Most bankers felt that with today's rate cut RBI has provided space for lowering lending and deposit rates. Public sector Allahabad Bank became the first to reduce the lending rate by 0.3%.

Home, auto and corporate loans are likely to cost less after RBI today cut interest rate by 0.25% for the third time this year to spur investment and growth but hinted there may not be any more cuts in the near-term sending stock markets into a tizzy.

Yielding to demands of Finance Minister Arun Jaitley and India Inc, RBI Governor Raghuram Rajan "front loaded" the repo rate cut despite worries of below normal monsoon and its impact on prices.

The Governor asked banks to follow suit and pass on the rate cuts -- 0.75% since January -- to individual and corporate borrowers.

Most bankers felt that with today's rate cut RBI has provided space for lowering lending and deposit rates. Public sector Allahabad Bank became the first to reduce the lending rate by 0.3%.

RBI cut the repo rate (short-term lending rate) from 7.5% to 7.25, but left all other policy tools like cash reserve requirement unchanged at 4% and Statutory Liquidity Ratio (SLR) at 21.5%.

Rajan lowered projections of the economic growth as measured by GVA (gross value added) to 7.6% from 7.8% estimated in April due to global factors and likely impact of below normal monsoon.

At the same time, inflation still remains a worry for the central bank as it expects price rise to remain subdued till August before rising to 6 per cent by January 2016.

It asked the government to put in place a "contingency plan" to manage the impact of low food production on inflation, mainly because of expected lower than normal rains.

The other concern for the RBI is rising crude oil prices. Since the last policy in April, the crude oil prices have witnessed an increase of 9%.

Soon after the policy announcement, the BSE Sensex plunged by over 400 points. The markets, however, later recovered slightly.

Chief Economic Adviser, Arvind Subramanian said: "These cuts are consistent with the trends in the economy including strongly declining inflation, contained current account deficit and ongoing strong fiscal discipline." The government and RBI agree that these cuts signify that the economy needs policy support as growth is recovering while the external environment remains weak, he said.

"The government and the RBI will work together to ensure that the macroeconomic (indicators) remain strong while investment and growth are accelerated towards their potential," Subramanian added.

Announcing the second bi-monthly monetary policy this fiscal, Rajan said that "with low domestic capacity utilisation, still mixed indicators of recovery, and subdued investment and credit growth, there is a case for a cut in the policy rate today".

Following the downward revision in the repo rate, the reverse repo rate (short-term borrowing rate) has got adjusted to 6.25% and Marginal Standing Facility rate as well as Bank rate to 8.25%.

Commenting on macroeconomic conditions, RBI said, the domestic economic activity remains moderate with agriculture being the most disappointing following the unseasonal rains and hailstorms in the most part of the country in March.

Rajan said however that the risks to inflation identified in April could cloud the picture with below par monsoons forecast for the second successive year.

He also called for astute food management to mitigate possible inflationary effects in case of failure of monsoon.

Given this background, Rajan said, "a conservative strategy would be to wait, especially for more certainty on both the monsoon out-turn as well as the effects of government responses if it (monsoon) turns out to be weak.

"(But) with still weak investment and the need to reduce supply constraints over the medium-term to stay on the proposed dis-inflationary path (to 4% in early 2018), a more appropriate stance is to front-load a rate cut today and then wait for data that clarify uncertainty," Rajan said while explaining the rationale behind the rate cut.

Rajan said he expects banks to pass on the policy rate cut to individual and corporate borrowers.

"Banks should pass sequence of lending rate cuts," he said.

Soon after the policy announcement, SBI chief Arundhati Bhattacharya said there is a downward bias on the interest rate and there would be tendency to pass on the rate cut.

"With inflation coming down and RBI cutting rate by 0.75%, banks will look at cutting lending rate," she said.

Echoing similar views, BoB acting CEO and Managing Director Rajan Dhawan said that "there is rate cut in store for us in the next 2-3 weeks".

Rajan said strong food policy and management will be important to help keep inflation and inflationary expectations contained over the near term.

Furthermore, he said, monetary easing can only create the enabling conditions for a fuller government policy thrust that hinges around a step up in public investment in several areas that can also crowd in private investment.

This will be important to relieve supply constraints and aid disinflation over the medium term, he added.

"Banks have started passing through some of past rate cuts into their lending rates, headline inflation has evolved along the projected path, the impact of unseasonal rains has been moderate so far, administered price increases remain muted, and the timing of normalisation of US monetary policy seems to have been pushed back," Rajan said.

The global data however points to not so rosy a picture. The global recovery is still slow and getting increasingly differentiated across regions. What is more worrisome is the US numbers where the world?s largest economy surprisingly shrank 0.7% in the first quarter, even as its currency has been on record high, he said.

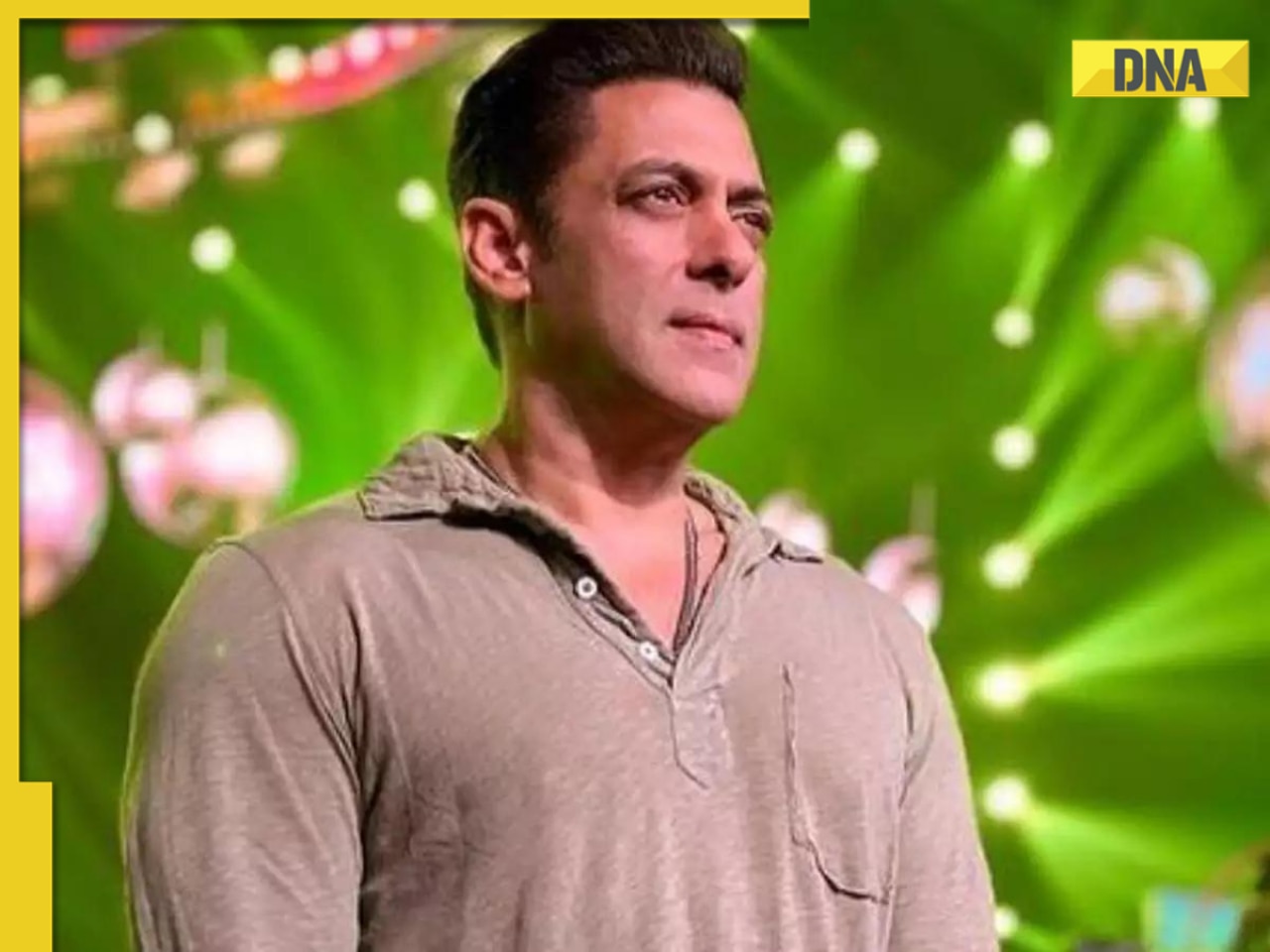

![submenu-img]() Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins

Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins![submenu-img]() Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'

Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'![submenu-img]() India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat

India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat![submenu-img]() Vellore Lok Sabha constituency: Check polling date, candidates list, past election results

Vellore Lok Sabha constituency: Check polling date, candidates list, past election results![submenu-img]() Meet NEET-UG topper who didn't take admission in AIIMS Delhi despite scoring AIR 1 due to...

Meet NEET-UG topper who didn't take admission in AIIMS Delhi despite scoring AIR 1 due to...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch

Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch![submenu-img]() Remember Tanvi Hegde? Son Pari's Fruity who has worked with Shahid Kapoor, here's how gorgeous she looks now

Remember Tanvi Hegde? Son Pari's Fruity who has worked with Shahid Kapoor, here's how gorgeous she looks now![submenu-img]() Remember Kinshuk Vaidya? Shaka Laka Boom Boom star, who worked with Ajay Devgn; here’s how dashing he looks now

Remember Kinshuk Vaidya? Shaka Laka Boom Boom star, who worked with Ajay Devgn; here’s how dashing he looks now![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?

What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?![submenu-img]() DNA Explainer: Reason behind caused sudden storm in West Bengal, Assam, Manipur

DNA Explainer: Reason behind caused sudden storm in West Bengal, Assam, Manipur![submenu-img]() Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins

Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins![submenu-img]() Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'

Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'![submenu-img]() India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat

India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat![submenu-img]() This film has earned Rs 1000 crore before release, beaten Animal, Pathaan, Gadar 2 already; not Kalki 2898 AD, Singham 3

This film has earned Rs 1000 crore before release, beaten Animal, Pathaan, Gadar 2 already; not Kalki 2898 AD, Singham 3![submenu-img]() This Bollywood star was intimated by co-stars, abused by director, worked as AC mechanic, later gave Rs 2000-crore hit

This Bollywood star was intimated by co-stars, abused by director, worked as AC mechanic, later gave Rs 2000-crore hit![submenu-img]() IPL 2024: Rohit Sharma's century goes in vain as CSK beat MI by 20 runs

IPL 2024: Rohit Sharma's century goes in vain as CSK beat MI by 20 runs![submenu-img]() RCB vs SRH IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Sunrisers Hyderabad

RCB vs SRH IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Sunrisers Hyderabad ![submenu-img]() IPL 2024: Phil Salt, Mitchell Starc power Kolkata Knight Riders to 8-wicket win over Lucknow Super Giants

IPL 2024: Phil Salt, Mitchell Starc power Kolkata Knight Riders to 8-wicket win over Lucknow Super Giants![submenu-img]() IPL 2024: Why are Lucknow Super Giants wearing green and maroon jersey against Kolkata Knight Riders at Eden Gardens?

IPL 2024: Why are Lucknow Super Giants wearing green and maroon jersey against Kolkata Knight Riders at Eden Gardens?![submenu-img]() IPL 2024: Shimron Hetmyer, Yashasvi Jaiswal power RR to 3 wicket win over PBKS

IPL 2024: Shimron Hetmyer, Yashasvi Jaiswal power RR to 3 wicket win over PBKS![submenu-img]() Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home

Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home![submenu-img]() This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...

This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...![submenu-img]() Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video![submenu-img]() iPhone maker Apple warns users in India, other countries of this threat, know alert here

iPhone maker Apple warns users in India, other countries of this threat, know alert here![submenu-img]() Old Digi Yatra app will not work at airports, know how to download new app

Old Digi Yatra app will not work at airports, know how to download new app

)

)

)

)

)

)

)