Has your life insurance policy lapsed because you missed the premium due date? Or were you unable to pay the premium because of your sudden job loss? Or did you decide not to pay because you misunderstood the policy features, but later on wish you had continued with the policy?

You can revive your lapsed life insurance policy without too much of a hassle. And if you do it during the revival campaign organised by your life insurance company, you can save the penalty that is charged otherwise.

Most life insurance companies organise campaigns to revive lapsed policies just before the end of the financial year. This helps them to improve their assets under management and shore up their bottomline. For customers, it is an opportunity to enjoy the continued life cover and the bonuses that will be restored on the revival. Let us see how it is done.

Why do policies lapse?

One of the most common reasons why life insurance policies lapse is policyholders forgetting the date of premium payment, says S Mahesh, executive vice-president and head - operations, Future Generali India Life Insurance. "We encourage policyholders to opt for the auto pay option, especially for monthly premium payments. But often policyholders are not aware of the exact date to pay the premium and hence the policy gets lapsed."

Sometimes, it could be because the policyholder has doubts over the product features. In such cases, the company reaches out to the policyholder to clarify doubts.

In some cases, the policyholder may deliberately let the policy lapse if she finds another policy with similar features and lower premium, says Anil Kumar Singh, chief actuarial officer, Aditya Birla Sun Life Insurance.

This happens as insurance companies launch new products based on revised mortality tables where the life expectancy is higher and thereby it is possible for companies to offer better pricing.

In case of some policies, the company may allow you to change the payment term from annually to half-yearly or quarterly. Use this option, if it is available, to manage your cash flow, advises Mahesh.

Why revive a lapsed policy?

The biggest risk when your life insurance policy lapses is that you lose the risk cover or protection, which is the aim of buying insurance. "If you have to buy a new policy, your premium may increase if you have moved to a higher age band. But if you revive your lapsed policy, the premium will be the same,'' points out Singh.

Another advantage is that all benefits, such as bonuses, that are accrued during the policy term, will be restored, Singh adds.

By reviving a lapsed policy, the objective for which the customer purchased the policy in the first place is fulfilled, points out Mahesh.

Future Generali India Life has currently launched a campaign called Revival Time to reinstate lapsed policies. The campaign is on till March 31. A customer who revives a lapsed policy during this time will not have to pay late fees up to Rs 2,000 on the outstanding premiums.

"This is the biggest benefit while reviving a policy during the campaign. Many times, policyholders don't want to pay the penalty and hence don't revive their lapsed policies. But by doing so, they lose out on the financial benefits,'' Mahesh points out.

Conditions while reviving lapsed policies:

All insurance companies give a grace period of 15 days to pay the premium in case of monthly premium and 30 days in case of quarterly, half-yearly and annual payment. If you don't pay within this period, but pay within three to six months, then you will have to pay a penalty or interest along with the lapsed premiums. The interest is calculated based on the delay in paying the premium after the due date. Remember, you have to pay all lapsed premiums to reinstate the policy.

If you still have not paid the premium, then companies usually allow you to revive the policy up to a period of two years after it has lapsed. You will have to sign a declaration of good health. In case the sum assured is higher, you may have to undergo a medical check-up and if you are found to be suffering from any ailment, your premium could increase.

"You have to pay interest for revival of all traditional policies. Only for Unit Linked Insurance Plans (Ulips) there is no interest for revival because you lose the growth in the net asset value during the period,'' says Singh.

Another advantage of reviving the policy during the campaign is that the company may relax the conditions for a medical check-up, Singh adds.

For instance, if the company usually asks for a medical test for a revival of a policy having sum assured of Rs 10 lakh, during the campaign, it may be allowed for policies having sum assured of up to Rs 20 lakh.

By definition, revival of policy does not mean that premiums will go up, but if you have developed any ailment during the interim, then the company may charge a higher premium.

"It is critical that policyholders provide the correct information in their declaration. In case of non-disclosure of material facts, then the claim could be repudiated or rejected,'' warns Mahesh.

WINDOW FOR REVIVAL

- While reviving the policy during the campaign the company may relax the conditions for a medical check-up

- If the company usuallys ask for medical test for revival of policy with Rs 10 lakh sum assured during the campaign the sum assured may be raised to Rs 20 lakh

![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

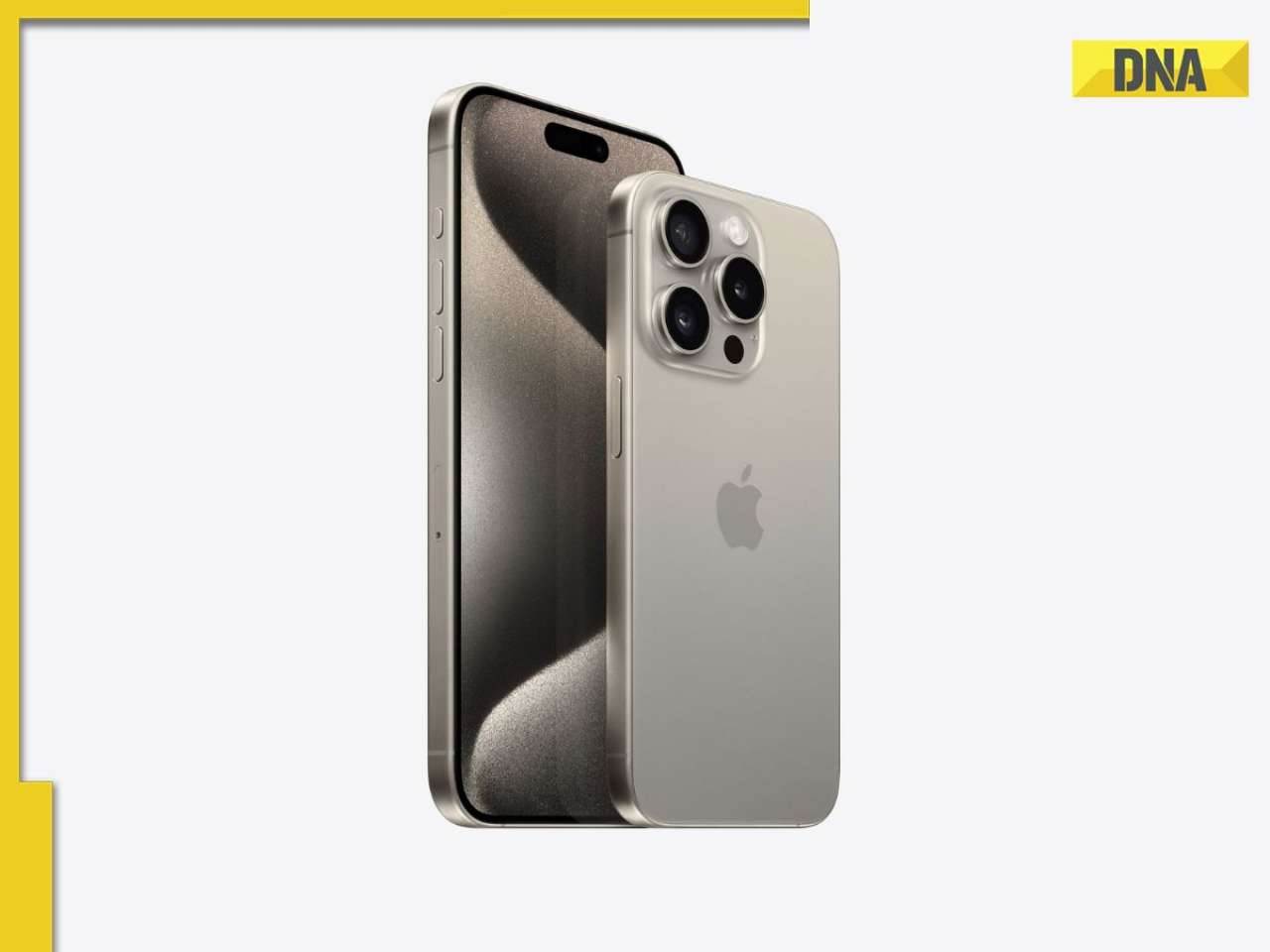

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() Apple iPhone camera module may now be assembled in India, plans to cut…

Apple iPhone camera module may now be assembled in India, plans to cut…![submenu-img]() HOYA Vision Care launches new hi-vision Meiryo coating

HOYA Vision Care launches new hi-vision Meiryo coating![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding

In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding![submenu-img]() In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month

In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch

Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?

What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans

Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans![submenu-img]() Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive

Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive![submenu-img]() Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now...

Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now... ![submenu-img]() IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR

IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR![submenu-img]() GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals

GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals![submenu-img]() 'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash

'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash![submenu-img]() IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB

IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here

Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here![submenu-img]() Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home

Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home![submenu-img]() This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...

This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...![submenu-img]() Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

)

)

)

)

)

)

)