US Act moots stringent penalties for individuals, banks, brokerages over non-disclosure of NRI accounts/assets/income of US taxpayers.

The United States will enforce the Foreign Account Tax Compliance Act, or Fatca, from January 1, 2013, mandating full disclosure of bank accounts held by US taxpayers in foreign countries including India.

The legislation directly affects deposits and investments made by non-resident Indians (NRIs) who are also taxpayers in the US.

Under Fatca, either the taxpayer or banks/institutions holding such deposits will have to disclose all details to the Internal Revenue Service (IRS), the agency responsible for tax collection and tax law enforcement in America, no matter the size of assets.

Data from the Reserve Bank of India (RBI) show Indian banks held NRI deposits worth $53.30 billion as of July 31 this year, tantamount to a sixth of India’s forex reserves.

How much of this comes from the US is not clear since the RBI does not provide disaggregated data.

All foreign financial institutions — including banks, non-banks and brokerages — will have to comply, apart from dollar taxpayers.

“Global banks have US account holders and the IRS is completely aware of that. What the US Treasury is doing is, saying, ‘Hey look, you have US account holders, you are making money out of them. You need to pay the US tax on it,’” said Milan Mandhani, a certified public accountant who runs Vimlan Tax Services LLC in Schaumburg, Illinois.

“Say an NRI owns a flat in India. And he has a mortgage (home loan) on it, which is paid to the State Bank of India or HDFC etc. Now, that NRI person doesn’t have any tax obligation in India, but he has a US tax obligation. The point is, an SBI or HDFC is not going to file tax on income sourced from the US. And the US thinks it is losing money on this. So, by law that US person has to withhold 30% of tax and pay to the US,” he told DNA Money.

Mandhani has spoken to many Indian bankers who, he said, will prefer to foreclose such accounts.

“Similarly, if they have NRI broking accounts at ICICI or Kotak Securities, the same rule applies,” he said.

“It’s my conjecture that public sector banks would easily fall in line since governments are involved on both sides. And ICICI, SBI, HDFC Bank… all have US operations. There are many different ways in which the US Treasury, the Department of Justice and the Securities and Exchange Commission can tie them down if there’s non-compliance,” Mandhani said.

The deadline for compliance is June 30, 2013, and will involve furnishing details of the account holders, their assets, their social security number, etc.

Under the Act, there are three key points that have to be borne in mind.

These include reporting by taxpayers holding foreign financial assets, reporting by foreign financial institutions and reporting of passive foreign investments (by US persons who are shareholders of foreign investment companies).

Non-compliance invokes extremely strong penalties.

“There is a $10,000 per incidence penalty (for any year starting after March 18, 2010) in addition to a possible $50,000 penalty for failing to comply with the new reporting requirements after IRS notification,” Milan and Vimal Madhani also wrote in a note to clients last week.

Any underpayment of tax attributable to non-disclosed foreign financial assets will also be subject to a penalty of 40%.

For example, if one has $75,000 in an Indian bank account which is not disclosed, the highest penalty would be $60,000 ($10,000 per incidence, and $50,000 after IRS notification) on the account alone.

And interest income earned on the account will first be subject to normal income tax plus a non-declaration penalty of 40% and statutory interest charged on the whole income tax and the penalty balance, the Madhanis said.

Indian banks are not ready to comment on the possible impact at this juncture.

But experts said this could lead to more stringent know your customer (KYC) guidelines.

Besides, some banks may also decide to reduce their exposure to US clients or start absorbing the 30% withholding tax as laid down by Fatca.

But the first step is to solve the problem is create awareness in the system.

“Proper awareness needs to be created about this, and also the manner in which this will come into effect. That has to be clarified through a series of communications as it will impact the financial services industry,” said Sandip Mukherjee, executive director (tax & regulatory services), PricewaterhouseCoopers.

The impact will not be just on non-resident Indian (NRI) accounts alone, say some.

“It is not just a question of just NRIs. Anybody who has an income in dollars will be affected. Banks have to ensure they capture details of any accounts that are US based and disclose that to the IRS in their annual returns,” said Abhay Gupte, senior director, Deloitte (India).

Mukherjee said this could mean US-based account holders will probably start dialogues with their banks and various other institutions and KYC norms may become a bit more stringent.

In fact many US-based customers may not want the bank to disclose their information. “If a customer does not want the bank to disclose, then they will have to shift. But then where will they go? Every bank will ask them the same thing,” said Gupte.

According to Rohit Mahajan, executive director and national head (forensic practice), KPMG India, banks may also reduce their exposure as they might decide to forgo such US clients.

“The other possibility is they do not comply with Fatca, but they start absorbing this 30% withholding tax,” he said.

![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

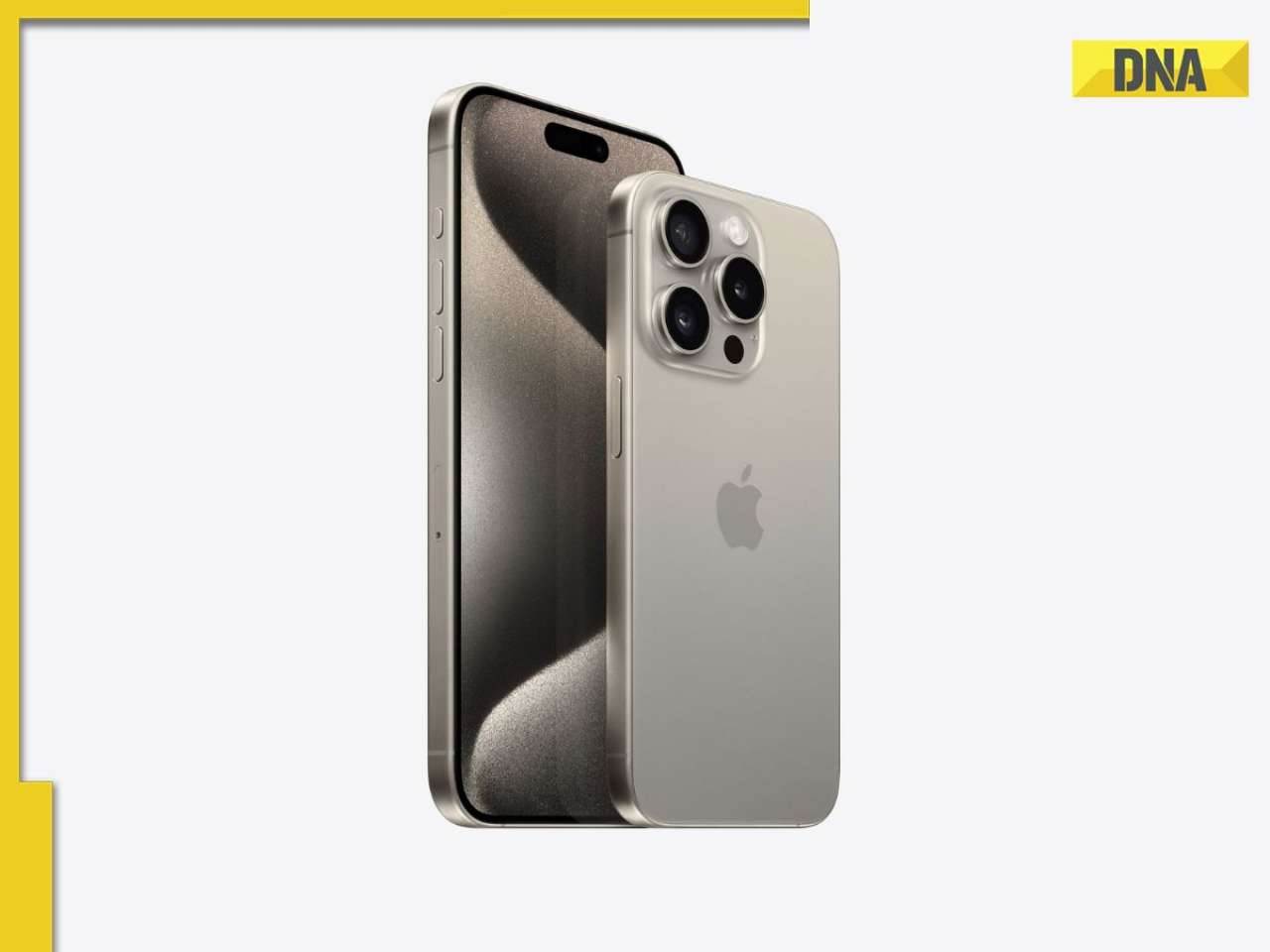

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() Apple iPhone camera module may now be assembled in India, plans to cut…

Apple iPhone camera module may now be assembled in India, plans to cut…![submenu-img]() HOYA Vision Care launches new hi-vision Meiryo coating

HOYA Vision Care launches new hi-vision Meiryo coating![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding

In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding![submenu-img]() In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month

In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch

Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?

What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans

Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans![submenu-img]() Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive

Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive![submenu-img]() Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now...

Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now... ![submenu-img]() IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR

IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR![submenu-img]() GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals

GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals![submenu-img]() 'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash

'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash![submenu-img]() IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB

IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here

Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here![submenu-img]() Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home

Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home![submenu-img]() This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...

This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...![submenu-img]() Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

)

)

)

)

)

)