Last week the finance minister said that he did not believe in mindless populism, and preferred fiscal prudence. His colleagues, including the prime minister himself had been talking about giving us doses of bitter medicine, before "acchhe din" could be enjoyed.

There was a stiff hike in railway fares, increase in diesel prices and increase in import duty of sugar. Did this mean that the budget would bring more nasty suprises? Did fiscal prudence mean that taxes would go up?

Thankfully the FM did not raise any rates. In fact, for most taxpayers there is tax saving, since the minimum exemption slabs have been raised. So there will be more disposable income in your pocket. Home loan repayments now have higher tax deductions. Further, the tax-free contribution to investments like PPF has gone up. The common taxpayer then has reason to be cheerful.

But then why did the markets not cheer up? That's because of the mixed signal on fiscal consolidation. The FM and his team had barely six weeks to prepare the budget, since there was a parliamentary deadline. Most people expected the FM to project a more realistic deficit target. But he chose to keep the challenging fiscal deficit target of 4.1 per cent of GDP, set by his predecessor in the interim budget back in February. But back then the opposition had accused that the very same number was unrealistically rosy. So how is the FM going to keep his promise now? He defended fiscal prudence by saying that raising the deficit today, means raising taxes for the future generations. This target, he said, is daunting. It is however desirable to break out of the vicious cycle of high inflation and interest rates, leading to low savings, investment and growth. Hence a lower deficit is a must. But the stock market was confused. It zoomed down, then zoomed up again, and ended the day in the negative region. It wasn't able to make up its mind whether the numbers presented were credible or not. The FM projects nominal GDP (inclusive of inflation) going up by 13 per cent, but tax revenues going up by 18 per cent.

The fiscal consolidation path envisages 4.1 per cent deficit going down to 3.6 and 3 in the next three years. This is achievable only if growth picks up substantially, so that tax revenues are harvested from that growth, which narrow the deficit. To achieve that growth we need private investors to come in enthusiastically. The FM announced many measures to spur growth in infrastructure. These include rural roads and national highways, ports, airports and urban development. Rural and low cost housing too got a boost.

The power sector projects got a three-year extension in tax holiday. Similarly there are many growth boosters for manufacturing too. This is a sector which has been languishing for the past two years. Small and medium enterprises (SMEs) are the unsung heroes of manufacturing. They produce half of all output, and provide half of all employment, but do not get even 5% of bank loans. To the SMEs the FM is now offering a venture capital fund of Rs10,000 crore. This is quite innovative, and its success will be eagerly watched. The FM has also provided for investment allowance, an approach which was restored in the recent past.

There were no populist measures like providing for loan waivers. But the FM did have a long list of fund allocations for a variety of causes and activities. In this respect, it resembled the speech of all earlier FMs.

Allocations for smart cities project, for digital inclusion, handicrafts, dental college as well as five new IITs and IIMs are but some of the many examples. All of these are individually unexceptional, but they do add up to a long list, and hence a considerable amount. The FM's preferred packet size for such handouts was "100 crore", and there are 29 instances of this magical amount in the budget highlights!

The Union budget size is more than 17 lakh crore rupees, amounting to 15 per cent of national income. Every rupee spent needs thought and justification. It has to be funded from your pocket and mine, and possibly from our unborn generations (deficit financing). Its success is in outcomes not merely outlays. We shall see in the coming days, how credible and effective is the tax and spend plan presented in the Lok Sabha on Thursday.

Ajit Ranade is an economist based in Mumbai

![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

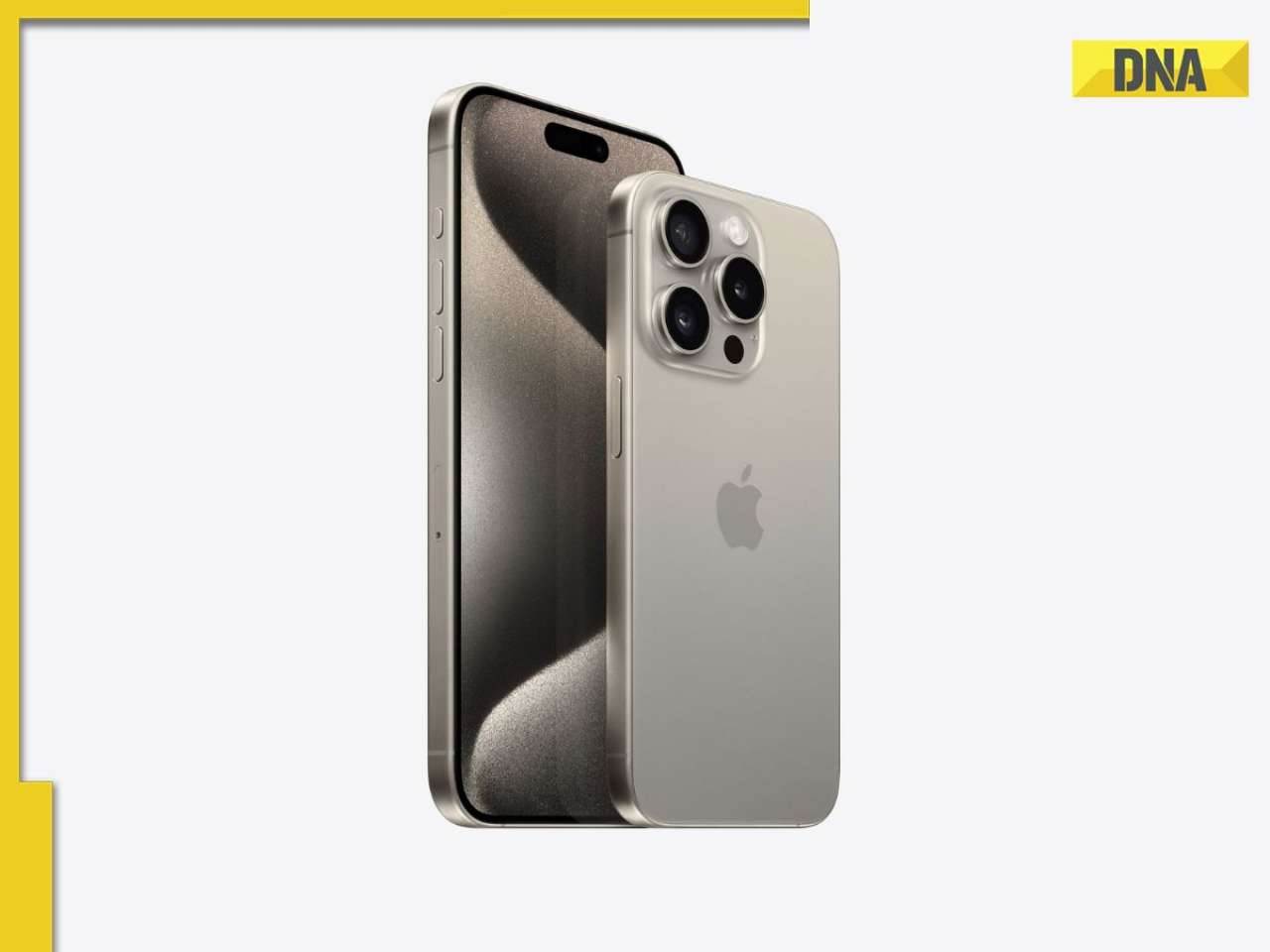

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() Apple iPhone camera module may now be assembled in India, plans to cut…

Apple iPhone camera module may now be assembled in India, plans to cut…![submenu-img]() HOYA Vision Care launches new hi-vision Meiryo coating

HOYA Vision Care launches new hi-vision Meiryo coating![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding

In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding![submenu-img]() In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month

In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch

Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?

What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans

Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans![submenu-img]() Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive

Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive![submenu-img]() Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now...

Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now... ![submenu-img]() IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR

IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR![submenu-img]() GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals

GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals![submenu-img]() 'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash

'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash![submenu-img]() IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB

IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here

Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here![submenu-img]() Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home

Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home![submenu-img]() This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...

This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...![submenu-img]() Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

)

)

)

)

)

)

)