The benchmark Sensex today fell 251 points, its biggest drop in six days, to end at 25,062.67 weighed down by losses in ONGC and RIL shares after the government deferred a decision to hike natural gas prices and caution prevailed on the last day of June derivative contracts. Brokers said a sudden gust of selling at the fag-end in realty, banking and metal shares also pulled down indices.

The benchmark Sensex today fell 251 pts, its biggest drop in six days, to end at 25,062.67 weighed down by losses in ONGC and RIL shares after the government deferred a decision to hike natural gas prices and caution prevailed on the last day of June derivative contracts. Brokers said a sudden gust of selling at the fag-end in realty, banking and metal shares also pulled down indices.

The BSE 30-share barometer resumed lower and remained in negative terrain throughout the day before falling sharply at the end to settle at 25,062.67, a net drop of 251.07 points or 0.99 per cent. In six out of last straight seven trading sessions, the Sensex has showed a bearish trend. The index's drop today was its steepest since 274.94-point fall on June 18. Shares of gas producers were at the receiving end after the Cabinet Committee on Economic Affairs last evening postponed a hike in natural gas prices by 3 months and decided comprehensive discussions were necessary on the issue.

"This (postponement of decision) has been taken negatively by the market, as it was contrary to the general expectations," said Rakesh Goyal, Senior Vice President, Bonanza Portfolio. All ten shares from sectoral S&P BSE Oil&Gas index ended with losses between 0.81 pct and 5.89 per cent. Sensex constituents RIL and ONGC contributed almost 150 points to the Sensex fall today

Other Sensex-based counters like HDFC, HDFC Bank, ICICI Bank, Infosys, Tata Motors, SBI, NTPC, Gail India and Coal India too suffered marked losses. Profit-booking on the last day of derivatives contract

also weighed on the market. As markets enter the July series, volatility is expected to remain high on account of the Union Budget, said Sahaj Agrawal, Deputy Vice President- Derivatives Research, Kotak Securities.

"The sentiment today further deteriorated after an update on weak monsoon by IMD," said Jayant Manglik, President-retail distribution, Religare Securities. The broader 50-issue CNX Nifty of the NSE tumbled 76.05

points to end at nearly three-week low of 7,493.20. The Nifty's drop today was its sharpest since 107.80-point loss on June 13.

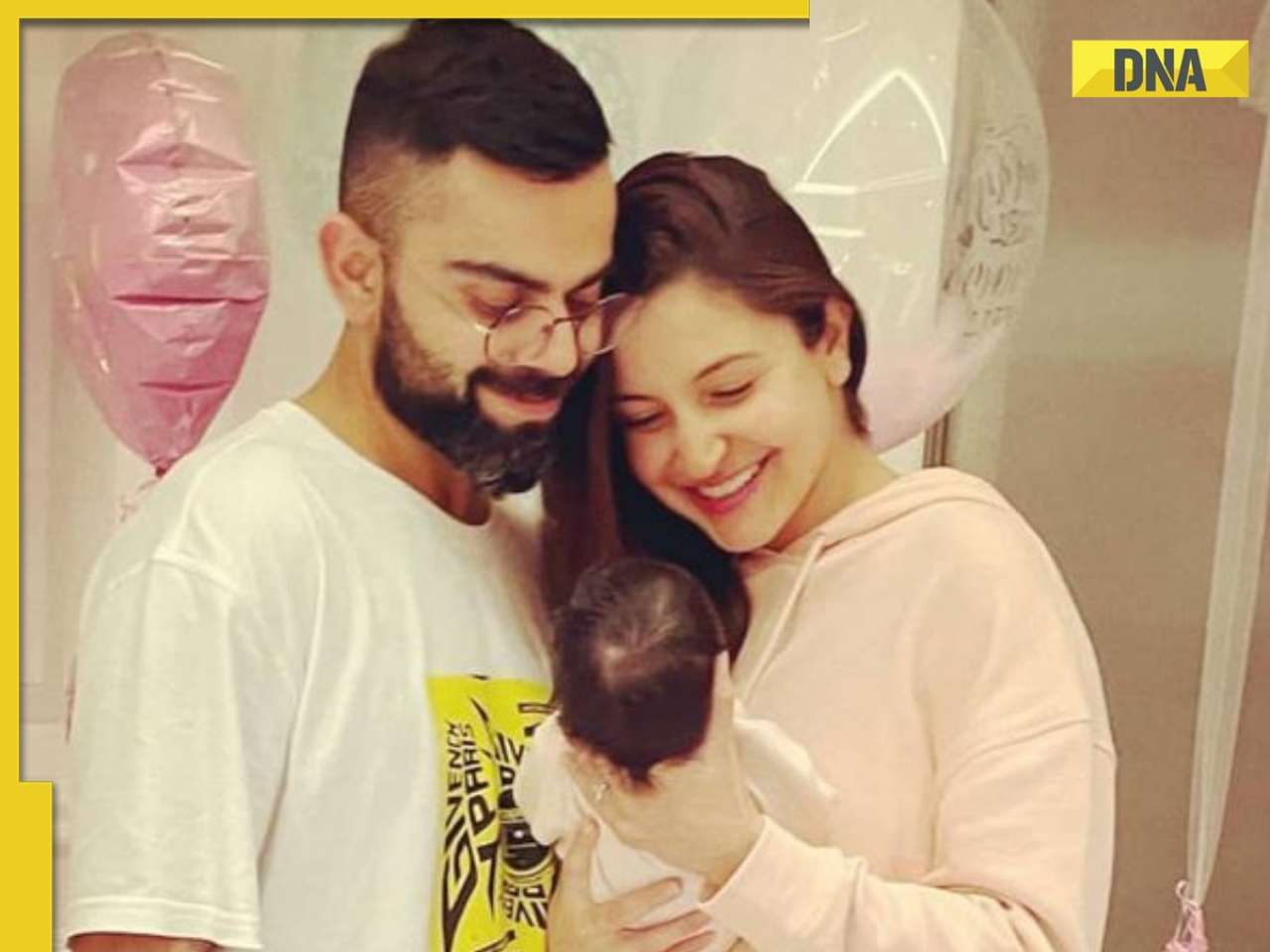

![submenu-img]() Anushka Sharma, Virat Kohli officially reveal newborn son Akaay's face but only to...

Anushka Sharma, Virat Kohli officially reveal newborn son Akaay's face but only to...![submenu-img]() Elon Musk's Tesla to fire more than 14000 employees, preparing company for...

Elon Musk's Tesla to fire more than 14000 employees, preparing company for...![submenu-img]() Meet man, who cracked UPSC exam, then quit IAS officer's post to become monk due to...

Meet man, who cracked UPSC exam, then quit IAS officer's post to become monk due to...![submenu-img]() How Imtiaz Ali failed Amar Singh Chamkila, and why a good film can also be a bad biopic | Opinion

How Imtiaz Ali failed Amar Singh Chamkila, and why a good film can also be a bad biopic | Opinion![submenu-img]() Ola S1 X gets massive price cut, electric scooter price now starts at just Rs…

Ola S1 X gets massive price cut, electric scooter price now starts at just Rs…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding

In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding![submenu-img]() In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month

In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch

Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

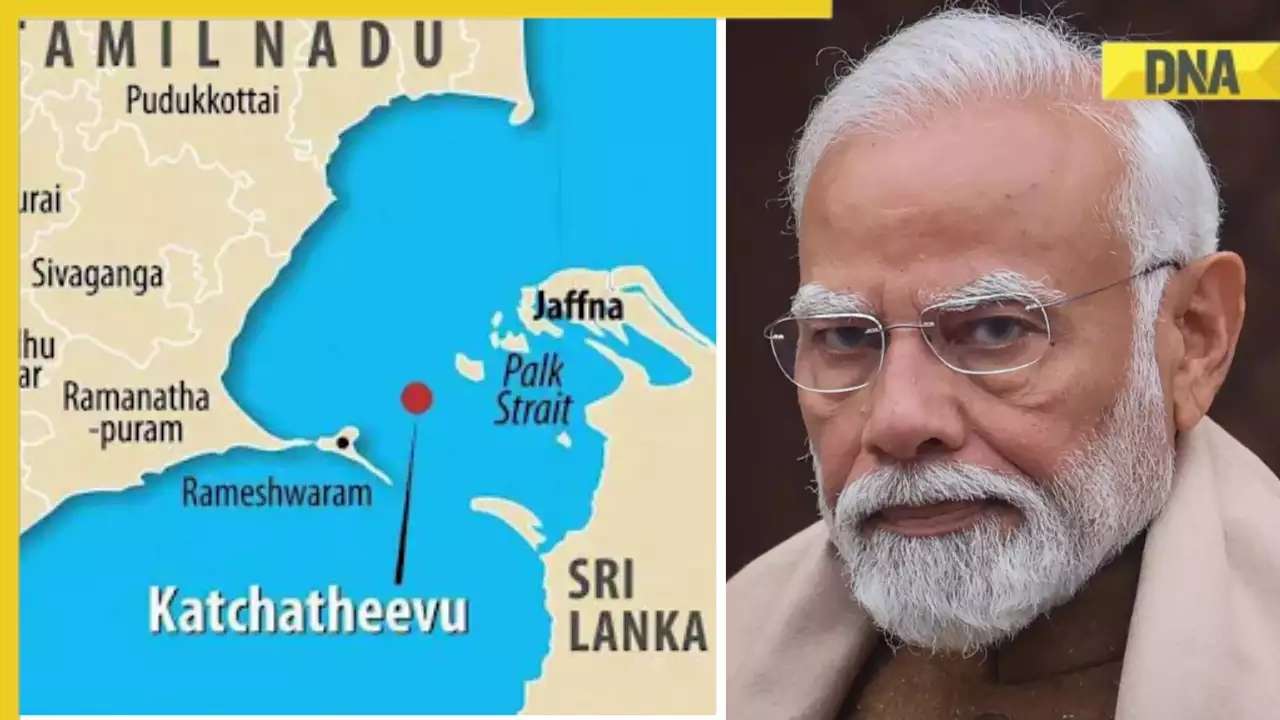

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?

What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?![submenu-img]() Anushka Sharma, Virat Kohli officially reveal newborn son Akaay's face but only to...

Anushka Sharma, Virat Kohli officially reveal newborn son Akaay's face but only to...![submenu-img]() How Imtiaz Ali failed Amar Singh Chamkila, and why a good film can also be a bad biopic | Opinion

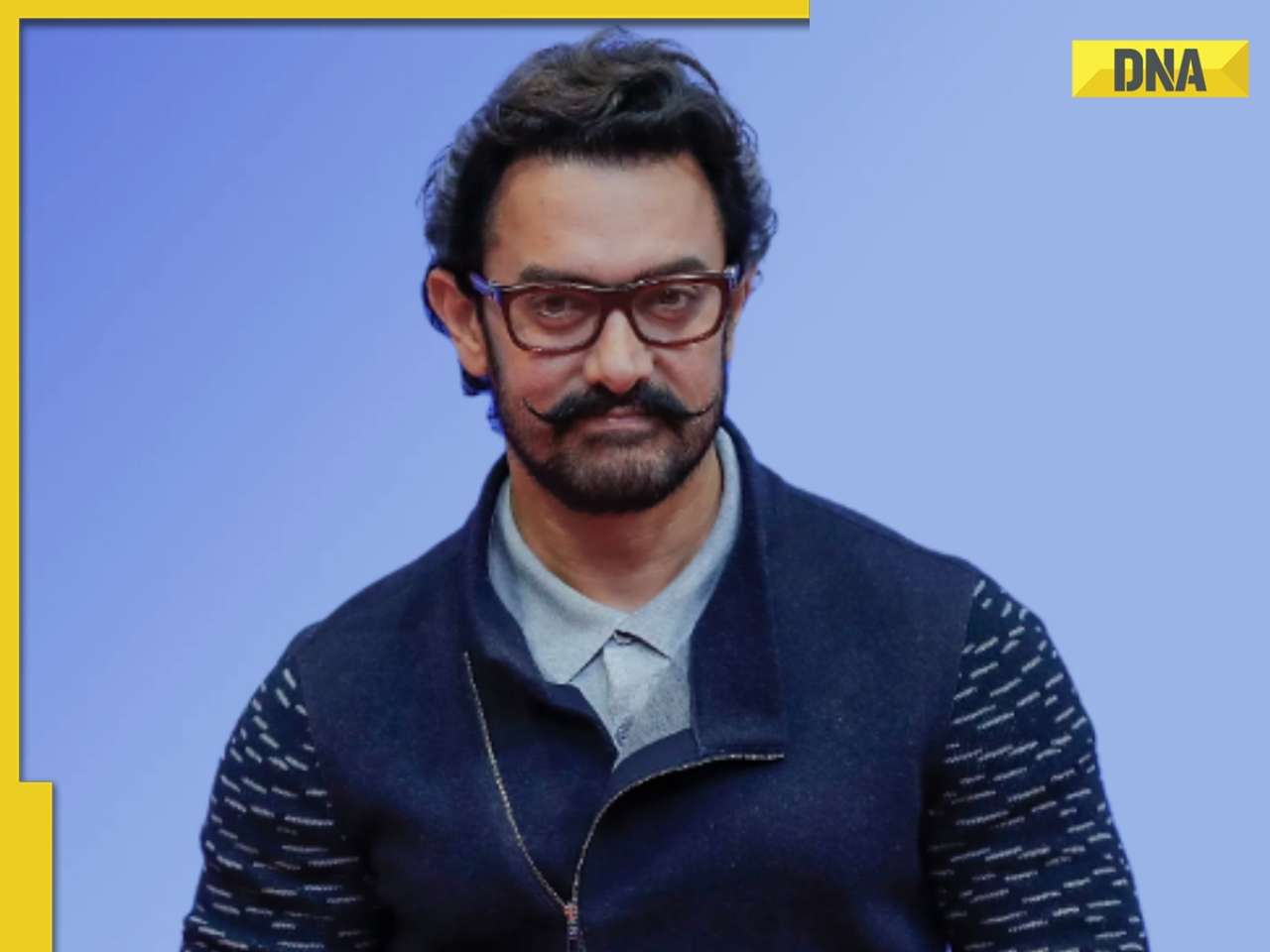

How Imtiaz Ali failed Amar Singh Chamkila, and why a good film can also be a bad biopic | Opinion![submenu-img]() Aamir Khan files FIR after video of him 'promoting particular party' circulates ahead of Lok Sabha elections: 'We are..'

Aamir Khan files FIR after video of him 'promoting particular party' circulates ahead of Lok Sabha elections: 'We are..'![submenu-img]() Henry Cavill and girlfriend Natalie Viscuso expecting their first child together, actor says 'I'm very excited'

Henry Cavill and girlfriend Natalie Viscuso expecting their first child together, actor says 'I'm very excited'![submenu-img]() This actress was thrown out of films, insulted for her looks, now owns private jet, sea-facing bungalow worth Rs...

This actress was thrown out of films, insulted for her looks, now owns private jet, sea-facing bungalow worth Rs...![submenu-img]() IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB

IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB![submenu-img]() KKR vs RR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

KKR vs RR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() KKR vs RR IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Rajasthan Royals

KKR vs RR IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Rajasthan Royals![submenu-img]() RCB vs SRH, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

RCB vs SRH, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() IPL 2024: Rohit Sharma's century goes in vain as CSK beat MI by 20 runs

IPL 2024: Rohit Sharma's century goes in vain as CSK beat MI by 20 runs![submenu-img]() Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home

Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home![submenu-img]() This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...

This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...![submenu-img]() Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video![submenu-img]() iPhone maker Apple warns users in India, other countries of this threat, know alert here

iPhone maker Apple warns users in India, other countries of this threat, know alert here![submenu-img]() Old Digi Yatra app will not work at airports, know how to download new app

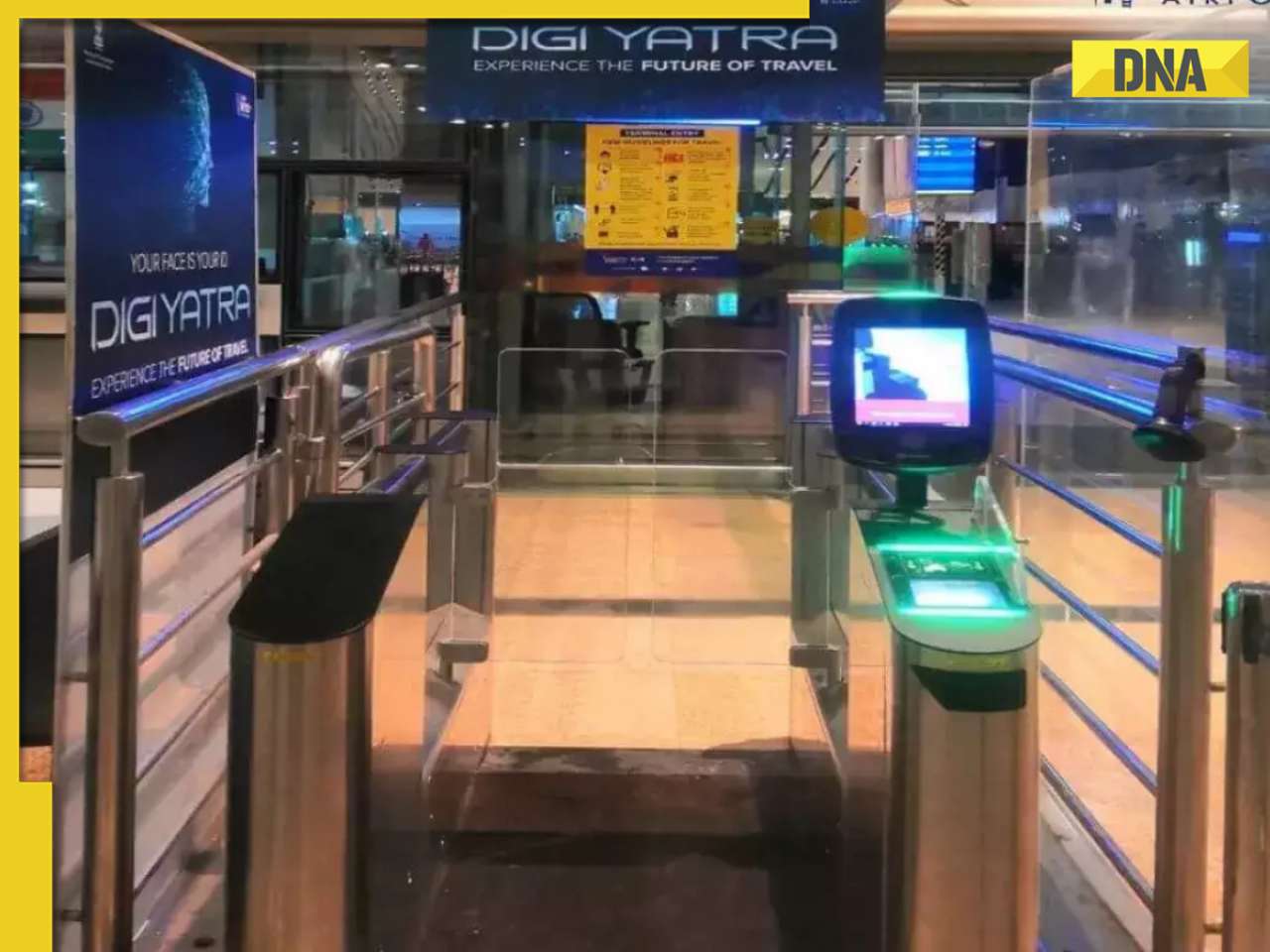

Old Digi Yatra app will not work at airports, know how to download new app

)

)

)

)

)

)

)