U. S. homebuilding fell in January as the construction of multi-family housing projects dropped, but upward revisions to the prior month's data and a jump in permits to a one-year high suggested the housing recovery remained on track.

U.S. homebuilding fell in January as the construction of multi-family housing projects dropped, but upward revisions to the prior month's data and a jump in permits to a one-year high suggested the housing recovery remained on track.

Other reports on Thursday also offered a fairly upbeat assessment of the economy early in the first quarter. Factory activity in the mid-Atlantic region vaulted to a 33-year high in February and the number of new applications for unemployment benefits was less than expected last week.

"There is not much to complain about the economy as housing and manufacturing are improving and the labor market remains tight. The economy is getting stronger," said Joel Naroff, chief economist at Naroff Economic Advisors in Holland, Pennsylvania.

Housing starts fell 2.6 percent to a seasonally adjusted annual rate of 1.25 million units last month, the Commerce Department said. The drop in homebuilding also may have resulted from unusually wet weather in California after years of drought.

December's starts were revised up to a rate of 1.28 million units from the previously reported pace of 1.23 million units. Homebuilding was up 10.5 percent compared to January 2016.

Permits for future construction jumped 4.6 percent in January to a rate of 1.29 million units, the highest level since November 2015. Building permits in the South, where most homebuilding occurs, hit their highest level since July 2007.

With overall permits now outpacing starts, homebuilding is likely to rebound in the coming months. Economists had forecast groundbreaking activity slipping to a rate of 1.22 million units last month and building permits rising to a 1.23 million pace.

The PHLX housing index fell 0.6 percent. U.S. stocks were trading lower after earlier touching record highs.

Shares in the nation's largest homebuilder, D.R. Horton , were little changed. Lennar Corp fell 0.27 percent and PulteGroup was down 0.18 percent. Prices of U.S. Treasuries rose while the dollar fell against a basket of currencies.

MANUFACTURING RECOVERY

In a separate report, the Philadelphia Federal Reserve Bank said its general activity index jumped to 43.3 this month, the highest reading since January 1984, from 23.6 in February.

Manufacturers in the mid-Atlantic region reported a surge in new orders and shipments. Factories also extended working hours for employees this month. The Philadelphia Fed's data mirrored other regional surveys in suggesting a broad recovery in manufacturing, which was squeezed by the collapse in oil prices and a strong dollar over the past two years.

"We do expect to see an acceleration in manufacturing output and employment growth this year," said Paul Ashworth, chief U.S. economist at Capital Economics in Toronto. "But ... we don't expect this revival to spill over into much faster GDP growth."

While manufacturers continued to report paying higher prices for raw materials this month, fewer said they were raising prices for their goods compared to January. That suggests the growing inflation pressures at the factory gate will probably not translate into significant price increases for consumers.

A government report on Wednesday showed the consumer price index increased 2.5 percent year-on-year in January, the biggest gain since March 2012. Rising inflation, if sustained, could erode households' purchasing power and hurt spending, including home purchases.

The housing recovery is being driven by a strong labor market, which is boosting employment opportunities for young people and supporting household formation.

In another report on Thursday, the Labor Department said initial claims for state unemployment benefits rose 5,000 to a seasonally adjusted 239,000 for the week ended Feb. 11.

Claims have been below 300,000, a threshold associated with a strong job market, for 102 consecutive weeks. That is the longest stretch since 1970, when the labor market was much smaller. The labor market is at or close to full employment, with the unemployment rate at 4.8 percent.

Economists had forecast first-time applications for jobless benefits rising to 245,000 in the latest week. While the labor market is expected to continue to underpin the housing market, higher mortgage rates could slow demand for housing.

January's starts were above the fourth-quarter average, suggesting housing will again contribute to gross domestic product in the first three months of this year.

Homebuilding last month surged 55.4 percent in the Northeast region of the country and jumped 20.0 percent in the South to the highest level since August 2007. Starts fell 41.3 percent in the West to the lowest level since March 2015, likely due to the soggy weather.

Last month, single-family homebuilding, which accounts for the largest share of the residential housing market, climbed 1.9 percent to a pace of 823,000 units. Starts for the volatile multi-family housing segment tumbled 10.2 percent to a rate of 423,000 units.

Single-family permits slipped 2.7 percent after increasing for five consecutive months. But single-family starts in the South rose to their highest level since August 2007.

Building permits for multi-family units soared 19.8 percent.

(This article has not been edited by DNA's editorial team and is auto-generated from an agency feed.)

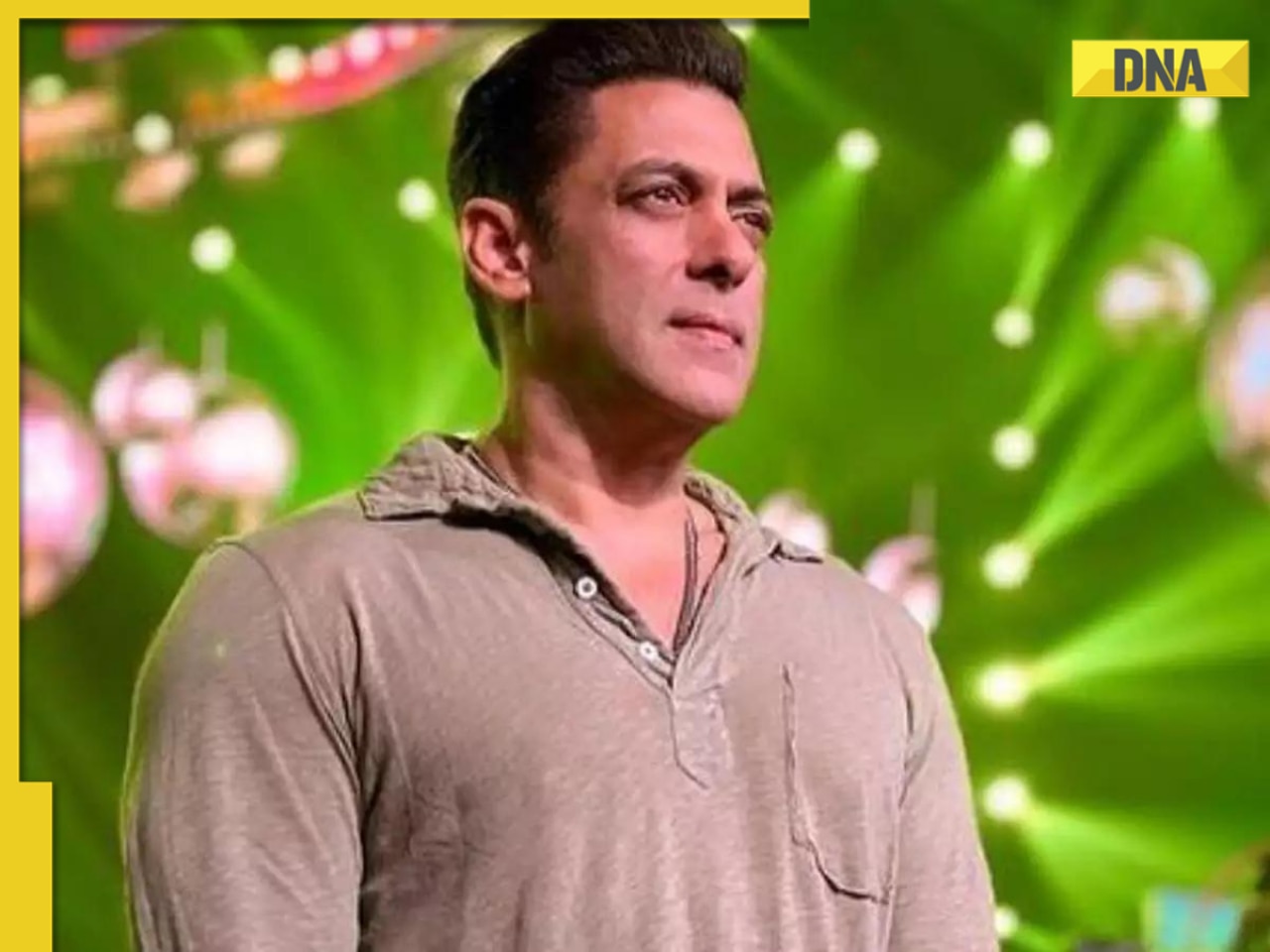

![submenu-img]() Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins

Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins![submenu-img]() Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'

Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'![submenu-img]() India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat

India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat![submenu-img]() Vellore Lok Sabha constituency: Check polling date, candidates list, past election results

Vellore Lok Sabha constituency: Check polling date, candidates list, past election results![submenu-img]() Meet NEET-UG topper who didn't take admission in AIIMS Delhi despite scoring AIR 1 due to...

Meet NEET-UG topper who didn't take admission in AIIMS Delhi despite scoring AIR 1 due to...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch

Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch![submenu-img]() Remember Tanvi Hegde? Son Pari's Fruity who has worked with Shahid Kapoor, here's how gorgeous she looks now

Remember Tanvi Hegde? Son Pari's Fruity who has worked with Shahid Kapoor, here's how gorgeous she looks now![submenu-img]() Remember Kinshuk Vaidya? Shaka Laka Boom Boom star, who worked with Ajay Devgn; here’s how dashing he looks now

Remember Kinshuk Vaidya? Shaka Laka Boom Boom star, who worked with Ajay Devgn; here’s how dashing he looks now![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

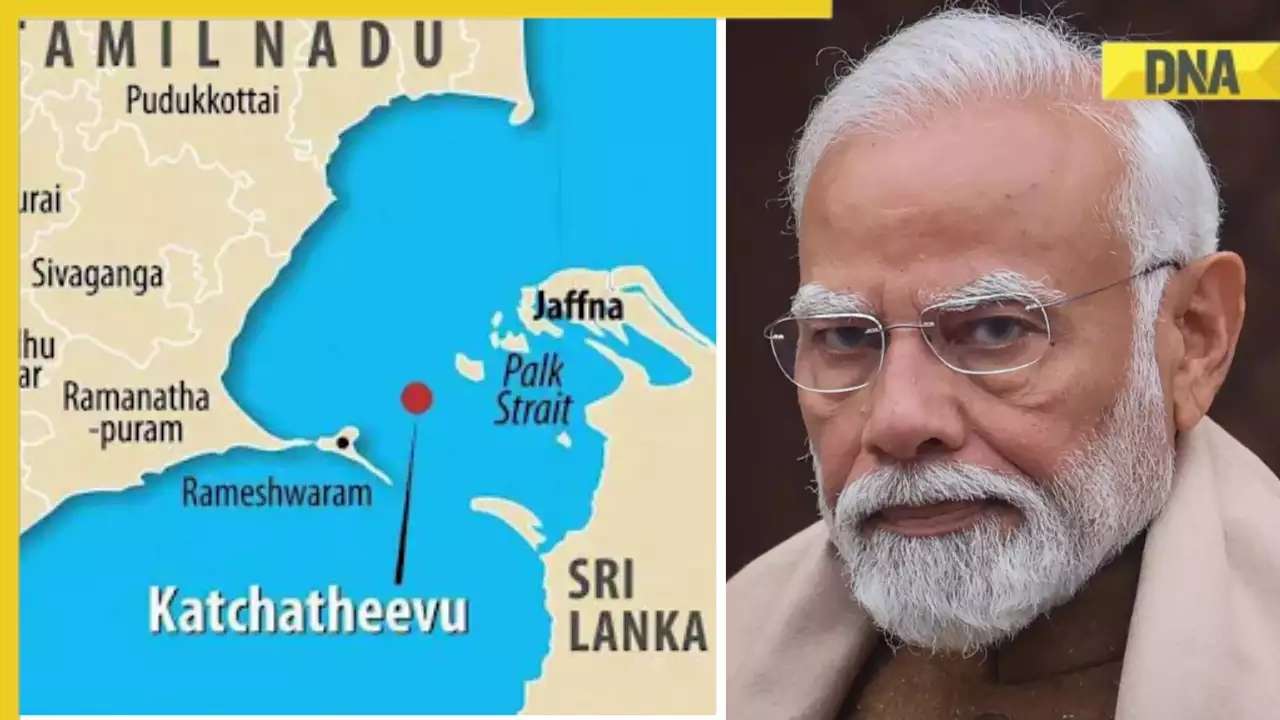

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?

What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?![submenu-img]() DNA Explainer: Reason behind caused sudden storm in West Bengal, Assam, Manipur

DNA Explainer: Reason behind caused sudden storm in West Bengal, Assam, Manipur![submenu-img]() Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins

Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins![submenu-img]() Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'

Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'![submenu-img]() India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat

India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat![submenu-img]() This film has earned Rs 1000 crore before release, beaten Animal, Pathaan, Gadar 2 already; not Kalki 2898 AD, Singham 3

This film has earned Rs 1000 crore before release, beaten Animal, Pathaan, Gadar 2 already; not Kalki 2898 AD, Singham 3![submenu-img]() This Bollywood star was intimated by co-stars, abused by director, worked as AC mechanic, later gave Rs 2000-crore hit

This Bollywood star was intimated by co-stars, abused by director, worked as AC mechanic, later gave Rs 2000-crore hit![submenu-img]() IPL 2024: Rohit Sharma's century goes in vain as CSK beat MI by 20 runs

IPL 2024: Rohit Sharma's century goes in vain as CSK beat MI by 20 runs![submenu-img]() RCB vs SRH IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Sunrisers Hyderabad

RCB vs SRH IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Sunrisers Hyderabad ![submenu-img]() IPL 2024: Phil Salt, Mitchell Starc power Kolkata Knight Riders to 8-wicket win over Lucknow Super Giants

IPL 2024: Phil Salt, Mitchell Starc power Kolkata Knight Riders to 8-wicket win over Lucknow Super Giants![submenu-img]() IPL 2024: Why are Lucknow Super Giants wearing green and maroon jersey against Kolkata Knight Riders at Eden Gardens?

IPL 2024: Why are Lucknow Super Giants wearing green and maroon jersey against Kolkata Knight Riders at Eden Gardens?![submenu-img]() IPL 2024: Shimron Hetmyer, Yashasvi Jaiswal power RR to 3 wicket win over PBKS

IPL 2024: Shimron Hetmyer, Yashasvi Jaiswal power RR to 3 wicket win over PBKS![submenu-img]() Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home

Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home![submenu-img]() This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...

This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...![submenu-img]() Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video![submenu-img]() iPhone maker Apple warns users in India, other countries of this threat, know alert here

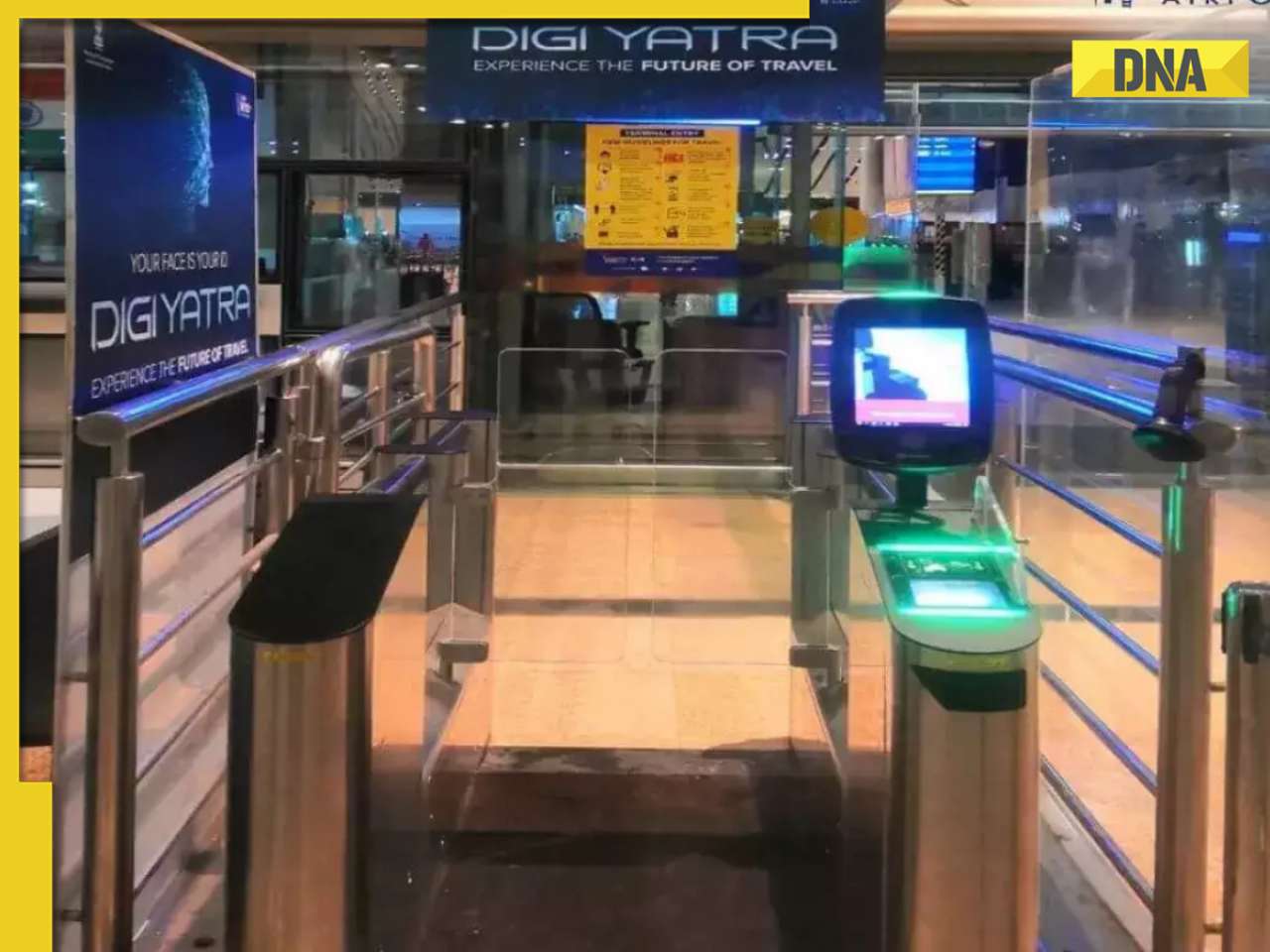

iPhone maker Apple warns users in India, other countries of this threat, know alert here![submenu-img]() Old Digi Yatra app will not work at airports, know how to download new app

Old Digi Yatra app will not work at airports, know how to download new app

)

)

)

)

)

)