Rating agency Moody's Investors Service on Tuesday lowered India's growth forecast to 7% for 2015, from 7.5% projected earlier, citing monsoon concerns and cautioned that further risks to growth stems from slow pace of reforms.

Rating agency Moody's Investors Service on Tuesday lowered India's growth forecast to 7% for 2015, from 7.5% projected earlier, citing monsoon concerns and cautioned that further risks to growth stems from slow pace of reforms.

"We have revised our GDP growth forecast down to around 7%, in light of a drier-than-average monsoon although rainfall was not as low as feared at the start of the season," Moody's Investors Service said in its 'Global Macro Outlook for 2015-16'.

Saying that India's growth outlook is resilient beyond short-term monsoon effects, Moody's has retained growth forecast for 2016 at 7.5%.

"One main risk to our forecast is that the pace of reforms slows significantly as consensus behind the need for reform weakens once the least controversial aspects of the government's plan have been implemented," Moody's said.

It said, as a net importer of commodities, India's growth outlook benefits from the fall in commodity prices over the past year. Also the country is "little affected" by demand from China and more generally slower global trade growth.

Moody's said economic activity will continue to strengthen on the back of a gradual implementation of reforms that foster domestic and foreign investment.

Consumption growth will continue to be supported by large income gains as inflation has fallen to relatively low levels by the country's past standards and favourable demographics.

"Barring a large shock to commodity prices or food inflation, we think that the central bank's inflation targets are achievable," it added.

"Maintaining inflation at lower levels than in the past will support real incomes and spending. As long as the central banks objective is credible, it will also foster investment by providing more visibility about future revenue growth and margins," Moody's said.

It added that growth in 2015-16 will also be supported by an accommodative fiscal policy stance and the budget focuses on sustained economic growth as a driver of narrower deficits.

As regards China, Moody's maintained its baseline GDP growth forecast of 6.8% for 2015 and 6.5% in 2016, before falling towards 6% by the end of the decade.

"The recent stock market correction is unlikely to have a significant impact on China's GDP growth. The depreciation of the renminbi so far will also not have any marked economic impact," it said.

Global economic growth, Moody's said, would be muted over the next two years. It projected G20 GDP growth at 2.7% this year, rising to around 3% in 2016, compared to 2.9% in 2014.

"The recovery in the US and, to a lesser extent, the euro area and Japan, will be offset by the ongoing slowdown in China, low or negative growth in Latin America and only a gradual Russian recovery from its recession this year," said Marie Diron, Senior Vice President, Credit Policy at Moody's Investors Service.

Moody's said it expects the Brent price to average $57 a barrel in 2016, only a little higher than the 2015 average of $55.

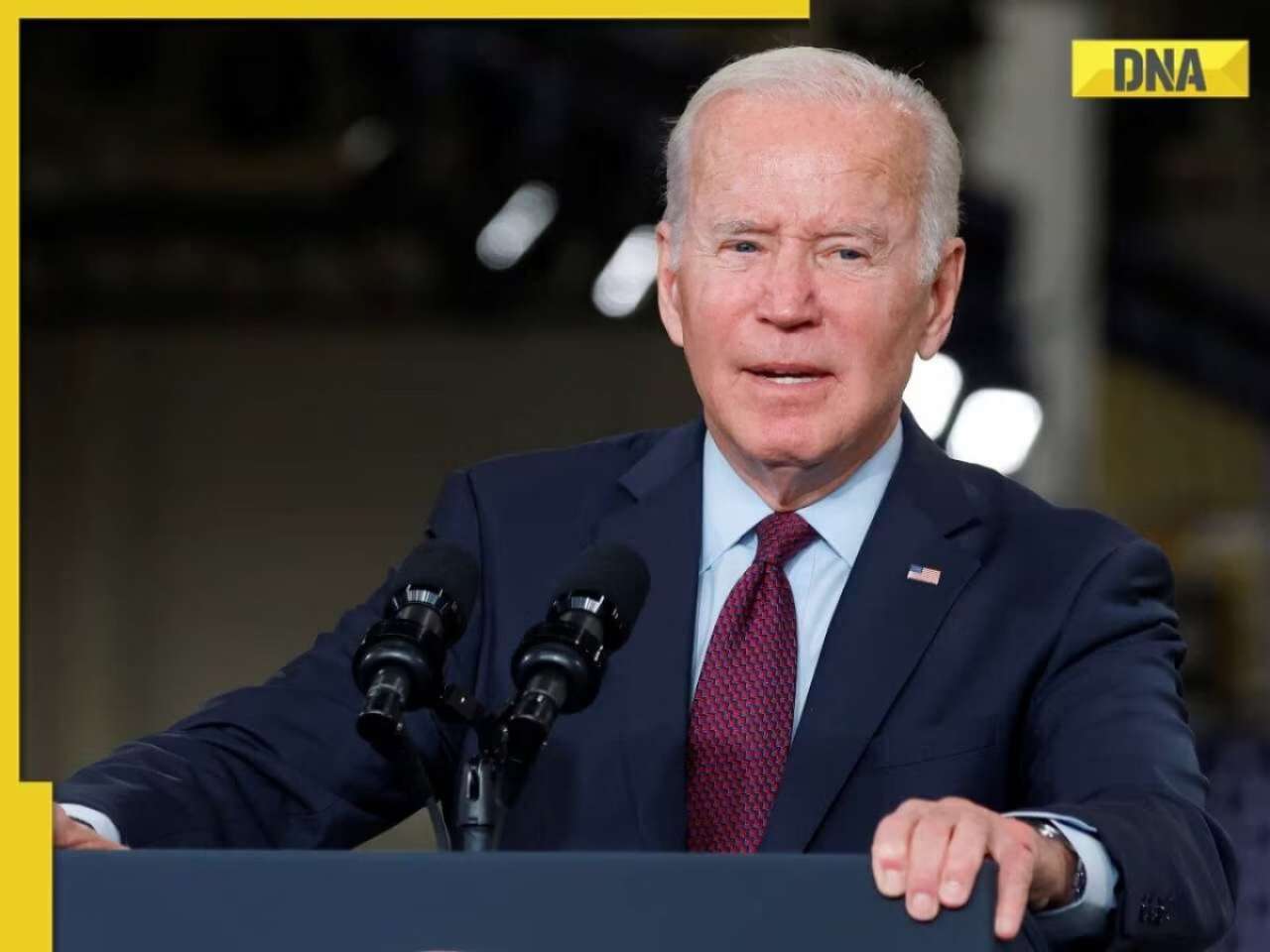

![submenu-img]() US imposes sanctions on Chinese, Belarus firms for providing ballistic missile tech to Pakistan

US imposes sanctions on Chinese, Belarus firms for providing ballistic missile tech to Pakistan![submenu-img]() 'Don't have any comment': White House mum on reports of Israeli strikes in Iran

'Don't have any comment': White House mum on reports of Israeli strikes in Iran![submenu-img]() Yes Bank co-founder Rana Kapoor gets bail after four years in bank fraud case

Yes Bank co-founder Rana Kapoor gets bail after four years in bank fraud case![submenu-img]() Barmer Lok Sabha Polls 2024: Check key candidates, date of voting and other important details

Barmer Lok Sabha Polls 2024: Check key candidates, date of voting and other important details![submenu-img]() This star once lived in garage, earned Rs 51 as first salary; now charges Rs 5 crore per film, is worth Rs 335 crore

This star once lived in garage, earned Rs 51 as first salary; now charges Rs 5 crore per film, is worth Rs 335 crore![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Ali Haji? Aamir Khan, Kajol's son in Fanaa, who is now director, writer; here's how charming he looks now

Remember Ali Haji? Aamir Khan, Kajol's son in Fanaa, who is now director, writer; here's how charming he looks now![submenu-img]() Remember Sana Saeed? SRK's daughter in Kuch Kuch Hota Hai, here's how she looks after 26 years, she's dating..

Remember Sana Saeed? SRK's daughter in Kuch Kuch Hota Hai, here's how she looks after 26 years, she's dating..![submenu-img]() In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding

In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding![submenu-img]() In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month

In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() This star once lived in garage, earned Rs 51 as first salary; now charges Rs 5 crore per film, is worth Rs 335 crore

This star once lived in garage, earned Rs 51 as first salary; now charges Rs 5 crore per film, is worth Rs 335 crore![submenu-img]() Meet actress, who worked as cook for free food, mopped floors, one Instagram post changed her life, is now worth…

Meet actress, who worked as cook for free food, mopped floors, one Instagram post changed her life, is now worth… ![submenu-img]() UP man arrested for booking cab from Salman Khan's house under Lawrence Bishnoi's name

UP man arrested for booking cab from Salman Khan's house under Lawrence Bishnoi's name ![submenu-img]() 'Justice milega': Ankita Lokhande talks about Sushant Singh Rajput, reveals she's still connected with his family

'Justice milega': Ankita Lokhande talks about Sushant Singh Rajput, reveals she's still connected with his family![submenu-img]() Rajkummar Rao reacts to plastic surgery rumours, admits he got fillers: 'If something gives me confidence...'

Rajkummar Rao reacts to plastic surgery rumours, admits he got fillers: 'If something gives me confidence...'![submenu-img]() IPL 2024: KL Rahul, Quinton de Kock star in Lucknow Super Giants' dominating 8-wicket win over Chennai Super Kings

IPL 2024: KL Rahul, Quinton de Kock star in Lucknow Super Giants' dominating 8-wicket win over Chennai Super Kings![submenu-img]() DC vs SRH, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

DC vs SRH, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() Watch: Virat Kohli's cheeky 'your wife' remark to Dinesh Karthik leaves RCB teammates in splits

Watch: Virat Kohli's cheeky 'your wife' remark to Dinesh Karthik leaves RCB teammates in splits ![submenu-img]() DC vs SRH IPL 2024 Dream11 prediction: Fantasy cricket tips for Delhi Capitals vs Sunrisers Hyderabad

DC vs SRH IPL 2024 Dream11 prediction: Fantasy cricket tips for Delhi Capitals vs Sunrisers Hyderabad![submenu-img]() 'Kohli said it's not an option, just...': KL Rahul recalls his IPL debut for RCB in 2013

'Kohli said it's not an option, just...': KL Rahul recalls his IPL debut for RCB in 2013![submenu-img]() Canada's biggest heist: Two Indian-origin men among six arrested for Rs 1300 crore cash, gold theft

Canada's biggest heist: Two Indian-origin men among six arrested for Rs 1300 crore cash, gold theft![submenu-img]() Donuru Ananya Reddy, who secured AIR 3 in UPSC CSE 2023, calls Virat Kohli her inspiration, says…

Donuru Ananya Reddy, who secured AIR 3 in UPSC CSE 2023, calls Virat Kohli her inspiration, says…![submenu-img]() Nestle getting children addicted to sugar, Cerelac contains 3 grams of sugar per serving in India but not in…

Nestle getting children addicted to sugar, Cerelac contains 3 grams of sugar per serving in India but not in…![submenu-img]() Viral video: Woman enters crowded Delhi bus wearing bikini, makes obscene gesture at passenger, watch

Viral video: Woman enters crowded Delhi bus wearing bikini, makes obscene gesture at passenger, watch![submenu-img]() This Swiss Alps wedding outshine Mukesh Ambani's son Anant Ambani's Jamnagar pre-wedding gala

This Swiss Alps wedding outshine Mukesh Ambani's son Anant Ambani's Jamnagar pre-wedding gala

)

)

)

)

)

)

)