Even as it is set to transform itself from a microfinance institution to a bank, Bandhan promises to maintain the poor as their target for loans and advances. The institution that is present across 22 states and has a 13 million customer base, received the in-principle approval for the banking license in April this year.

Even as it is set to transform itself from a microfinance institution to a bank, Bandhan promises to maintain the poor as their target for loans and advances. The institution that is present across 22 states and has a 13 million customer base, received the in-principle approval for the banking license in April this year.

When I first interviewed the chairman and managing director CS Ghosh in 2010, he was happy in the world of microfinance. He was convinced he did not want to get listed and wanted to focus only on the group that did not get access to funds otherwise. A lot has changed since then. He had told me then, that he was more open to equity coming in from individual private investors and did not want to enter the market even as other players like SKS Microfinance and its peers were either getting listed or submitting their draft prospectus.

In 2011, International Finance Corporation entered the foray with funds for Bandhan and now holds 10.9% share in the company. IFC also lent Rs 160 crore to Bandhan recently, a fund given for 7 years at a rate of 14.5% annual cost.

On the sidelines of a banking conference organised by FICCI, Ghosh told dna that he would launch his new bank before next Durga Puja. He said more than 500 branches would be launched on the same day so that their 13 million captive customer base gets access to banking services from the first day. He said he aims to prove that a bank serving those untouched by the banking industry otherwise can sustain itself and be profitable as well.

Here are excerpts from the interview:

You have come a long way from being a microfinance institution to a bank. What is your strategy going ahead? Is the target customer base going to change now?

Our existing captive customers are poor economically backward people with less than Rs 50,000 income per year. We are now trying to target those with income above Rs 50,000 per year, the middle class as well as the rich. But this is only from a deposit point of view, because we need to expand our deposit base. The target group for the advances or the loans remain the same, those who otherwise do not have access to banking services. We would also like to tap small businesses, the SMEs for loans but not the big corporate.

There are lot of concerns regarding rising bad loans for banks. As a bank, you are clear that you do not want to tap the big corporate for loans, and it is not like big corporates have always repaid the loans on time. But now that you are going to expand as a universal bank, focussing only on the economically backward population, do bad loans worry you?

I believe if the staff of the bank rightly assesses the cash flow of the customer and after the disbursement of the money, if they physically visit the customers and check it, bad loans will not be an issue. The physical touch is more important to reduce NPA (non performing assets) and not so much IT. For the banking sector, the beginning should be physical touch and then can be brought to IT. Without a direct physical touch with the customer and frequent visits, NPA will become worrisome for the country.

You will target the SMEs for big loans and not big corporate. It was earlier raised in the conference that SMEs have high mortality in the sense, around 50% of them perish in less than 3 years of establishment. How will you address this issue while disbursing money to them?

If you again look at the bottom of the graph that we are working with, they are not bankable. They are refused by banks. But we have proved they are not high risk but high potential. Similarly for SMEs, we will prove they are not high risk but high potential - just give it some time.

Any human resource challenges you are facing while recruiting for your new bank?

Only 26% people in our country get fixed monthly salaries in our country. The rest of them earn by small businesses or erratic jobs. Unemployment is one of the major problems in our country. Getting people is not a problem, though it could be an issue about how to build up the capacity of these people. How to train people so that people get the service. It is an idea that even microfinance institutions (MFI) have to be run with an MBA. But we have trained people in a way that they have run the MFI successfully without formal management degrees. Now they will be running the bank. For specific requirements, like say the compliance head or the risk management head, we are recruiting people from the banking industry.

Where do you see Bandhan in five years’ time?

We would like to see Bandhan as a commercially viable bank, catering mainly to the people who are untouched otherwise by the banking industry. We will prove again that even as a bank, it is possible to serve the people in a cost effective manner, in an effective manner and still be sustainable.

![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() Apple iPhone camera module may now be assembled in India, plans to cut…

Apple iPhone camera module may now be assembled in India, plans to cut…![submenu-img]() HOYA Vision Care launches new hi-vision Meiryo coating

HOYA Vision Care launches new hi-vision Meiryo coating![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding

In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding![submenu-img]() In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month

In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch

Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

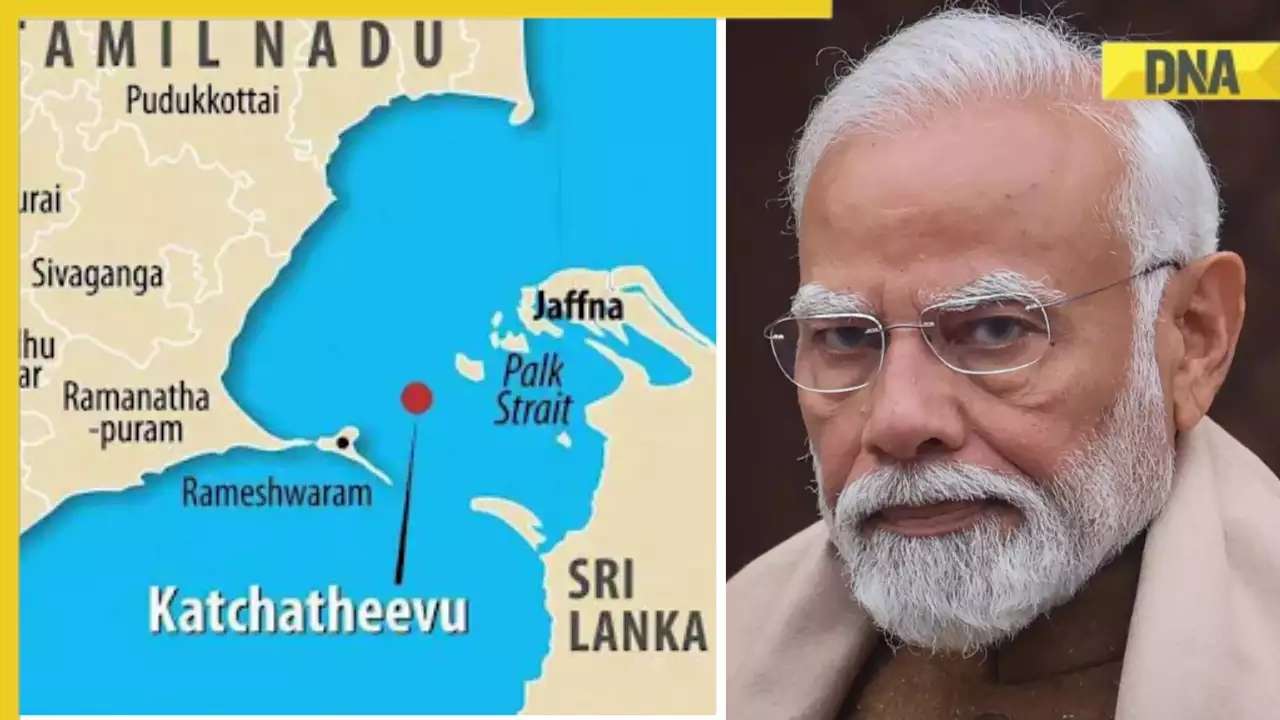

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?

What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans

Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans![submenu-img]() Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive

Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive![submenu-img]() Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now...

Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now... ![submenu-img]() IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR

IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR![submenu-img]() GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals

GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals![submenu-img]() 'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash

'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash![submenu-img]() IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB

IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here

Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here![submenu-img]() Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home

Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home![submenu-img]() This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...

This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...![submenu-img]() Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

)

)

)

)

)

)

)