Those who had their home loans sanctioned in June 2010 will pay 10.90% as compared to the 8.35% paid by new home loan borrowers today

Recently SBI announced a 0.30% drop in its base rate from 8.95% to 8.65%. That looks like a big drop till you realise it only applies to those home loan consumers who had their loan sanctioned before April 2016.

The drop does not look so big when you realise that for those who had their home loan sanctioned in July 2010 (when base rates were introduced) will continue to pay 10.40% interest even after this “big” drop in interest rate as compared to 8.35% paid by current home loan borrowers.

Those who had borrowed under the prime lending rate (PLR) system just before the base rate was introduced are even worse off despite SBI reducing its PLR also by a similar margin of 0.30% to 13.40% from 13.70%. Those who had their home loans sanctioned in June 2010 will pay 10.90% as compared to the 8.35% paid by new home loan borrowers today.

Despite the inadequate reduction in interest rates for old borrowers, SBI’s share price still fell by 1% on news of the reduction indicating how much the bank depended on past borrowers to pay higher interest rates. You might be surprised to note that there are around 80 lakh borrowers whose loan rates are linked to base rates and who have not bothered to get it changed to the current MCLR regime. The number of borrowers on the old PLR system is not known. If you multiply these numbers across all banks it will indicate the extent to which all banks depend on borrower inertia for their profitability.

All this when all that a borrower with a good repayment track record has to do is to threaten to shift his loan to another lender for his existing lender to provide the lower rate to him. Most borrowers, however, are blissfully unaware of what interest rate they are paying on their loan let alone under which system (MCLR or base rate) their loan is. Even those who wake up get caught in doing complicated calculations whether it makes sense to shift their loan.

This is a primer for those borrowers whose loans were sanctioned prior to April 2016. First – you don’t need to do any calculations. It makes sense for you to shift your loan to the new system – whether with the same lender or a new lender. First write (don’t call, write) to your existing lender asking for the amount needed to fully pay off the loan as well as a certificate indicating the title deeds held by the lender. This is a signal to the lender that you are considering shifting your loan and if you have been a good borrower the bank will provide a counter offer to you. Do not waste your time calling and talking to people in the lender organisation. Write to the address that would be mentioned in the statements that are sent to you every year or some lenders even allow this to be done online. If the lender does not respond back within 30 days, then file a grievance (through email or written letter) at the address that is mentioned on the lenders website.

After this if your existing lender gives a decent deal (meaning somewhere close to 8.35% interest) then you can take it even if it means paying a small fee to them for the shift since it avoids all other administrative hassles of shifting your loan. If they do not give you a good offer look around in the market. You are bound to get a good home loan offer from the market (8.35% or thereabouts) unless something is seriously wrong with your credit profile or your property papers or your loan amount outstanding is very low (less than Rs 20 lakh say). You can take that and reduce your effective interest cost. This may involve some cost in terms of stamp duty etc. Most lenders would be happy to waive any processing fee or any upfront fees. To summarise therefore if your home loan has been sanctioned before April 2016 – shift it to the new system today. It is not very difficult, especially if you do it with the same lender.

KNOW YOUR RATE SYSTEM?

- Those who had their home loans sanctioned in June 2010 will pay 10.90% as compared to the 8.35% paid by new home loan borrowers today

- Borrowers under the prime lending rate system just before the base rate was introduced are even worse off

The writer is Sebi-registered investment advisor

![submenu-img]() Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins

Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins![submenu-img]() Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'

Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'![submenu-img]() India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat

India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat![submenu-img]() Vellore Lok Sabha constituency: Check polling date, candidates list, past election results

Vellore Lok Sabha constituency: Check polling date, candidates list, past election results![submenu-img]() Meet NEET-UG topper who didn't take admission in AIIMS Delhi despite scoring AIR 1 due to...

Meet NEET-UG topper who didn't take admission in AIIMS Delhi despite scoring AIR 1 due to...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch

Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch![submenu-img]() Remember Tanvi Hegde? Son Pari's Fruity who has worked with Shahid Kapoor, here's how gorgeous she looks now

Remember Tanvi Hegde? Son Pari's Fruity who has worked with Shahid Kapoor, here's how gorgeous she looks now![submenu-img]() Remember Kinshuk Vaidya? Shaka Laka Boom Boom star, who worked with Ajay Devgn; here’s how dashing he looks now

Remember Kinshuk Vaidya? Shaka Laka Boom Boom star, who worked with Ajay Devgn; here’s how dashing he looks now![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

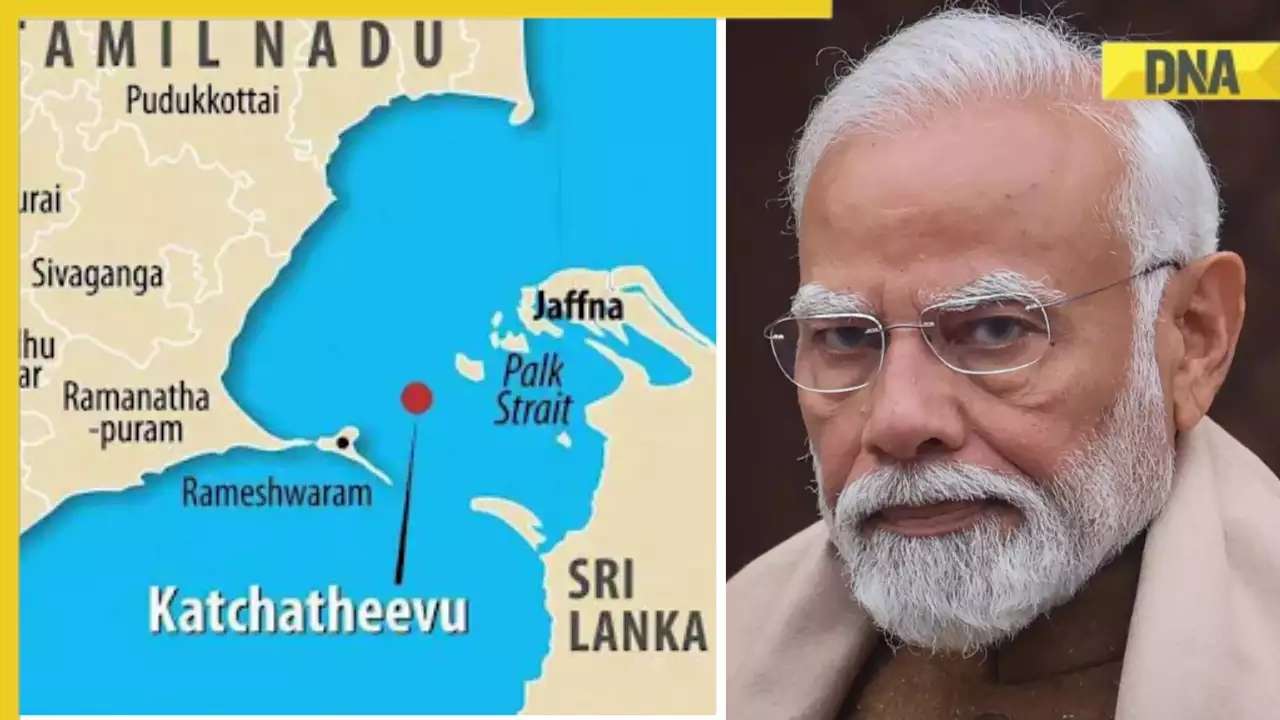

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?

What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?![submenu-img]() DNA Explainer: Reason behind caused sudden storm in West Bengal, Assam, Manipur

DNA Explainer: Reason behind caused sudden storm in West Bengal, Assam, Manipur![submenu-img]() Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins

Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins![submenu-img]() Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'

Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'![submenu-img]() India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat

India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat![submenu-img]() This film has earned Rs 1000 crore before release, beaten Animal, Pathaan, Gadar 2 already; not Kalki 2898 AD, Singham 3

This film has earned Rs 1000 crore before release, beaten Animal, Pathaan, Gadar 2 already; not Kalki 2898 AD, Singham 3![submenu-img]() This Bollywood star was intimated by co-stars, abused by director, worked as AC mechanic, later gave Rs 2000-crore hit

This Bollywood star was intimated by co-stars, abused by director, worked as AC mechanic, later gave Rs 2000-crore hit![submenu-img]() IPL 2024: Rohit Sharma's century goes in vain as CSK beat MI by 20 runs

IPL 2024: Rohit Sharma's century goes in vain as CSK beat MI by 20 runs![submenu-img]() RCB vs SRH IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Sunrisers Hyderabad

RCB vs SRH IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Sunrisers Hyderabad ![submenu-img]() IPL 2024: Phil Salt, Mitchell Starc power Kolkata Knight Riders to 8-wicket win over Lucknow Super Giants

IPL 2024: Phil Salt, Mitchell Starc power Kolkata Knight Riders to 8-wicket win over Lucknow Super Giants![submenu-img]() IPL 2024: Why are Lucknow Super Giants wearing green and maroon jersey against Kolkata Knight Riders at Eden Gardens?

IPL 2024: Why are Lucknow Super Giants wearing green and maroon jersey against Kolkata Knight Riders at Eden Gardens?![submenu-img]() IPL 2024: Shimron Hetmyer, Yashasvi Jaiswal power RR to 3 wicket win over PBKS

IPL 2024: Shimron Hetmyer, Yashasvi Jaiswal power RR to 3 wicket win over PBKS![submenu-img]() Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home

Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home![submenu-img]() This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...

This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...![submenu-img]() Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video![submenu-img]() iPhone maker Apple warns users in India, other countries of this threat, know alert here

iPhone maker Apple warns users in India, other countries of this threat, know alert here![submenu-img]() Old Digi Yatra app will not work at airports, know how to download new app

Old Digi Yatra app will not work at airports, know how to download new app

)

)

)

)

)

)

)