Indicating a sharp improvement for the second consecutive quarter, the CII Business Confidence Index (CII-BCI) for July-Sept quarter FY15 has shot up to 57.4, up from 53.7 in April-June quarter and 49.9 in Jan-March quarter this year. During the same quarter last fiscal, the index had touched the all-time low value of 45.7. The number 50 is the dividing line on the index between positive and weak business confidence.

Commenting on the upward march in the value of index, Chandrajit Banerjee, Director General of CII, said "The determination shown by the new government at the Center to provide an impetus to growth along with reviving the 'feel good' factor has sent the business confidence index soaring for the second quarter in a row. In order to capitalize on the early signs of improving business sentiments, we must ensure that this momentum is maintained going forward."

The 88th Business Outlook Survey is based on responses from over 150 industry members. Majority of the respondents (44 %) belong to large-scale sector, while medium scale companies comprise another 12%. Around 38% and 6% respectively are from the small-scale and micro firms. Further, 60% of the respondents are from manufacturing and 36% are from the services sector.

The highest percentage (41%) of respondents expected GDP in the current fiscal to expand by 5.0-5.5%, up from sub-5% growth witnessed in the last two years. In fact, 30% respondents expected GDP to grow in a range of 5.5-6.0% in FY15, which indicates that 6% growth is within reach this year. We have already started this financial year on an impressive note with the first quarter GDP recording a growth of 5.7%, up from 4.6% in the previous quarter.

WPI Inflation is expected to average 5.5-6.5% in FY15, which is slightly on a higher side considering the likelihood of a sub-normal monsoon this year. "The management of inflationary expectations through supply-side measures would hold the key for ensuring continued momentum of economic revival.

The expectation of higher economic growth in the current fiscal is rooted in optimism about the overall demand situation. A significant 77% of the respondents expected their sales to increase in the July-Sep quarter, much higher than 50% respondents in the previous quarter. Similarly, 49 % of the respondents expected their export orders to increase in July-Sep quarter compared to 39% respondents in the previous quarter. The revival in domestic and global demand has resulted in a majority (46 %) of the surveyed businesses contemplating new investment in the July-Sep quarter, whereas only 10% expected contraction. This indicates that economic recovery is sustainable, provided we maintain the demand momentum, where the monetary stance by the Central Bank will play a crucial role.

The businesses, besides undertaking new investments, have started experiencing a rise in capacity utilization. Nearly half (49.5 %) of the respondent firms expected their capacity utilization to exceed 75% in July-Sep quarter of FY15, up from 34% respondents in the previous quarter, which augurs well for the turnaround of the economy. CII survey has observed a sharp decline in the percentage of respondents reporting increase in inputs costs related to raw materials, energy and employees in the Jul-Sep quarter as compared to the previous quarter, which is in line with the official data specifying the current moderation in inflation rate.

Expectation of recovery in sales, coupled with sharp decline in input costs, has led to a rise in percentage of respondents expecting an increase in profits after tax (PAT) in the July-Sept quarter to 40% as against 36% in the previous quarter. On the other hand, the percentage of respondents reporting a decline in PAT between the two periods declined from 30% to 20%.

A slow pick up in global demand, high inflation and rising borrowing costs are cited to be the top three concerns of the respondents. "While we can do little about addressing the global slowdown concern, all policy options must be explored to tackle the problem of inflation and high borrowing cost. At a time when economic recovery needs to be strengthened, the ideal policy instrument would be to manage inflation through supply-side measures, and make a direct intervention to reduce borrowing costs", added Banerjee.

![submenu-img]() Meet Gautam Adani’s ‘right hand’, used to work as teacher, he’s now Rs 1600000 crore…

Meet Gautam Adani’s ‘right hand’, used to work as teacher, he’s now Rs 1600000 crore…![submenu-img]() Meet actor who worked with Amitabh Bachchan, Aishwarya Rai, entered films because of a bus conductor, is now India's..

Meet actor who worked with Amitabh Bachchan, Aishwarya Rai, entered films because of a bus conductor, is now India's..![submenu-img]() Meet Bollywood star, who was a tourist guide, married 4 times, went bankrupt, his son died by suicide, then...

Meet Bollywood star, who was a tourist guide, married 4 times, went bankrupt, his son died by suicide, then...![submenu-img]() This actor made Sharmila Tagore forget her lines, once did film for Rs 100, could never be a superstar because..

This actor made Sharmila Tagore forget her lines, once did film for Rs 100, could never be a superstar because..![submenu-img]() Volkswagen Taigun GT Line, Taigun GT Plus launched in India, price starts at Rs 14.08 lakh

Volkswagen Taigun GT Line, Taigun GT Plus launched in India, price starts at Rs 14.08 lakh![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Abhishek Sharma? Hrithik Roshan's brother from Kaho Naa Pyaar Hai has become TV star, is married to..

Remember Abhishek Sharma? Hrithik Roshan's brother from Kaho Naa Pyaar Hai has become TV star, is married to..![submenu-img]() Remember Ali Haji? Aamir Khan, Kajol's son in Fanaa, who is now director, writer; here's how charming he looks now

Remember Ali Haji? Aamir Khan, Kajol's son in Fanaa, who is now director, writer; here's how charming he looks now![submenu-img]() Remember Sana Saeed? SRK's daughter in Kuch Kuch Hota Hai, here's how she looks after 26 years, she's dating..

Remember Sana Saeed? SRK's daughter in Kuch Kuch Hota Hai, here's how she looks after 26 years, she's dating..![submenu-img]() In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding

In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding![submenu-img]() In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month

In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() Meet actor who worked with Amitabh Bachchan, Aishwarya Rai, entered films because of a bus conductor, is now India's..

Meet actor who worked with Amitabh Bachchan, Aishwarya Rai, entered films because of a bus conductor, is now India's..![submenu-img]() Meet Bollywood star, who was a tourist guide, married 4 times, went bankrupt, his son died by suicide, then...

Meet Bollywood star, who was a tourist guide, married 4 times, went bankrupt, his son died by suicide, then...![submenu-img]() This actor made Sharmila Tagore forget her lines, once did film for Rs 100, could never be a superstar because..

This actor made Sharmila Tagore forget her lines, once did film for Rs 100, could never be a superstar because..![submenu-img]() Mumtaz urges to lift ban on Pakistani artistes in Bollywood: ‘Woh log hum logon se...'

Mumtaz urges to lift ban on Pakistani artistes in Bollywood: ‘Woh log hum logon se...'![submenu-img]() Not Kiara Advani, but this actress was first choice opposite Shahid Kapoor in Kabir Singh, she rejected because...

Not Kiara Advani, but this actress was first choice opposite Shahid Kapoor in Kabir Singh, she rejected because...![submenu-img]() IPL 2024: Yashasvi Jaiswal, Sandeep Sharma guide Rajasthan Royals to 9-wicket win over Mumbai Indians

IPL 2024: Yashasvi Jaiswal, Sandeep Sharma guide Rajasthan Royals to 9-wicket win over Mumbai Indians![submenu-img]() IPL 2024: How can RCB still qualify for playoffs after 1-run loss against KKR?

IPL 2024: How can RCB still qualify for playoffs after 1-run loss against KKR?![submenu-img]() CSK vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

CSK vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() RR vs MI: Yuzvendra Chahal scripts history, becomes first bowler to achieve this massive milestone in IPL

RR vs MI: Yuzvendra Chahal scripts history, becomes first bowler to achieve this massive milestone in IPL![submenu-img]() 'Yeh toh second tier ki bhi team nhi': Ramiz Raja slams Babar Azam and co. after 3rd T20I loss vs New Zealand

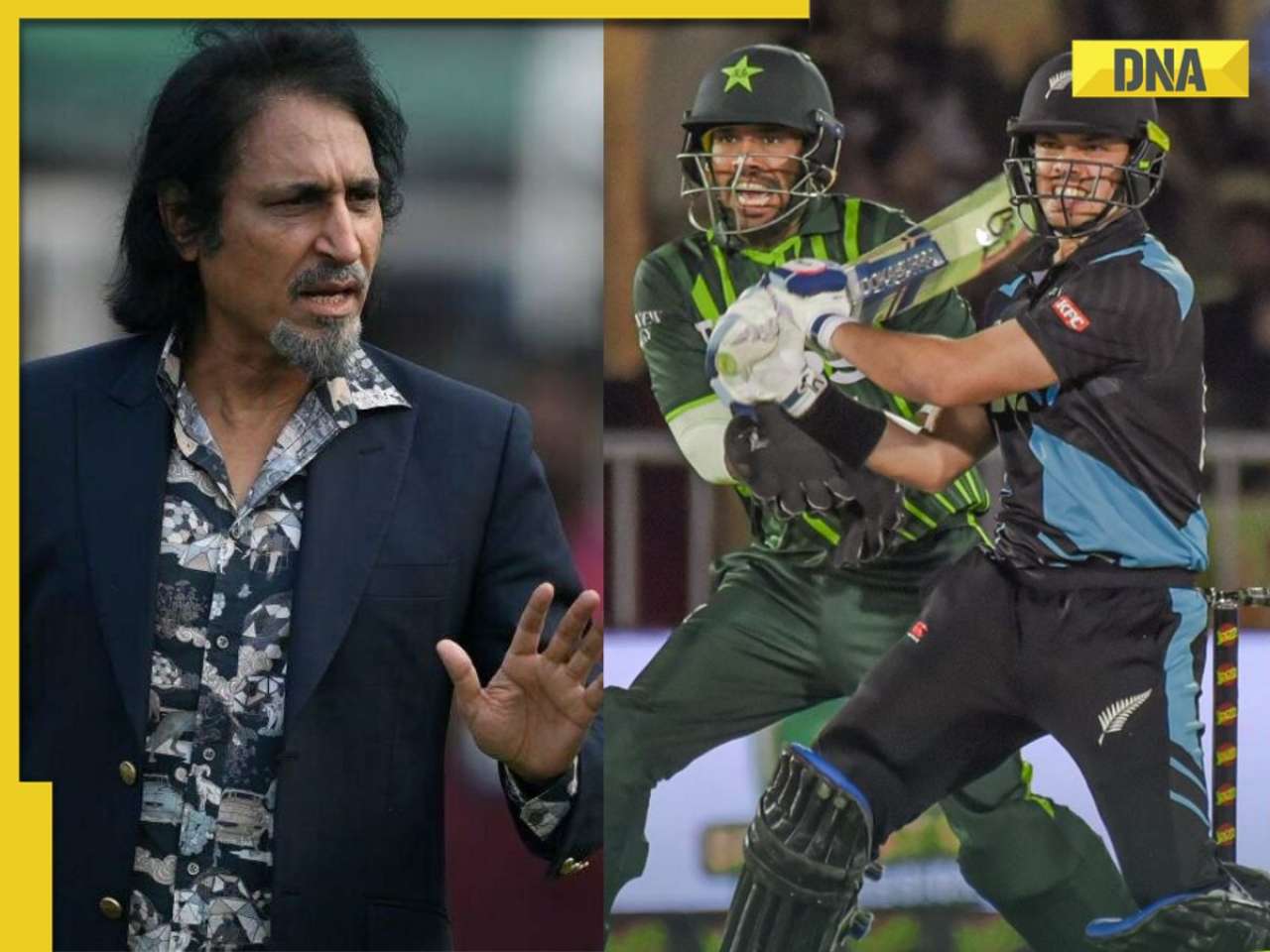

'Yeh toh second tier ki bhi team nhi': Ramiz Raja slams Babar Azam and co. after 3rd T20I loss vs New Zealand![submenu-img]() Mukesh Ambani's son Anant Ambani likely to get married to Radhika Merchant in July at…

Mukesh Ambani's son Anant Ambani likely to get married to Radhika Merchant in July at…![submenu-img]() India's most expensive wedding costs more than weddings of Isha Ambani, Akash Ambani, total money spent was...

India's most expensive wedding costs more than weddings of Isha Ambani, Akash Ambani, total money spent was...![submenu-img]() Meet Indian genius who lost his father at 12, studied at Cambridge, took Rs 1 salary, he is called 'architect of...'

Meet Indian genius who lost his father at 12, studied at Cambridge, took Rs 1 salary, he is called 'architect of...'![submenu-img]() Earth Day 2024: Google Doodle features aerial photos of planet's natural beauty, biodiversity

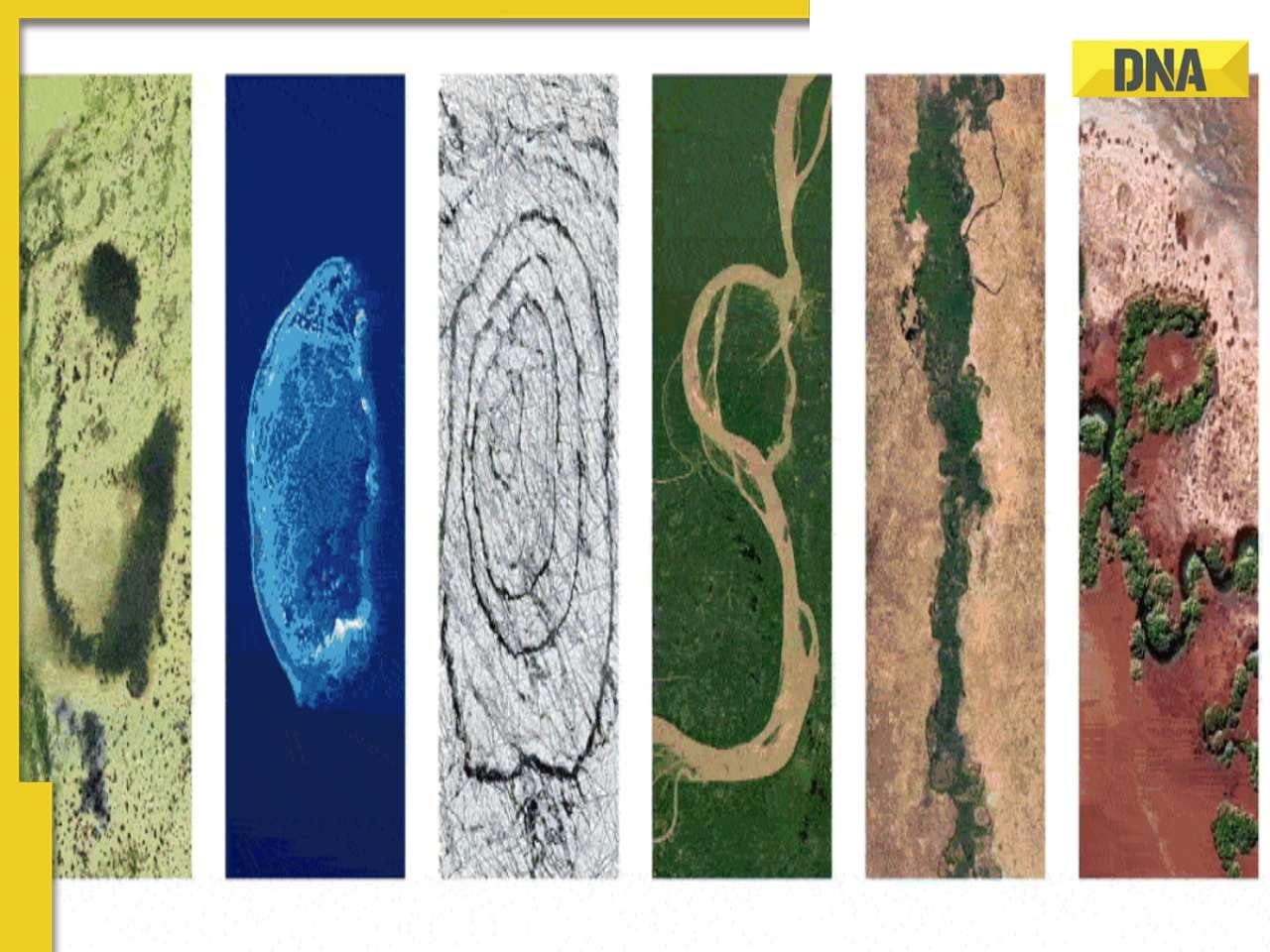

Earth Day 2024: Google Doodle features aerial photos of planet's natural beauty, biodiversity![submenu-img]() Meet India's first billionaire, much richer than Mukesh Ambani, Adani, Ratan Tata, but was called miser due to...

Meet India's first billionaire, much richer than Mukesh Ambani, Adani, Ratan Tata, but was called miser due to...

)

)

)

)

)

)

)