Financial awareness, and not tax incentives, is required to bring in more investors into the capital markets, SEBI Chairman Ajay Tyagi today said.

Financial awareness, and not tax incentives, is required to bring in more investors into the capital markets, SEBI Chairman Ajay Tyagi today said.

"People should be (financially) aware. To take everyone along and to help them understand the potential of the market is a big task," he said.

Tyagi was speaking at a function organised at the National Institute of Securities Markets (NISM) campus at Patalganga near Navi Mumbai.

"Some people say to get people invest into capital markets, there should be some support in terms of tax. I don't support this," he added.

Noting that it is crucial to spread financial literacy across the country, the senior IAS officer said, "India is a huge country and if there is participation only from some areas then something is not correct."

He said people across the country should invest in the capital markets, and not just those from Mumbai and Ahmedabad.

Pointing to a SEBI survey where investors thought derivatives are a safer instrument than bonds, the SEBI chief said the finding was disturbing.

"The capital market are booming but if only some people participate in them, then it is unfair and wrong," said Tyagi, who took over as the SEBI chairman last month.

The function was organised to felicitate the winners of National Financial Literacy Assessment Tests (NFLAT).

NFLAT is conducted across the country for school students. So far, nearly five lakh students have taken the NFLAT since its inception and close to 4,000 schools have participated in the tests.

The Sebi chief today announced that NFLAT, held under the aegis of National Centre for Financial Education (NCFE), would be available through out the year.

He said financial literacy has become important in the present-day context with many products available for investors and some of them becoming increasingly complex.

"Financial education and awareness help individuals do planning to achieve their financial goals, understand the risks involved in various financial products, ultimately contributing to their financial well-being," Tyagi said.

Financial awareness also helps investors keep away from ponzi schemes (which promise very high return on investment), he said.

Besides, financial education has become even more important due to increase in digital transactions post- demonetisation, the SEBI chief said.

Numerous apps and alternative instruments for investors have come up. It is extremely important to keep pace with these developments in order to reap the benefits of technology, Tyagi said.

(This article has not been edited by DNA's editorial team and is auto-generated from an agency feed.)

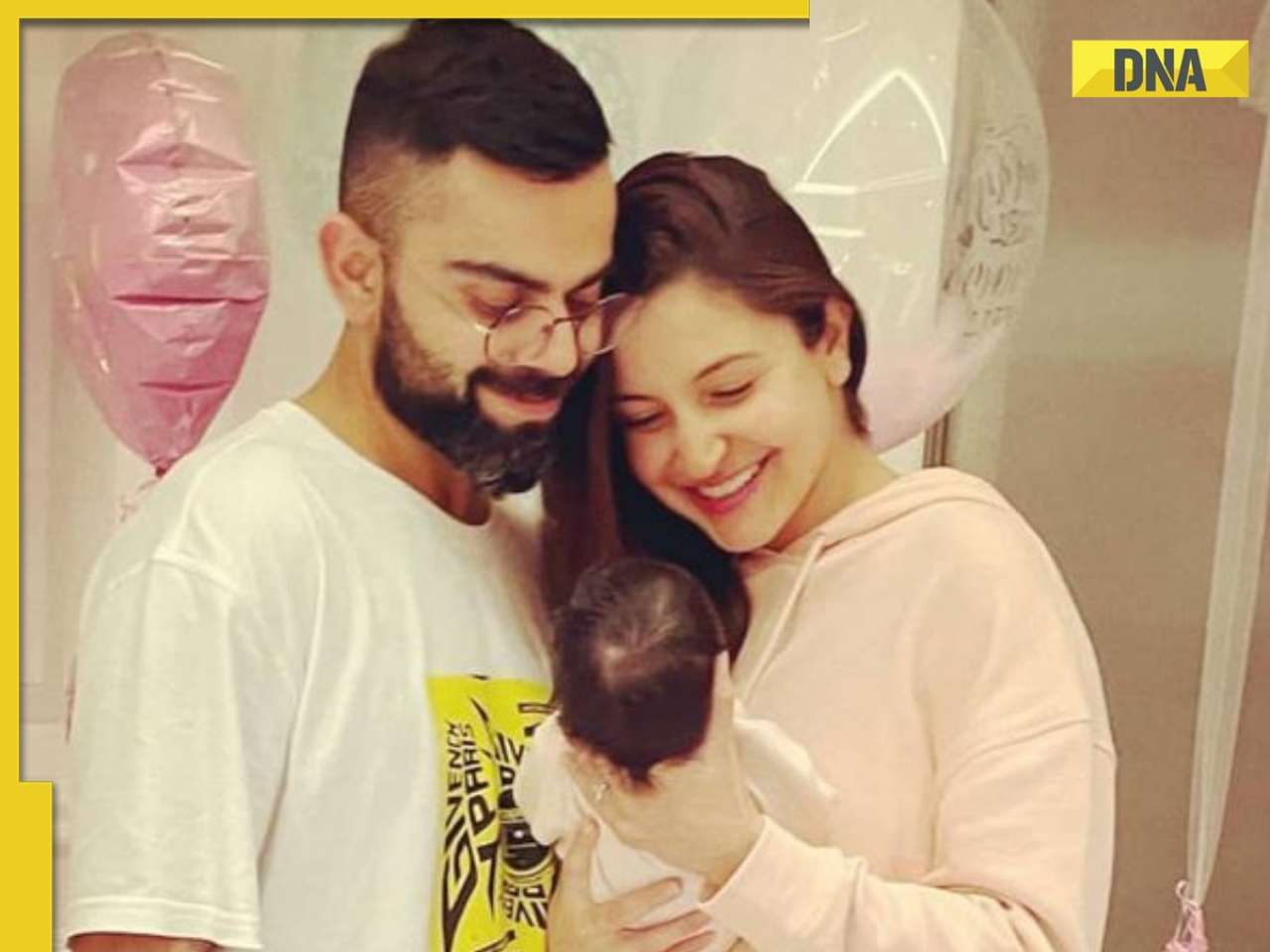

![submenu-img]() Anushka Sharma, Virat Kohli officially reveal newborn son Akaay's face but only to...

Anushka Sharma, Virat Kohli officially reveal newborn son Akaay's face but only to...![submenu-img]() Elon Musk's Tesla to fire more than 14000 employees, preparing company for...

Elon Musk's Tesla to fire more than 14000 employees, preparing company for...![submenu-img]() Meet man, who cracked UPSC exam, then quit IAS officer's post to become monk due to...

Meet man, who cracked UPSC exam, then quit IAS officer's post to become monk due to...![submenu-img]() How Imtiaz Ali failed Amar Singh Chamkila, and why a good film can also be a bad biopic | Opinion

How Imtiaz Ali failed Amar Singh Chamkila, and why a good film can also be a bad biopic | Opinion![submenu-img]() Ola S1 X gets massive price cut, electric scooter price now starts at just Rs…

Ola S1 X gets massive price cut, electric scooter price now starts at just Rs…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding

In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding![submenu-img]() In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month

In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch

Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

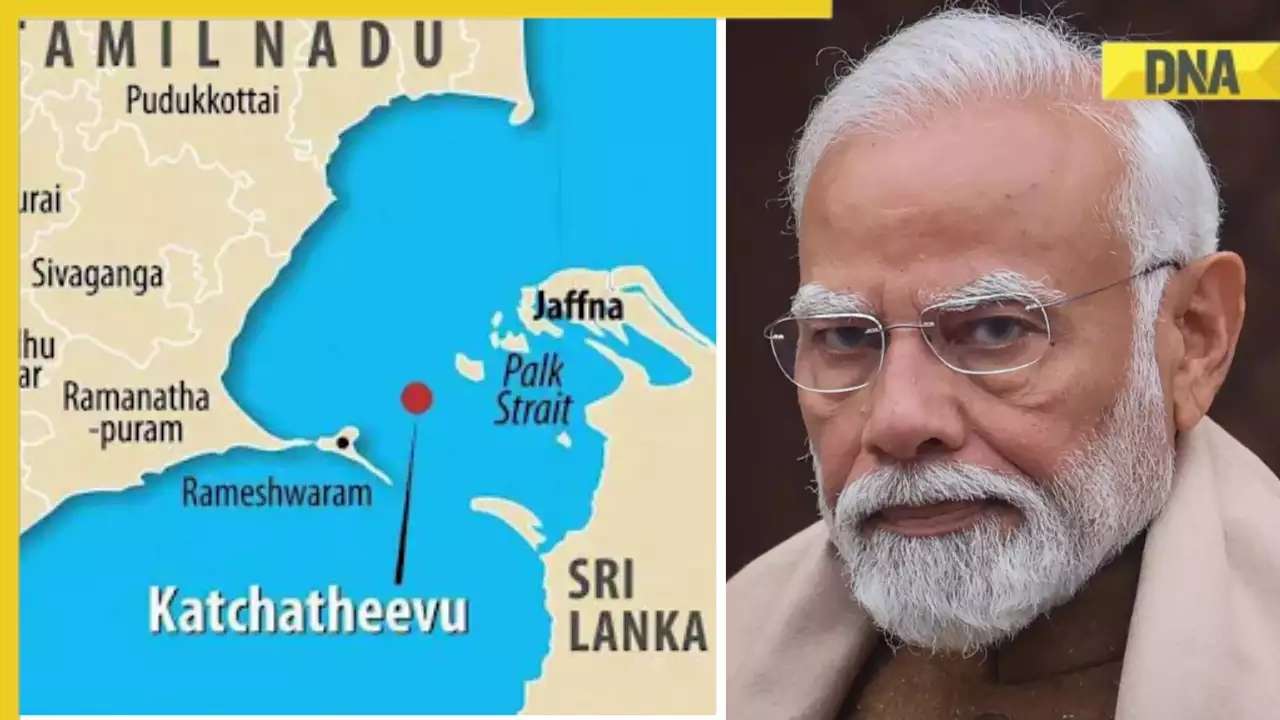

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?

What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?![submenu-img]() Anushka Sharma, Virat Kohli officially reveal newborn son Akaay's face but only to...

Anushka Sharma, Virat Kohli officially reveal newborn son Akaay's face but only to...![submenu-img]() How Imtiaz Ali failed Amar Singh Chamkila, and why a good film can also be a bad biopic | Opinion

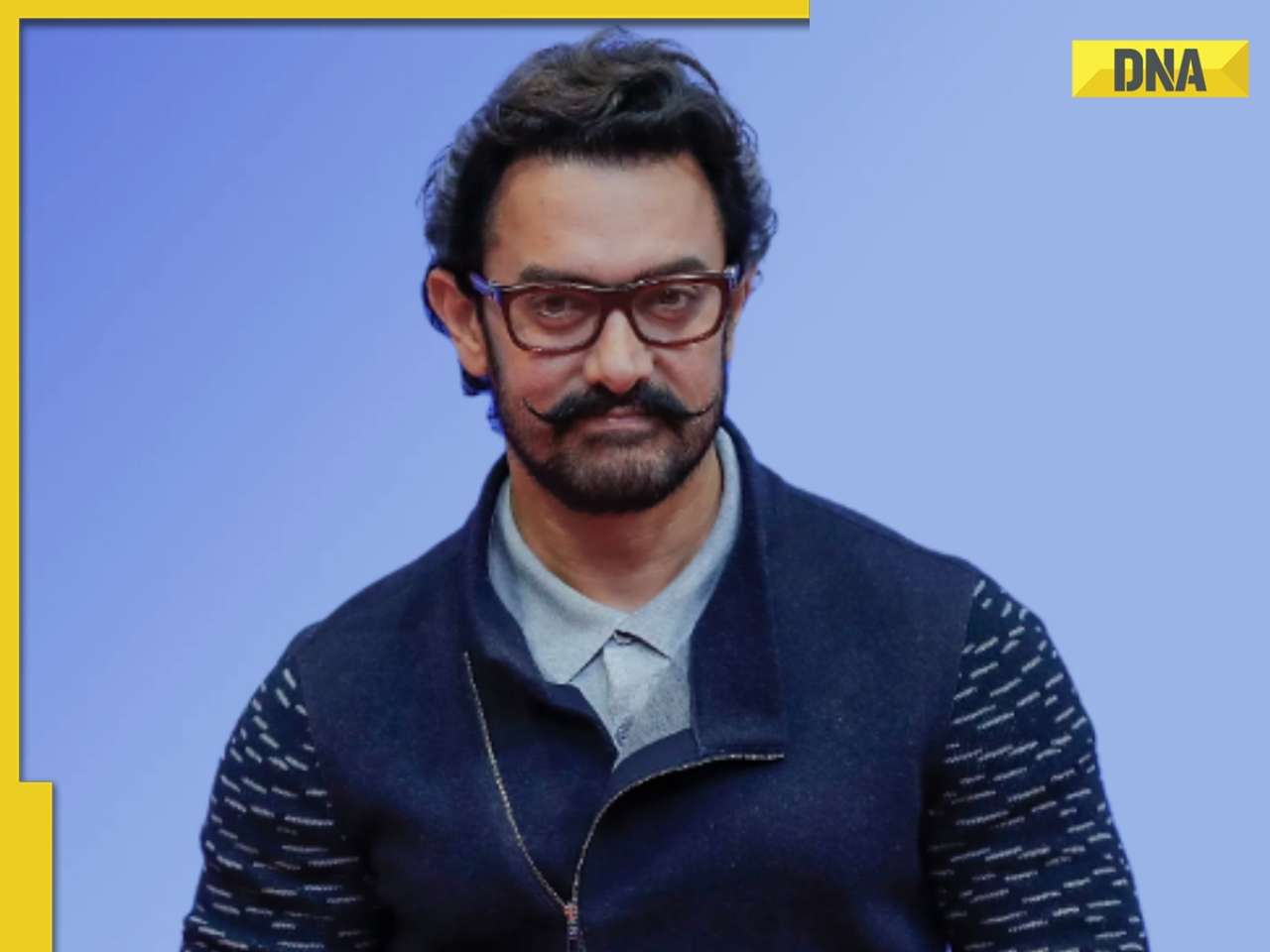

How Imtiaz Ali failed Amar Singh Chamkila, and why a good film can also be a bad biopic | Opinion![submenu-img]() Aamir Khan files FIR after video of him 'promoting particular party' circulates ahead of Lok Sabha elections: 'We are..'

Aamir Khan files FIR after video of him 'promoting particular party' circulates ahead of Lok Sabha elections: 'We are..'![submenu-img]() Henry Cavill and girlfriend Natalie Viscuso expecting their first child together, actor says 'I'm very excited'

Henry Cavill and girlfriend Natalie Viscuso expecting their first child together, actor says 'I'm very excited'![submenu-img]() This actress was thrown out of films, insulted for her looks, now owns private jet, sea-facing bungalow worth Rs...

This actress was thrown out of films, insulted for her looks, now owns private jet, sea-facing bungalow worth Rs...![submenu-img]() IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB

IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB![submenu-img]() KKR vs RR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

KKR vs RR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() KKR vs RR IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Rajasthan Royals

KKR vs RR IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Rajasthan Royals![submenu-img]() RCB vs SRH, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

RCB vs SRH, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() IPL 2024: Rohit Sharma's century goes in vain as CSK beat MI by 20 runs

IPL 2024: Rohit Sharma's century goes in vain as CSK beat MI by 20 runs![submenu-img]() Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home

Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home![submenu-img]() This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...

This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...![submenu-img]() Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video![submenu-img]() iPhone maker Apple warns users in India, other countries of this threat, know alert here

iPhone maker Apple warns users in India, other countries of this threat, know alert here![submenu-img]() Old Digi Yatra app will not work at airports, know how to download new app

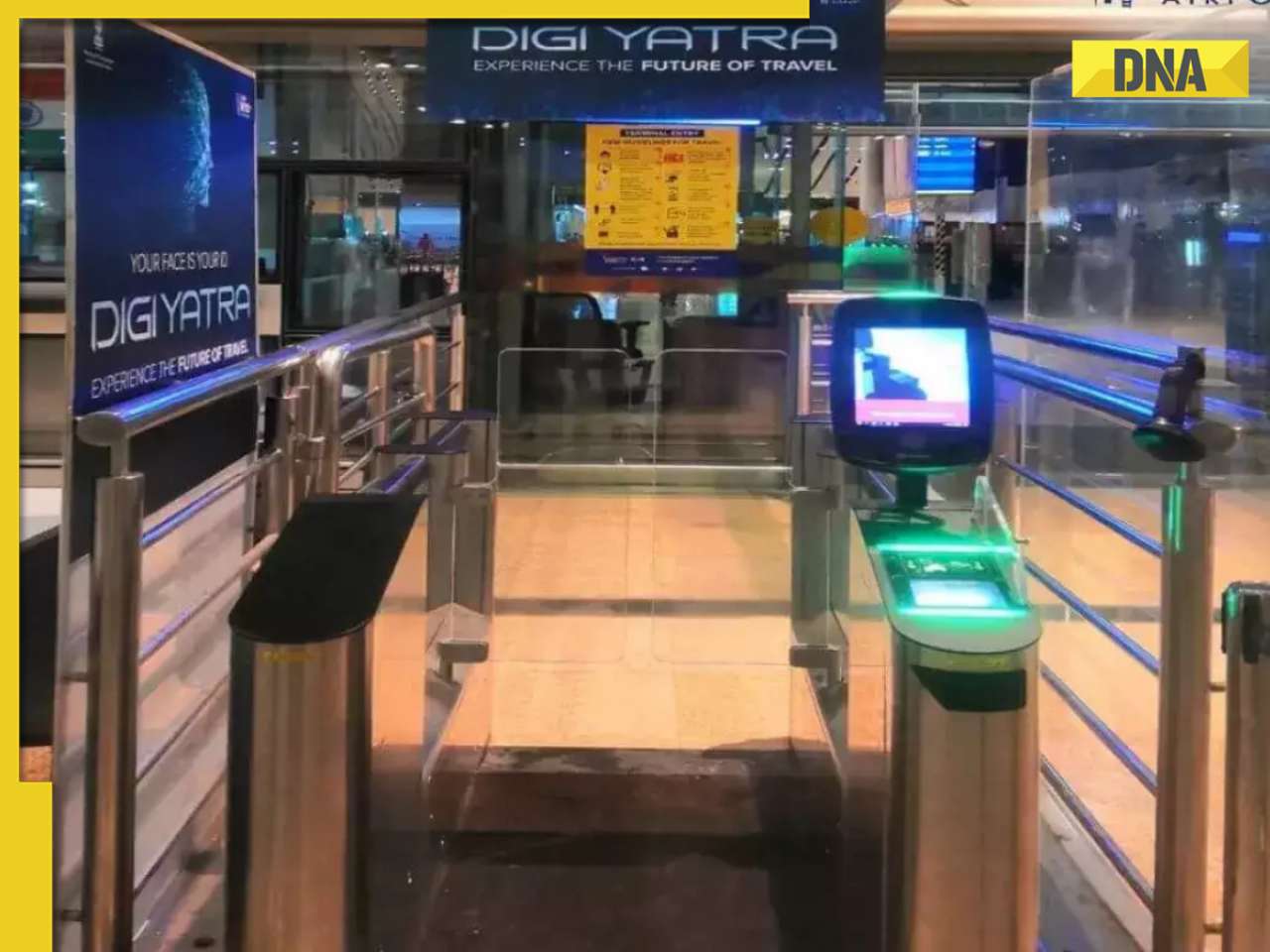

Old Digi Yatra app will not work at airports, know how to download new app

)

)

)

)

)

)