra Short Duration Funds?

Ultra Short Duration Funds are suitable for investors seeking slightly higher returns than traditional savings accounts or liquid funds without taking on significant interest rate or credit risk. They are ideal for investors with short to medium-term investment horizons who prioritize capital preservation and liquidity.

How do Ultra Short Duration Funds differ from other debt funds?

Ultra Short Duration Funds invest in securities with shorter maturities, unlike longer-term debt funds, which generally reduces interest rate risk. They offer higher potential returns compared to liquid funds but with slightly higher risk.

Disclaimer- Consumer Connect Initiative

(This article is part of IndiaDotCom Pvt Ltd’s Consumer Connect Initiative, a paid publication programme. IDPL claims no editorial involvement and assumes no responsibility, liability or claims for any errors or omissions in the content of the article. The IDPL Editorial team is not responsible for this content.)

![submenu-img]() NZ vs PNG, T20 World Cup 2024: Lockie Ferguson creates history as New Zealand beat Papua New Guinea by 7 wickets

NZ vs PNG, T20 World Cup 2024: Lockie Ferguson creates history as New Zealand beat Papua New Guinea by 7 wickets![submenu-img]() DNA TV Show: Opposition's strategy for key post of Lok Sabha Speaker

DNA TV Show: Opposition's strategy for key post of Lok Sabha Speaker![submenu-img]() Delhi-Meerut RRTS: Big update on 14 km section in Delhi; check details

Delhi-Meerut RRTS: Big update on 14 km section in Delhi; check details![submenu-img]() Amala Paul, Jagat Desai blessed with a baby boy Ilai, seven months after their marriage: 'Meet our little miracle'

Amala Paul, Jagat Desai blessed with a baby boy Ilai, seven months after their marriage: 'Meet our little miracle'![submenu-img]() Will there be another pandemic after Covid? Here's what US experts suggest

Will there be another pandemic after Covid? Here's what US experts suggest![submenu-img]() NCERT to replace ‘India’ with ‘Bharat’ in school textbooks? Here's what council chief says

NCERT to replace ‘India’ with ‘Bharat’ in school textbooks? Here's what council chief says![submenu-img]() Meet doctor who worked for 14 hours daily, studied in break, cracked UPSC in first attempt to become IAS with AIR...

Meet doctor who worked for 14 hours daily, studied in break, cracked UPSC in first attempt to become IAS with AIR...![submenu-img]() Meet Indian genuis, who was part of Chandrayaan-3 mission team, quit ISRO after 6 years due to...

Meet Indian genuis, who was part of Chandrayaan-3 mission team, quit ISRO after 6 years due to...![submenu-img]() Meet Indian genius who cracked IIT JEE, NEET at 17 in first attempt, is class 12 topper, he wants to become..

Meet Indian genius who cracked IIT JEE, NEET at 17 in first attempt, is class 12 topper, he wants to become..![submenu-img]() Meet IIT graduate, hired at Rs 100 crore salary package, fired within a year, he is now…

Meet IIT graduate, hired at Rs 100 crore salary package, fired within a year, he is now…![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() From Jawan to Munjya, 5 films that showcased exceptional VFX and ruled box office recently

From Jawan to Munjya, 5 films that showcased exceptional VFX and ruled box office recently![submenu-img]() In pics: Raghubir Yadav, Chandan Roy celebrate success of Panchayat season 3 with TVF founder Arunabh Kumar, cast, crew

In pics: Raghubir Yadav, Chandan Roy celebrate success of Panchayat season 3 with TVF founder Arunabh Kumar, cast, crew![submenu-img]() How Kalki 2898 AD makers dared to dream pan-India with its unique promotional campaign for Prabhas-starrer

How Kalki 2898 AD makers dared to dream pan-India with its unique promotional campaign for Prabhas-starrer![submenu-img]() In pics: Prabhas' robotic car Bujji from Kalki 2898 AD takes over Mumbai streets, fans call it 'India's Batmobile'

In pics: Prabhas' robotic car Bujji from Kalki 2898 AD takes over Mumbai streets, fans call it 'India's Batmobile'![submenu-img]() Streaming This Week: Bade Miyan Chote Miyan, Maidaan, Gullak season 4, latest OTT releases to binge-watch

Streaming This Week: Bade Miyan Chote Miyan, Maidaan, Gullak season 4, latest OTT releases to binge-watch![submenu-img]() DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal?

DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal? ![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Amala Paul, Jagat Desai blessed with a baby boy Ilai, seven months after their marriage: 'Meet our little miracle'

Amala Paul, Jagat Desai blessed with a baby boy Ilai, seven months after their marriage: 'Meet our little miracle'![submenu-img]() Shatrughan Sinha to not attend Sonakshi Sinha, Zaheer Iqbal's wedding? Family friend says 'he can't...'

Shatrughan Sinha to not attend Sonakshi Sinha, Zaheer Iqbal's wedding? Family friend says 'he can't...'![submenu-img]() Pushpa 2 The Rule: Allu Arjun-starrer gets postponed, new release date announced; film will now clash with...

Pushpa 2 The Rule: Allu Arjun-starrer gets postponed, new release date announced; film will now clash with...![submenu-img]() Kabir Khan breaks his silence on Chandu Champion's low opening at box office: 'Kartik Aaryan's fans have...'

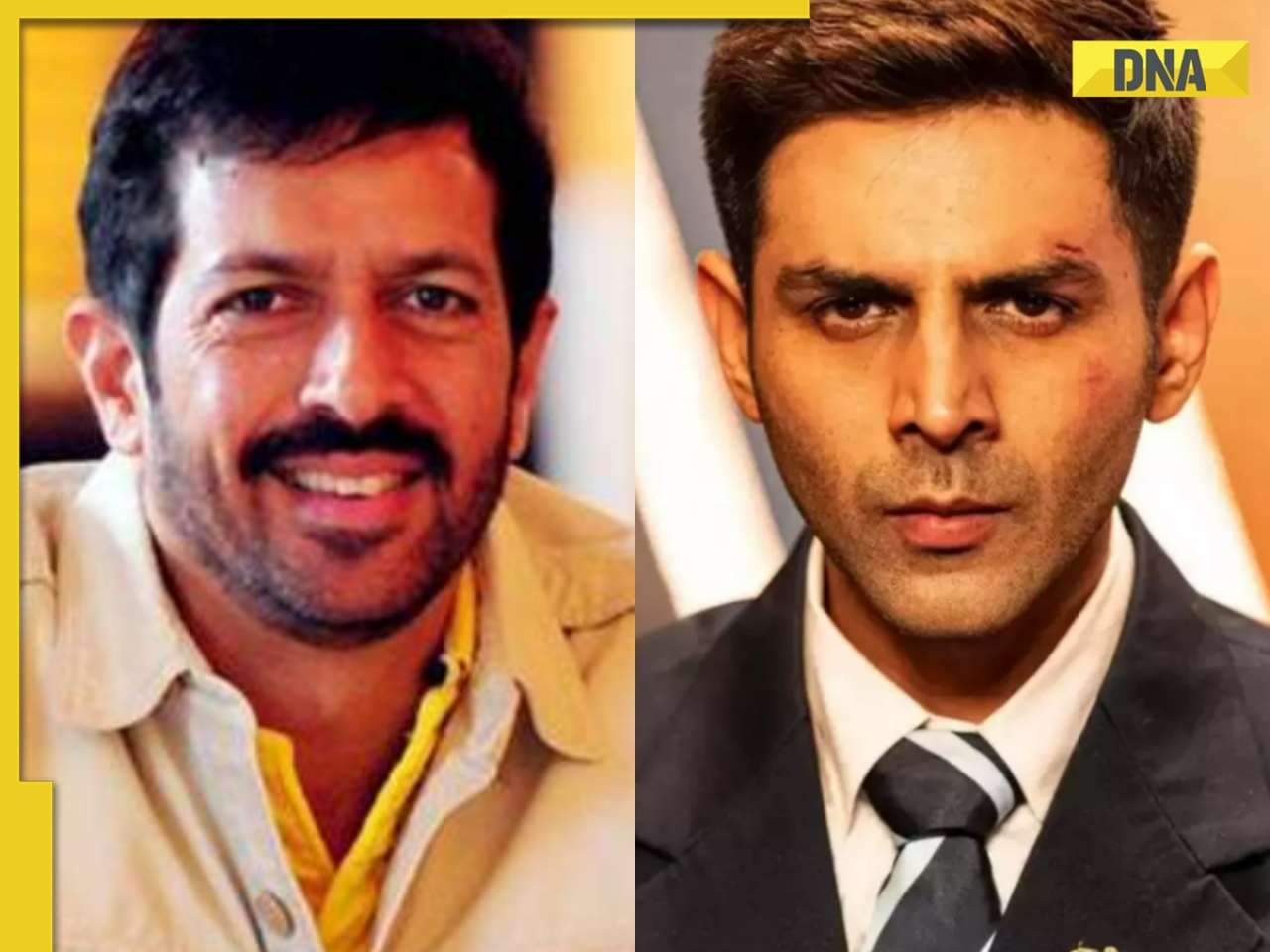

Kabir Khan breaks his silence on Chandu Champion's low opening at box office: 'Kartik Aaryan's fans have...'![submenu-img]() Swara Bhasker slams netizen's 'proud to be vegetarian' post on Bakrid: 'Please relax with the virtue signalling'

Swara Bhasker slams netizen's 'proud to be vegetarian' post on Bakrid: 'Please relax with the virtue signalling'![submenu-img]() Air India reacts after passenger finds metal blade in meal served in flight

Air India reacts after passenger finds metal blade in meal served in flight![submenu-img]() Two trucks meet with accident in Haryana's Jhajjar, catch fire, watch video here

Two trucks meet with accident in Haryana's Jhajjar, catch fire, watch video here![submenu-img]() WATCH: UPSC aspirant denied entry for being late to exam centre, parents' reaction goes viral

WATCH: UPSC aspirant denied entry for being late to exam centre, parents' reaction goes viral![submenu-img]() Watch video: Days after Mumbai man found human finger in ice cream, woman in Noida finds centipede inside ice cream tub

Watch video: Days after Mumbai man found human finger in ice cream, woman in Noida finds centipede inside ice cream tub![submenu-img]() Who is Uma Harathi, IAS trainee officer, whose pic with cop father has gone viral?

Who is Uma Harathi, IAS trainee officer, whose pic with cop father has gone viral?

)

)

)

)

)

)

)