Hong Kong handed out billions in tax cuts and poverty relief on Wednesday, to stimulate its economy that is expected to grow more strongly than expected at 2 to 3 percent this year despite headwinds from rising global trade protectionism

Financial Secretary Paul Chan said in his maiden annual budget address that stronger exports and jobs, rising wages and construction projects worth nearly HK$87 billion this year, had bolstered consumer confidence and domestic demand that would feed into the local economy.

Hong Kong handed out billions in tax cuts and poverty relief on Wednesday, to stimulate its economy that is expected to grow more strongly than expected at 2 to 3 percent this year despite headwinds from rising global trade protectionism

Financial Secretary Paul Chan said in his maiden annual budget address that stronger exports and jobs, rising wages and construction projects worth nearly HK$87 billion this year, had bolstered consumer confidence and domestic demand that would feed into the local economy. He warned, however, that the city's astronomical property prices continued to be an issue.

While the financial hub's economy was projected to grow faster than the 1.3 percent expansion forecast by six economists surveyed by Reuters, Chan cautioned risks remained.

"The uncertain external environment and interest rate trend may trigger abrupt shifts in capital flows and heighten volatility in local asset prices, with repercussions on consumption and investment sentiments and on macro-economic stability," Chan told lawmakers.

Credit Rating Agency Moody's said in a research note that the budget was relatively balanced and fiscally prudent but doubted Hong Kong would meet its bullish GDP forecast.

"We do not expect a material rebound in global trade which will weigh on Hong Kong's exports, while growth in domestic demand will be somewhat dampened by higher interest rates," Moody's wrote. "We expect three to four interest rate increases by the U.S. Federal Reserve this year which will push interest rates up in Hong Kong."

For highlights of the budget

On the property market, which Chan called exuberant and "out of tune with the local economy" despite a raft of cooling measures, he said the government would "substantially" increase residential flat supply in the next few years.

SHARING THE WEALTH

Hong Kong's provisional budget surplus was a much higher than expected HK$92.8 billion ($11.96 billion) for the 2016/17 financial year, far in excess of the HK$11 billion last year, with fiscal reserves of HK$935.7 billion.

The government said some HK$61 billion would be ploughed into elderly services, sports development, youth development and developing the high technology sector.

Chan said Hong Kong could afford to be more proactive with its spending and his measures to "share the fruits of economic development" would help stimulate domestic demand, stabilise the economy and help the job market.

The populist-leaning budget comes at a time of flux for Hong Kong amid rising political tensions and as the city in July marks the 20th anniversary of its handover from British to Chinese rule in 1997. The city will also usher in a new leader in a March 26 election involving a 1,200-member election committee stacked with Beijing loyalists.

Chan's predecessor, longstanding former financial secretary John Tsang, is one of several candidates eyeing the top job.

The package of one-off economic handouts and stimulus measures include reducing salaries tax and profits tax up to a ceiling of HK$20,000 per individual or firm, that would cost the government some HK$18.3 billion, as well as extra social welfare handouts for the elderly and disabled.

Total expenditure would increase to more than HK$490 billion in 2017-18 from HK$380 billion in 2012-13, Chan said.

Sectors such as tourism and catering that have struggled from a slump in visitors from China would receive help such as from waiving of licence fees for travel agents, guesthouses and restaurants, and pumping more money into tourism promotion.

Visitor arrivals fell nearly 5 percent last year, leading to the worst retail sales slump in nearly two decades. Even the once vibrant financial sector has been plagued with layoffs and dwindling stock market turnover.

($1 = 7.7610 Hong Kong dollars)

(This article has not been edited by DNA's editorial team and is auto-generated from an agency feed.)

![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

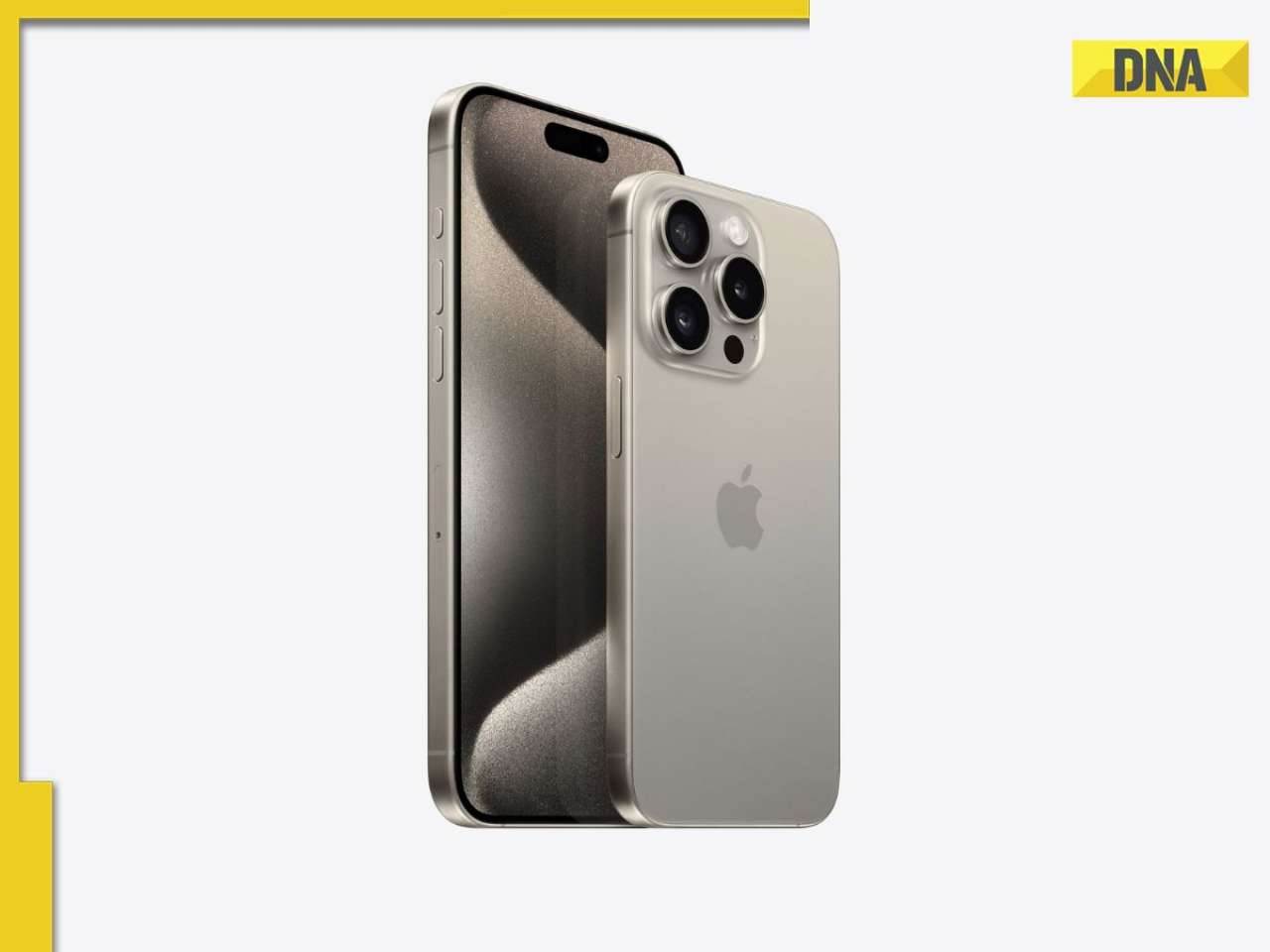

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() Apple iPhone camera module may now be assembled in India, plans to cut…

Apple iPhone camera module may now be assembled in India, plans to cut…![submenu-img]() HOYA Vision Care launches new hi-vision Meiryo coating

HOYA Vision Care launches new hi-vision Meiryo coating![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding

In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding![submenu-img]() In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month

In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch

Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?

What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans

Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans![submenu-img]() Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive

Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive![submenu-img]() Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now...

Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now... ![submenu-img]() IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR

IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR![submenu-img]() GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals

GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals![submenu-img]() 'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash

'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash![submenu-img]() IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB

IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here

Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here![submenu-img]() Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home

Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home![submenu-img]() This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...

This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...![submenu-img]() Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

)

)

)

)

)

)