You just need to ensure to keep all the original documents and receipts of these expenses with you

Will hospitalisation claim cover pathology test done by other than MD medicine? Are pathology expenses payable?

– Ganesh Zute

Once your insurer confirms the admissibility of your hospitalisation claim, it's going to pay all the expenses related to the ailment for which you've registered the claim as per the sum insured and conditions of your health insurance policy. Typically, expenses for medicines, room charges, doctor charges and pathology expenses are all covered by a health insurance plan. You just need to ensure to keep all the original documents and receipts of these expenses with you.

I bought an expensive sports bicycle which I will use for adventure sports. Can I insure it? And will it be motor insurance?

– Rupesh Dhillon

Home insurance policies generally have a section exclusively for Pedal Cycles cover under which even your sports bicycle can be covered. Alternatively, you can also opt for a standalone pedal cycle insurance policy for the same, premium for which usually varies from 1% to 2% of the bicycle's value. Motor insurance is not applicable to a bicycle, although the cover is pretty much similar. Home insurance/standalone pedal cycle policy will pay for the repair or replacement costs of the bicycle caused by any unforeseen and sudden physical loss (like an Accident, Fire, Burglary, Flood, Cyclone, etc.). Insurer will also pay litigation expenses and compensation for any Third Party property damage/ Third Party injury or death, due to an accident involving the bicycle.

Since you are into adventure sports, I would also suggest you to opt for a personal accident cover which covers adventure sports. This policy covers death and permanent total disability due to accidental injury sustained while participating in adventure sports, with some insurers offering global coverage. While buying this policy you also need to check, whether it provides medical evacuation in isolated areas, because that is going to make a difference of life and death.

Is there a deductible in motor insurance? Will my full claim not be paid? I have made a claim of Rs 20,000 after my car met with an accident and the windshield has to be replaced, but the company is saying they cannot pay the entire amount.

– Siddharth Pal

A deductible is mainly a part of the claim that needs to be paid by you before your insurance company takes the responsibility of the claim. There are two types of deductibles – Compulsory deductible, which is an amount fixed by the insurance company at the time of policy purchase and second is a voluntary deductible, which as the name suggests is voluntarily opted by the policyholder. Hence, the compulsory deductible in any case is applicable to your claim. Claim is usually paid after subtracting the compulsory deductible amount and depreciation applicable on the parts that need to replaced/repaired. I would suggest you to buy a zero depreciation cover, which is an add-on cover offered by many insurance companies as it reduces your expenses by excluding the depreciation cost of your vehicle when you file a claim. It covers depreciation amount, partly or fully, on damaged parts for replacement during repairs in case of partial loss to your vehicle Additionally, I would also suggest you to read your policy document carefully so that you are not caught unaware at the time of claim.

The writer is MD & CEO, Bajaj Allianz General Insurance

Send your queries related to general insurance to personalfinance@dnaindia.net.

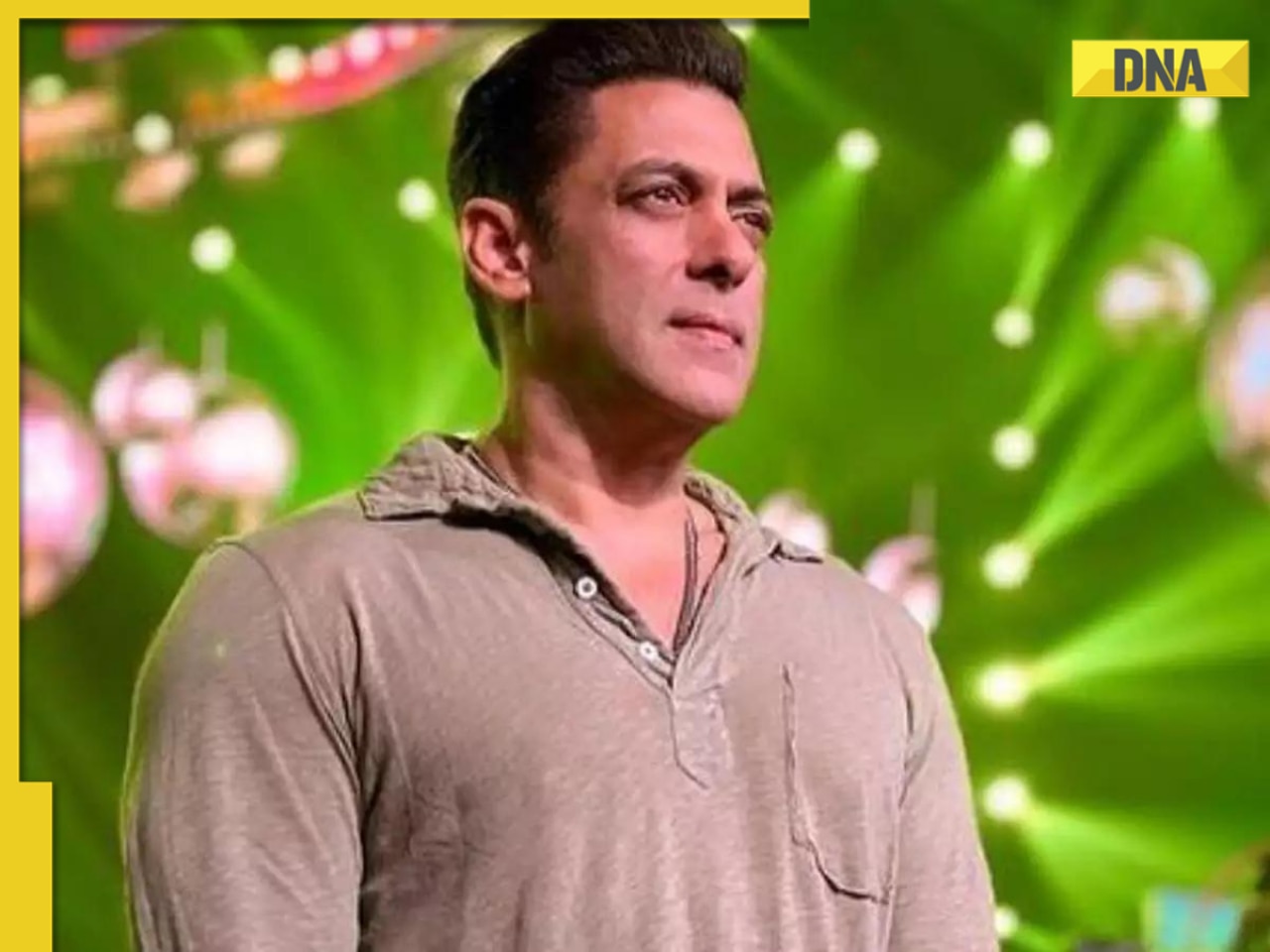

![submenu-img]() Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins

Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins![submenu-img]() Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'

Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'![submenu-img]() India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat

India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat![submenu-img]() Vellore Lok Sabha constituency: Check polling date, candidates list, past election results

Vellore Lok Sabha constituency: Check polling date, candidates list, past election results![submenu-img]() Meet NEET-UG topper who didn't take admission in AIIMS Delhi despite scoring AIR 1 due to...

Meet NEET-UG topper who didn't take admission in AIIMS Delhi despite scoring AIR 1 due to...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch

Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch![submenu-img]() Remember Tanvi Hegde? Son Pari's Fruity who has worked with Shahid Kapoor, here's how gorgeous she looks now

Remember Tanvi Hegde? Son Pari's Fruity who has worked with Shahid Kapoor, here's how gorgeous she looks now![submenu-img]() Remember Kinshuk Vaidya? Shaka Laka Boom Boom star, who worked with Ajay Devgn; here’s how dashing he looks now

Remember Kinshuk Vaidya? Shaka Laka Boom Boom star, who worked with Ajay Devgn; here’s how dashing he looks now![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?

What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?![submenu-img]() DNA Explainer: Reason behind caused sudden storm in West Bengal, Assam, Manipur

DNA Explainer: Reason behind caused sudden storm in West Bengal, Assam, Manipur![submenu-img]() Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins

Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins![submenu-img]() Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'

Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'![submenu-img]() India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat

India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat![submenu-img]() This film has earned Rs 1000 crore before release, beaten Animal, Pathaan, Gadar 2 already; not Kalki 2898 AD, Singham 3

This film has earned Rs 1000 crore before release, beaten Animal, Pathaan, Gadar 2 already; not Kalki 2898 AD, Singham 3![submenu-img]() This Bollywood star was intimated by co-stars, abused by director, worked as AC mechanic, later gave Rs 2000-crore hit

This Bollywood star was intimated by co-stars, abused by director, worked as AC mechanic, later gave Rs 2000-crore hit![submenu-img]() IPL 2024: Rohit Sharma's century goes in vain as CSK beat MI by 20 runs

IPL 2024: Rohit Sharma's century goes in vain as CSK beat MI by 20 runs![submenu-img]() RCB vs SRH IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Sunrisers Hyderabad

RCB vs SRH IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Sunrisers Hyderabad ![submenu-img]() IPL 2024: Phil Salt, Mitchell Starc power Kolkata Knight Riders to 8-wicket win over Lucknow Super Giants

IPL 2024: Phil Salt, Mitchell Starc power Kolkata Knight Riders to 8-wicket win over Lucknow Super Giants![submenu-img]() IPL 2024: Why are Lucknow Super Giants wearing green and maroon jersey against Kolkata Knight Riders at Eden Gardens?

IPL 2024: Why are Lucknow Super Giants wearing green and maroon jersey against Kolkata Knight Riders at Eden Gardens?![submenu-img]() IPL 2024: Shimron Hetmyer, Yashasvi Jaiswal power RR to 3 wicket win over PBKS

IPL 2024: Shimron Hetmyer, Yashasvi Jaiswal power RR to 3 wicket win over PBKS![submenu-img]() Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home

Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home![submenu-img]() This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...

This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...![submenu-img]() Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video![submenu-img]() iPhone maker Apple warns users in India, other countries of this threat, know alert here

iPhone maker Apple warns users in India, other countries of this threat, know alert here![submenu-img]() Old Digi Yatra app will not work at airports, know how to download new app

Old Digi Yatra app will not work at airports, know how to download new app

)

)

)

)

)

)

)