Payments bank licence will allow companies to collect deposits (initially up to Rs 1 lakh per individual), offer Internet banking, facilitate money transfers and sell insurance and mutual funds.

Companies run by billionaires Mukesh Ambani and Kumar Mangalam Birla as well as telcos Bharti Airtel and Vodafone are among the 11 entities that on Wednesday got the Reserve Bank's nod to set up non-lending payments banks as part of the financial inclusion drive.

Reliance Industries, which had previously announced partnership with State Bank of India, Airtel M Commerce Services Limited, Aditya Birla Nuvo, Vodafone m-pesa, Tech Mahindra and Department of Posts got the 'in-principal' approval from RBI to set up such niche banks.

Sun Pharma promoter Dilip Shantilal Shanghvi and Vijay Shekhar Sharma of PayTM also got approval in their individual capacities.

Besides, Cholamandalam Distribution Services, Fino PayTech, and National Securities Depository (NSDL) also got approval, out of the 41 applicants.

Payments bank licence will allow companies to collect deposits (initially up to Rs 1 lakh per individual), offer Internet banking, facilitate money transfers and sell insurance and mutual funds.

Besides, they can issue ATM/debit cards, but not credit cards.

Commenting on the development, Finance Minister Arun Jaitley said such banks will ensure more money comes into the banking system and will help reach out to people in rural areas.

"Various banks are looking at increasing their rural reach which includes big banks like SBI; payments banks will help them realise this," he added.

SBI, the country's largest lender, will take as much as 30% in RIL's proposed bank while Bharti Airtel, India's largest telecom operator, plans to give 19.9% stake in the bank to Kotak Mahindra Bank Ltd.

A total of 41 companies had applied for the permit but "some of the entities who did not qualify in this round, could well be successful in future rounds," RBI said, adding that in future it plans to grant such licences "virtually on tap".

Aditya Birla Nuvo Limited has tied up with Idea Cellular which will have 49% stake in the joint venture.

"The 'in-principle' approval granted will be valid for a period of 18 months, during which time the applicants have to comply with the requirements under the guidelines and fulfil the other conditions as may be stipulated by the Reserve Bank," RBI said.

Communications and IT Minister Ravi Shankar Prasad said the payments bank licence is a proud moment for the postal department and it should prepare itself properly and effectively to become a vehicle of financial inclusion in the country.

The payments bank licence will enable the network of 1,54,000 post offices (including 1,30,000 rural post offices) to offer banking services to the masses in the country.

"We are confident that this move will play a pivotal role in bringing millions of unbanked Indians into the folds of banking," Airtel said in a statement.

Vodafone India MD and CEO Sunil Sood said the licence will enable the firm to build further on this and "offer a more comprehensive portfolio of banking and financial products and services, accelerating India's journey into a cashless economy."

After getting the approval, G V Nageswara Rao, CEO and MD of NSDL said the depository will be going alone "but of course we want to keep our options open."

"We don't have any specific timeline to share with you but the real work starts now," he added.

PayTM founder Vijay Shekhar Sharma said he wants to launch the payments bank at the earliest as this is an opportunity.

"I would first go in areas where customers understand PayTM well," he added.

Meanwhile, RBI further said that on being satisfied that the 11 applicants have complied with the requisite conditions as part of 'in-principle' approval, it would consider granting to them a licence for commencement of banking business.

Until a regular licence is issued, the applicants can not undertake any banking business, the central bank added.

Draft guidelines for licencing of payments banks were released for public comments in July 2014 while the final guidelines were issued in November 2014.

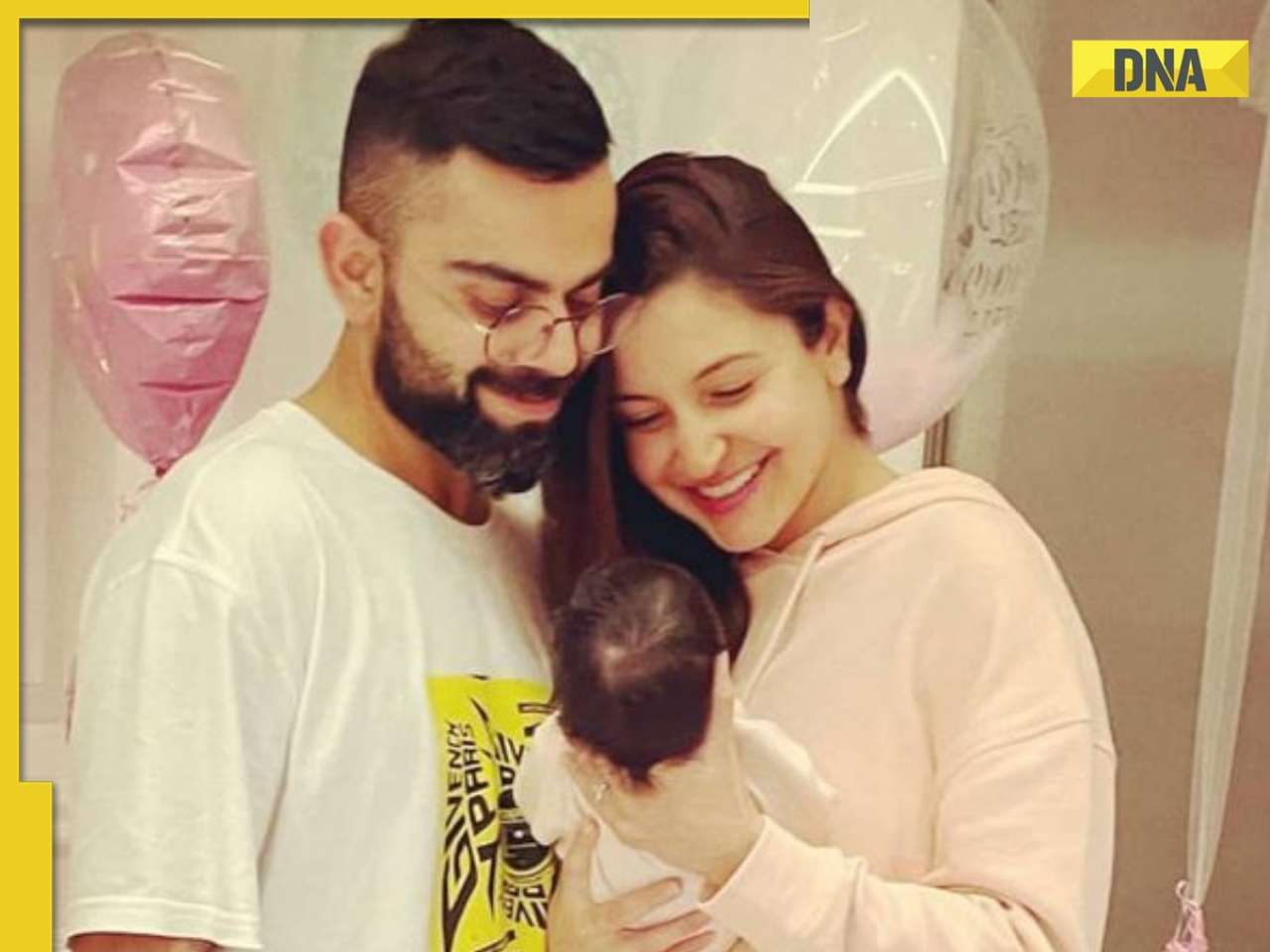

![submenu-img]() Anushka Sharma, Virat Kohli officially reveal newborn son Akaay's face but only to...

Anushka Sharma, Virat Kohli officially reveal newborn son Akaay's face but only to...![submenu-img]() Elon Musk's Tesla to fire more than 14000 employees, preparing company for...

Elon Musk's Tesla to fire more than 14000 employees, preparing company for...![submenu-img]() Meet man, who cracked UPSC exam, then quit IAS officer's post to become monk due to...

Meet man, who cracked UPSC exam, then quit IAS officer's post to become monk due to...![submenu-img]() How Imtiaz Ali failed Amar Singh Chamkila, and why a good film can also be a bad biopic | Opinion

How Imtiaz Ali failed Amar Singh Chamkila, and why a good film can also be a bad biopic | Opinion![submenu-img]() Ola S1 X gets massive price cut, electric scooter price now starts at just Rs…

Ola S1 X gets massive price cut, electric scooter price now starts at just Rs…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding

In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding![submenu-img]() In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month

In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch

Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

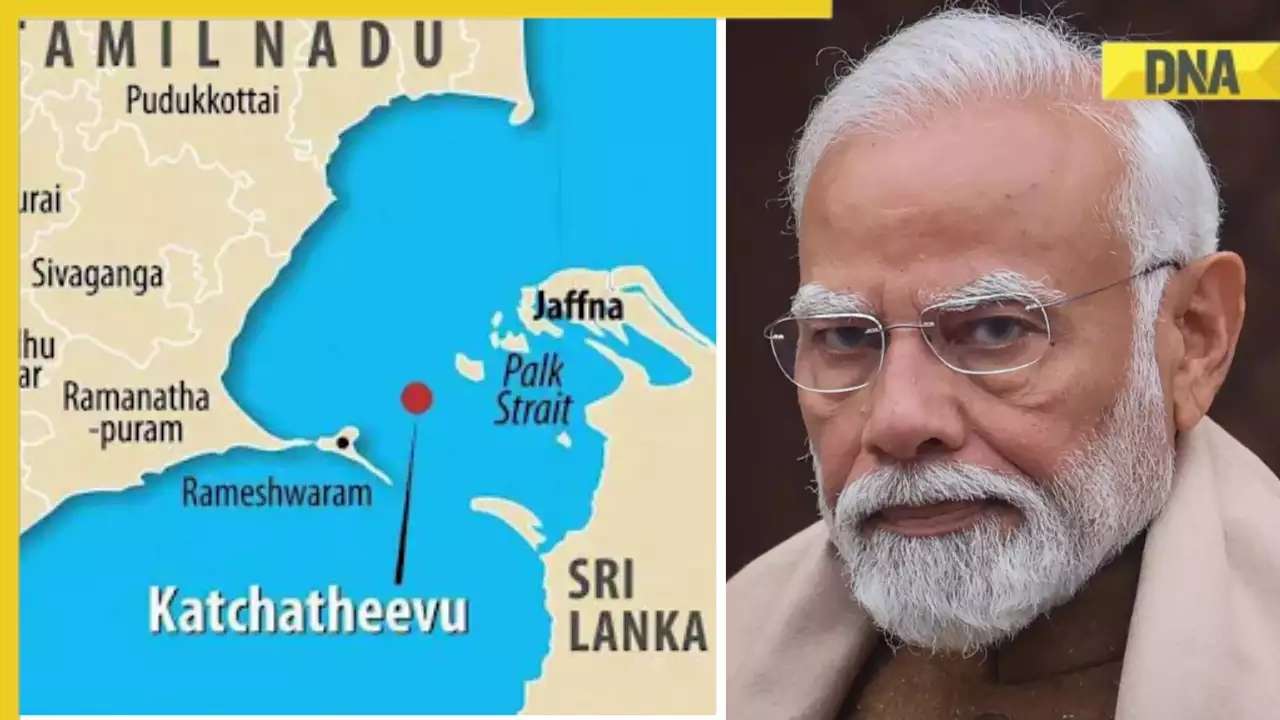

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?

What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?![submenu-img]() Anushka Sharma, Virat Kohli officially reveal newborn son Akaay's face but only to...

Anushka Sharma, Virat Kohli officially reveal newborn son Akaay's face but only to...![submenu-img]() How Imtiaz Ali failed Amar Singh Chamkila, and why a good film can also be a bad biopic | Opinion

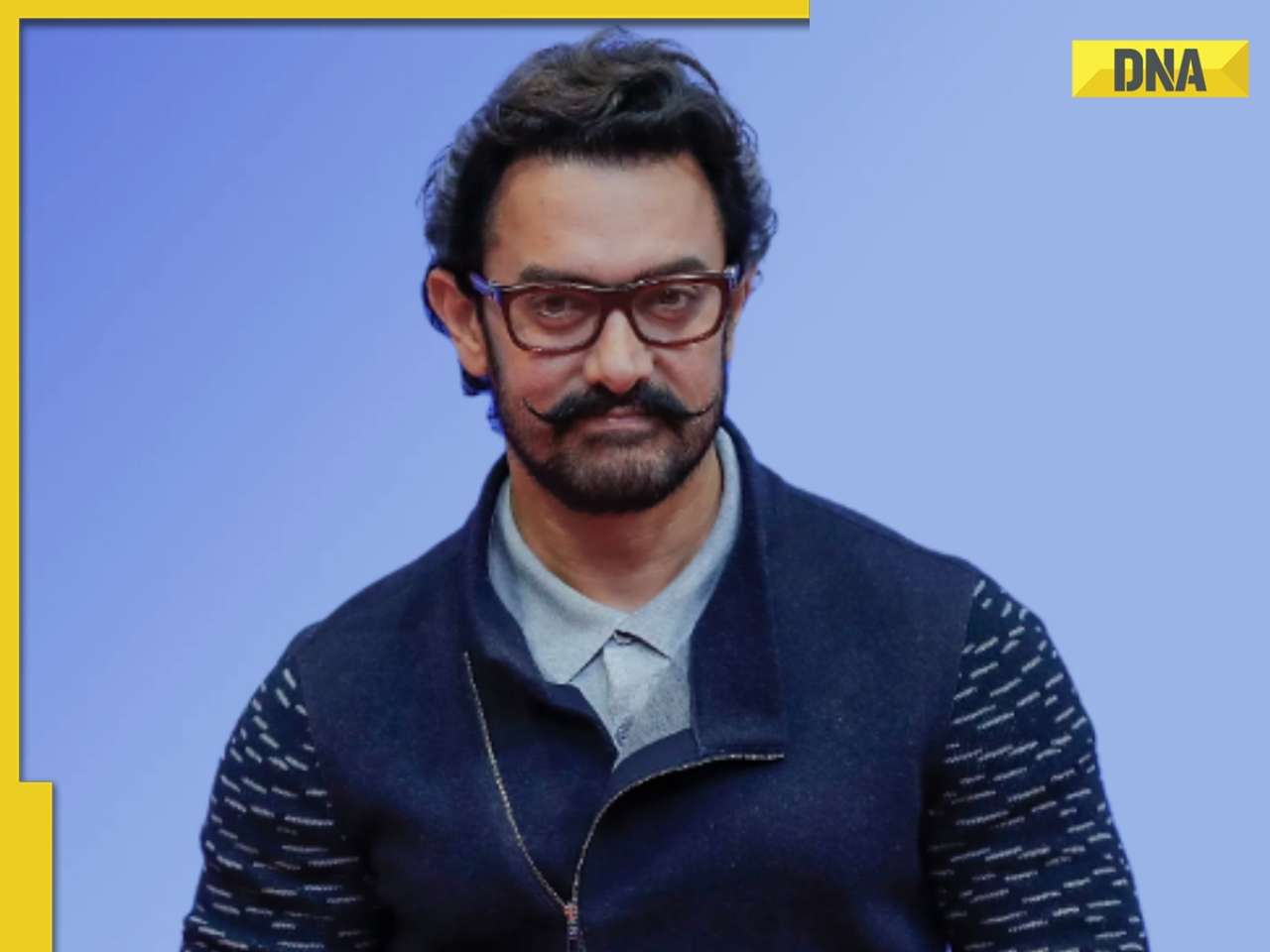

How Imtiaz Ali failed Amar Singh Chamkila, and why a good film can also be a bad biopic | Opinion![submenu-img]() Aamir Khan files FIR after video of him 'promoting particular party' circulates ahead of Lok Sabha elections: 'We are..'

Aamir Khan files FIR after video of him 'promoting particular party' circulates ahead of Lok Sabha elections: 'We are..'![submenu-img]() Henry Cavill and girlfriend Natalie Viscuso expecting their first child together, actor says 'I'm very excited'

Henry Cavill and girlfriend Natalie Viscuso expecting their first child together, actor says 'I'm very excited'![submenu-img]() This actress was thrown out of films, insulted for her looks, now owns private jet, sea-facing bungalow worth Rs...

This actress was thrown out of films, insulted for her looks, now owns private jet, sea-facing bungalow worth Rs...![submenu-img]() IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB

IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB![submenu-img]() KKR vs RR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

KKR vs RR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() KKR vs RR IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Rajasthan Royals

KKR vs RR IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Rajasthan Royals![submenu-img]() RCB vs SRH, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

RCB vs SRH, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() IPL 2024: Rohit Sharma's century goes in vain as CSK beat MI by 20 runs

IPL 2024: Rohit Sharma's century goes in vain as CSK beat MI by 20 runs![submenu-img]() Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home

Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home![submenu-img]() This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...

This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...![submenu-img]() Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video![submenu-img]() iPhone maker Apple warns users in India, other countries of this threat, know alert here

iPhone maker Apple warns users in India, other countries of this threat, know alert here![submenu-img]() Old Digi Yatra app will not work at airports, know how to download new app

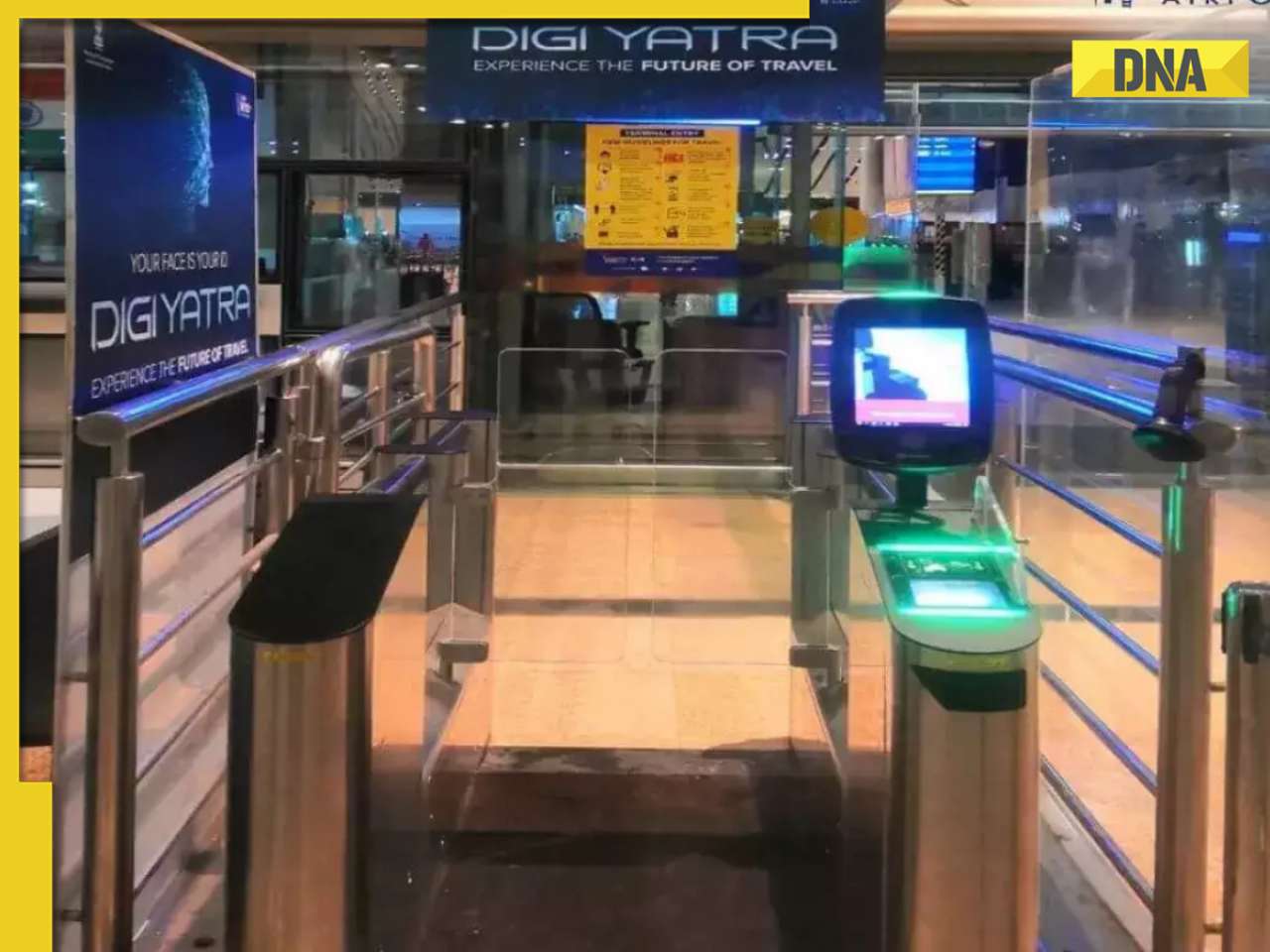

Old Digi Yatra app will not work at airports, know how to download new app

)

)

)

)

)

)

)