Domestic lenders, however, are trying to sell off the company's assets to recover their unpaid dues

In an unprecedented move, the world's largest investor BlackRock along with Credit Suisse and UBS have stepped in to revive the ailing Rei Agro, till recently the country's largest basmati player even as domestic lenders are trying to sell off the assets to recover their unpaid loans.

New York-based BlackRock with $4.6 trillion worth of assets under management has taken the lead by urging the domestic lenders of Rei Agro to reject the current Corrective Action Plan of the company. It has instead proposed a balance sheet restructuring plan to the lenders that takes into consideration the interest of domestic as well as overseas creditors, according to documents available with dna.

The proposed plan has been worked out by Houlihan Lokey Investment Banking Services on behalf of BlackRock and has been approved by Credit Suisse and UBS, the document said.

"Moreover, foreign lenders are also willing to provide additional funding so that Rei Agro, which is working with lakhs of Indian farmers, can revive its business," an official of the company said.

Troubles for Rei Agro started about a year back when it started defaulting on loans and the promoters, the Jhunjhunwala family, then had initiated a Corrective Action Plan - a nomenclature under Reserve Bank of India guidelines - following directives from its consortium of banks which formed a Joint Lenders Forum to implement it.

Amid lingering crisis in the company, what prompted this sudden interest from BlackRock and other foreign lenders?

While the Indian banking sector has exposure of Rs 5,680 crore worth of stressed loan with the company, foreign investors have a collective stake of Rs 1,800 crore.

BlackRock Investment Management has told the Joint Lenders' Forum in the letter that it is a major investor in Rei Agro, holding 80% of the aggregate $150 million or Rs 662 crore worth of 5.5% Foreign Currency Convertible Bonds and believes the current restructuring plan being implemented by the domestic lenders is unviable.

"We have spent a significant amount of time discussing with the company's domestic and international lenders as well as the promoters over the past eight months and believe that the company's proposed Corrective Action Plan is unviable. As a consequence, Houlihan Lockey and Avista Advisory, on behalf of BackRock, have put together a revised balance sheet restructuring proposal.

"The revised proposal was reviewed by BlackRock and all offshore subsidiaries' creditors (Credit Suisse Syndicate and UBS Syndicate) who collectively hold approximately $285 million (Rs 1,800 crore) in total outstanding debt," the letter by Houlihan Lokey Europe to UCO Bank, which heads the lenders' forum, said.

The revised proposal provides a "sustainable long-term capital structure allowing for increased operational flexibility and transfers majority ownership of the restructured company to existing creditors.

"On this basis, BlackRock and (Rei Agro's) offshore subsidiaries' creditors are willing to enter into a dialogue around a proposal as long as the promoters agrees to bring in capital as part of the deal and work with CDR lenders to finalise a restructuring proposal by March 31," the letter said.

Meanwhile, the domestic lenders are planning to dispose off the company's assets which would effectively put to rest any chances of revival.

Indian Overseas Bank has just given an ultimatum to Rei Argo asking it to pay within 2 months, failing which it would sell assets including the land and plant at Rewari in Haryana..

Apart from Indian Overseas Bank, which has an exposure of Rs 470 crore, UCO Bank (Rs 850 crore), Jammu and Kashmir Bank (Rs 650 crore), United Bank of India (Rs 215 crore) and Dena Bank (Rs 100 crore) are other domestic lenders to Rei Agro.

![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

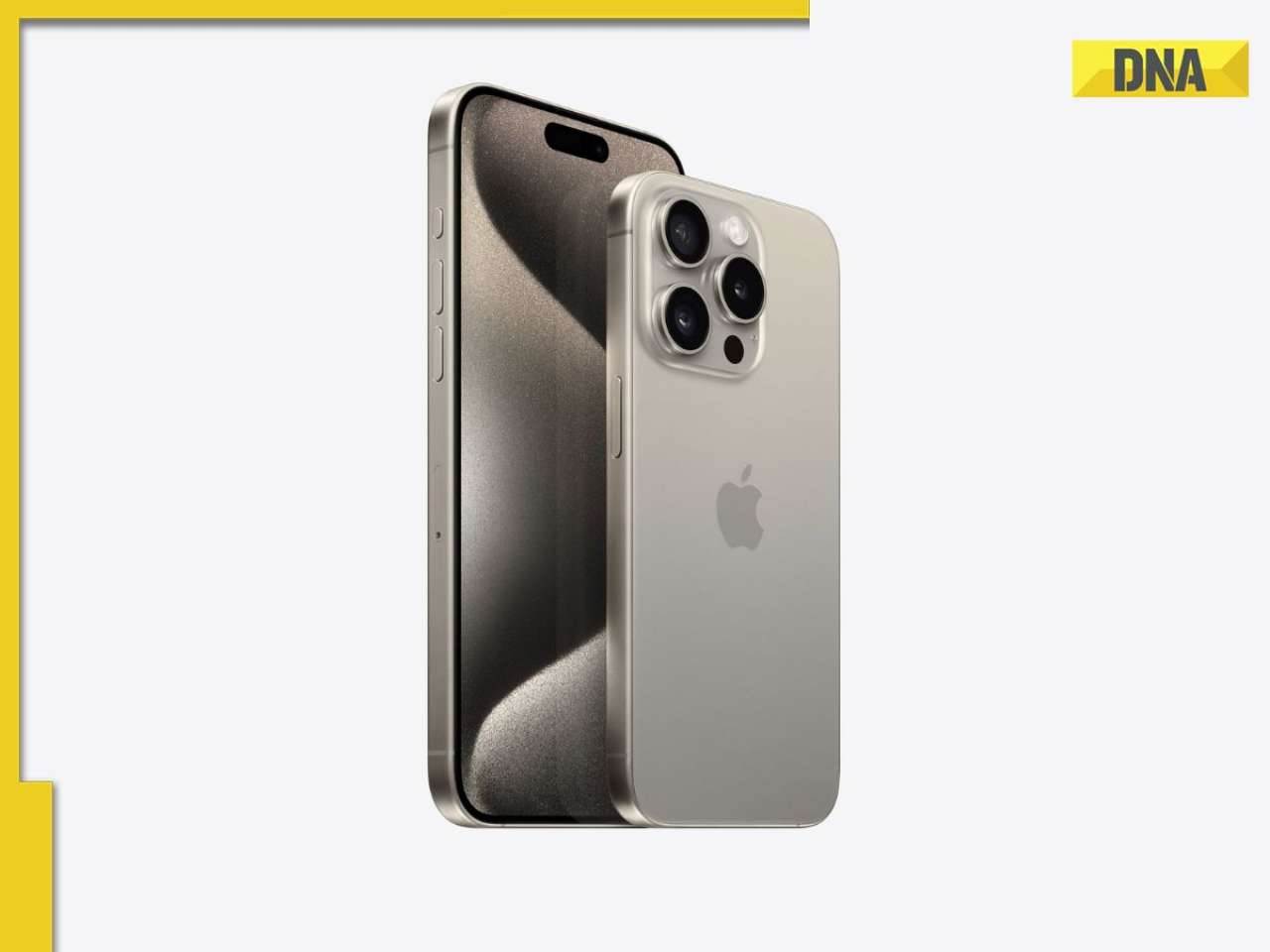

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() Apple iPhone camera module may now be assembled in India, plans to cut…

Apple iPhone camera module may now be assembled in India, plans to cut…![submenu-img]() HOYA Vision Care launches new hi-vision Meiryo coating

HOYA Vision Care launches new hi-vision Meiryo coating![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding

In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding![submenu-img]() In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month

In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch

Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?

What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans

Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans![submenu-img]() Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive

Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive![submenu-img]() Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now...

Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now... ![submenu-img]() IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR

IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR![submenu-img]() GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals

GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals![submenu-img]() 'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash

'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash![submenu-img]() IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB

IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here

Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here![submenu-img]() Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home

Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home![submenu-img]() This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...

This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...![submenu-img]() Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

)

)

)

)

)

)