From his stern message to defaulters to doing what he does, here are 6 times he proved that he is king of Dalal Street.

Raghuram Rajan, Governor, Reserve Bank of India turned 53 on Wednesday. Rajan came to India as a rescue machine at a time when the country was suffering from a financial crisis— markets were tanking and the rupee had suffered a steep drop. Since then, he has worked hard to keep the currency in the pink of health.

From his stern message to defaulters to doing what he does, here are 6 reasons why Rajan is absolutely worth celebrating

1. "My name is Raghuram Rajan and I do what I do"

When Raghuram Rajan says "I do what I do", he means every word of it. Last September, Rajan surprised everyone when he cut repo rate by 50 basis points which brought it down to 6.75% and he clarified, "We are not throwing Diwali bonus".

When people asked him about being hawkish on his policy stance, he said, "I don't know what you want to call me... Santa Claus. you want to call me hawk, I don't know. I don't go by this. My name is Raghuram Rajan and I do what I do."

On Tuesday, even as most industry stakeholders were vying for the last rate cut from the sixth monetary policy meet ahead of the budget to give the economy a much-needed push, Rajan kept rates unchanged and tossed the ball in Finance Minister Arun Jaitley's hands. RBI will eye fiscal and reform changes in the Budget statement for further monetary policy stance, he said.

2. A forward thinker and always ahead of markets

It was in 2005 when Rajan came into the limelight globally. It was in this year that he predicted the global recession before hand. In his book Fault Lines, he penned how the recession will affect the economy worldwide. When things unfurled in the same way that Rajan had predicted, he was touted as one of the best analysts of all time.

3. One man, many laurels

Raghuram Rajan attained his bachelor's degree in electrical engineering from IIT-Delhi and was a gold medalist from IIM-Ahmedabad after getting his PGD in Business Administration. In 1991, he earned his PhD for his thesis "Essays on Banking" from the MIT Sloan School of Management.

He was appointed the Chief Economist of Management at the International Monetary Fund (IMF) in 2003.

Rajan continues to be a member of the American Academy of Arts and Sciences since 2011 when he was appointed as the President of the American Finance Association.

In 2012, Rajan replaced Kaushik Basu to be the Chief Economic Adviser to the Government of India.

And it was finally in 2013 that Rajan succeeded Duvvuri Subbarao to be the 23rd Governor of the Reserve Bank of India and became the youngest man ever to take the post.

Last year, he was appointed as Vice Chairman of the Bank for International Settlements (BIS).

He left his job as a professor at the World Bank and the US Federal Reserve Board to come back to India and work for his country.

The rest is history...

After the final monetary policy, when Rajan was asked where he sees himself in next five years, pat came his reply, "Five years from now? In my academic office, writing or thinking."

3. Worthy of getting the Nobel prize in Economics

Various global investors suggested that Raghuram Rajan should get a Nobel prize in Economics. Calling him one of the best bankers in the world, experts such as Marc Faber, a Swiss investor based in Thailand and Jim Rogers of Rogers Holdings said that he had a good hold on monetary policies.

In one of the interviews with ET Now, Jim Rogers said, "One of the advantages that India has other than having a lot of smarter people is that your central banker is probably the best central banker in the world, or at least, the least bad central banker in the world".

The RBI chief was also praised by Marc Faber. He had said that he doesn't trust any central bankers except India's Rajan. He further said that Rajan has a strong hold on the monetary policy, unlike other bankers who are basically money printers, according to a Business Insider report.

4. A man who does not yield to pressures of the government

From the time he took over as the governor of the central bank, Rajan has always stuck to an inflation-focussed policy regime. He trashed wholesale price index (WPI) as its key indicator on inflation and adopted consumer price index (CPI) which showed his upfront intention and his willingness to tackle tough problems.

At a time when Finance Minister Arun Jaitley and Chief Economic Advisor Arvind Subramanian called the China-led slowdown of the world economy as an opportunity for India to grow, he contradicted them and said it will be a "long time" before India can replace China as a growth engine for global economy even though it grows at a faster rate.

Earlier this year Rajan cautioned the government against putting too much faith in exports through its 'Make in India' policy, when BJP leaders had taken to chiding him for being tough with interest rates.

5. As forthright a leader as can be

Raghuram Rajan has always been straightforward and no doubt people listen to him. His opinions are always followed by logic and definite facts. Whenever he has raised his voice, he has almost always been right.

In one of the monetary policy meets when he maintained status quo, he strictly asked bankers to cut interest rates and not expect the RBI to keep cutting repo rates.

In another instance, he asked real estate players to cut prices rather than rely on rate cuts. He said, "I do believe that if real estate developers who are sitting on unsold stocks bring down prices, that will be a very great help to the sector because once there is a sense that prices have stabilised, more people will be willing to buy."

6. "You should behave and not flaunt money and throw birthday bashes": Rajan's message to wilful defaulters

Rajan conveyed a stern message to wilful defaulters of the country. He said rich businesses owing large sums to banks should behave and not flaunt 'massive birthday bashes' while still in serious debt.

"If we can get those guys to behave ... If you flaunt your massive birthday bashes etc even while owing the system a lot of money, it does seem to public that 'I don't care'", he added.

(With Agencies)

![submenu-img]() Meet Gautam Adani’s ‘right hand’, used to work as teacher, he’s now Rs 1600000 crore…

Meet Gautam Adani’s ‘right hand’, used to work as teacher, he’s now Rs 1600000 crore…![submenu-img]() Meet actor who worked with Amitabh Bachchan, Aishwarya Rai, entered films because of a bus conductor, is now India's..

Meet actor who worked with Amitabh Bachchan, Aishwarya Rai, entered films because of a bus conductor, is now India's..![submenu-img]() Meet Bollywood star, who was a tourist guide, married 4 times, went bankrupt, his son died by suicide, then...

Meet Bollywood star, who was a tourist guide, married 4 times, went bankrupt, his son died by suicide, then...![submenu-img]() This actor made Sharmila Tagore forget her lines, once did film for Rs 100, could never be a superstar because..

This actor made Sharmila Tagore forget her lines, once did film for Rs 100, could never be a superstar because..![submenu-img]() Volkswagen Taigun GT Line, Taigun GT Plus launched in India, price starts at Rs 14.08 lakh

Volkswagen Taigun GT Line, Taigun GT Plus launched in India, price starts at Rs 14.08 lakh![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Abhishek Sharma? Hrithik Roshan's brother from Kaho Naa Pyaar Hai has become TV star, is married to..

Remember Abhishek Sharma? Hrithik Roshan's brother from Kaho Naa Pyaar Hai has become TV star, is married to..![submenu-img]() Remember Ali Haji? Aamir Khan, Kajol's son in Fanaa, who is now director, writer; here's how charming he looks now

Remember Ali Haji? Aamir Khan, Kajol's son in Fanaa, who is now director, writer; here's how charming he looks now![submenu-img]() Remember Sana Saeed? SRK's daughter in Kuch Kuch Hota Hai, here's how she looks after 26 years, she's dating..

Remember Sana Saeed? SRK's daughter in Kuch Kuch Hota Hai, here's how she looks after 26 years, she's dating..![submenu-img]() In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding

In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding![submenu-img]() In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month

In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() Meet actor who worked with Amitabh Bachchan, Aishwarya Rai, entered films because of a bus conductor, is now India's..

Meet actor who worked with Amitabh Bachchan, Aishwarya Rai, entered films because of a bus conductor, is now India's..![submenu-img]() Meet Bollywood star, who was a tourist guide, married 4 times, went bankrupt, his son died by suicide, then...

Meet Bollywood star, who was a tourist guide, married 4 times, went bankrupt, his son died by suicide, then...![submenu-img]() This actor made Sharmila Tagore forget her lines, once did film for Rs 100, could never be a superstar because..

This actor made Sharmila Tagore forget her lines, once did film for Rs 100, could never be a superstar because..![submenu-img]() Mumtaz urges to lift ban on Pakistani artistes in Bollywood: ‘Woh log hum logon se...'

Mumtaz urges to lift ban on Pakistani artistes in Bollywood: ‘Woh log hum logon se...'![submenu-img]() Not Kiara Advani, but this actress was first choice opposite Shahid Kapoor in Kabir Singh, she rejected because...

Not Kiara Advani, but this actress was first choice opposite Shahid Kapoor in Kabir Singh, she rejected because...![submenu-img]() IPL 2024: Yashasvi Jaiswal, Sandeep Sharma guide Rajasthan Royals to 9-wicket win over Mumbai Indians

IPL 2024: Yashasvi Jaiswal, Sandeep Sharma guide Rajasthan Royals to 9-wicket win over Mumbai Indians![submenu-img]() IPL 2024: How can RCB still qualify for playoffs after 1-run loss against KKR?

IPL 2024: How can RCB still qualify for playoffs after 1-run loss against KKR?![submenu-img]() CSK vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

CSK vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() RR vs MI: Yuzvendra Chahal scripts history, becomes first bowler to achieve this massive milestone in IPL

RR vs MI: Yuzvendra Chahal scripts history, becomes first bowler to achieve this massive milestone in IPL![submenu-img]() 'Yeh toh second tier ki bhi team nhi': Ramiz Raja slams Babar Azam and co. after 3rd T20I loss vs New Zealand

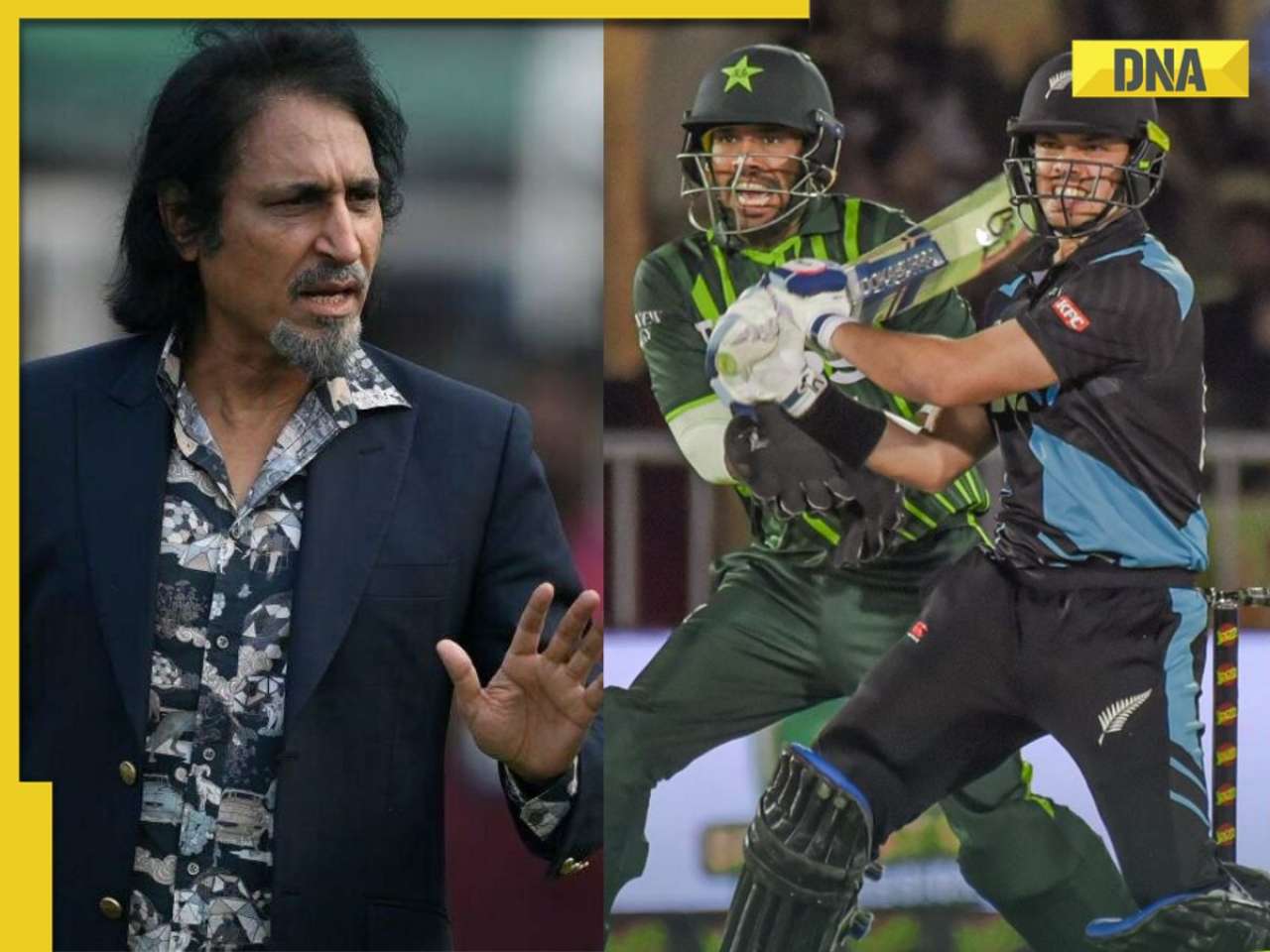

'Yeh toh second tier ki bhi team nhi': Ramiz Raja slams Babar Azam and co. after 3rd T20I loss vs New Zealand![submenu-img]() Mukesh Ambani's son Anant Ambani likely to get married to Radhika Merchant in July at…

Mukesh Ambani's son Anant Ambani likely to get married to Radhika Merchant in July at…![submenu-img]() India's most expensive wedding costs more than weddings of Isha Ambani, Akash Ambani, total money spent was...

India's most expensive wedding costs more than weddings of Isha Ambani, Akash Ambani, total money spent was...![submenu-img]() Meet Indian genius who lost his father at 12, studied at Cambridge, took Rs 1 salary, he is called 'architect of...'

Meet Indian genius who lost his father at 12, studied at Cambridge, took Rs 1 salary, he is called 'architect of...'![submenu-img]() Earth Day 2024: Google Doodle features aerial photos of planet's natural beauty, biodiversity

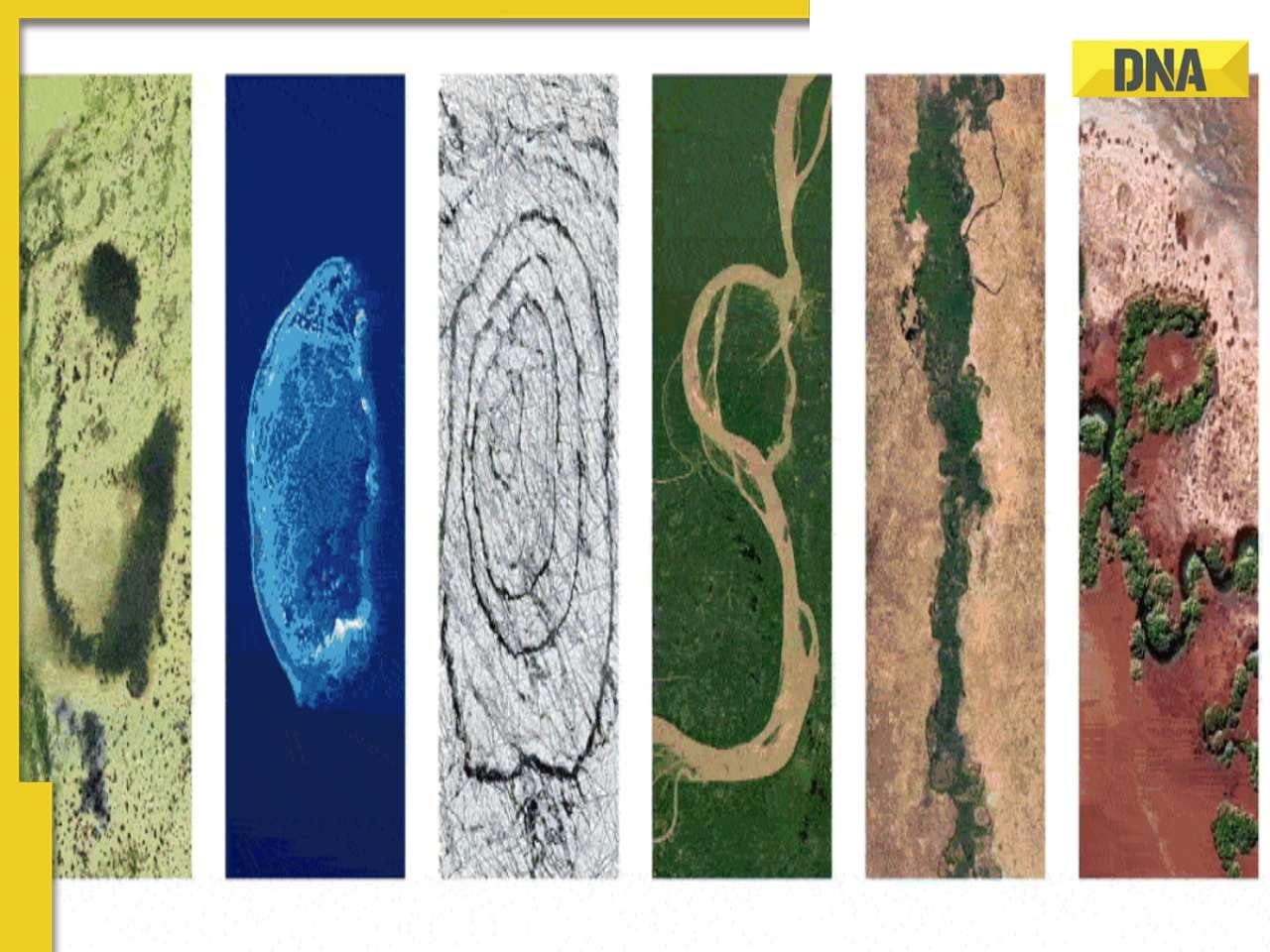

Earth Day 2024: Google Doodle features aerial photos of planet's natural beauty, biodiversity![submenu-img]() Meet India's first billionaire, much richer than Mukesh Ambani, Adani, Ratan Tata, but was called miser due to...

Meet India's first billionaire, much richer than Mukesh Ambani, Adani, Ratan Tata, but was called miser due to...

)

)

)

)

)

)

)