It could give some telcos a bloody nose with Rel Jio out to hit them where it hurts.

Telecom companies are all set to battle it out today. This time, though, their warzone is not the market but the auction room.

The largest spectrum auction for over 2,354.55 mega Hertz (MHz) of airwaves in seven bands — 700 MHz, 800 MHz, 900 MHz, 1,800 MHz, 2,100 MHz, 2,300 MHz and 2,500 MHz – worth Rs 5.63 lakh crore at reserve price kicks off today and will go on for more than a week.

And, against the backdrop of the ongoing fourth generation (4G) or data war and muscled players such as Mukesh Ambani's Reliance Jio Infocomm Ltd (RJIL), Vodafone and Bharti Airtel in the fray, industry watchers are expecting one of bloodiest auctions.

A telecom expert, who spoke on condition of anonymity, said Reliance Jio, which skewed the telecom market landscape by announcing free voice service and pricing its 4G Long Term Evolution (LTE) data services at a fraction of what other players were currently offering, could "intentionally" push up airwave prices in many bands to outbid rivals and financially weaken them. He said Reliance Jio, which has spectrum in 850 MHz band and pooled adequate airwaves through an alliance with Reliance Communication (RCom)-Aircel-MTS combine, is not in dire need for more spectrum but it has the intent to make it expensive for others.

"They (Reliance Jio) don't have the need (for more spectrum) but they have the means and intent to make it expensive for other players," he said.

G Krishna Kumar, a Bangalore-based telecom expert, had a contrasting view. He did not see the government being able to garner its target revenue even at the floor price. "I am not expecting a blockbuster auction because of the changed industry dynamics, where spectrum trading and sharing have been allowed and merger and acquisitions (M&As) are happening. With these things in place, the need to acquire spectrum in the auction is not so great," he said. However, Krishna Kumar said the flipside of the same argument was that "the more the spectrum the merrier it is for telcos".

"Because you will always use it (spectrum) for providing additional services," said the telecom expert.

Even the earnest money deposit (EMD), which telecom operators commit upfront to show their seriousness for bidding for the radio waves, does not signal aggressive bidding. The government has collected a total EMD of Rs14,653 crore with Reliance Jio topping the list at Rs 6,500 crore, followed by Vodafone at Rs2,740 crore, Idea at Rs2,000 crore and Airtel at Rs1,980 crore. Tata Teleservices's EMD is Rs 1,000 crore, Reliance Communications' Rs313 crore and Aircel's Rs120 crore.

Since EMD is reportedly around 10% of what a telecom operator can bid for, many experts say it indicates that the revenue generated from the auction may well be below government's expectation.

One frequency band, which will be keenly watched by everyone, is 700 MHz, which is exorbitantly priced at Rs11,485 crore per unit. This band alone can fetch the government Rs4 lakh crore if the entire airwaves put on the block is sold.

Spectrum in 700 MHz band is one of the most efficient in terms of cost as it requires fewer Base Transceiver Stations (BTSs) for rolling out services. Despite its prohibitive pricing, some telcos could be motivated to bid for it. Given below is what could guide the top players to participate in this band.

Vodafone: They look to be serious bidders. Right before the auction, they have announced an investment of $7.2 billion in the domestic market. Telecom industry observers are expecting a large chunk of it to flow into spectrum auction. Its intention to come out with an initial public offer (IPO) some time next year, could also push it to stock up airwaves.

"I am presuming they (Vodafone) will see action because going to IPO without spectrum in 700 MHz band would simply not be viable," said a telecom expert.

One analyst said while the UK-headquartered telco had means, it did not have the need and intent for bidding in the 700 MHz band. A top-level executive of Vodafone, who did not want to be named, told dna the second largest telecom service provider was interested in bidding in several circles.

"Our auction team has put a strategy for the same in place," he said.

Reliance Jio –It doesn't have the need because it has plenty of spectrum in the 850 MHz band but it certainly has the means and it is in its interest to get people to buy 700 MHz spectrum because that will financially weaken its rivals further.

"They (Reliance Jio) don't have the need but they have means and they have the intent to make it expensive for other players. But they will be playing a very risky game because you end up actually buying (the spectrum)," said a telecom analyst.

Idea Cellular – It has the need but doesn't have adequate means. So, it's hard to guess know how they will play.

Bharti Airtel – It has the means but the least need for spectrum among all operators. "They already have enough spectrum. Although, 700 MHz is much better than the 900 MHz and 1800 MHz spectrum. The question is if they can make do without it (700 MHz). The answer is yes. Can they make do without it in this round? Again, the answer is yes. Will they need it sometime later? The answer is yes. So, they can afford to sit it out in this auction," said the same analyst.

According to him, the only two players who desperately need spectrum, come what may, are Tata Tele and Idea; "For Tata's a lot of spectrum is expiring soon".

The Department of Telecom (DoT) has come out with easier and more bidder-friendly norm to make the auction a huge success. The telcos will have rights over the airwaves won in the auction for 20 years. It has offered easier payment mode by staggering the instalments over a longer period and snipped interest rate to 9.3% this year against 10% in 2015. It has also reduced the lock-in period of equity in the company to one year instead of the earlier stipulation of a minimum period of three years or completion of roll out obligation, whichever is later.

In this year's Union budget, finance minister Arun Jaitley has estimated a revenue of Rs 98,995 crore from communication services. This includes proceeds from the auction, fees and other charges levied by the telecom department.

![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

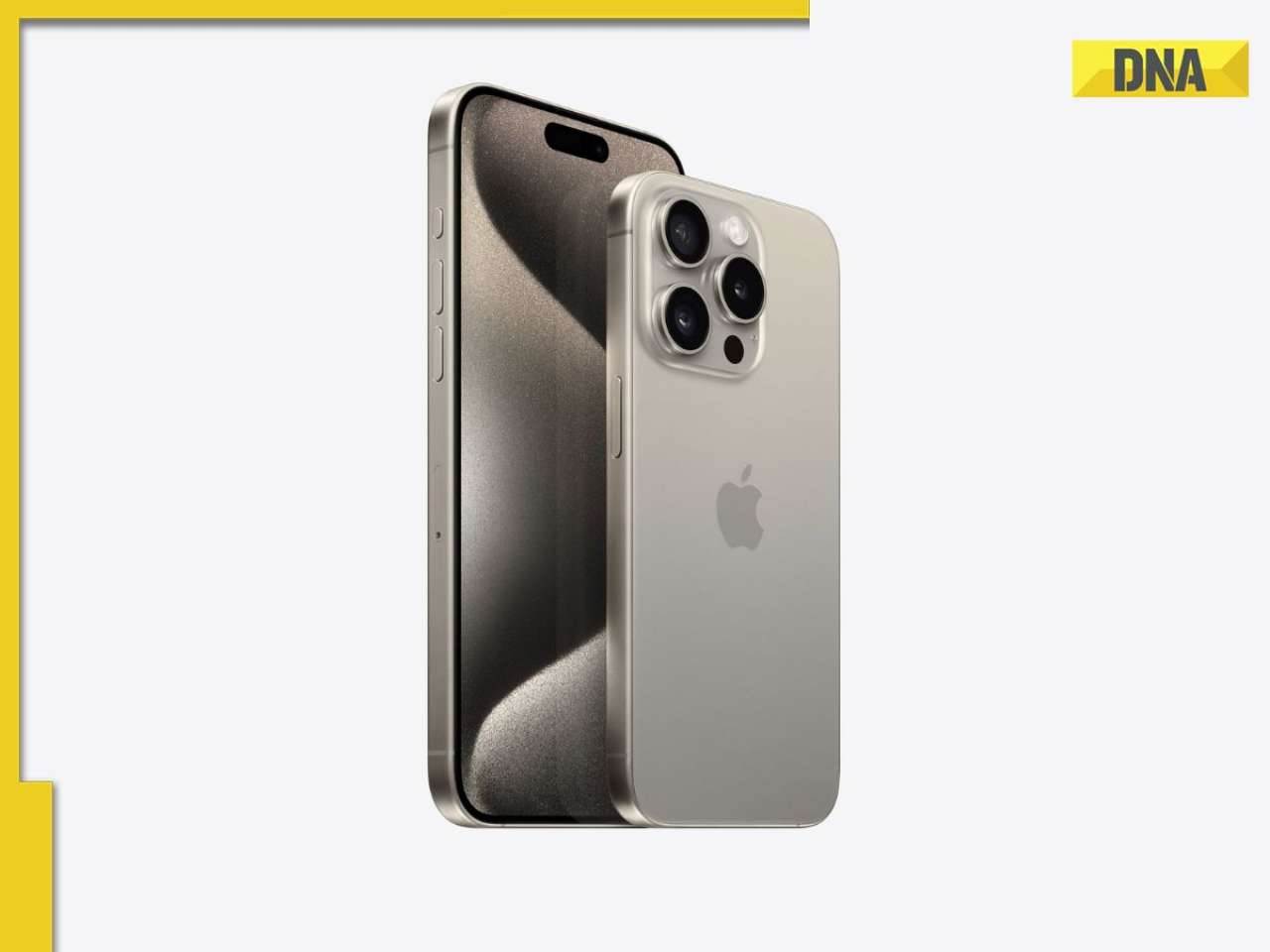

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() Apple iPhone camera module may now be assembled in India, plans to cut…

Apple iPhone camera module may now be assembled in India, plans to cut…![submenu-img]() HOYA Vision Care launches new hi-vision Meiryo coating

HOYA Vision Care launches new hi-vision Meiryo coating![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding

In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding![submenu-img]() In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month

In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch

Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?

What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans

Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans![submenu-img]() Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive

Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive![submenu-img]() Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now...

Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now... ![submenu-img]() IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR

IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR![submenu-img]() GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals

GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals![submenu-img]() 'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash

'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash![submenu-img]() IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB

IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here

Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here![submenu-img]() Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home

Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home![submenu-img]() This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...

This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...![submenu-img]() Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

)

)

)

)

)

)

)