A slowdown in China is making the world economy wobble and will lead to declining trade, growth and returns to capital.

Soon after the fall of the Berlin Wall and the collapse of the Soviet Union, Francis Fukuyama published The End of History and the Last Man. He proclaimed: “The end point of mankind’s ideological evolution and the universalization of Western liberal democracy as the final form of human government.”

Fukuyama was being a bit too Americano and just a touch premature in his prediction. The one thing we know from history is that trends toward universalization tend to trip up. Both fervent Catholicism and godless communism failed to convert everyone, despite their best efforts.

After the end of the Cold War, new high priests emerged and their creed swept through the great universities of the planet. These priests were economists who assumed that human beings were rational, that they were highly informed and they made highly conscious and wise choices. Just as Catholics worship Jesus, economists swore by Jeremy Bentham, an Englishman who wanted the greatest good of the greatest number in his utilitarian philosophy. He proposed the Panopticon prison, which would “cost nothing to the nation.” One gaoler would be able to watch all inmates who would do menial labour and pay for their upkeep. The Panopticon was meant to be “a mill for grinding rogues honest,” and the government of William Pitt the Younger duly paid Bentham £2,000 for his splendid ideas.

When communism fell, people turned to markets for salvation. Milton Friedman, the favoured priest of Ronald Reagan and Augusto Pinochet, became particularly influential. His prescription of privatisation of collectively-owned assets such as the post office and national parks suddenly became respectable. In former communist countries, privatisation was duly carried out. The relatives, friends and cronies of former party bosses bought state-owned assets for a fraction of their value and appropriated most of the wealth of the public. Friedman, a midget cheerleader in short skirts, approved. He crudely conflated capitalism with freedom, forgetting Adam Smith’s fine point that “moral sentiments” underpin markets.

Like Humpty Dumpty, the new world economy that was born in 1991 has taken a great fall. In the first six months of 2015, world trade has contracted at the fastest pace since 2009. In simple terms, it means the Americans are cutting down purchases of Chinese-made goods, the Brazilians are buying fewer Ferraris and the Chinese are quaffing smaller quantities of Burgundies. As The Economist points out, this is “the reversal of a trend where for decades the growth in global trade outstripped that of the world economy.”

This growth occurred because of three reasons. First, people wanted to consume more. People in formerly communist countries were besotted with better products from advanced economies such as cars, washing machines and cosmetics. Similarly, people in richer countries wanted more for less, be it chocolate or lingerie. Second, the new free market zeitgeist led to the birth of a global framework for trade in the form of the World Trade Organisation that had been stalled for over four decades. Finally, capital chasing ever greater returns flocked to poorer countries where labour cost less. So, companies such as Nike and Apple shifted manufacturing to places like Vietnam and China. These reasons have now been exploited to the hilt, and world trade can no longer grow as in the recent past.

The biggest immediate shock to the world economy is now emanating from China. In August, manufacturing “fell to a six-and-a-half year low” and the stock market plumbed new depths this week. Since July, Chinese authorities have unwisely thrown the kitchen sink to prop up share prices. This has transferred wealth from the poor to the rich in exactly the same way as Hank Paulson’s bailout of US banks in 2008. Like Paulson, the Chinese authorities have panicked and most of their knee-jerk reactions are not working. Over investment, bad debts, corruption, pollution and extreme reliance on exports have been longstanding problems. Rulers of the Middle Kingdom cannot keep flogging an ailing horse that might die soon.

August 24 is being referred to as “Black Monday” because the Shanghai Composite Index fell by nearly 9%, its biggest one-day drop since 2007. China’s crash caused pandemonium in markets worldwide. Germany’s DAX fell by over 20%, Britain’s FTSE 100 lost more than $90 billion, Asian markets crashed and Wall Street buckled, with shares of General Electric dropping by more than 20% at one point. As this author has pointed out earlier, other economies are inextricably intertwined with China’s. If China buys less soybean and perfumes, then Brazil and France suffer. If Chinese factories start going out of business, then profits of US companies shrink. It is for this reason that market panic has spread faster than SARS. Currencies of emerging economies have slumped, commodity prices have crashed and oil prices are nearly back to the low levels of six years ago.

As a response, the People’s Bank of China cut its key lending rate to a record low of 4.6%. This follows the devaluation of the renminbi and the stock market bailout of two weeks ago. Other central banks are also pumping money into their economies and the world economy is now awash with cash. This excessive liquidity is leading to asset bubbles yet again. With stocks yo-yoing, capital is seeking a “safe haven” in bond markets, property markets and the US dollar. Yet bond market buyers of debt could do well to remember the Greek crisis. Economies of many countries will not grow dramatically and current levels of debt are unsustainable.

The debt restructuring deal that Ukraine agreed with its creditors proves this point. Bondholders agreed to write-off 20% of Ukraine’s $19 billion debt and give the country another four years for repayment. Prima facie, the deal looks decent. On closer inspection, just as in the case of the agreement with Greece, creditors have kicked the can further down the road and refused to confront brutal realities. Ukraine is in a mess. Conflict continues, inflation is nearly 60%, the dollar value of the gross domestic product (GDP) has fallen by 60% over the last two years and Ukraine is poorer than it was under the Soviet Union. Clearly, privatisation of state assets without moral sentiments did not help. Similarly, repaying the International Monetary Fund over $4 billion before 2019 will not do Ukraine much good either.

In the coming years, trade, growth and returns to capital will decline. Citizens, politicians and even economists have to take cognizance of environmental damage, decreasing wages, increasing inequality, social conflict and declining democracy.

Perhaps things are not so bad. Of the 1.5 billion people with access to the Internet, more than a billion logged into Facebook on Black Monday. Elon Musk, Marc Andreessen and Mark Zuckerberg might lead us to Fukuyama’s end of history and Bentham’s utilitarian utopia yet.

This article was first published in fairobserver.com.

Atul Singh is the Founder, CEO & Editor-in-Chief of Fair Observer, and he teaches Political Economy at the University of California, Berkeley. He studied Philosophy, Politics and Economics at Oxford on the Radhakrishnan Scholarship and did an MBA with a triple major in finance, strategy and entrepreneurship at the Wharton School. Singh worked as a corporate lawyer in London and led special operations as an elite officer in India’s volatile border areas where he had many near-death experiences. He has also been a poet, playwright, sportsman, mountaineer and a founder of many organisations.

![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

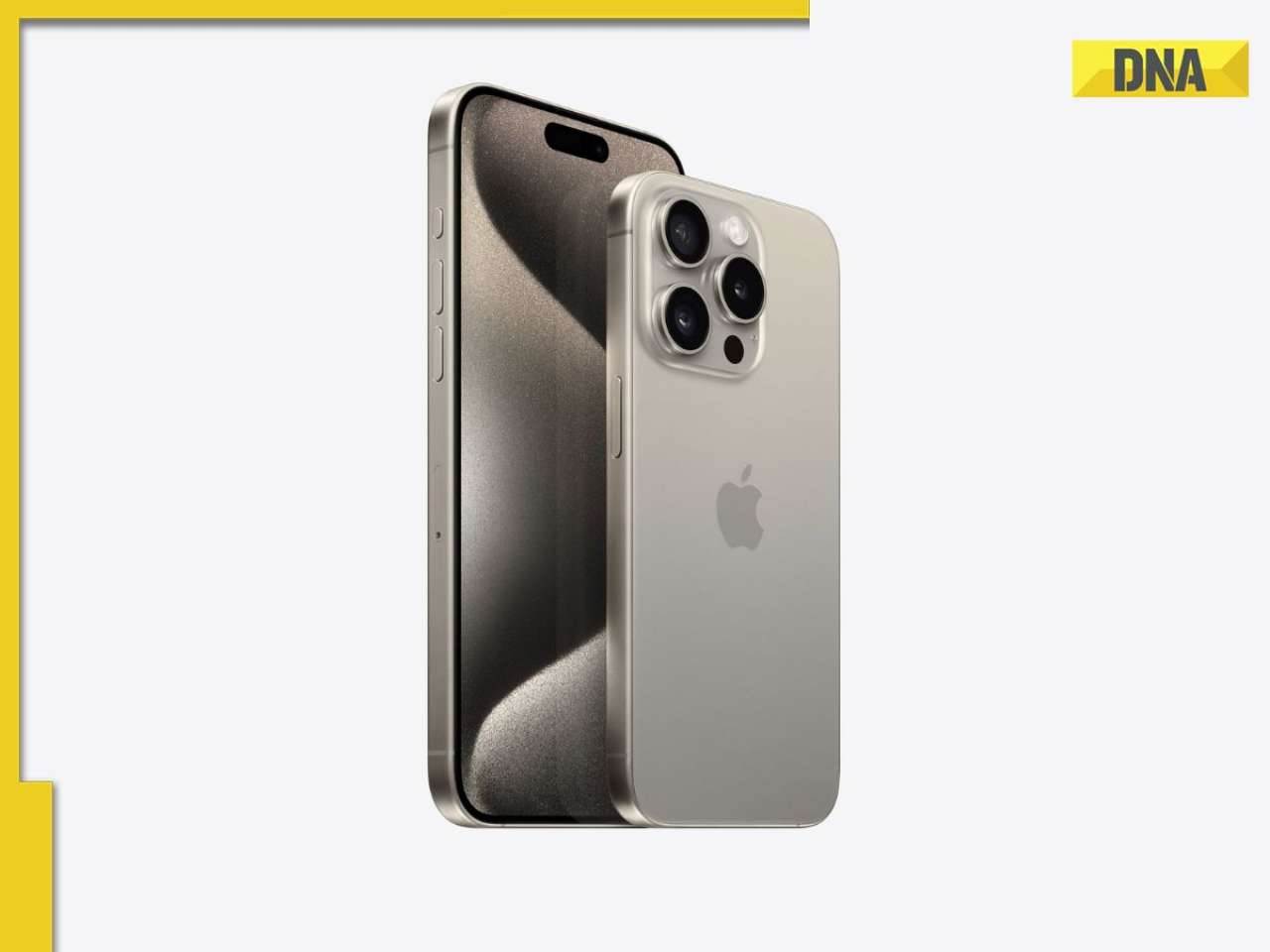

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() Apple iPhone camera module may now be assembled in India, plans to cut…

Apple iPhone camera module may now be assembled in India, plans to cut…![submenu-img]() HOYA Vision Care launches new hi-vision Meiryo coating

HOYA Vision Care launches new hi-vision Meiryo coating![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding

In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding![submenu-img]() In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month

In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch

Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?

What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans

Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans![submenu-img]() Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive

Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive![submenu-img]() Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now...

Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now... ![submenu-img]() IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR

IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR![submenu-img]() GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals

GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals![submenu-img]() 'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash

'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash![submenu-img]() IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB

IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here

Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here![submenu-img]() Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home

Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home![submenu-img]() This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...

This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...![submenu-img]() Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

)

)

)

)

)

)

)